An agreement that creates an interest in real property as security for an obligation, such as the payment of a note, and that is to cease upon the performance of the obligation, is called a mortgage. The person whose interest in the property is given as security is the mortgagor. The person who receives the security is the mortgagee (e.g., lender). A release, deed of reconveyance, deed of release, or authority to cancel is used by a mortgagee to renounce a claim upon a person's real property subject to the mortgage.

Virgin Islands Letter Tendering Final Payment of Amount Due Pursuant to a Promissory Note Secured by a Mortgage in Order to Obtain a Release of the Mortgaged Premises

Description

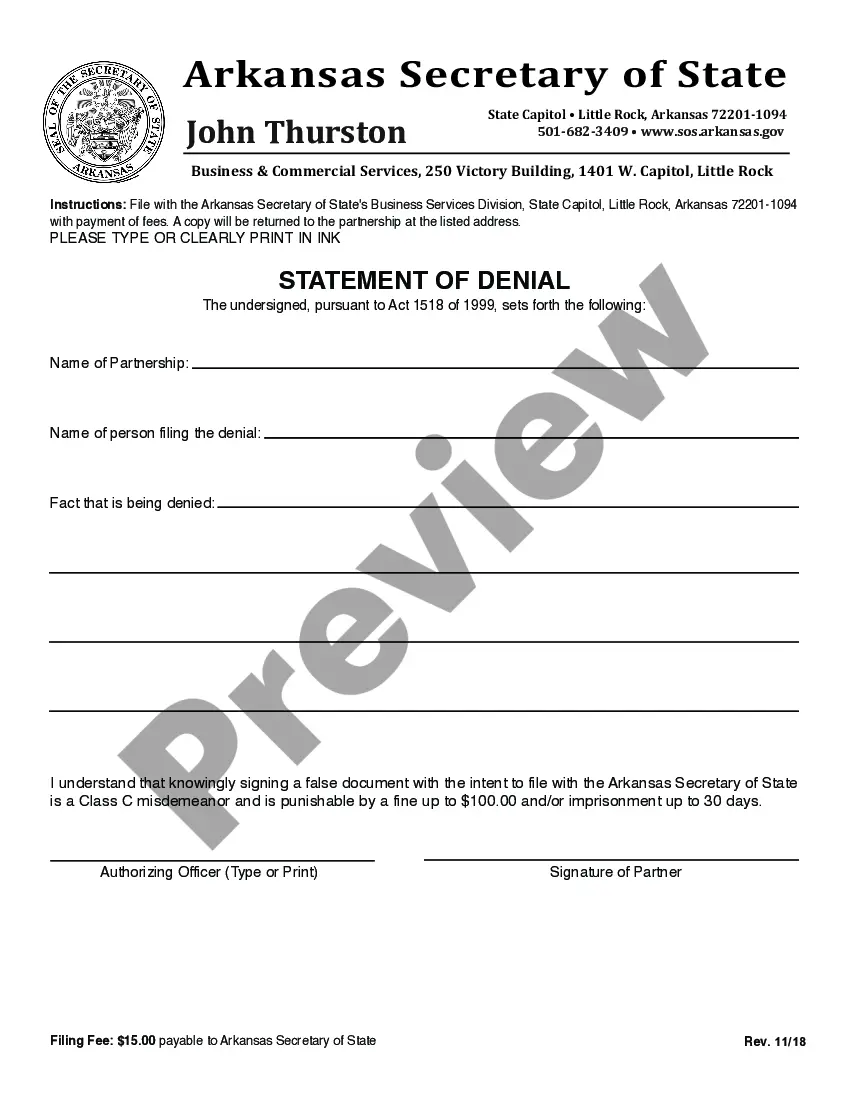

How to fill out Letter Tendering Final Payment Of Amount Due Pursuant To A Promissory Note Secured By A Mortgage In Order To Obtain A Release Of The Mortgaged Premises?

Are you presently in the situation in which you need files for both organization or person reasons virtually every working day? There are a variety of authorized record themes available on the Internet, but finding ones you can rely isn`t straightforward. US Legal Forms delivers a large number of form themes, much like the Virgin Islands Letter Tendering Final Payment of Amount Due Pursuant to a Promissory Note Secured by a Mortgage in Order to Obtain a Release of the Mortgaged Premises, which are written to satisfy state and federal demands.

In case you are already informed about US Legal Forms website and possess a merchant account, simply log in. Following that, it is possible to down load the Virgin Islands Letter Tendering Final Payment of Amount Due Pursuant to a Promissory Note Secured by a Mortgage in Order to Obtain a Release of the Mortgaged Premises design.

If you do not provide an profile and wish to begin to use US Legal Forms, follow these steps:

- Obtain the form you require and ensure it is for that correct town/state.

- Use the Review button to review the form.

- Browse the explanation to actually have selected the correct form.

- In case the form isn`t what you are searching for, take advantage of the Research discipline to find the form that meets your needs and demands.

- Whenever you find the correct form, just click Purchase now.

- Choose the prices program you would like, complete the required information to generate your account, and pay money for your order using your PayPal or Visa or Mastercard.

- Select a practical data file formatting and down load your version.

Locate all of the record themes you might have bought in the My Forms food list. You can aquire a more version of Virgin Islands Letter Tendering Final Payment of Amount Due Pursuant to a Promissory Note Secured by a Mortgage in Order to Obtain a Release of the Mortgaged Premises whenever, if possible. Just go through the necessary form to down load or produce the record design.

Use US Legal Forms, one of the most extensive selection of authorized varieties, to save lots of some time and stay away from blunders. The services delivers skillfully produced authorized record themes which can be used for an array of reasons. Create a merchant account on US Legal Forms and start generating your way of life easier.

Form popularity

FAQ

Secured promissory notes The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.

Your lender will keep the original promissory note until your loan is paid off.

Secured: A secured promissory note is common in traditional mortgages. It means the borrower backs their loan with collateral. For a mortgage, the collateral is the property. If the borrower fails to pay back their loan, the lender has a legal claim over the asset and, in extreme cases, may foreclose on the property.

Your lender will keep the original promissory note until your loan is paid off.

A promissory note is a document between the lender and the borrower in which the borrower promises to pay back the lender, it is a separate contract from the mortgage. The mortgage is a legal document that ties or "secures" a piece of real estate to an obligation to repay money.

Types of Mortgage Notes Mortgage notes can vary based on the kind of lender and the kind of loan used to buy a home: Secured loan note. This note uses the real estate property to secure the loan. If the borrower fails to repay the loan ing the note's terms, the lender may take possession of the property.

Secured promissory notes The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.

Before a promissory note can be canceled, the lender must agree to the terms of canceling it. A well-drafted and detailed promissory note can help the parties involved avoid future disputes, misunderstandings, and confusion. When canceling the promissory note, the process is referred to as a release of the note.