An assignment by a beneficiary of a portion of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Virgin Islands Assignment by Beneficiary of a Percentage of the Income of a Trust

Description

How to fill out Assignment By Beneficiary Of A Percentage Of The Income Of A Trust?

Are you situated in a location where you require documents for potentially business or personal purposes almost daily.

There are numerous legal document templates accessible online, but locating reliable ones can be challenging.

US Legal Forms offers a vast collection of document templates, including the Virgin Islands Assignment by Beneficiary of a Percentage of the Income of a Trust, designed to comply with state and federal requirements.

Once you find the correct document, click Buy now.

Choose the payment plan you prefer, complete the required information to set up your account, and pay for your order using PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Virgin Islands Assignment by Beneficiary of a Percentage of the Income of a Trust template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the document you need and ensure it is tailored to your specific city/county.

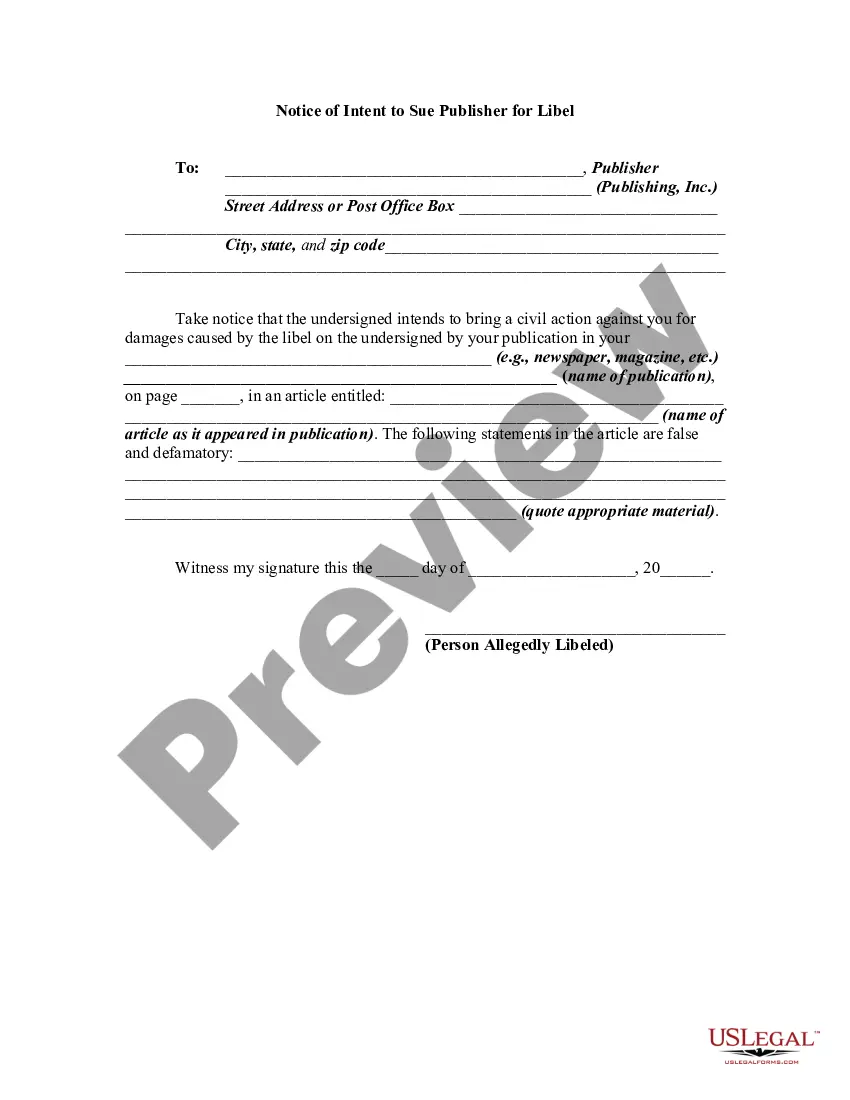

- Utilize the Review button to assess the form.

- Check the description to confirm you’ve selected the correct document.

- If the document is not what you are looking for, use the Search field to find the form that meets your needs and requirements.

Form popularity

FAQ

To report a beneficiary income from a Virgin Islands Assignment by Beneficiary of a Percentage of the Income of a Trust, you need to include this income on your tax return. Begin by identifying the specific forms required by the IRS and the Virgin Islands tax authority. You should also keep careful records of the payments received and any associated deductions. For more precise guidance, consider utilizing USLegalForms, which provides resources tailored to navigating the complexities of trust income reporting.

While the Virgin Islands follow some aspects of US law, it also has its own local statutes. This unique legal position means that certain federal laws may not be applied directly. For individuals considering a Virgin Islands Assignment by Beneficiary of a Percentage of the Income of a Trust, it is crucial to consult with legal experts to navigate these differences effectively.

The US Virgin Islands do not impose inheritance tax, making it an attractive location for estate planning. This absence of tax can encourage more efficient distribution of assets, benefiting family members and beneficiaries alike. A Virgin Islands Assignment by Beneficiary of a Percentage of the Income of a Trust can be an excellent tool in optimizing these distributions.

Yes, several states in the US do not have an inheritance tax, which can benefit estate planning. States like Texas and Florida offer individuals the opportunity to pass on assets without additional taxation. Residents of the Virgin Islands may also find that a Virgin Islands Assignment by Beneficiary of a Percentage of the Income of a Trust can further enhance their estate plans without the inheritance tax concern.

Allocating trust income to beneficiaries involves the trust's governing documents, which outline the distribution process. Typically, trustees are responsible for ensuring that income is distributed according to the terms specified. When utilizing a Virgin Islands Assignment by Beneficiary of a Percentage of the Income of a Trust, understanding these allocations can reinforce favorable financial outcomes.

No, the Virgin Islands do not impose an inheritance tax. This feature can be especially beneficial for individuals considering estate planning strategies involving trusts. A Virgin Islands Assignment by Beneficiary of a Percentage of the Income of a Trust allows for more strategic asset distribution without the burden of inheritance taxes.

Indeed, living in the Virgin Islands can offer unique tax advantages. The territory has different tax laws compared to the mainland, potentially resulting in lower overall tax liabilities. Beneficiaries receiving income from a trust may find that a Virgin Islands Assignment by Beneficiary of a Percentage of the Income of a Trust enhances their tax planning opportunities.

Yes, income from a trust is generally taxable to the beneficiary who receives it. When a trust distributes income, that income is reported on the beneficiary's tax returns. However, in the context of a Virgin Islands Assignment by Beneficiary of a Percentage of the Income of a Trust, certain tax strategies may be considered to optimize tax obligations.

Trust income taxation in the Virgin Islands depends on the beneficiary's residency and the specific tax laws applicable to the trust. Generally, if the beneficiary resides in a jurisdiction that taxes worldwide income, they may be liable for taxes on the income distributed from the trust. The Virgin Islands Assignment by Beneficiary of a Percentage of the Income of a Trust structure may offer certain advantages, so understanding the local tax implications is crucial. Utilizing platforms like US Legal Forms can help clarify these taxation issues and aid in proper reporting.

In the British Virgin Islands (BVI), the trust duty involves the obligation of trustees to manage the trust assets in accordance with the terms set by the trust deed. Trustees must act in the best interest of the beneficiaries, ensuring compliance with the Virgin Islands Assignment by Beneficiary of a Percentage of the Income of a Trust. This duty includes maintaining accurate records, providing regular accountings, and making prudent investment decisions. A trustworthy framework supports both the management of the trust and the protection of the beneficiaries' interests.