Virgin Islands Promissory Note with Payments Amortized for a Certain Number of Years

Description

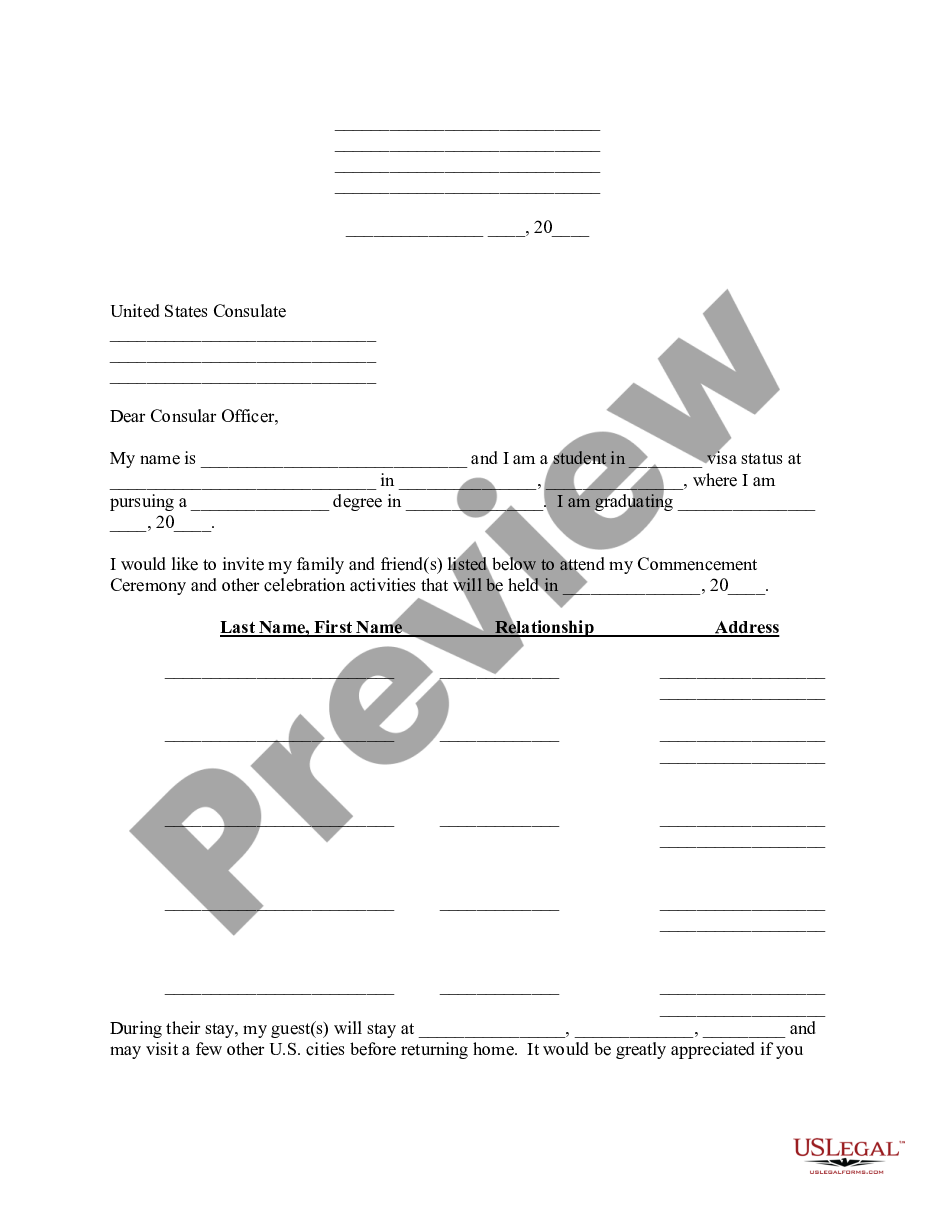

How to fill out Promissory Note With Payments Amortized For A Certain Number Of Years?

US Legal Forms - one of the largest collections of legal templates in the United States - provides a diverse assortment of legal document templates that you can obtain or print.

By utilizing the website, you can discover thousands of forms for commercial and personal purposes, organized by categories, states, or keywords. You can locate the latest versions of documents like the Virgin Islands Promissory Note with Payments Amortized for a Specified Number of Years in just moments.

If you already have an account, Log In and retrieve the Virgin Islands Promissory Note with Payments Amortized for a Specified Number of Years from the US Legal Forms catalog. The Download button will appear on each form you review. You can access all previously saved forms within the My documents section of your account.

Complete the purchase. Use your Visa or Mastercard or PayPal account to finalize the transaction.

Download the form in your chosen format to your device. Edit. Fill out, alter, print, and sign the saved Virgin Islands Promissory Note with Payments Amortized for a Specified Number of Years. Each template you added to your account has no expiration date and is yours indefinitely. So, if you want to obtain or print another copy, just go to the My documents section and click on the form you desire.

- If you are using US Legal Forms for the first time, here are straightforward instructions to assist you.

- Ensure you have selected the correct form for your city/state.

- Click the Review button to examine the content of the form.

- Check the form information to confirm that you have selected the appropriate form.

- If the form does not meet your needs, use the Search field at the top of the screen to find the suitable one.

- If you are content with the form, affirm your choice by clicking the Acquire now button.

- Then, select the payment plan you prefer and provide your details to register for an account.

Form popularity

FAQ

To effectively fill out a promissory note, begin by entering the names and addresses of both parties involved. Following that, state the amount being loaned and the interest agreement, making it easy to see the financial commitment. It’s crucial to detail the payment schedule, especially for a Virgin Islands Promissory Note with Payments Amortized for a Certain Number of Years, to keep everything organized and transparent. Finally, have both parties sign the document to formalize the agreement.

The entry of a promissory note refers to a legal acknowledgment of debt between the borrower and lender. Typically, it includes critical details such as the debt amount, payment terms, and the duration of the agreement. When considering a Virgin Islands Promissory Note with Payments Amortized for a Certain Number of Years, it's vital to record these entries properly in financial documents to maintain accurate records and ensure compliance with local regulations.

Filling out a promissory note involves several key details. Begin with listing the principal amount borrowed, followed by the interest rate and payment schedule. Make sure to include provisions for late fees and default conditions if the borrower fails to make payments. When drafting the Virgin Islands Promissory Note with Payments Amortized for a Certain Number of Years, ensure that all terms are clear and concise to avoid misunderstandings.

The payment for amortization of a Virgin Islands Promissory Note with Payments Amortized for a Certain Number of Years involves regular installments that cover both interest and principal. Each payment remains consistent, allowing for easier financial planning. To get an accurate understanding of the payment, consider using tools or platforms like uslegalforms, which can assist you in calculating your specific amortization schedule.

The duration of a promissory note varies based on the terms agreed upon by both parties, but it typically ranges from one to thirty years. A Virgin Islands Promissory Note with Payments Amortized for a Certain Number of Years has a clearly defined repayment schedule, making it easier for borrowers to plan their finances. It is important to review the terms to understand your repayment timeline.

Generally, the repayment of a promissory note itself is not taxable income for the lender, as they are simply receiving their principal back. However, any interest received might be taxable, depending on the tax laws applicable. When dealing with a Virgin Islands Promissory Note with Payments Amortized for a Certain Number of Years, both parties should consult tax professionals to understand their obligations and ensure compliance.

To account for a promissory note, you should create entries that track the principal and interest components of each payment. Each time a payment is made, you will adjust the balances accordingly. This is especially important with a Virgin Islands Promissory Note with Payments Amortized for a Certain Number of Years, ensuring that the accounting reflects the ongoing obligations correctly.

Yes, there is typically a time limit on a promissory note, which is often defined by the terms outlined within the document itself. In the context of a Virgin Islands Promissory Note with Payments Amortized for a Certain Number of Years, the repayment period is specified upfront. It's crucial for both parties to understand and agree upon this timeframe to avoid any potential legal issues in the future.