Virgin Islands General Form of Revocable Trust Agreement

Description

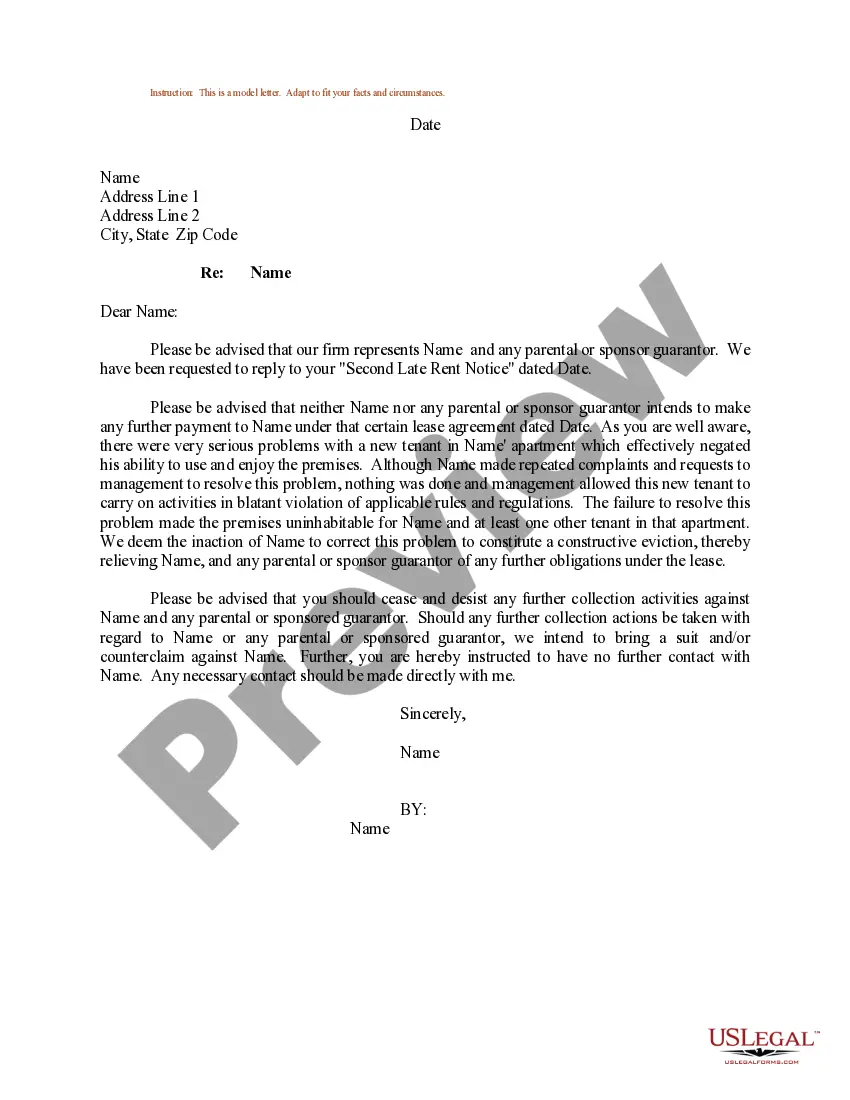

How to fill out General Form Of Revocable Trust Agreement?

You can spend numerous hours online searching for the legal document template that satisfies the federal and state requirements you need.

US Legal Forms offers an extensive collection of legal forms that are assessed by experts.

It's easy to download or print the Virgin Islands General Form of Revocable Trust Agreement from our service.

If you wish to obtain an additional version of the form, use the Search area to find the template that fulfills your requirements.

- If you possess a US Legal Forms account, you can sign in and then click on the Obtain button.

- Subsequently, you can fill out, modify, print, or sign the Virgin Islands General Form of Revocable Trust Agreement.

- Every legal document template you purchase is yours permanently.

- To acquire an extra copy of a purchased form, go to the My documents section and click the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your region/area of interest.

- Review the form description to confirm you have chosen the right template.

Form popularity

FAQ

A revocable trust offers a moderate level of security for your assets. While it does not provide asset protection from creditors, it effectively avoids the probate process, which can expose your assets to public scrutiny. This leads to a more private and streamlined transfer of assets upon your death. By drafting a Virgin Islands General Form of Revocable Trust Agreement, you enhance the management of your estate while maintaining a degree of confidentiality.

The greatest advantage of a revocable trust lies in its flexibility. You can modify or dissolve the trust during your lifetime, allowing you to adapt to changes in your circumstances or intentions. This flexibility ensures that your assets are managed in accordance with your current wishes. By utilizing the Virgin Islands General Form of Revocable Trust Agreement, you gain a powerful tool to maintain control over your estate.

Yes, a revocable trust transitions to an irrevocable trust upon the death of the grantor. This means that after death, the terms of the trust cannot be changed. This feature is essential for the distribution of assets according to your wishes. When you establish a Virgin Islands General Form of Revocable Trust Agreement, you secure this transition effectively.

A codicil is an amendment specifically for a will, while an amendment pertains to a trust. In the context of a Virgin Islands General Form of Revocable Trust Agreement, an amendment allows you to make changes to the trust terms, beneficiaries, or assets. Understanding this distinction can help you manage your estate planning effectively and ensure your documents are up to date.

You can find a trust amendment form on various legal resources, but one of the easiest ways is to visit US Legal Forms. They offer a wide range of templates, including the Virgin Islands General Form of Revocable Trust Agreement, making it simple for you to locate the amendment form you need. Just search for the specific form and follow the instructions provided for a seamless experience.

Yes, you can amend your trust by yourself, provided you follow the correct procedures outlined in your Virgin Islands General Form of Revocable Trust Agreement. It is crucial to document any changes properly to avoid confusion in the future. Tools and templates available on US Legal Forms can simplify this process and help you ensure all amendments meet the legal requirements.

When creating a revocable trust, avoid placing certain assets, such as retirement accounts or insurance policies, directly into the trust. Instead, consider naming the trust as the beneficiary for these assets, while you maintain control over them. By doing this, you can ensure that your Virgin Islands General Form of Revocable Trust Agreement works effectively without complicating your estate plan.

You can easily obtain a trust amendment form by visiting reputable online legal platforms like US Legal Forms. They provide various templates, including the Virgin Islands General Form of Revocable Trust Agreement, which can guide you in making necessary amendments. Simply select the appropriate form, and you can fill it out online or download it for your convenience.

When creating a trust using the Virgin Islands General Form of Revocable Trust Agreement, it’s wise to exclude certain assets, such as retirement accounts or life insurance policies with named beneficiaries. Additionally, personal property like your primary residence may need special consideration, as it could complicate the trust's overall management. Always consult with an expert to determine which assets should remain outside of the trust for optimal estate planning.

Filing a tax return for a revocable trust, including those established with the Virgin Islands General Form of Revocable Trust Agreement, generally involves reporting the trust's income on your personal tax return using IRS Form 1040. Since revocable trusts are treated as pass-through entities for tax purposes, the trust's income is passed on to you, the grantor. It’s advisable to keep organized records of the trust's income and expenses for accurate reporting.