Vermont Accounts Receivable Monthly Customer Statement

Description

How to fill out Accounts Receivable Monthly Customer Statement?

If you wish to compile, download, or print sanctioned document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Take advantage of the site's straightforward and user-friendly search to find the documents you require.

Various templates for commercial and personal purposes are organized by categories and titles, or keywords.

Once you have found the form you need, select the Acquire now button. Choose the pricing plan you prefer and enter your details to register for the account.

Process the transaction. You can use your credit card or PayPal account to complete the purchase.

- Utilize US Legal Forms to obtain the Vermont Accounts Receivable Monthly Customer Statement with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to retrieve the Vermont Accounts Receivable Monthly Customer Statement.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Ensure you have chosen the form for your specific city/state.

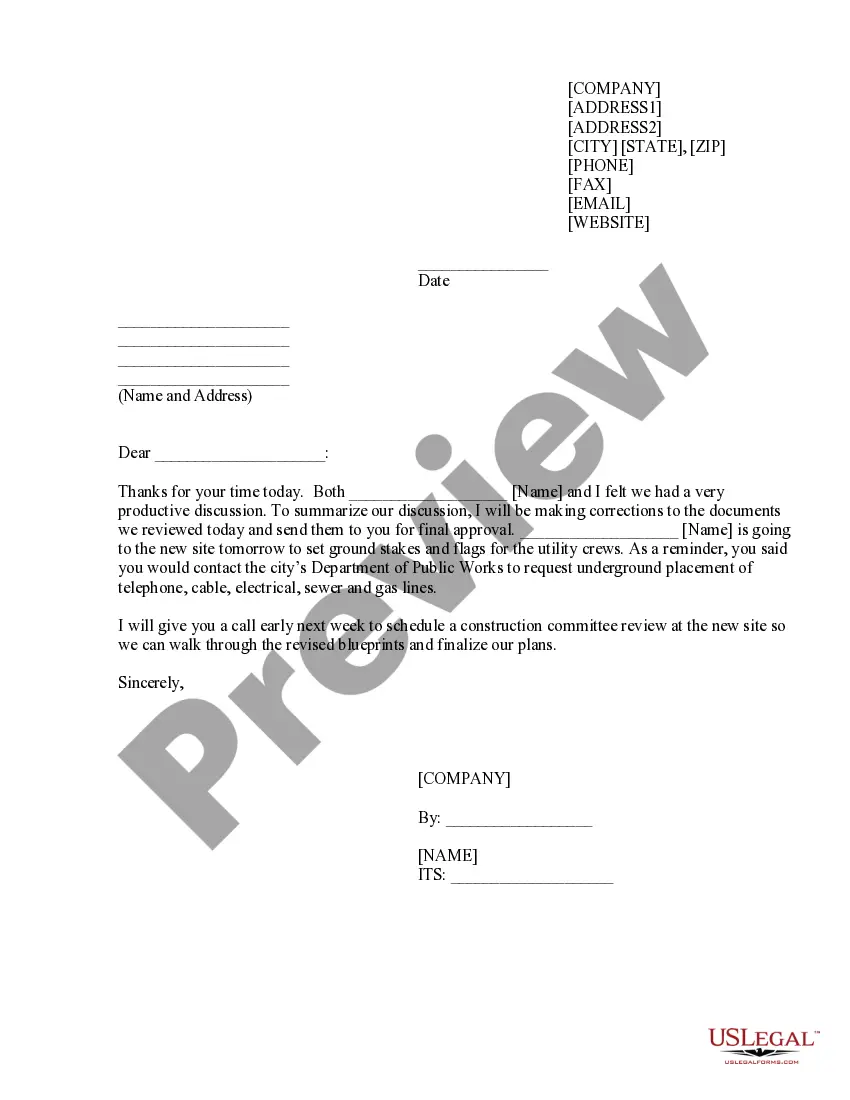

- Use the Review option to examine the form's content. Don't forget to read the description.

- If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Accounts receivable is typically listed on the balance sheet under current assets. It reflects the total amount owed to your business by customers for goods or services delivered. By examining your financial statements, including the Vermont Accounts Receivable Monthly Customer Statement, you can gain insights into your revenue flow and assess your company’s liquidity. Understanding this information is crucial for making informed business decisions.

To obtain a customer statement on Sage, start by navigating to the Accounts Receivable module. From there, you can select the appropriate customer and choose the option to generate a Vermont Accounts Receivable Monthly Customer Statement. This process allows you to customize the statement according to the date range and specific details you need. By leveraging Sage, you can efficiently manage your customer accounts and streamline your financial reporting.

Filing Vermont sales tax involves collecting the appropriate tax from customers and reporting it to the state. You can file online through the Vermont Department of Taxes website or by using paper forms. Keeping accurate records of sales transactions is essential in this process. A Vermont Accounts Receivable Monthly Customer Statement can help you monitor your sales and ensure you file the correct amounts on time.

Yes, Vermont requires 1099 filings for certain payments made to individuals or businesses. This includes payments for services rendered and other specified transactions. Filing these forms correctly is crucial to avoiding penalties. To maintain accurate records and streamline your filing process, consider using the Vermont Accounts Receivable Monthly Customer Statement to track relevant payments.

The in 113 form is a Vermont tax form used for income reporting. It is vital for individuals and businesses to report various types of income, ensuring that all tax obligations are met. Completing this form accurately can prevent future issues with tax authorities. Utilizing tools like the Vermont Accounts Receivable Monthly Customer Statement can assist in keeping your records organized and compliant.

Accounts receivable (AR) represent the amount of money that customers owe your company for products or services that have been delivered. AR are listed on the balance sheet as current assets and also refer to invoices that clients owe for items or work performed for them on credit.

Accounts receivable (AR) are funds the company expects to receive from customers and partners. AR is listed as a current asset on the balance sheet. Lenders and potential investors look at AP and AR to gauge a company's financial health.

Hear this out loud PauseAccounts receivable isn't reported on your income statement, but you will record it in your trial balance and balance sheet ? a helpful financial statement for year-end reporting and getting a full picture of your business's net worth.

Hear this out loud PauseThe Accounts Receivables Statements are documents that itemize all invoices, payments, and credits created during a specific time period, and whose intention is to remind the account holder of their account status. Statements can be mailed, emailed, faxed, or previewed.

To prepare it, you break down the accounts receivables into age categories and indicate against the names the total outstanding balances for specified periods. Review open invoices. ... Categorize customers ing to the aging schedule. ... Create a list of customers with outstanding invoices.