Vermont Loan Agreement - Long Form

Description

How to fill out Loan Agreement - Long Form?

You can spend hours on the Internet looking for the valid document template that meets the state and federal requirements you need.

US Legal Forms offers thousands of valid forms that can be examined by experts.

You can easily obtain or create the Vermont Loan Agreement - Long Form from our services.

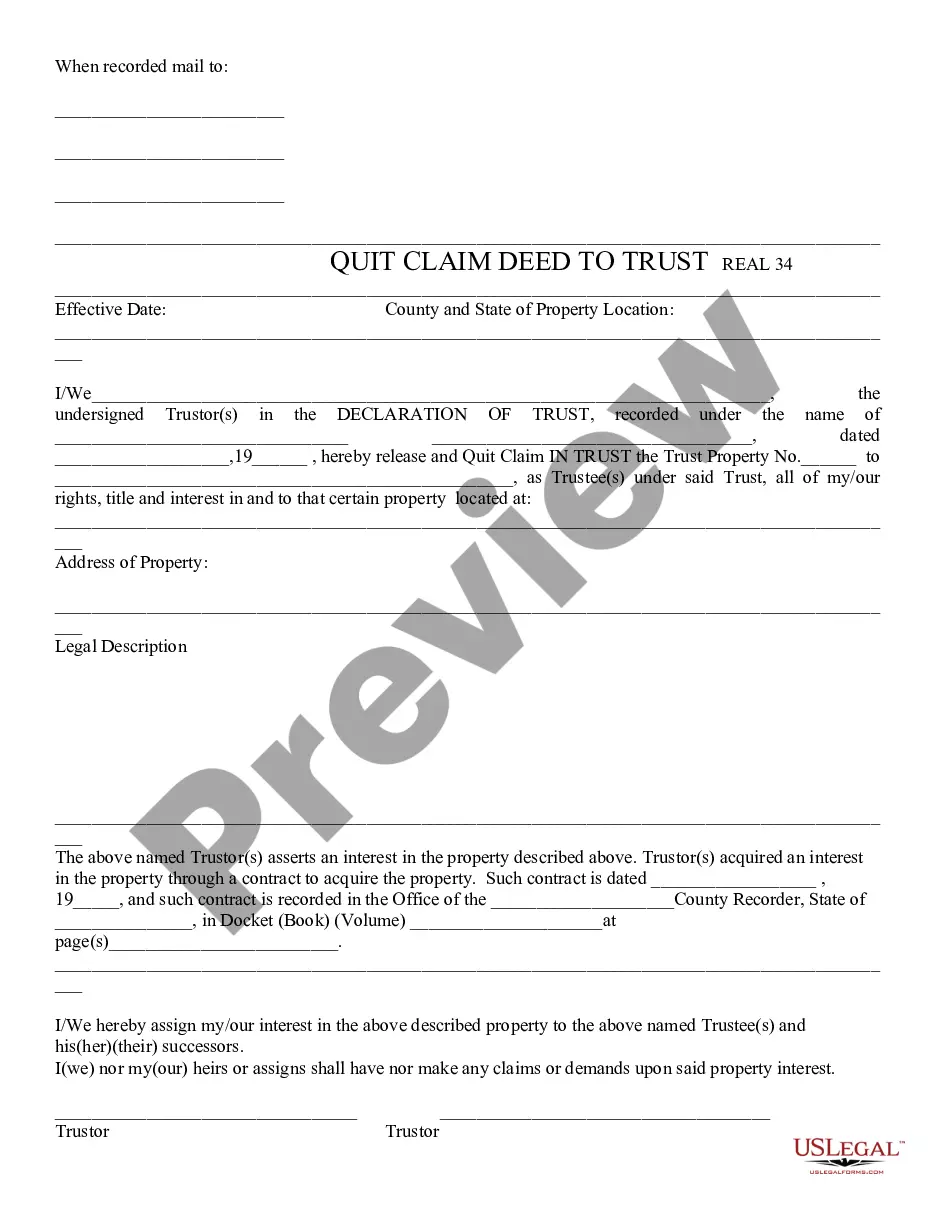

If available, use the Review button to view the document template as well. If you want to obtain another version of the form, use the Search field to find the template that fits your needs. Once you have located the template you desire, click Purchase now to proceed. Select the pricing plan you want, enter your details, and create an account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the valid template. Choose the format of the document and download it to your device. Make modifications to the document if necessary. You can complete, edit, sign, and print the Vermont Loan Agreement - Long Form. Access and print thousands of document templates using the US Legal Forms Website, which offers the largest selection of valid forms. Utilize professional and state-specific templates to manage your business or personal needs.

- If you have a US Legal Forms account, you can Log In and then click the Obtain button.

- After that, you can complete, edit, create, or sign the Vermont Loan Agreement - Long Form.

- Every valid document template you obtain is yours permanently.

- To get another copy of a purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your state/region that you choose.

- Check the form description to confirm you have selected the proper template.

Form popularity

FAQ

Loan terms refer to the terms and conditions involved when borrowing money. This can include the loan's repayment period, the interest rate and fees associated with the loan, penalty fees borrowers might be charged, and any other special conditions that may apply.

First and foremost, understand that personal loan agreements fall into the classification of contracts. Technically, you don't have to notarize these documents. But if you want to make this document legally binding, then notarization is the best course of action.

How to make a family loan agreement The amount borrowed and how it will be used. Repayment terms, including payment amounts, frequency and when the loan will be repaid in full. The loan's interest rate. ... If the loan can be repaid early without penalty, and how much interest will be saved by early repayment.

What to include in your loan agreement? The amount of the loan, also known as the principal amount. The date of the creation of the loan agreement. The name, address, and contact information of the borrower. The name, address, and contact information of the lender.

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.

In general, a personal loan contract is just as legally binding between friends or family as it would be with a bank. However, a contract between friends or family might be simpler or have fewer terms. Each agreement, though, is likely to have the same main provisions.

You can write up a personal loan agreement by hand, with pen and paper, or draft it on your computer. Once the document looks good, it can be printed out and signed by both parties.