Virgin Islands Form of Revolving Promissory Note

Description

How to fill out Form Of Revolving Promissory Note?

Choosing the best authorized document design can be quite a battle. Naturally, there are a variety of web templates accessible on the Internet, but how would you discover the authorized form you will need? Utilize the US Legal Forms site. The assistance delivers thousands of web templates, like the Virgin Islands Form of Revolving Promissory Note, which can be used for company and private needs. Each of the varieties are checked by specialists and meet up with federal and state requirements.

When you are currently listed, log in for your account and then click the Obtain switch to obtain the Virgin Islands Form of Revolving Promissory Note. Make use of your account to look from the authorized varieties you have ordered earlier. Visit the My Forms tab of your respective account and get one more backup from the document you will need.

When you are a new consumer of US Legal Forms, allow me to share straightforward recommendations that you should follow:

- First, make certain you have chosen the right form for your area/region. You are able to check out the form making use of the Review switch and browse the form explanation to ensure it is the right one for you.

- In case the form fails to meet up with your requirements, utilize the Seach industry to find the appropriate form.

- Once you are certain that the form is acceptable, select the Acquire now switch to obtain the form.

- Pick the pricing prepare you want and enter the needed information and facts. Design your account and buy your order utilizing your PayPal account or Visa or Mastercard.

- Opt for the data file file format and acquire the authorized document design for your system.

- Comprehensive, modify and print out and indicator the obtained Virgin Islands Form of Revolving Promissory Note.

US Legal Forms will be the greatest library of authorized varieties in which you can find various document web templates. Utilize the company to acquire skillfully-produced documents that follow condition requirements.

Form popularity

FAQ

In common speech, other terms, such as "loan", "loan agreement", and "loan contract" may be used interchangeably with "promissory note". The term "loan contract" is often used to describe a contract that is lengthy and detailed. A promissory note is very similar to a loan.

A revolving promissory note is a form of business financing that allows the company to borrow more money when needed. The process starts with an initial loan and then can be used as collateral for future loans that are paid back over time.

Promissory notes don't have to be notarized in most cases. You can typically sign a legally binding promissory note that contains unconditional pledges to pay a certain sum of money. However, you can strengthen the legality of a valid promissory note by having it notarized.

However, using a lawyer is not necessary for the loan to be valid. Once you draft the promissory note, it's time for everyone to sign it: the lender, the borrower and the co-signer (if there is one). Again, seeking professional help such as notarizing the signatures is a good idea but not required.

Promissory notes are quite simple and can be prepared by anyone. They do not need to be prepared by a lawyer or be notarized. It isn't even particularly significant whether a promissory note is handwritten or typed and printed.

Types of Promissory Notes Simple Promissory Note. ... Student Loan Promissory Note. ... Real Estate Promissory Note. ... Personal Loan Promissory Notes. ... Car Promissory Note. ... Commercial Promissory note. ... Investment Promissory Note. ... Installment Payments.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

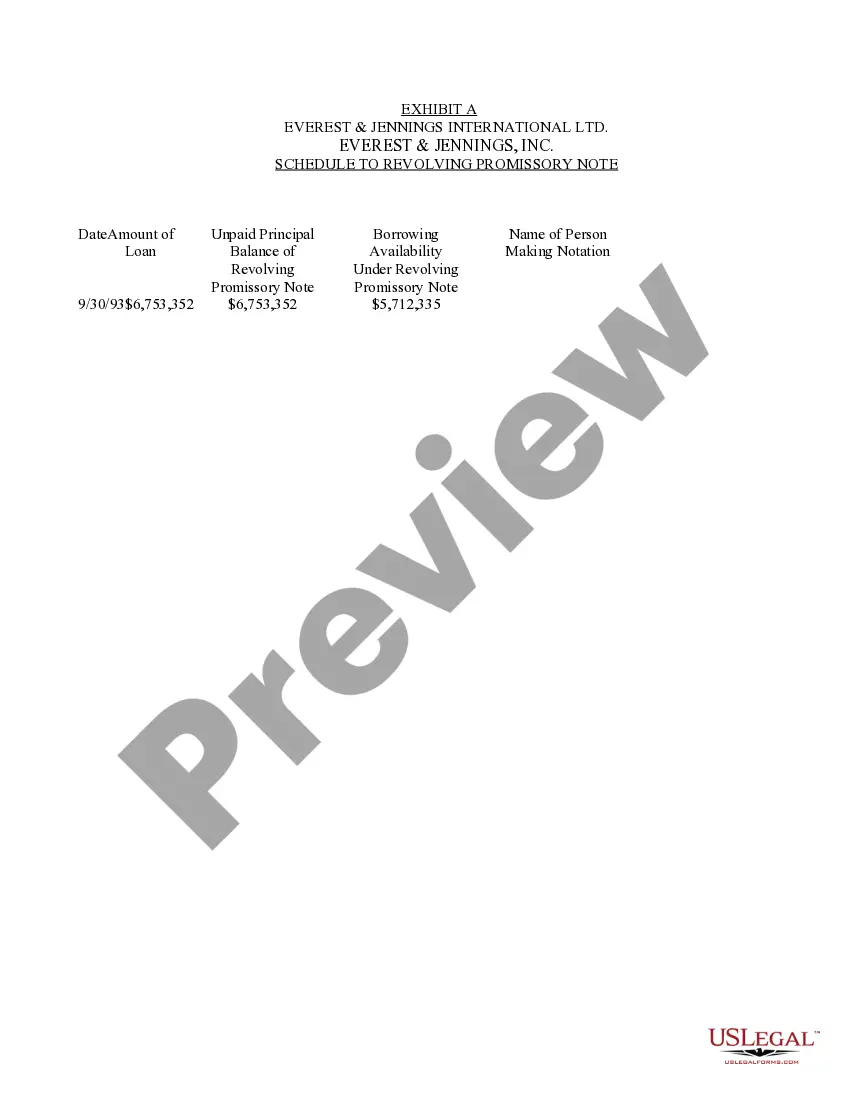

A promissory note typically contains all the terms involved, such as the principal debt amount, interest rate, maturity date, payment schedule, the date and place of issuance, and the issuer's signature.