Vermont Direct Deposit Form for Stimulus Check

Description

How to fill out Direct Deposit Form For Stimulus Check?

Discovering the right legal papers web template can be a have difficulties. Naturally, there are plenty of themes available online, but how would you discover the legal form you require? Use the US Legal Forms website. The assistance gives 1000s of themes, for example the Vermont Direct Deposit Form for Stimulus Check, that can be used for organization and personal demands. All of the varieties are inspected by experts and fulfill federal and state needs.

Should you be presently listed, log in to your profile and click on the Obtain switch to get the Vermont Direct Deposit Form for Stimulus Check. Utilize your profile to appear through the legal varieties you may have bought in the past. Go to the My Forms tab of your respective profile and get another copy of your papers you require.

Should you be a fresh consumer of US Legal Forms, listed below are basic recommendations so that you can comply with:

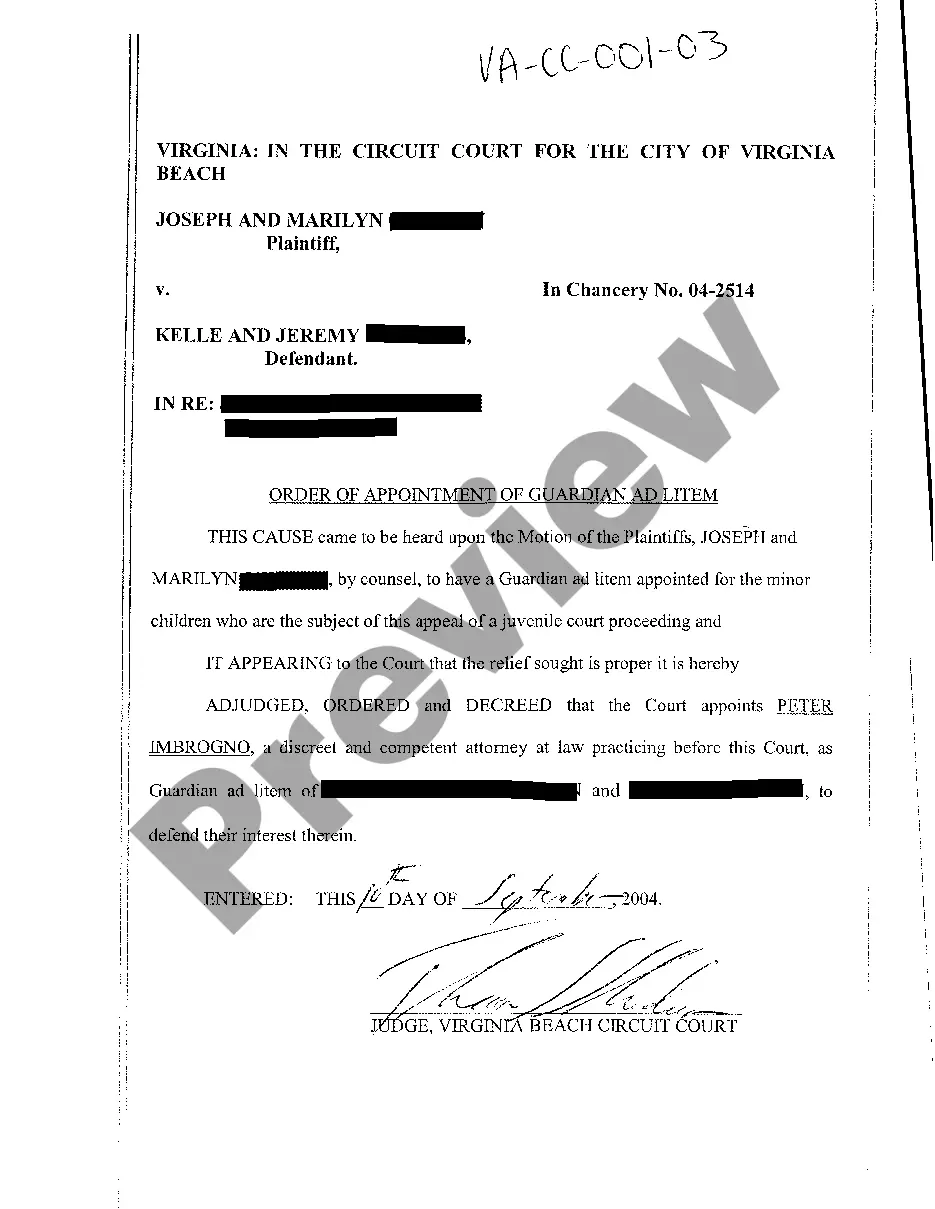

- First, make certain you have selected the right form for your personal town/county. It is possible to check out the form making use of the Review switch and study the form explanation to make certain it will be the right one for you.

- In the event the form is not going to fulfill your preferences, take advantage of the Seach field to get the appropriate form.

- When you are positive that the form would work, click on the Get now switch to get the form.

- Pick the rates prepare you want and enter in the required information and facts. Build your profile and pay money for the order using your PayPal profile or Visa or Mastercard.

- Pick the data file format and obtain the legal papers web template to your product.

- Comprehensive, change and print out and indicator the attained Vermont Direct Deposit Form for Stimulus Check.

US Legal Forms is the biggest library of legal varieties where you can discover numerous papers themes. Use the service to obtain professionally-made papers that comply with condition needs.

Form popularity

FAQ

byState Comparison of Income Tax Rates StateTax RatesLowest and Highest Income BracketsTennessee0%NoneTexas0%NoneUtah4.95%Flat rate applies to all incomesVermont3.35% to 8.75%$42,150 and $213,15047 more rows ?

The Vermont Standard Deduction increases an average of $267. For tax year 2022, it is $13,050 for Married/CU Filing Jointly or Qualifying Widow(er), $6,500 for Single or Married/CU Filing Separately, $9,800 for Head of Household, and an additional $1,050 for individuals 65 and older and/or blind.

Vermont's personal exemption allowed for each taxpayer and dependent is: $4,500 for 2022. $4,350 for 2020 and 2021.

Note: If you are at least 65 years old or blind, you can claim an additional 2023 standard deduction of $1,850 (also $1,850 if using the single or head of household filing status).

All tax filers can claim this deduction unless they choose to itemize their deductions. For the 2022 tax year, the standard deduction is $12,950 for single filers ($13,850 in 2023), $25,900 for joint filers ($27,700 in 2023) and $19,400 for heads of household ($20,800 in 2023).