Vermont Private Annuity Agreement with Payments to Last for Life of Annuitant

Description

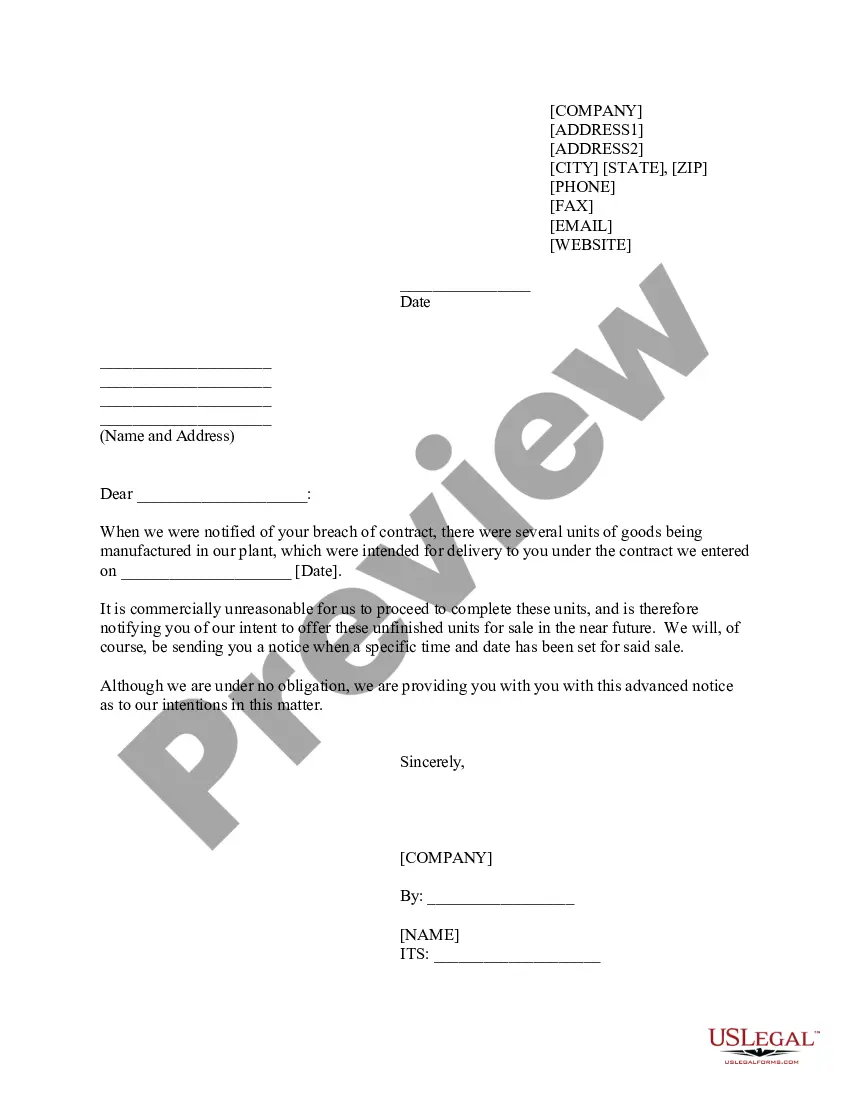

How to fill out Private Annuity Agreement With Payments To Last For Life Of Annuitant?

If you need to acquire, download, or print licensed document templates, utilize US Legal Forms, the largest selection of legal forms, available online.

Employ the site's user-friendly and convenient search to locate the documents you need.

Various templates for commercial and personal use are organized by categories and jurisdictions, or keywords.

Step 4. Once you have found the form you need, click the Buy Now button. Choose your pricing plan and enter your details to create an account.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction. Step 6. Choose the format of the legal document and download it to your device. Step 7. Complete, review, and print or sign the Vermont Private Annuity Agreement with Payments for the Life of the Annuitant. Each legal document template you acquire is yours permanently. You have access to each form you downloaded within your account. Click on the My documents section and select a document to print or download again. Stay competitive and obtain and print the Vermont Private Annuity Agreement with Payments for the Life of the Annuitant using US Legal Forms. There are millions of professional and state-specific templates available for your personal business or personal needs.

- Use US Legal Forms to access the Vermont Private Annuity Agreement with Payments for the Life of the Annuitant with a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Vermont Private Annuity Agreement with Payments for the Life of the Annuitant.

- You can also reach forms you've previously accessed from the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

- Step 2. Utilize the Review option to examine the contents of the form. Don’t forget to read the description.

- Step 3. If you are not happy with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

The annuity payout option that offers lifetime payments along with a guaranteed minimum term is often referred to as a life annuity with a period certain. This option ensures that the annuitant receives payments for their entire life, but if they pass away before the minimum term ends, the beneficiaries will receive payments for the remaining duration. A Vermont Private Annuity Agreement with Payments to Last for Life of Annuitant can be tailored to include this feature, combining lifetime security with a safety net for loved ones. It gives individuals and families greater assurance during retirement.

A lifetime payout annuity guarantees payments to the annuitant for as long as they live. This type of annuity aims to provide financial security by ensuring that individuals do not outlive their savings. Whether structured as part of a Vermont Private Annuity Agreement with Payments to Last for Life of Annuitant or another format, this annuity can offer peace of mind. It represents a reliable source of income during retirement, which can aid in long-term financial planning.

The life only annuity payout option is designed to provide regular payments to the annuitant for the duration of their life. This option means that once the annuitant passes away, no further payments are made. Many individuals choose this option under a Vermont Private Annuity Agreement with Payments to Last for Life of Annuitant because it offers the highest monthly payout compared to other choices. It is an excellent way for individuals to ensure they receive maximum income for their lifetime.

A joint and survivor annuity in a Vermont Private Annuity Agreement with Payments to Last for Life of Annuitant provides payments for two individuals, typically spouses. This option ensures that one party continues to receive income for their lifetime, even after the other has passed. It is a thoughtful choice for couples looking to secure lifelong financial support for each other. To create an agreement that best reflects your wishes, you can effectively utilize the resources available at uslegalforms.

The option you are looking for is known as a life income with period certain in a Vermont Private Annuity Agreement with Payments to Last for Life of Annuitant. This arrangement provides payments for the lifetime of the annuitant or for a pre-defined period, whichever lasts longer. It offers flexible and lasting financial planning, ensuring a consistent income stream while protecting your interests. Additionally, you can rely on uslegalforms to create a tailored agreement that suits your unique situation.

The option you are referring to is called a period certain annuity in a Vermont Private Annuity Agreement with Payments to Last for Life of Annuitant. This plan guarantees payments for a specified number of years, ensuring beneficiaries receive payment even if the annuitant passes away. This can be an excellent choice for those who want to ensure their loved ones continue to receive support. Consider using uslegalforms to draft an agreement that meets your specific needs efficiently.

The lifetime payout option in a Vermont Private Annuity Agreement with Payments to Last for Life of Annuitant ensures that the annuitant receives consistent payments throughout their lifetime. This feature offers financial security, as it eliminates the worry of outliving your resources. By choosing this option, you can enjoy peace of mind knowing that the payments will continue as long as you are alive. Such personalized annuity agreements are available through platforms like uslegalforms, which simplifies the process for you.

Upon the death of the annuitant, a Vermont Private Annuity Agreement with Payments to Last for Life of Annuitant can have specific tax implications. Generally, any remaining payments or benefits may be treated as part of the annuitant’s estate and could be subject to estate taxes. Additionally, the payout to beneficiaries may vary in tax treatment depending on various factors. To navigate these complex tax issues, consulting with a tax specialist or using US Legal Forms can provide you with essential tools and information.

In a Vermont Private Annuity Agreement with Payments to Last for Life of Annuitant, payments will cease upon the death of the annuitant. This means that the structured payments provide income support during the annuitant's lifetime, ensuring financial security while they are alive. Once the annuitant passes away, the agreement concludes, and beneficiaries will not receive any additional funds from this specific annuity. If you need help understanding these details, US Legal Forms can provide clear resources and guidance.

The life annuity is a settlement arrangement that stops making payments when the annuitant dies. This is a key feature of the Vermont Private Annuity Agreement with Payments to Last for Life of Annuitant, as it simplifies the coverage and focuses on providing benefits during the annuitant's life. Understanding this aspect is essential for those planning their financial futures.