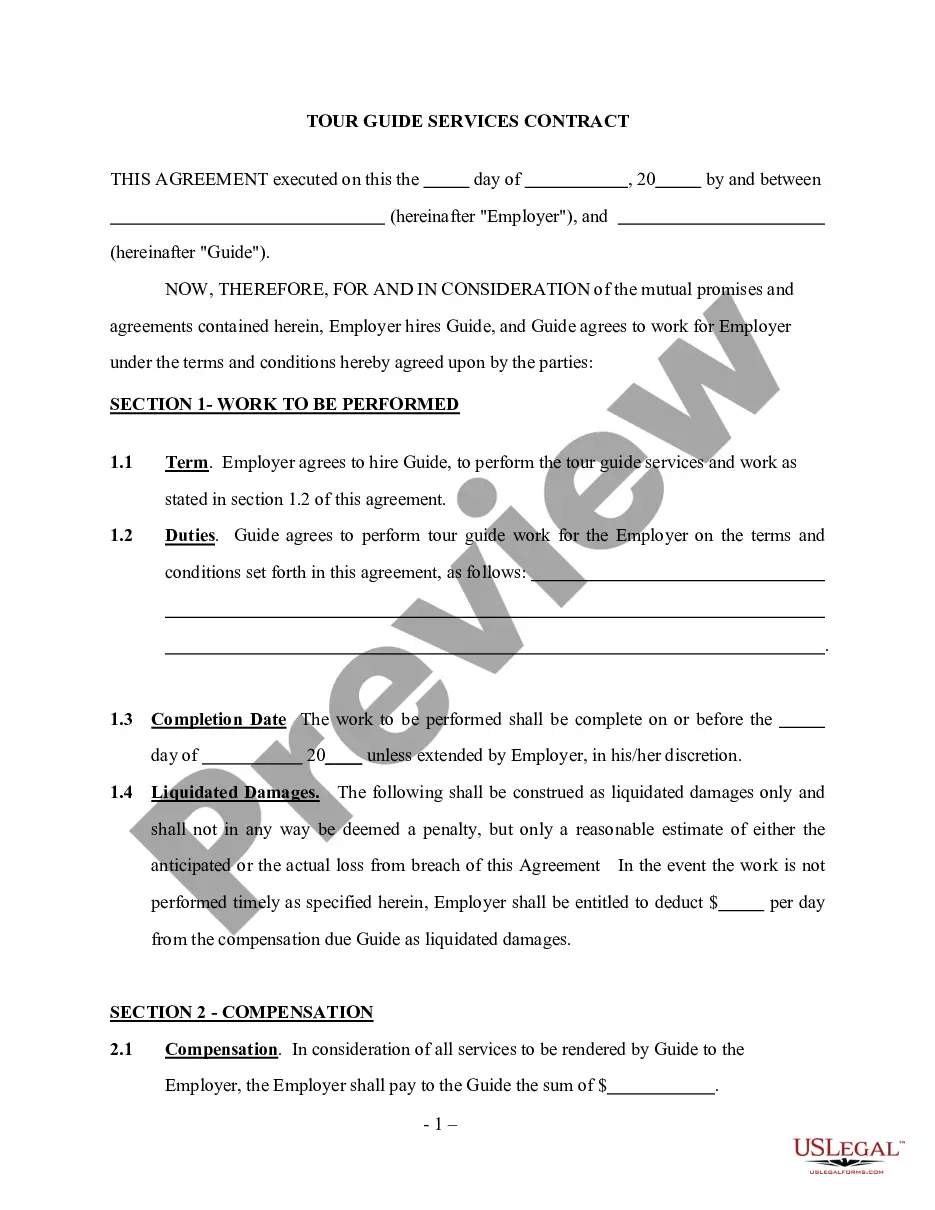

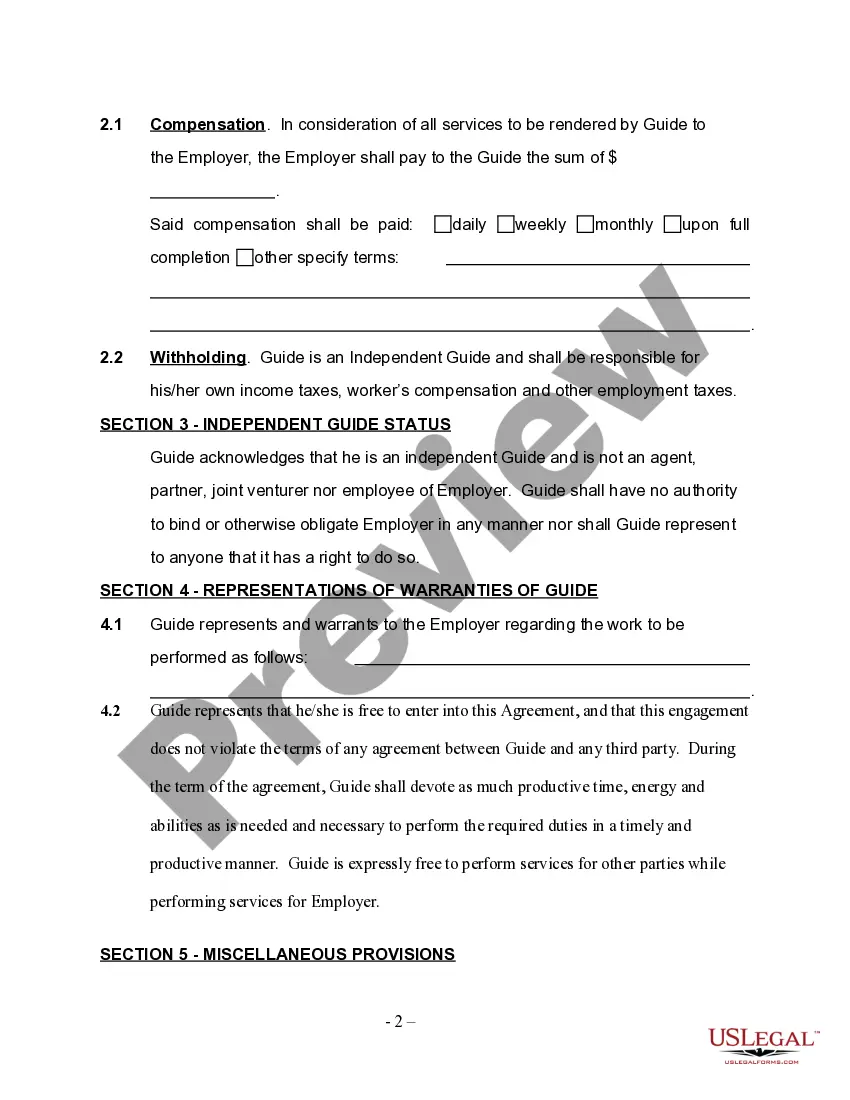

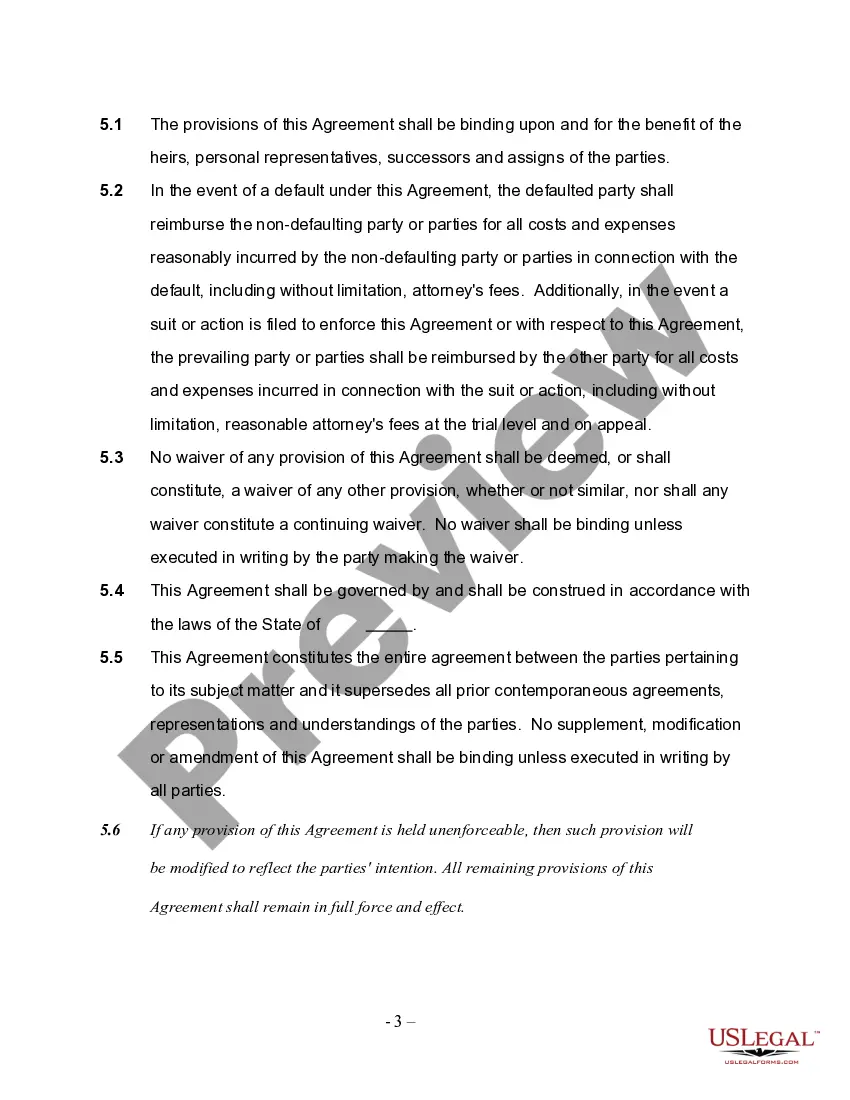

Virgin Islands Self-Employed Tour Guide Services Contract

Description

How to fill out Self-Employed Tour Guide Services Contract?

If you wish to be thorough, obtain, or print official document templates, utilize US Legal Forms, the largest repository of legal forms accessible online.

Employ the site’s straightforward and user-friendly search to retrieve the documents you require.

A range of templates for commercial and individual purposes are organized by categories and states, or keywords.

Every legal document template you purchase is yours indefinitely. You will have access to all forms you saved in your account. Visit the My documents section and select a form to print or download again.

Stay competitive and obtain, and print the Virgin Islands Self-Employed Tour Guide Services Contract with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal requirements.

- Ensure you have chosen the form for the correct city/state.

- Utilize the Preview option to review the form's content. Remember to read the description.

- If you are dissatisfied with the form, use the Search bar at the top of the screen to find alternative versions of the legal form template.

- Once you have found the form you need, click the Acquire now button. Choose the pricing plan you prefer and enter your details to create an account.

- Process the payment. You may use your credit card or PayPal account to finalize the transaction.

- Select the format of the legal form and download it to your device.

- Complete, modify, and print or sign the Virgin Islands Self-Employed Tour Guide Services Contract.

Form popularity

FAQ

Yes, you typically need a permit to operate as a tour guide in the Virgin Islands. This requirement helps ensure that all tour guides meet the local regulations and standards for safety and professionalism. Obtaining a Virgin Islands Self-Employed Tour Guide Services Contract can guide you through the necessary legal steps, including securing your permit. By using a reliable platform like uslegalforms, you can easily access the resources and documents needed to start your journey as a tour guide.

To report foreign self-employment income, you must include it on your federal tax return, even if you earn it outside the United States. Utilize Form 1040 and ensure you accurately report your income and expenses. A Virgin Islands Self-Employed Tour Guide Services Contract can help you manage your foreign income effectively and meet all reporting requirements.

New rules for the self-employed include changes in tax reporting requirements and the classification of workers. It is crucial for self-employed individuals to stay updated on these regulations. A Virgin Islands Self-Employed Tour Guide Services Contract can provide guidance and help you understand your responsibilities, ensuring you remain compliant while maximizing your earnings.

The new federal rule for independent contractors focuses on clarifying the classification of workers. It emphasizes the importance of determining whether a worker is truly independent or an employee. If you operate as a self-employed tour guide, a Virgin Islands Self-Employed Tour Guide Services Contract can help establish your status and protect your rights.

Form 8689 is used to allocate your income and tax liability between the Virgin Islands and the United States. If you are a self-employed individual with income from both territories, this form ensures you report your earnings accurately. Consider consulting a professional or utilizing a Virgin Islands Self-Employed Tour Guide Services Contract to navigate this process smoothly.

Schedule SE is required for individuals who earn self-employment income, including those operating under a Virgin Islands Self-Employed Tour Guide Services Contract. If you earn $400 or more, you must file this form to calculate your self-employment tax. Filing this schedule helps ensure you comply with federal regulations regarding your earnings.

Currently, self-assessment for self-employed individuals is not changing to every three months. The requirement remains annual, but it is advisable to stay informed about any future changes. Utilizing a Virgin Islands Self-Employed Tour Guide Services Contract can help streamline your reporting process and ensure you meet all necessary obligations.

In the Virgin Islands, you can earn up to $600 in a tax year before needing to register as self-employed. If your earnings exceed this threshold, you must report them and consider a Virgin Islands Self-Employed Tour Guide Services Contract to formalize your business. It is essential to keep accurate records of your income, as this helps ensure compliance with tax regulations.

Yes, you typically need a license to operate as a tour guide in the Virgin Islands. Licensing requirements can vary, so it's important to check local regulations before starting your business. Having a Virgin Islands Self-Employed Tour Guide Services Contract can provide clarity on your services and responsibilities. Platforms like US Legal Forms can help you navigate the necessary paperwork to ensure compliance.

A tourism freelancer is an individual who offers services related to travel and tourism on a contract basis. This can include guiding tours, planning trips, or providing travel advice without being tied to a single employer. If you are interested in this field, creating a Virgin Islands Self-Employed Tour Guide Services Contract will help you establish your business relationship with clients. Using resources like US Legal Forms can assist you in crafting a professional contract.