Virgin Islands Agreement to Compromise Debt by Returning Secured Property

Description

How to fill out Agreement To Compromise Debt By Returning Secured Property?

Are you currently in a circumstance that requires documents for either business or personal purposes almost every day.

There is a wide array of legal document templates accessible online, but finding ones you can rely on isn't straightforward.

US Legal Forms provides numerous form templates, including the Virgin Islands Agreement to Settle Debt by Returning Secured Property, specifically designed to fulfill federal and state requirements.

Once you have the appropriate form, click on Buy now.

Choose the pricing plan you prefer, fill in the required details to set up your payment, and finalize your order using PayPal or a Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After logging in, you can download the Virgin Islands Agreement to Settle Debt by Returning Secured Property template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct area/county.

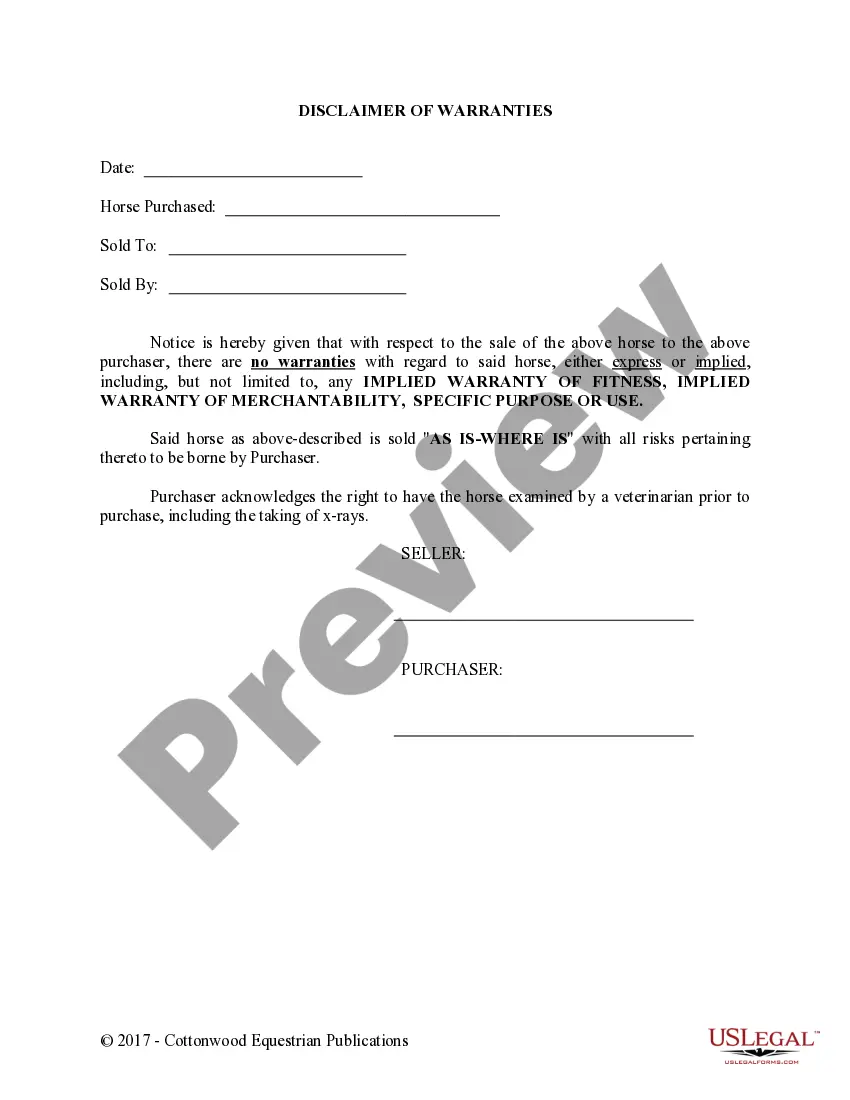

- Utilize the Review button to examine the form.

- Read the description to confirm that you have selected the right form.

- If the form isn't what you are looking for, use the Search bar to find the form that fits your needs.

Form popularity

FAQ

Section 175 of the BVI Business Companies Act addresses the appointment of receivers during insolvency proceedings. This section outlines the processes for creditors to recover debts and manage securities effectively. Understanding Section 175 can be vital when navigating the complexities of the Virgin Islands Agreement to Compromise Debt by Returning Secured Property. Familiarity with these regulations can aid both creditors and debtors in making informed decisions.

A creditor's claim to the assets of a business refers to the legal right of creditors to seek payment from the business's resources. This claim becomes central during discussions around the Virgin Islands Agreement to Compromise Debt by Returning Secured Property. A well-defined claim allows creditors to recover losses while giving the business a chance to restructure and recover. Clarity about these claims helps facilitate smoother negotiations.

Insolvency law in the British Virgin Islands governs the processes for dealing with companies that cannot meet their financial obligations. This law establishes methods for liquidating assets and prioritizing creditor claims, particularly relevant during the Virgin Islands Agreement to Compromise Debt by Returning Secured Property discussions. Understanding these laws ensures all parties work within the proper legal framework, promoting fair resolutions.

A legal claim against an asset until the debt is repaid is commonly referred to as a lien. This lien provides the creditor with a legal right to retain possession of the debtor's asset until the outstanding balance is settled. In situations involving the Virgin Islands Agreement to Compromise Debt by Returning Secured Property, understanding how liens function can help both parties manage expectations about asset recovery. This knowledge supports fair negotiations.

A creditor's claim against an owner's assets is a legal right to seize those assets as a form of repayment for an unpaid obligation. When a debtor defaults, creditors can enforce this claim through court intervention or settlement agreements, such as the Virgin Islands Agreement to Compromise Debt by Returning Secured Property. These claims ensure that creditors have a mechanism to recover losses, which can be critical in times of financial strain.

In the British Virgin Islands, local laws govern various financial matters, including debt compromises. The applicable laws often include the BVI Business Companies Act and insolvency regulations. When exploring the Virgin Islands Agreement to Compromise Debt by Returning Secured Property, it's essential to understand these laws' impact on both creditors and debtors. This knowledge can ensure that all parties comply with legal requirements during negotiations.

In the Virgin Islands Agreement to Compromise Debt by Returning Secured Property context, a secured creditor typically does need to file a proof of claim. This document asserts the creditor's right to repayment and establishes a claim against the debtor's property. It is crucial for the creditor to act promptly, as delays may jeopardize their claim. Understanding the filing process can significantly impact the outcome.

Removing child support from a credit report is possible but can be complex. If there are reporting errors, you can dispute them with credit bureaus. Additionally, a successful resolution through the Virgin Islands Agreement to Compromise Debt by Returning Secured Property may improve your financial standing, possibly helping to enhance your credit profile over time.

Purging child support typically involves making consistent payments to erase arrears. You might also consider petitioning the court for relief under the Virgin Islands Agreement to Compromise Debt by Returning Secured Property. This agreement may offer strategies to address and potentially limit your child support obligations, leading to financial relief.

You can discharge debt legally through bankruptcy, negotiation with creditors, or utilizing certain agreements. The Virgin Islands Agreement to Compromise Debt by Returning Secured Property enables you to propose settling certain secured debts, potentially easing your overall financial burden. Consulting a legal expert can also guide you through the best options.