Virgin Islands Qualified Investor Certification and Waiver of Claims

Description

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status, take Investor statements regarding information, and waiver of claims.

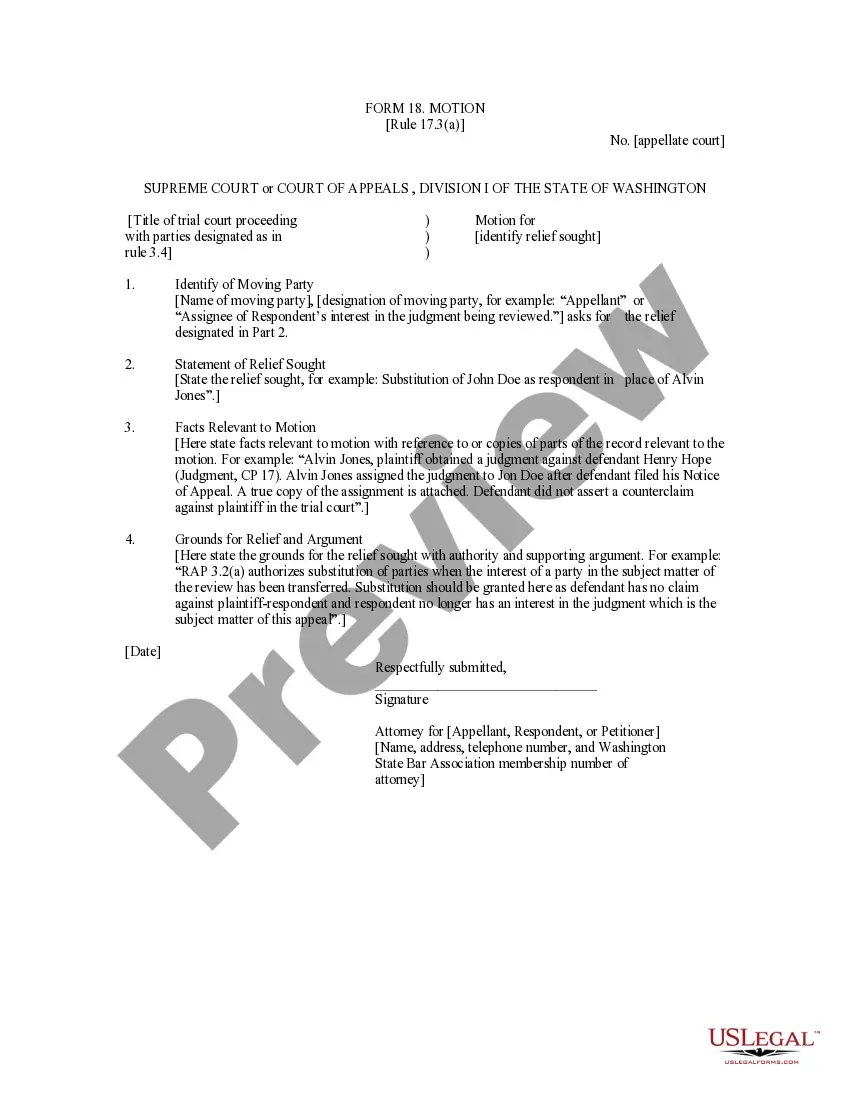

How to fill out Qualified Investor Certification And Waiver Of Claims?

US Legal Forms - one of many biggest libraries of lawful kinds in the USA - offers a variety of lawful file templates you can obtain or print. Utilizing the website, you will get a large number of kinds for enterprise and individual functions, categorized by categories, claims, or key phrases.You will find the most up-to-date models of kinds much like the Virgin Islands Qualified Investor Certification and Waiver of Claims in seconds.

If you already possess a monthly subscription, log in and obtain Virgin Islands Qualified Investor Certification and Waiver of Claims from the US Legal Forms catalogue. The Down load switch can look on each and every type you see. You have accessibility to all earlier acquired kinds in the My Forms tab of your accounts.

If you wish to use US Legal Forms the very first time, allow me to share easy instructions to help you get started:

- Be sure to have picked the correct type for the area/state. Select the Preview switch to check the form`s articles. See the type description to ensure that you have selected the appropriate type.

- In case the type doesn`t suit your demands, utilize the Search industry near the top of the monitor to obtain the one which does.

- Should you be content with the shape, validate your selection by simply clicking the Acquire now switch. Then, opt for the costs plan you want and offer your credentials to register for an accounts.

- Approach the purchase. Make use of credit card or PayPal accounts to complete the purchase.

- Select the file format and obtain the shape on the system.

- Make changes. Load, modify and print and indication the acquired Virgin Islands Qualified Investor Certification and Waiver of Claims.

Every template you included with your money lacks an expiration day which is the one you have permanently. So, in order to obtain or print another copy, just visit the My Forms section and click in the type you will need.

Get access to the Virgin Islands Qualified Investor Certification and Waiver of Claims with US Legal Forms, one of the most considerable catalogue of lawful file templates. Use a large number of specialist and status-particular templates that satisfy your company or individual needs and demands.

Form popularity

FAQ

To become an institutional investor, earn at least a bachelor's degree in finance, economics or business and gain experience in a specialized area of investing, like real estate, stocks, venture capital or angel investing.

The amendments add a new category to the definition for individuals to qualify as accredited investors based on possession of certain professional certifications, designations or other credentials that demonstrate a background and understanding in the areas of securities and investing. SEC Expands Accredited Investor Definition To Allow More ... skadden.com ? publications ? 2020/08 ? sec... skadden.com ? publications ? 2020/08 ? sec...

Among other categories, the SEC now defines accredited investors to include the following: individuals who have certain professional certifications, designations, or credentials; individuals who are ?knowledgeable employees? of a private fund; and SEC- and state-registered investment advisors. Accredited Investor Defined: Understand the Requirements investopedia.com ? terms ? accreditedinvestor investopedia.com ? terms ? accreditedinvestor

An institutional investor is an entity that manages their clients' investments. Investment banks, insurance companies, and mutual funds are examples of institutional investors.

This criteria requires that an individual have net assets that count for at least $5 million, with liabilities subtracted. This means that an investor with $4.5 million in real estate and $500,000 in cash may be considered an accredited investor.

Generally speaking, a QIB will always meet the criteria to be classified as an accredited investor, but the reverse is not always true. QIBs are typically large financial institutions while accredited investors can be both individuals and companies.