An alteration of a written instrument is a change in language of the instrument that is made by one of the parties to the instrument who is entitled to make the change. Any material alteration of a written instrument, after its execution, made by the owner or holder of the instrument, without the consent of the party to be charged, renders the instrument void as to the nonconsenting party. The party to be charged refers to that party or parties against whom enforcement of a contract or instrument is sought.

If a party consents to the alteration, the instrument will not be rendered invalid as to that party.

Virgin Islands Ratification of Re-Execution of Recorded Instrument With Alterations

Description

How to fill out Ratification Of Re-Execution Of Recorded Instrument With Alterations?

You can spend hours online trying to find the legal document template that fits the federal and state standards you require.

US Legal Forms provides a vast array of legal forms that have been reviewed by experts.

It is easy to download or print the Virgin Islands Ratification of Re-Execution of Recorded Instrument With Alterations from their service.

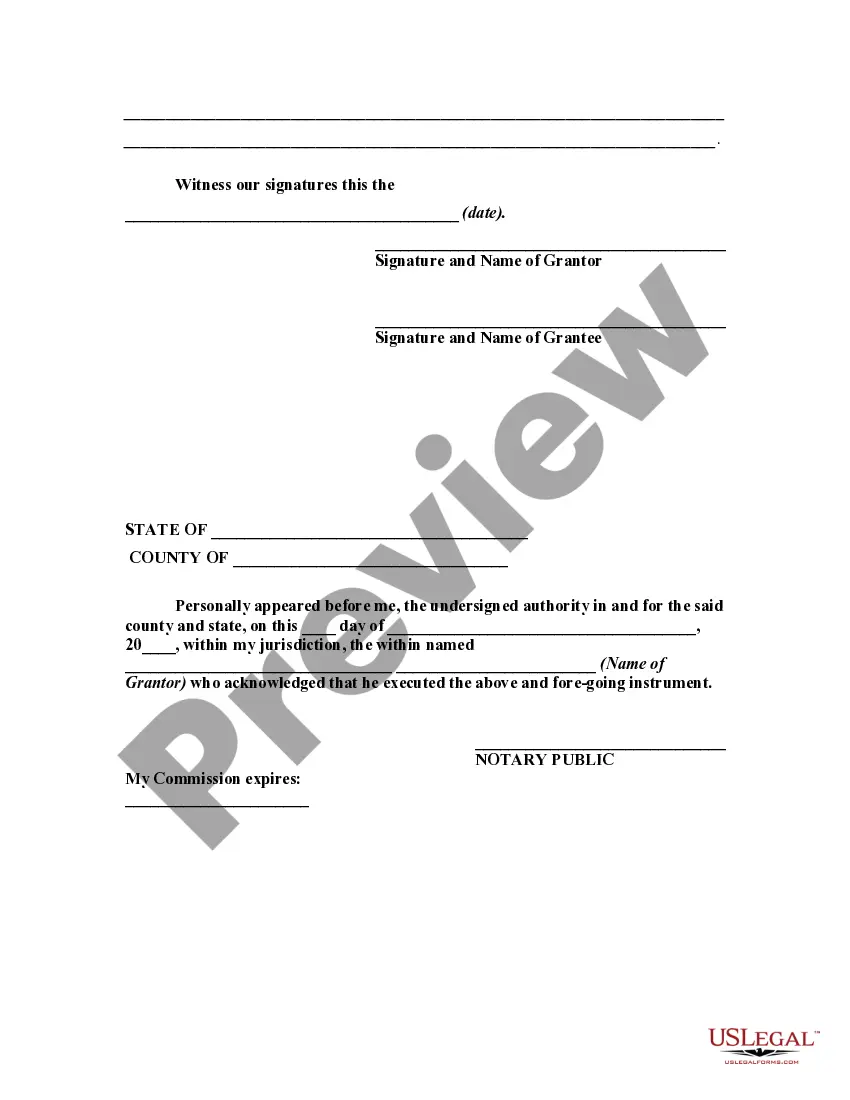

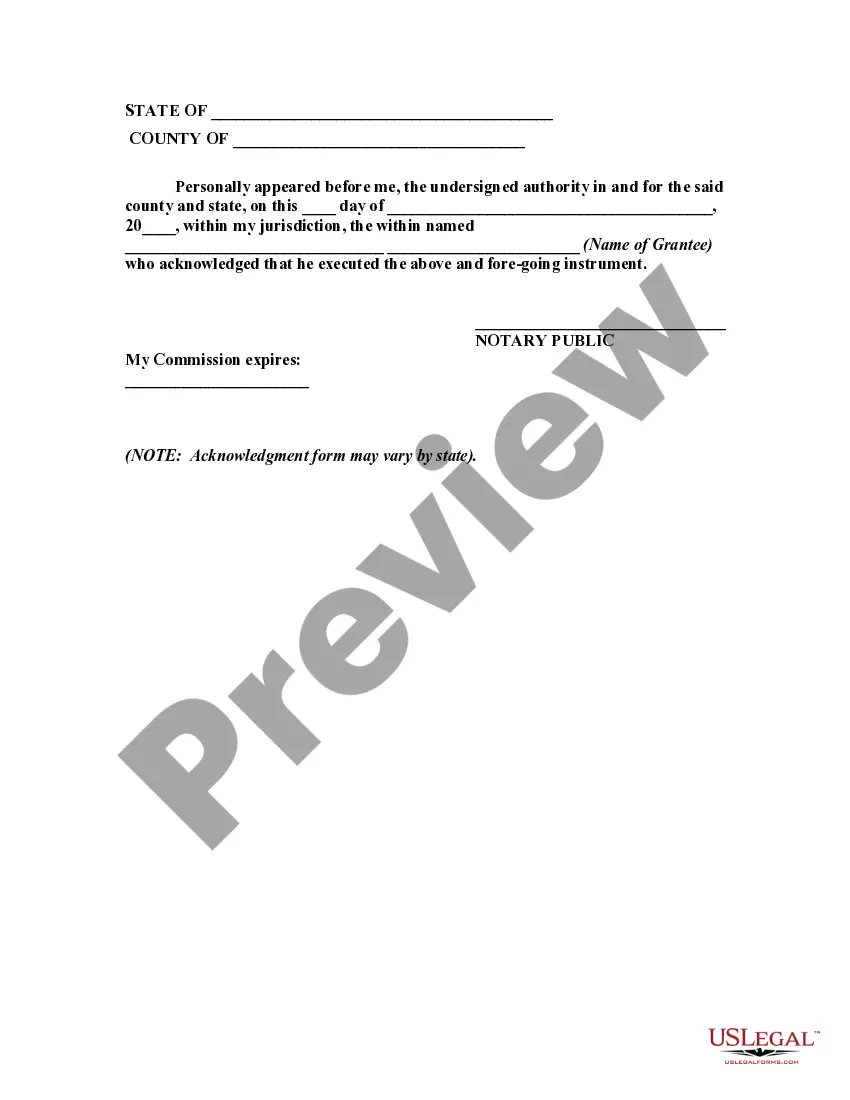

If available, use the Preview button to review the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Obtain button.

- Then, you can complete, edit, print, or sign the Virgin Islands Ratification of Re-Execution of Recorded Instrument With Alterations.

- Each legal document template you obtain is yours indefinitely.

- To get another copy of any acquired form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow these simple instructions below.

- First, ensure you have selected the correct document template for your county/town of choice.

- Check the form description to verify you have chosen the right form.

Form popularity

FAQ

While BVI companies offer numerous advantages, there are some disadvantages to consider. These can include regulatory compliance costs, potential scrutiny from jurisdictions with stricter scrutiny, and the challenge of navigating changing laws. Businesses must weigh these factors carefully, particularly in the context of the Virgin Islands Ratification of Re-Execution of Recorded Instrument With Alterations, where legal intricacies play a significant role.

In the BVI, companies enjoy a favorable tax regime, as there are no corporate income taxes on profits. This attractive tax environment encourages businesses to establish themselves within the territory. Understanding tax treatment is essential for any business considering the Virgin Islands Ratification of Re-Execution of Recorded Instrument With Alterations, as it impacts overall financial planning.

Section 179 of the BVI Companies Act addresses the provision of indemnity for directors and officers against liabilities. This section protects individuals who act on behalf of the company, ensuring they are shielded from certain legal repercussions. It's important for BVI companies to understand this section, especially when considering the Virgin Islands Ratification of Re-Execution of Recorded Instrument With Alterations.

Section 175 of the BVI Companies Act pertains to the powers of directors concerning document execution and management. This section is key for understanding how decisions are made within a company and how its documents are officially recognized. It plays a significant role in the context of the Virgin Islands Ratification of Re-Execution of Recorded Instrument With Alterations.

The new financial reporting rules for BVI enhance transparency and accountability among businesses operating in the jurisdiction. These rules require companies to maintain accurate financial records and report their activities regularly. Compliance with these rules aligns with the principles behind the Virgin Islands Ratification of Re-Execution of Recorded Instrument With Alterations.

BVI companies execute documents by following specific guidelines set forth in the BVI Companies Act. Typically, this involves signatures from directors or authorized signatories. Proper execution is crucial, particularly when considering the Virgin Islands Ratification of Re-Execution of Recorded Instrument With Alterations to ensure legal validity.

Section 162 of the BVI Companies Act outlines the requirements for the execution of documents by BVI companies. This section is essential for understanding how companies can legally bind themselves to agreements. It emphasizes the importance of proper execution, especially in the context of the Virgin Islands Ratification of Re-Execution of Recorded Instrument With Alterations.