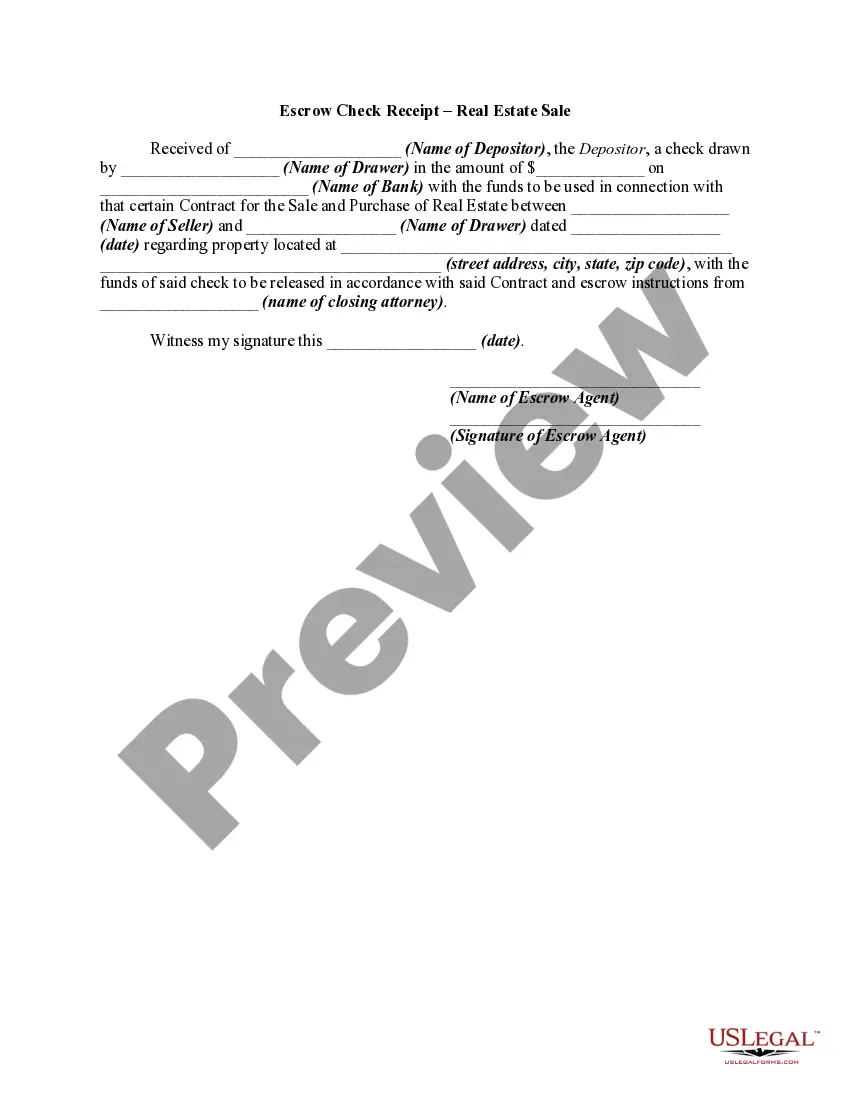

Vermont Escrow Check Receipt Form

Description

How to fill out Escrow Check Receipt Form?

Finding the correct legitimate documents format can be challenging.

Clearly, there are numerous templates available online, but how can you locate the valid version you require.

Utilize the US Legal Forms website. This service provides a wide array of templates, including the Vermont Escrow Check Receipt Form, suitable for both business and personal needs.

You can preview the form by using the Preview button and verify the form details to confirm that this is the appropriate one for you.

- All documents are reviewed by professionals and adhere to state and federal regulations.

- If you're already registered, Log In to your account and click the Download button to retrieve the Vermont Escrow Check Receipt Form.

- Use your account to review the legal documents you have previously purchased.

- Go to the My documents tab in your account to download another copy of the documents you require.

- If you are a new user of US Legal Forms, here are some easy steps to follow.

- First, ensure you have selected the correct form for your city/state.

Form popularity

FAQ

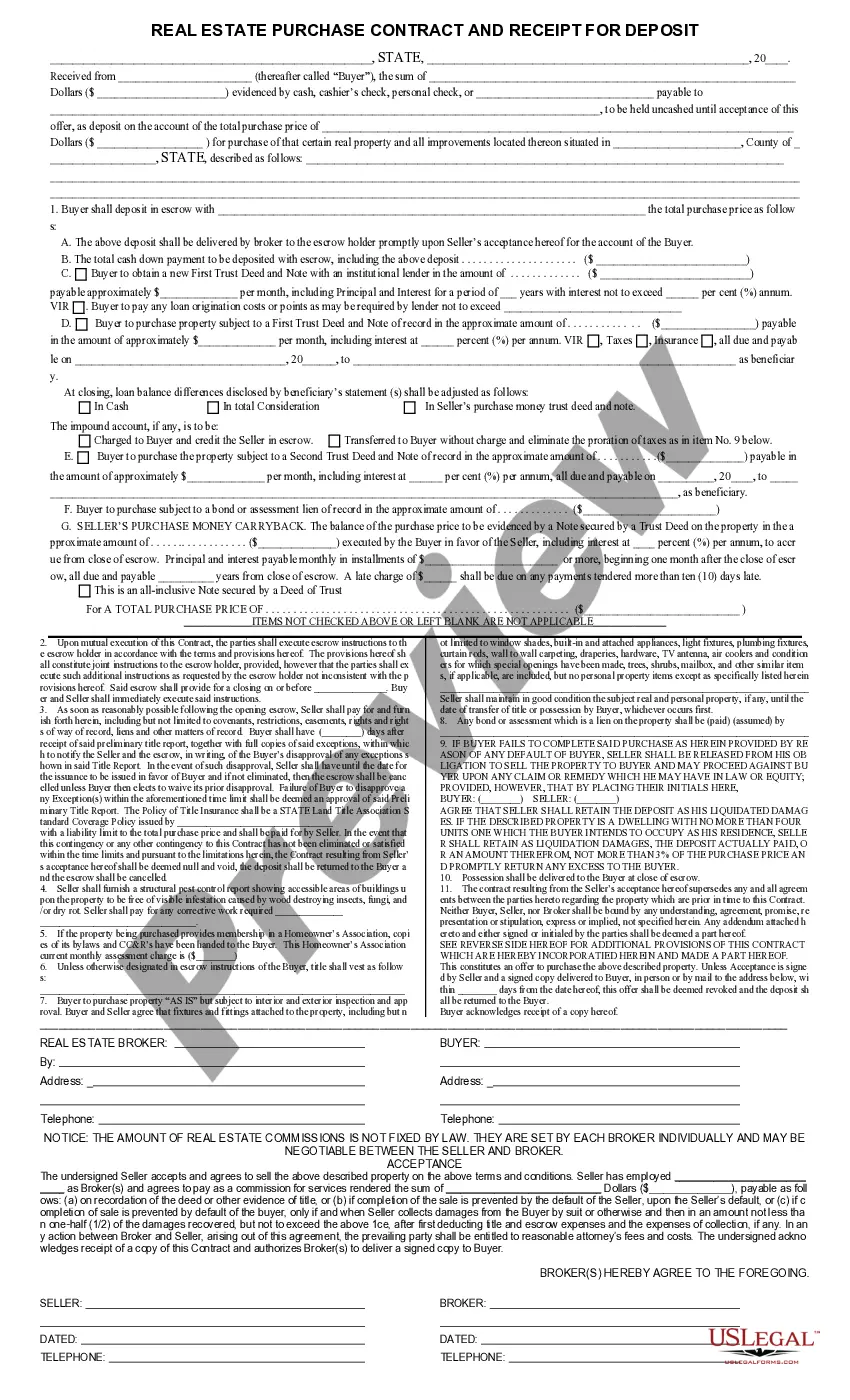

Yes, you can deposit a check into an escrow account as part of a transaction. The process usually involves completing a Vermont Escrow Check Receipt Form to provide important information about the check you're depositing. Once submitted, the escrow agent will keep the funds in a secure account until all conditions are satisfied. This step adds a layer of protection, making it a vital part of the transaction process.

To deposit a check into escrow, you need to follow the guidelines outlined in your escrow agreement. Typically, you will fill out a Vermont Escrow Check Receipt Form, which details the check amount and purpose. After completing the form, you'll submit the check to your escrow agent, who will securely manage the funds according to the contract's terms. This process ensures a smooth transaction.

An escrow account functions similarly to a bank account, but it serves a specific purpose in transactions. It holds funds securely until conditions outlined in a contract are met. When using a Vermont Escrow Check Receipt Form, you can ensure that funds are managed properly throughout the transaction process. This arrangement protects both buyers and sellers, providing peace of mind.

The non-resident tax form for Vermont is typically known as Form IN-113. This form is necessary for non-residents who earned income in Vermont and need to report it. It is essential to accurately complete the Vermont Escrow Check Receipt Form as it can support your claims and validate your transactions. For more guidance on filling out the forms, consider using our services at uslegalforms for clarity and efficiency.

To check the status of your Vermont refund, visit the Vermont Department of Taxes website. There, you will find options to track your refund using your Social Security number and the amount you claimed. If you filed your return using our Vermont Escrow Check Receipt Form, make sure to have that information handy for a better tracking experience. Staying updated about your refund status ensures you understand when to expect your funds.

Yes, senior citizens often qualify for various tax breaks, depending on their income and state regulations. In Vermont, there are specific programs aimed at reducing property taxes for seniors, making it essential to understand your rights and benefits. The Vermont Escrow Check Receipt Form may also help in clearly documenting your financial situation as you seek these tax relief opportunities.

Yes, you can file Vermont taxes online, which simplifies the process significantly. The Vermont Department of Taxes offers online services where you can complete your tax returns electronically. Don’t forget to gather necessary documents, including the Vermont Escrow Check Receipt Form, as these can enhance your online filing experience.

Indeed, Vermont provides property tax breaks specifically designed for seniors. These breaks aim to ease the financial burden on those who qualify, making it important to explore all available options. Utilizing forms such as the Vermont Escrow Check Receipt Form can provide clarity on your tax payments and eligibility for such breaks.

Lowering property taxes in Vermont often involves applying for available tax credits or exemptions. Seniors and veterans may qualify for specific programs that can significantly reduce their tax burden. Consider discussing your options with a tax professional or using resources from platforms like USLegalForms to gather necessary documents like the Vermont Escrow Check Receipt Form.

To close a Vermont withholding account, you must file an application with the Vermont Department of Taxes. Ensure that all outstanding tax liabilities are settled before submitting your closure request. It might be beneficial to have documents like the Vermont Escrow Check Receipt Form on hand, as they provide proof of your withholding contributions.