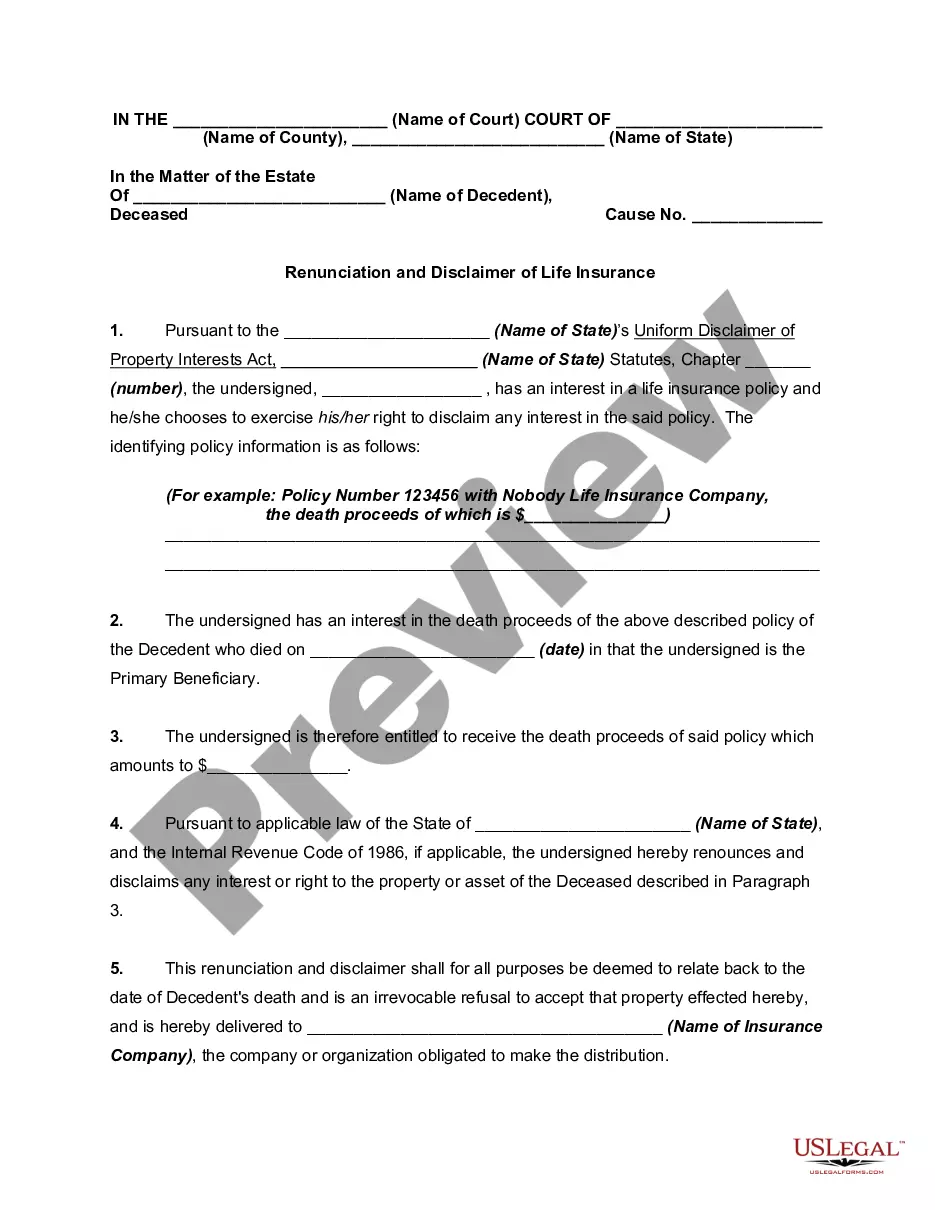

If you wish to total, down load, or printing authorized record layouts, use US Legal Forms, the most important selection of authorized varieties, which can be found online. Take advantage of the site`s easy and hassle-free search to get the paperwork you need. A variety of layouts for business and personal uses are sorted by types and claims, or keywords and phrases. Use US Legal Forms to get the Virgin Islands Renunciation and Disclaimer of Interest in Life Insurance Proceeds in a couple of mouse clicks.

If you are previously a US Legal Forms client, log in for your account and then click the Down load button to get the Virgin Islands Renunciation and Disclaimer of Interest in Life Insurance Proceeds. You can even entry varieties you in the past delivered electronically in the My Forms tab of your own account.

Should you use US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Be sure you have chosen the shape for that right city/land.

- Step 2. Take advantage of the Review option to check out the form`s content material. Never forget to read the explanation.

- Step 3. If you are unsatisfied with the form, take advantage of the Search discipline at the top of the monitor to find other versions in the authorized form design.

- Step 4. After you have found the shape you need, click the Get now button. Pick the costs program you choose and include your references to register for an account.

- Step 5. Process the purchase. You may use your bank card or PayPal account to finish the purchase.

- Step 6. Choose the file format in the authorized form and down load it on the device.

- Step 7. Full, change and printing or indicator the Virgin Islands Renunciation and Disclaimer of Interest in Life Insurance Proceeds.

Every authorized record design you acquire is the one you have for a long time. You possess acces to every single form you delivered electronically within your acccount. Select the My Forms area and pick a form to printing or down load yet again.

Contend and down load, and printing the Virgin Islands Renunciation and Disclaimer of Interest in Life Insurance Proceeds with US Legal Forms. There are thousands of specialist and condition-particular varieties you may use for your business or personal requirements.