Vermont Resolution of Meeting of LLC Members to Sell or Transfer Stock

Description

How to fill out Resolution Of Meeting Of LLC Members To Sell Or Transfer Stock?

If you need to finalize, download, or print authentic document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Leverage the site's user-friendly search feature to find the documents you require.

A range of templates for corporate and personal use is organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Purchase now option. Choose the payment plan you prefer and enter your details to register for the account.

Step 6. Finalize the transaction. You can use your credit card or PayPal account to complete the transaction.

- Use US Legal Forms to obtain the Vermont Resolution of Meeting of LLC Members to Sell or Transfer Stock with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download option to find the Vermont Resolution of Meeting of LLC Members to Sell or Transfer Stock.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

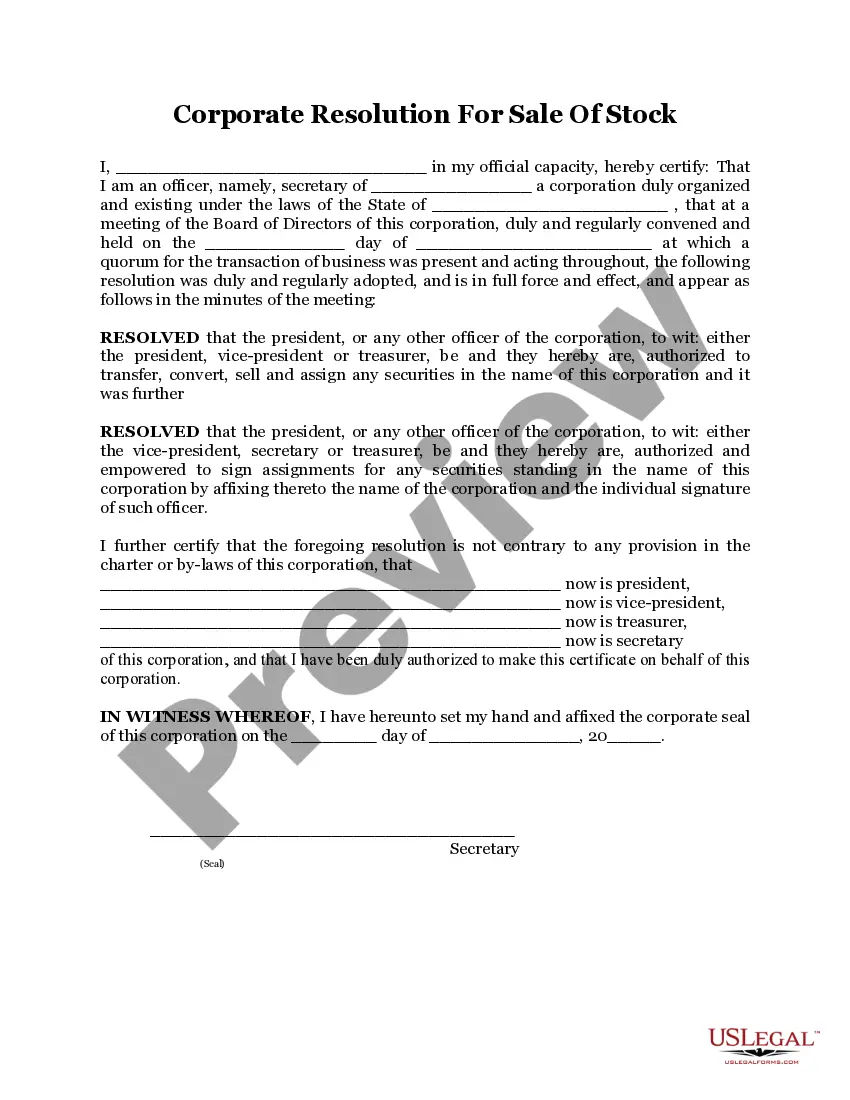

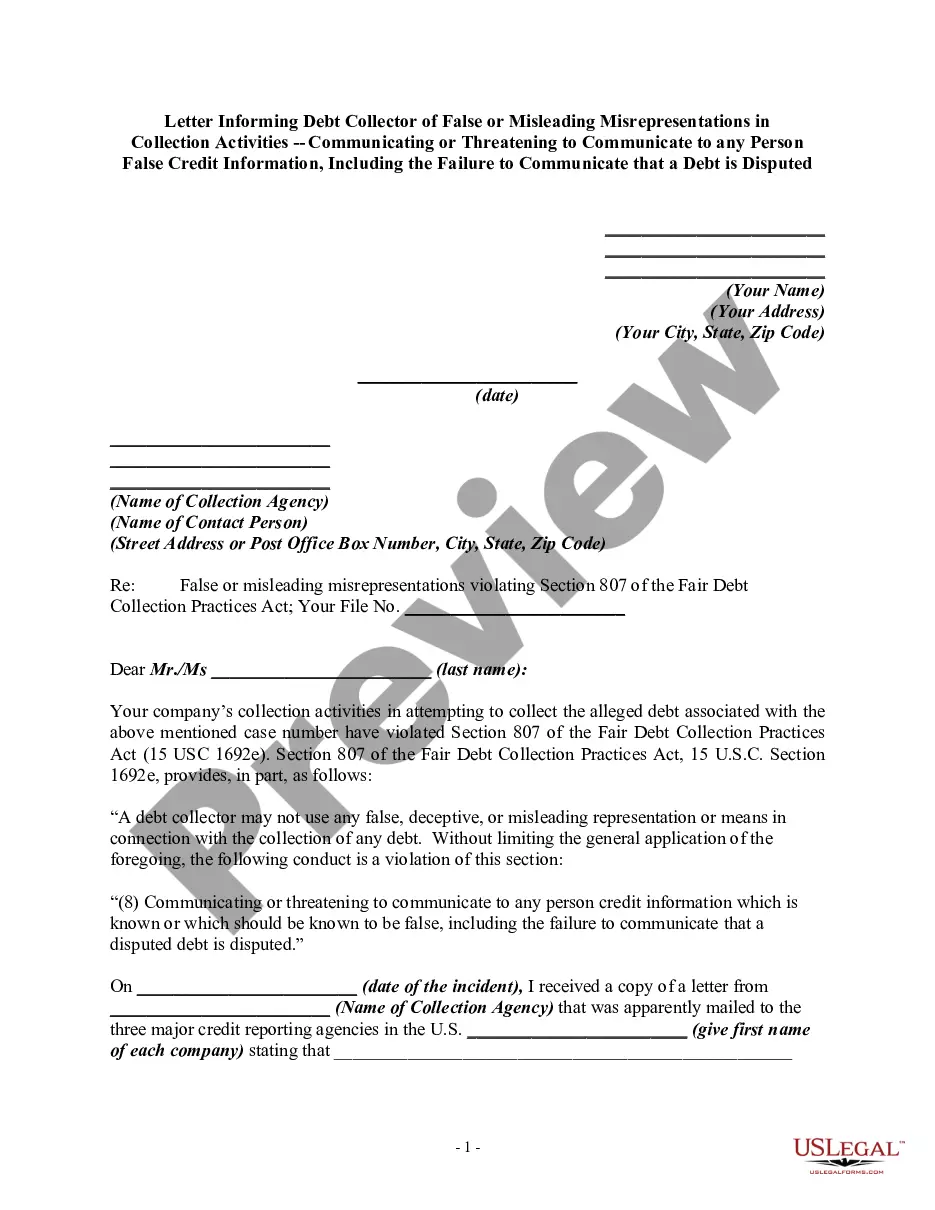

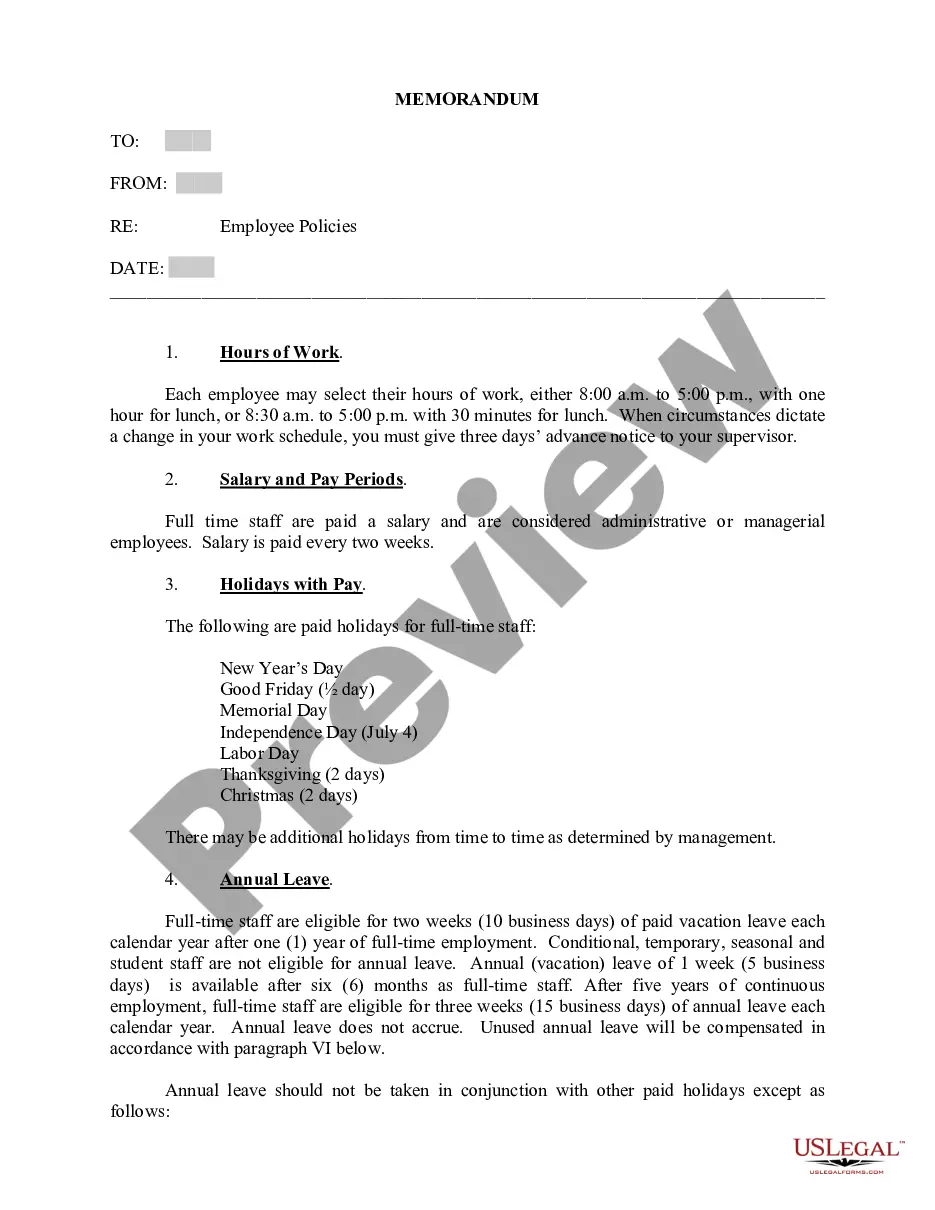

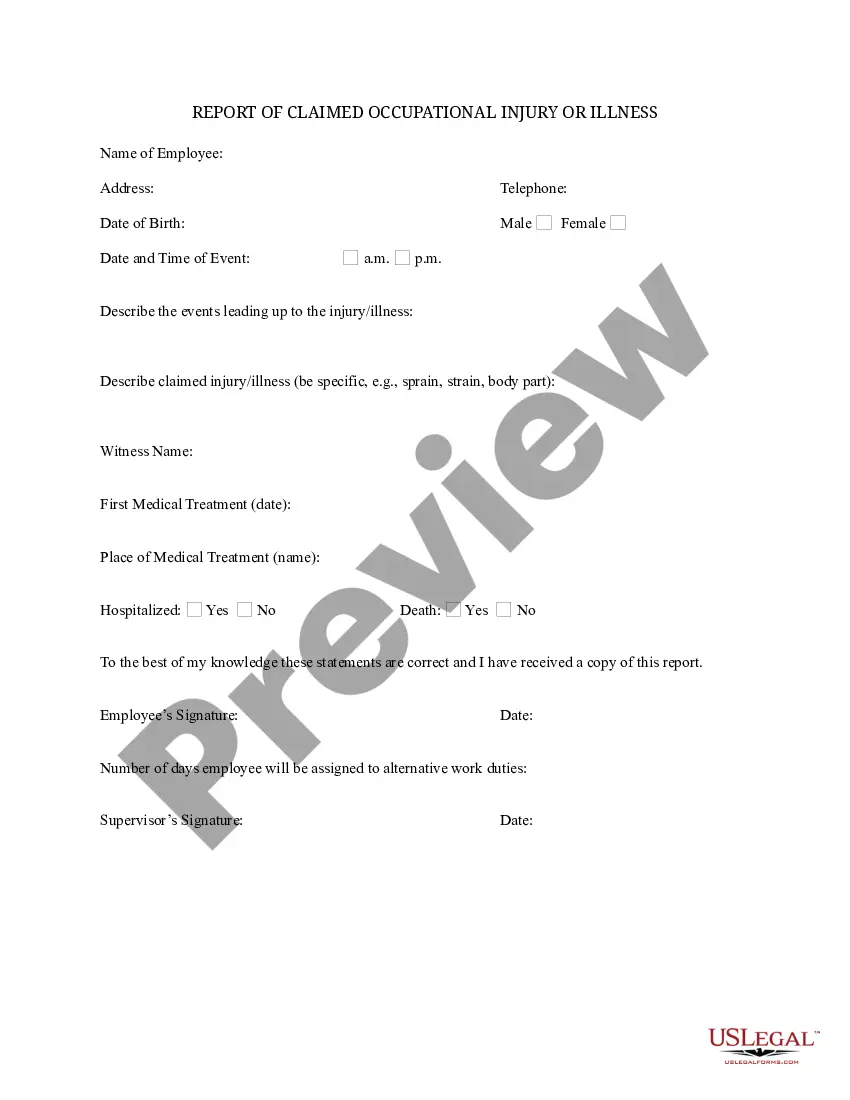

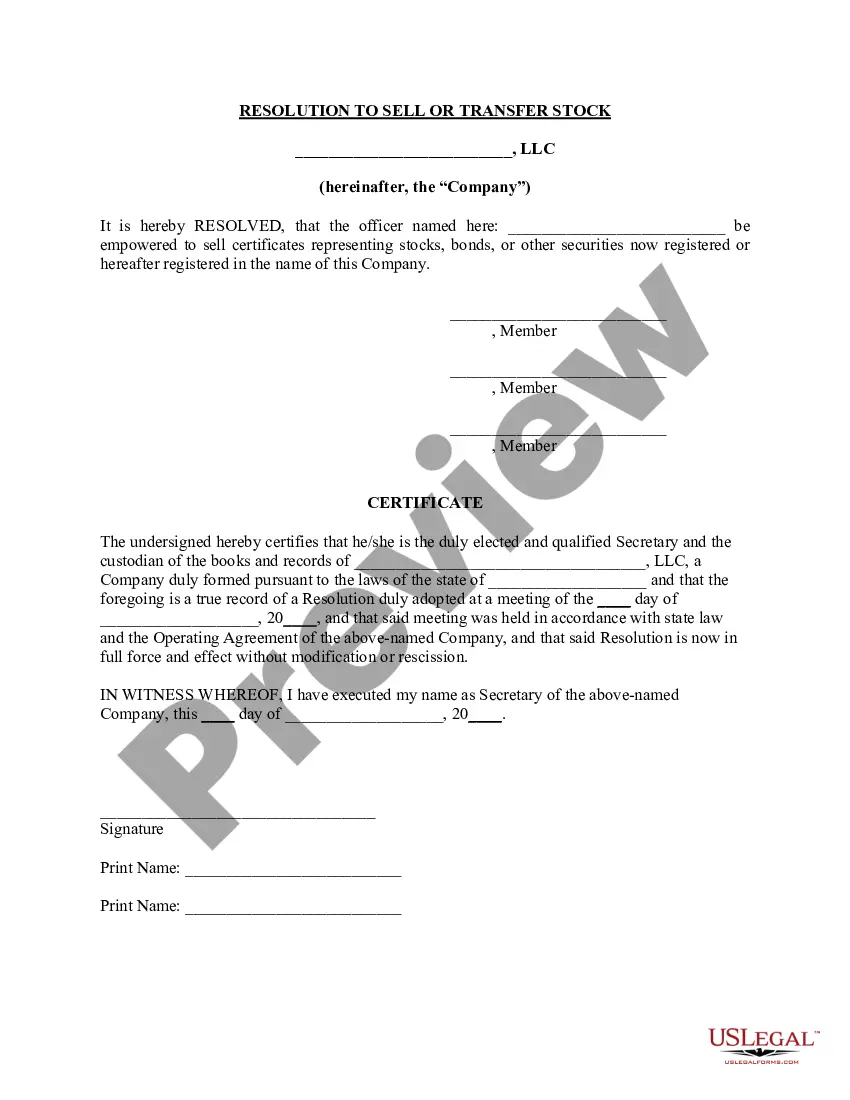

- Step 2. Use the Preview feature to review the contents of the form. Remember to read the information.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

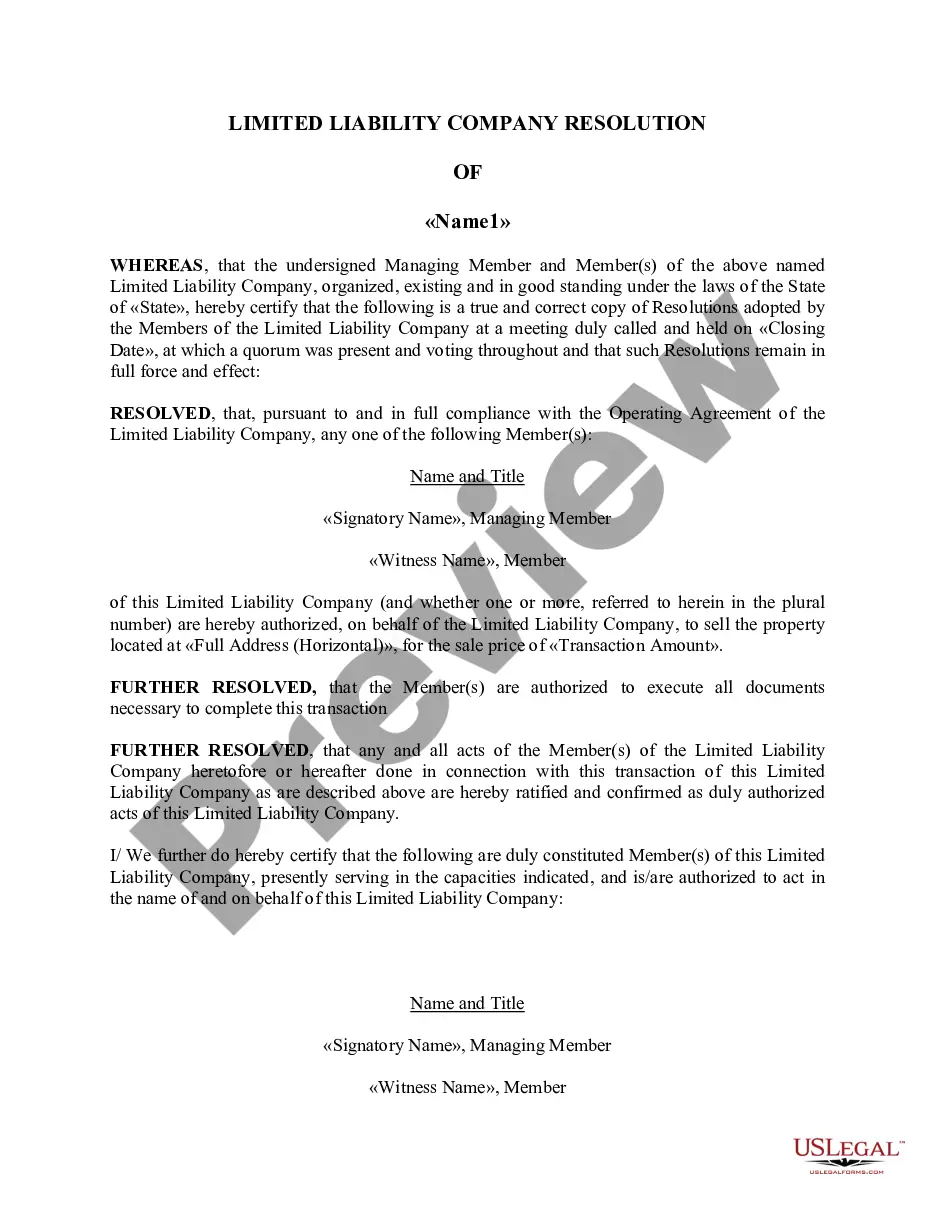

An operating agreement is a foundational document that outlines the structure and management of the LLC, including members' roles and responsibilities. In contrast, a resolution is a document that records a specific decision made by the LLC members or managers. When dealing with the Vermont Resolution of Meeting of LLC Members to Sell or Transfer Stock, understanding these differences is crucial for effectively managing company operations and agreements.

Closing an LLC in Vermont requires filing the necessary paperwork with the Secretary of State and settling any outstanding debts or obligations. You'll need to create a plan for dissolving the business and obtain the approval of all members. Using the Vermont Resolution of Meeting of LLC Members to Sell or Transfer Stock can simplify this process by providing clear documentation of the closure agreement.

Any LLC member can propose a resolution, but all members must vote on it. Typically a majority of the members is needed to pass the resolution, but each LLC may have different voting rights. Some LLCs give a different value to each member's vote based on their percentage of interest in the company.

6 Steps to Dissolve a Corporation#1 Seek Approval from the Board of Directors and Shareholders. First, hold a meeting with the board of directors.#2 File Articles of Dissolution.#3 Finalize Taxes.#4 Notify Creditors.#5 Liquidate and Distribute Assets.#6 Wrap Up Operations.

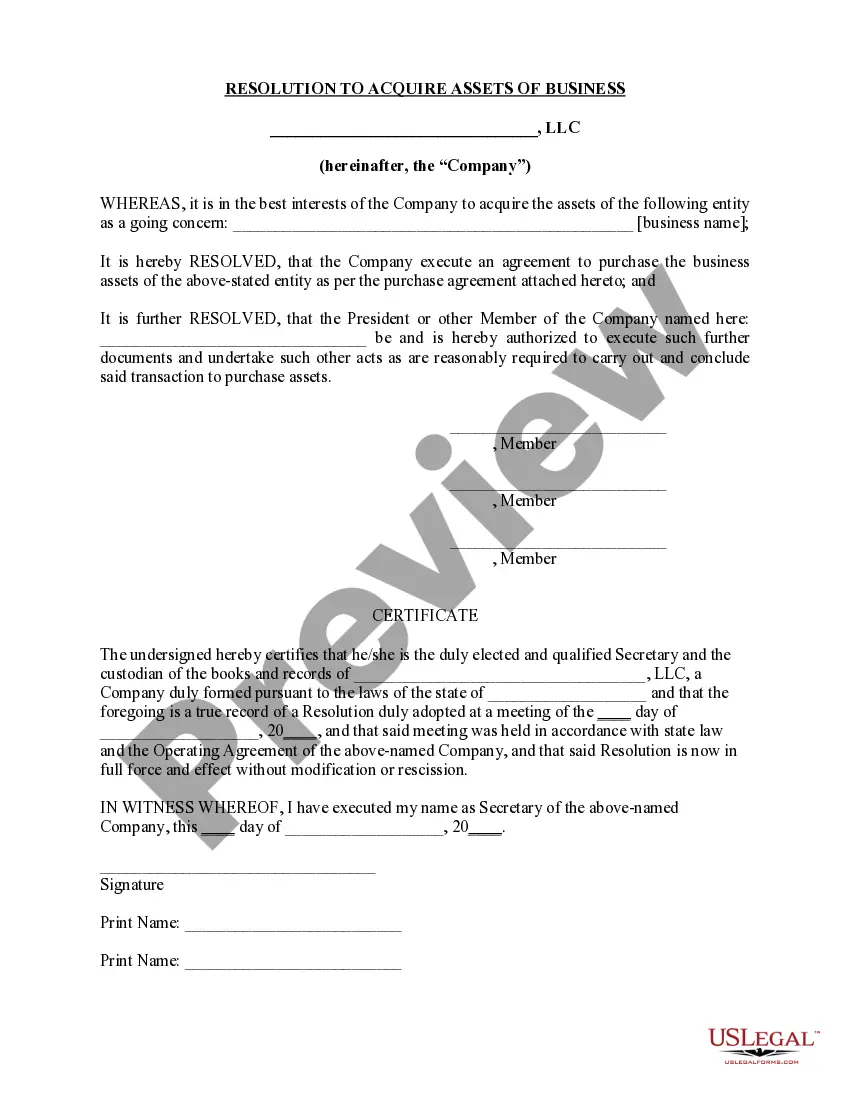

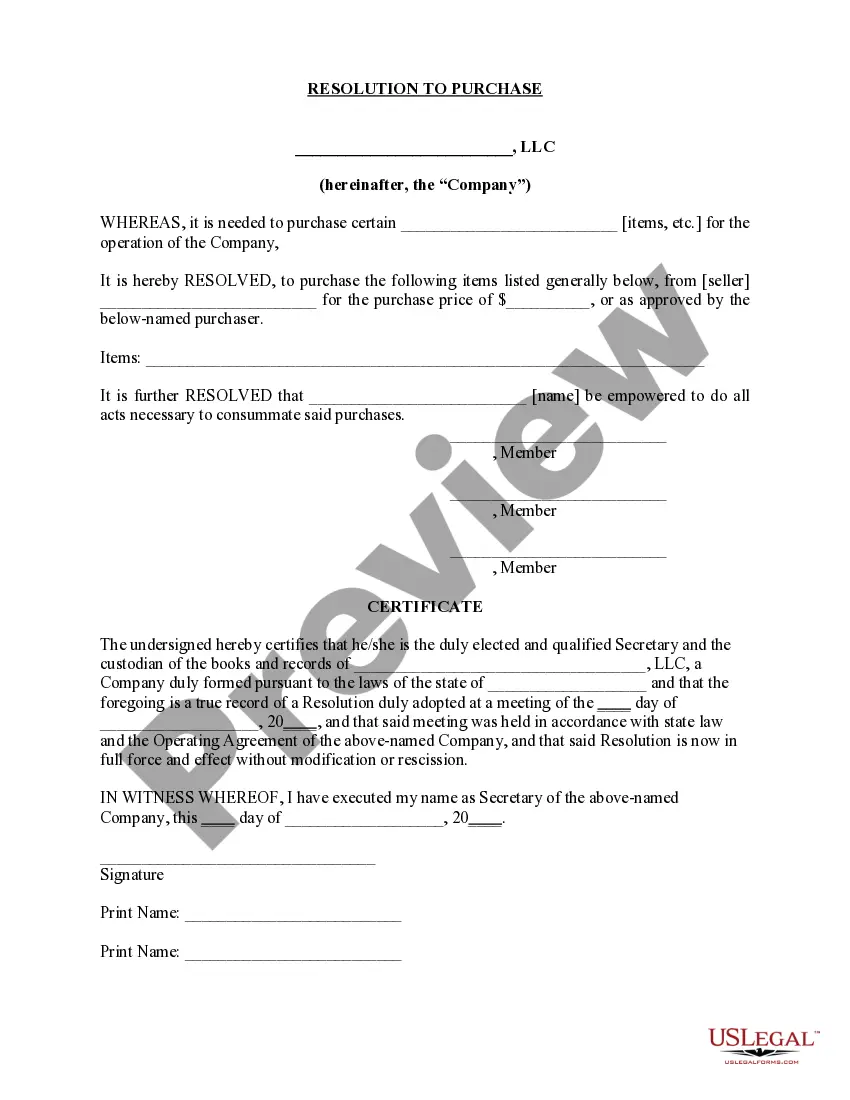

How To Write a Corporate Resolution Step by StepStep 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.

To dissolve your Vermont Corporation, file Articles of Dissolution, in duplicate, with the Vermont Secretary of State, Corporations Division (SOS). You do not have to use the Vermont SOS forms. You may draft your own corporate articles of dissolution.

An LLC does not have to make resolutions, but there are times it could be useful: An LLC member makes a decision regarding the business's organization. A member must establish their authority to open a bank account for the LLC. Members must prove their authority to sign a loan on the LLC's behalf.

An LLC resolution is a written record of important decisions made by members that describes an action taken by the company and confirms that members were informed about it and agreed to it.

An LLC corporate resolution is a record of a decision made through a vote by the board of directors or LLC members. Limited liability companies (LLCs) enjoy specific tax and legal benefits modeled after a corporate structure, although they are not corporations.

An LLC Corporate Resolution Form is a document that describes the management and decision-making processes of the LLC. While LLCs are generally not required to draft a resolution form, it is highly beneficial and important for all businesses to draft corporate resolutions.