Virgin Islands Corporate Resolution For Sale of Stock

Description

How to fill out Corporate Resolution For Sale Of Stock?

If you aim to complete, acquire, or generate sanctioned document templates, utilize US Legal Forms, the most extensive compilation of legal forms available online.

Leverage the site’s straightforward and convenient search to locate the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Every legal document template you obtain is yours indefinitely. You have access to every form you downloaded in your account. Click on the My documents section and select a form to print or download again.

Complete and acquire, and print the Virgin Islands Corporate Resolution For Sale of Stock with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to find the Virgin Islands Corporate Resolution For Sale of Stock within just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to locate the Virgin Islands Corporate Resolution For Sale of Stock.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, check the instructions provided below.

- Step 1. Make sure you have chosen the form for the correct city/state.

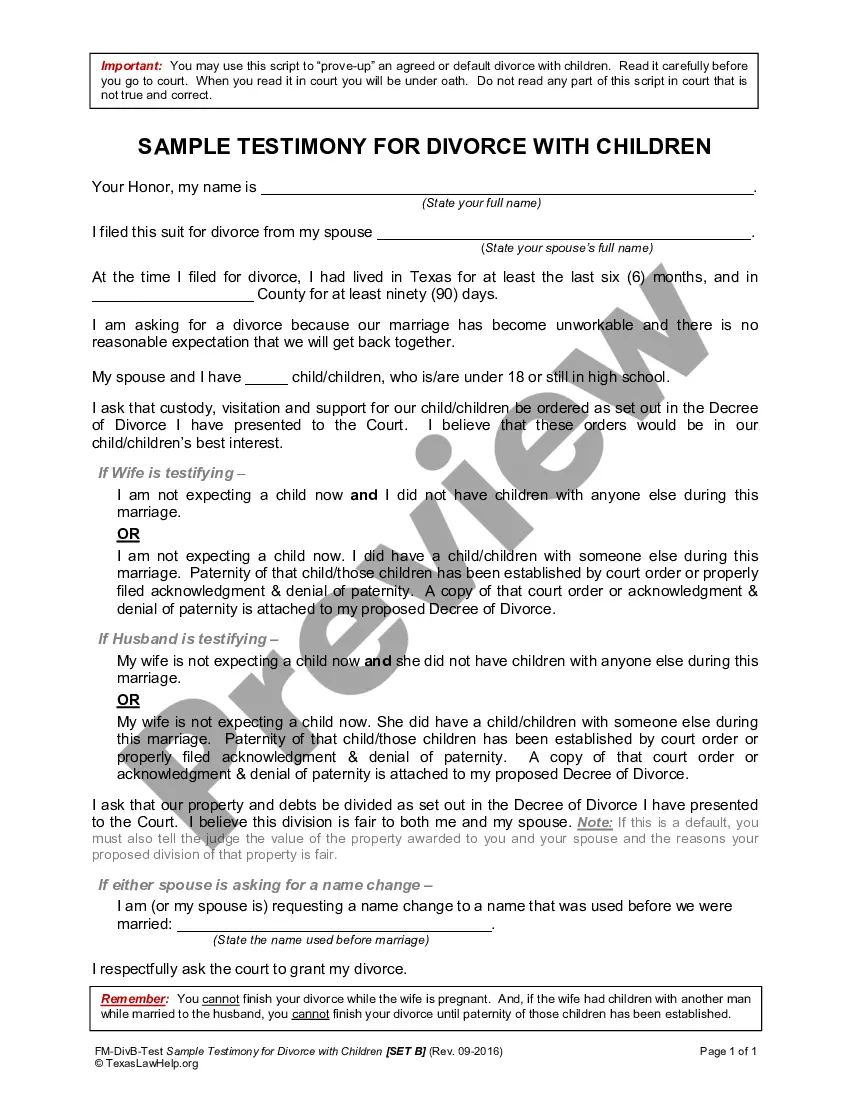

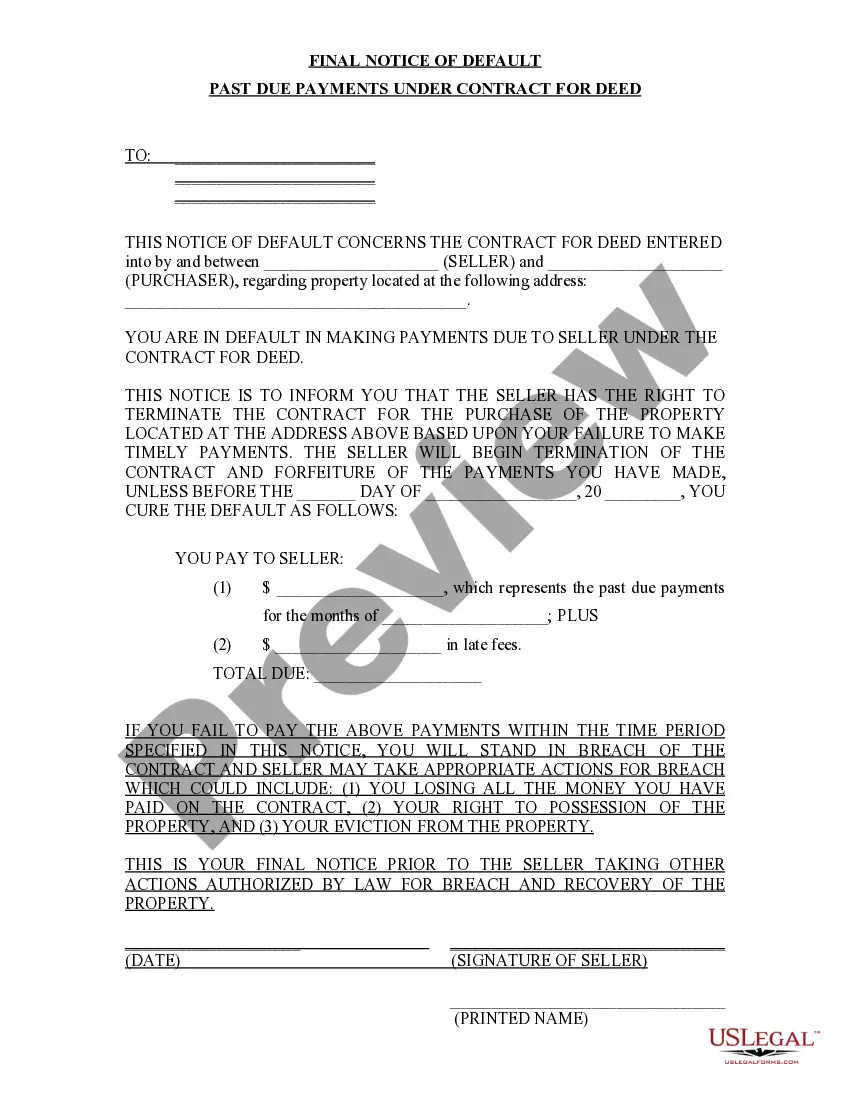

- Step 2. Use the Review method to examine the form's contents. Remember to read the description.

- Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to find alternative forms within the legal document template.

- Step 4. Once you have identified the required form, click on the Buy now button. Choose the pricing plan you prefer and enter your details to create an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Retrieve the format of the legal form and download it to your device.

- Step 7. Complete, modify and print or sign the Virgin Islands Corporate Resolution For Sale of Stock.

Form popularity

FAQ

What Documents are required for share transfer ?Income Tax PAN of both the transferee and the transferor.Passport size colour Photo of both the transferee and the transferor.Aadhaar Card or Electricity Bill or Passport or Driving License or Voter ID Card of both the transferee and the transferor.More items...

Shares or debentures are movable property. They are transferable in the manner provided by the articles of the company, especially, the shares of any member of a public company. The transfer of securities is possible through any contract or arrangement between two or more persons.

Paragraph 34A of Schedule 2 to the Business Companies Act, 2004 (BCA) statutorily amended the memorandum and articles of association of all BVI companies to prohibit the issue of bearer shares after 31 December 2009 (the Transition Date).

All limited companies must issue at least one share. There is no maximum share capital, but all shareholders must pay the company the value of their shares. For example, if a shareholder owns 50 shares at £1 each, they would have to pay the company A£50.

A company which does not have share capital is a company limited by guarantee. The profits that are earned are again re invested.

Basic Procedure for Transfer of Share in a Public CompanyThe deed of Share transfer in form SH-4 must be duly executed both by the transferor and the transferee.The share transfer deed must bear stamps according to the Indian Stamp Act, and Stamp Duty must be given in the State concerned.More items...?30 Sept 2016

What documents are required to transfer the share?Original share certificate(s) of transferor.Self-attested copy of PAN card of Transferor(s) (i.e. sellers) and Transferee(s) (i.e. buyers)Pay appropriate stamp duty @0.25% on market value by way of franking or affix share transfer stamps.More items...?

The normal authorised share capital of a BVI company is 50,000 shares with all of the shares having a par value, this being the maximum share capital for the minimum duty payable upon incorporation and annually thereafter. The share capital may be expressed in any currency.

(1) Registered shares are transferred by a written instrument of transfer signed by the transferor and containing the name and address of the transferee. (2) The instrument of transfer shall also be signed by the transferee if registration as a holder of the share imposes a liability to the company on the transferee.

Understanding Authorized Share Capital Although all these terms are interrelated, they are not synonyms. Authorized share capital is the broadest term used to describe a company's capital. It comprises every single share of every category that the company could issue if it needed or wanted to.