US Legal Forms - one of several biggest libraries of authorized forms in the United States - provides a variety of authorized file web templates you may obtain or print out. Using the site, you may get 1000s of forms for enterprise and specific reasons, sorted by groups, claims, or keywords.You will find the most up-to-date variations of forms much like the Vermont Receipt of Beneficiary for Early Distribution from Estate and Indemnity Agreement in seconds.

If you already have a subscription, log in and obtain Vermont Receipt of Beneficiary for Early Distribution from Estate and Indemnity Agreement in the US Legal Forms catalogue. The Obtain switch will show up on each kind you look at. You have access to all formerly downloaded forms in the My Forms tab of your respective profile.

If you would like use US Legal Forms the first time, listed here are easy guidelines to obtain started:

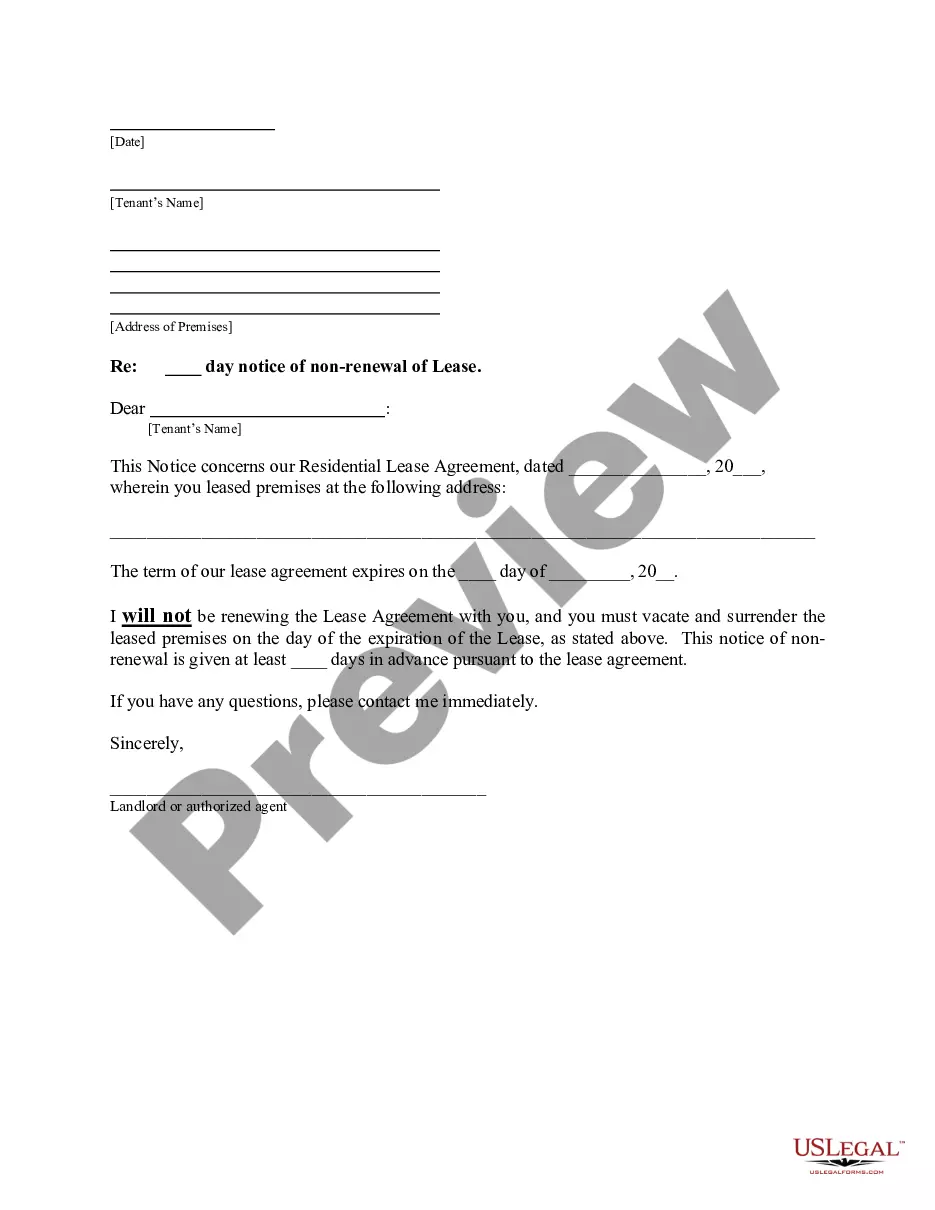

- Be sure you have selected the right kind for the town/state. Go through the Review switch to review the form`s articles. Look at the kind information to actually have chosen the right kind.

- In case the kind doesn`t fit your requirements, utilize the Research industry towards the top of the screen to find the one who does.

- If you are pleased with the shape, validate your option by clicking on the Acquire now switch. Then, select the prices plan you like and offer your references to register for the profile.

- Approach the transaction. Utilize your Visa or Mastercard or PayPal profile to finish the transaction.

- Select the file format and obtain the shape on your product.

- Make changes. Fill out, edit and print out and sign the downloaded Vermont Receipt of Beneficiary for Early Distribution from Estate and Indemnity Agreement.

Each template you included with your money lacks an expiration particular date and is also your own property for a long time. So, in order to obtain or print out an additional version, just visit the My Forms portion and then click on the kind you will need.

Gain access to the Vermont Receipt of Beneficiary for Early Distribution from Estate and Indemnity Agreement with US Legal Forms, probably the most substantial catalogue of authorized file web templates. Use 1000s of specialist and condition-certain web templates that meet your company or specific demands and requirements.