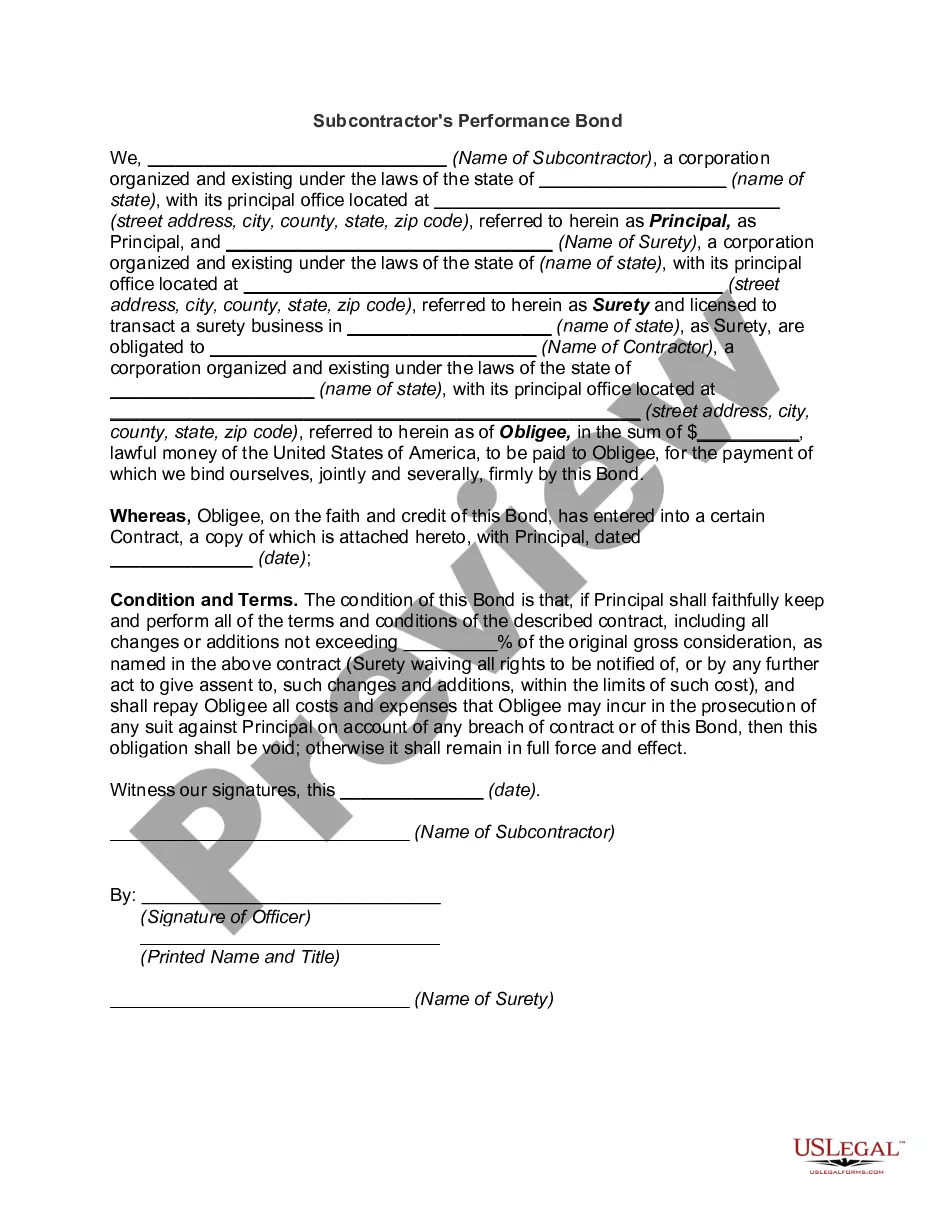

Vermont Performance Bond

Description

How to fill out Performance Bond?

If you have to total, down load, or produce authorized papers templates, use US Legal Forms, the biggest assortment of authorized types, which can be found on the web. Utilize the site`s simple and convenient research to discover the paperwork you want. Different templates for organization and individual purposes are sorted by types and claims, or keywords. Use US Legal Forms to discover the Vermont Performance Bond with a few click throughs.

Should you be presently a US Legal Forms client, log in in your account and click on the Obtain option to have the Vermont Performance Bond. You may also access types you formerly saved within the My Forms tab of your account.

Should you use US Legal Forms initially, refer to the instructions listed below:

- Step 1. Be sure you have selected the form for that correct metropolis/nation.

- Step 2. Make use of the Review option to examine the form`s articles. Never forget about to read the information.

- Step 3. Should you be not satisfied with the type, make use of the Search industry towards the top of the screen to find other versions in the authorized type design.

- Step 4. Upon having identified the form you want, click on the Acquire now option. Choose the pricing strategy you prefer and add your references to sign up for an account.

- Step 5. Process the financial transaction. You can utilize your bank card or PayPal account to finish the financial transaction.

- Step 6. Choose the formatting in the authorized type and down load it on your own gadget.

- Step 7. Complete, modify and produce or indicator the Vermont Performance Bond.

Every authorized papers design you buy is the one you have permanently. You possess acces to every type you saved inside your acccount. Go through the My Forms section and select a type to produce or down load again.

Contend and down load, and produce the Vermont Performance Bond with US Legal Forms. There are millions of skilled and state-certain types you can use for the organization or individual requirements.

Form popularity

FAQ

Typical cost of a Performance Bond Rates for performance bonds can differ depending on the qualification of the contractor, as well as type and size of the contract. The rate paid is typically a percentage of either the contract amount or bond amount. The average rates and costs can range from 1% - 5%.

A performance bond is issued to one party of a contract as a guarantee against the failure of the other party to meet the obligations of the contract. A performance bond is usually issued by a bank or an insurance company.

A performance bond is a type of contract construction bond that guarantees a contractor will complete a project ing to the terms outlined in a contract by the project owner, also called the obligee. The obligee can be a city, state, or local government, as well as the federal government or a private developer.

The contractor will engage with a bond provider, or surety, to provide a performance bond for that project. In order to get a performance bond, the contractor agrees to pay the surety a small percentage of the total bond amount, usually between 1% and 4%.

A letter of credit can be posted to guarantee a purely financial obligation, such as a loan, or a performance obligation, such as a contract, while the On-Demand Performance (or Payment) bond is posted to meet specific performance, payment, and liquidated damages obligations as defined in the underlying contracts.

A Performance Bond, also known as a surety bond, contract bond or construction bond is a legal agreement issued by an insurance company. Performance bonds protect construction project owners by guaranteeing that the contractor will complete the construction project in ance with the terms of the contract.

One key difference between performance bonds and surety bonds is the scope of their coverage. Performance bonds only cover a specific project, while surety bonds can cover multiple projects or ongoing business activities.

A bank guarantee occurs when a lending institution stands as a guarantor and promises to cover any losses when the borrower fails to do so. A bond is a deal or agreement between the borrower and lender that acts as a surety of the payment for either borrower or lender.