Virgin Islands Receipt for Payment of Rent

Description

How to fill out Receipt For Payment Of Rent?

If you desire to complete, obtain, or print licensed document templates, utilize US Legal Forms, the most extensive assortment of legal forms, accessible online.

Make use of the website's straightforward and user-friendly search to locate the documents you require. Various templates for commercial and specific objectives are categorized by groups and regions, or keywords.

Utilize US Legal Forms to find the Virgin Islands Receipt for Payment of Rent in just a few clicks.

Every legal document template you purchase belongs to you forever. You have access to every form you downloaded within your account. Navigate to the My documents section and choose a form to print or download again.

Stay competitive and acquire, and print the Virgin Islands Receipt for Payment of Rent with US Legal Forms. There are numerous professional and state-specific forms available for your business or individual needs.

- If you are already a US Legal Forms client, Log In to your account and click the Download button to acquire the Virgin Islands Receipt for Payment of Rent.

- You may also access forms you previously downloaded in the My documents tab of your account.

- If you are engaging with US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

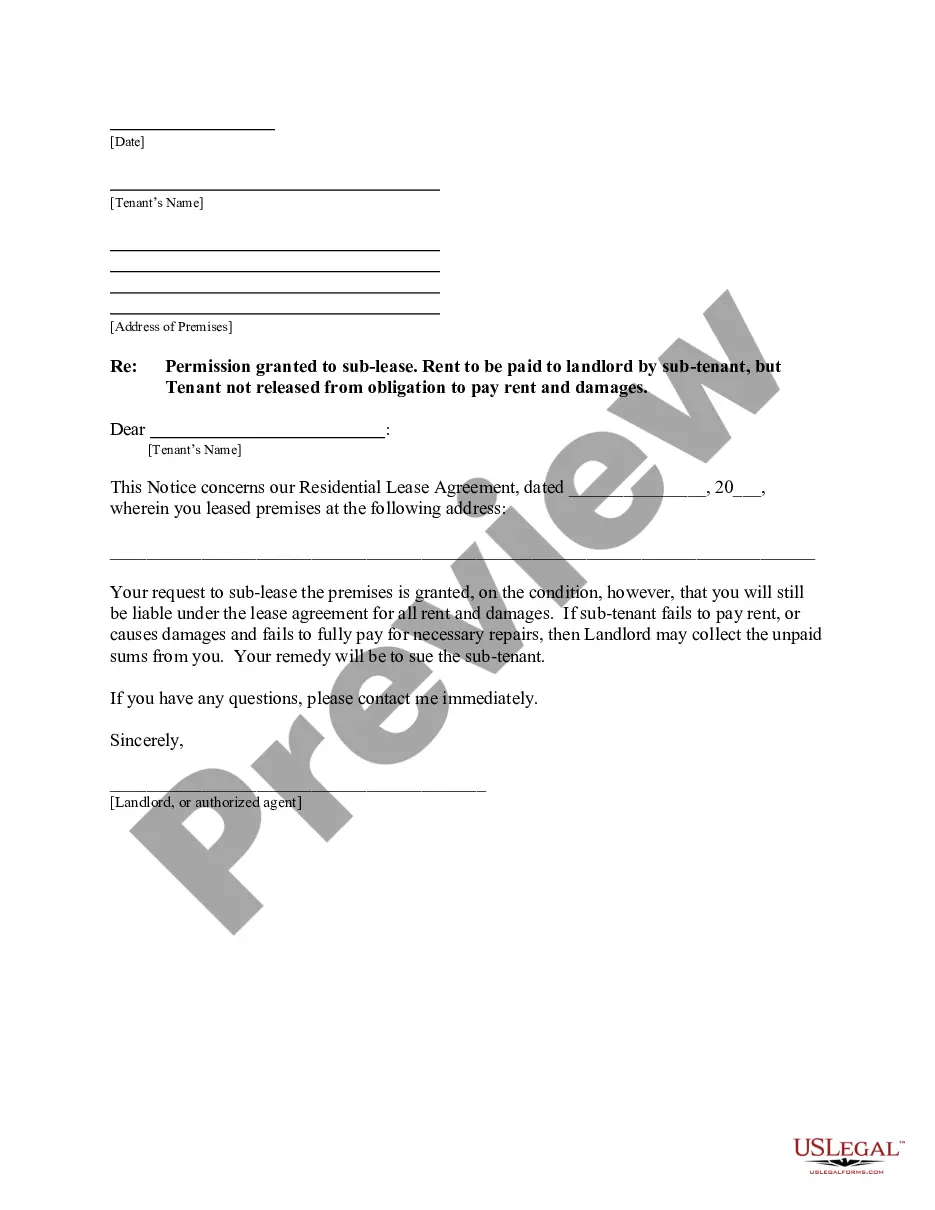

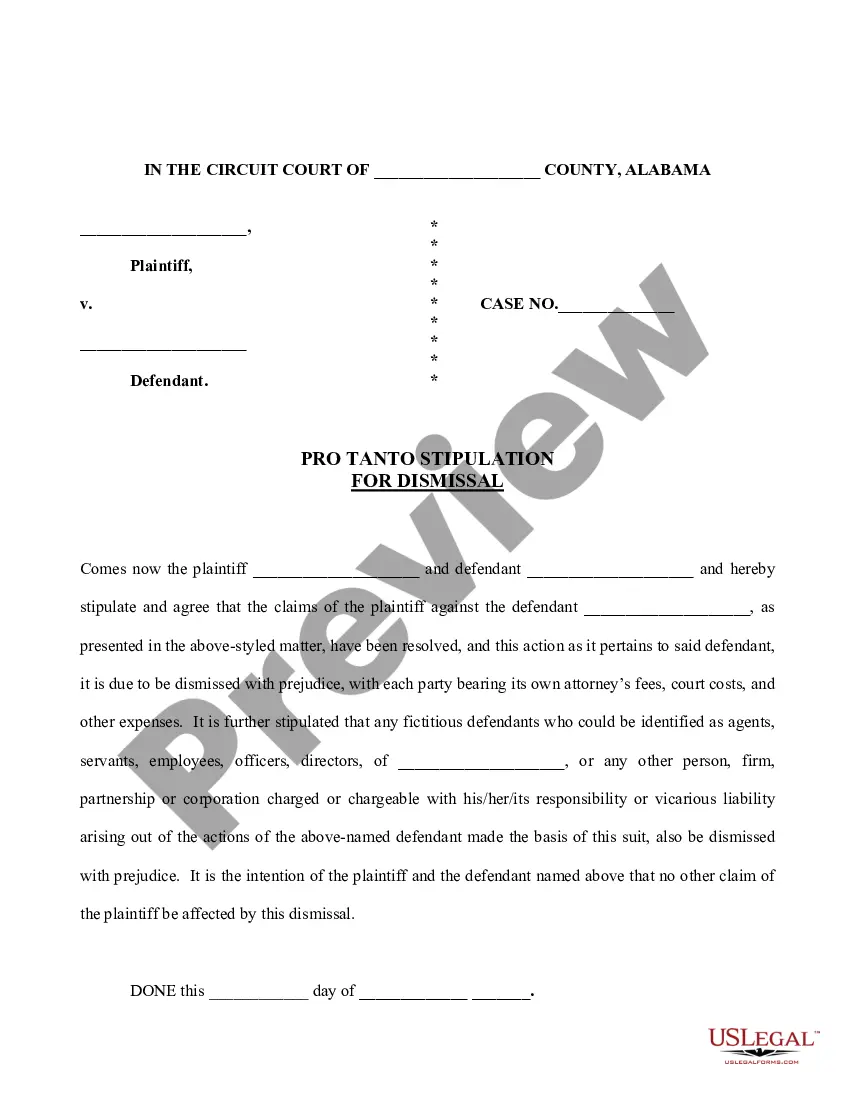

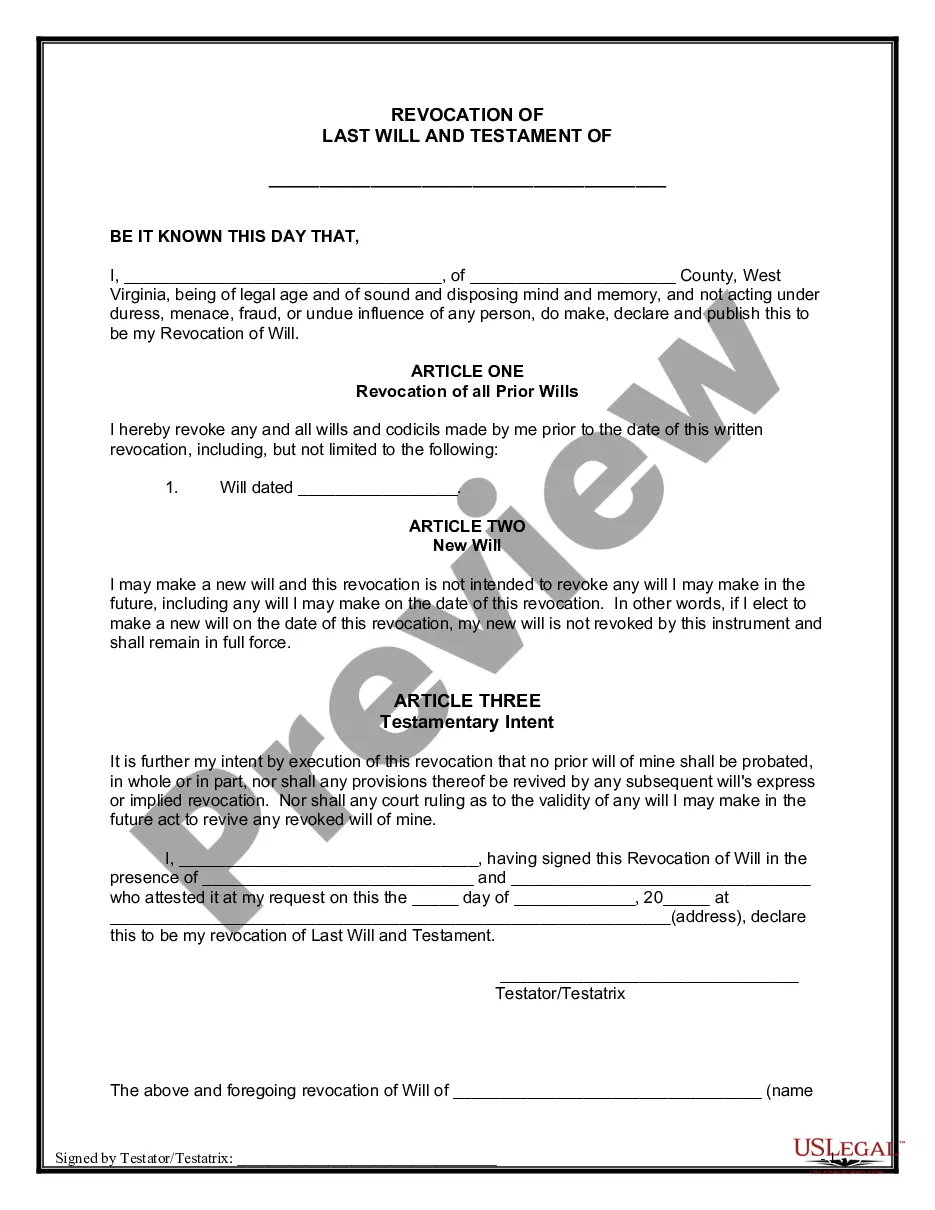

- Step 2. Utilize the Review feature to examine the form's content. Be sure to read the overview.

- Step 3. If you are not satisfied with the form, utilize the Search box at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the form you need, click the Buy now button. Choose the pricing plan you prefer and input your information to register for an account.

- Step 5. Process the payment. You can use your Visa or Mastercard or PayPal account to complete the transaction.

- Step 6. Select the format of the legal document and download it to the device.

- Step 7. Fill out, modify and print or sign the Virgin Islands Receipt for Payment of Rent.

Form popularity

FAQ

Living in the US Virgin Islands can provide various tax advantages, including potential exemptions and lower rates on certain types of income. This can make it an attractive destination for individuals and businesses alike. To fully leverage these benefits, ensure you keep thorough records and obtain necessary documents such as the Virgin Islands Receipt for Payment of Rent when required.

Yes, many people regard the US Virgin Islands as a tax haven due to its unique tax incentives and lower tax rates for businesses and residents. However, it is crucial for anyone considering moving or investing to understand the specific tax implications. Consulting a qualified tax advisor can help you maximize your benefits while ensuring all necessary paperwork, including a Virgin Islands Receipt for Payment of Rent, is completed.

The US Virgin Islands is a territory of the United States, but it has its own tax system that is distinct from federal tax laws. Residents typically file tax returns with the Virgin Islands Bureau of Internal Revenue instead of the IRS. Staying informed about these differences can help you manage your taxes more effectively and ensure proper documentation, such as a Virgin Islands Receipt for Payment of Rent.

The US Virgin Islands offer certain tax incentives that may draw businesses and individuals seeking favorable tax treatment, which can lead some to consider it a tax haven. However, it is important to understand the legal obligations that come with living or conducting business there. Always consult tax professionals to navigate these regulations effectively, especially when dealing with documents like a Virgin Islands Receipt for Payment of Rent.

Filing your tax return in the US Virgin Islands involves completing an appropriate form and submitting it to the Virgin Islands Bureau of Internal Revenue. You can usually do this online or via traditional mail. Make sure to include any relevant documents, such as your Virgin Islands Receipt for Payment of Rent, as this could support your tax claims and deductions.

The gross receipts tax exemption for the US Virgin Islands allows businesses to benefit from reduced tax liabilities under specific conditions. This exemption helps stimulate economic growth and encourage local investment. A Virgin Islands Receipt for Payment of Rent may be part of the documentation required to demonstrate compliance with tax regulations and facilitate such benefits.

The name on the rent receipt typically belongs to the person who made the payment, which is usually the tenant. It's important to have both the landlord's and tenant's names on the receipt for clarity. This practice can help avoid disputes, and using a Virgin Islands Receipt for Payment of Rent will ensure all relevant details are documented correctly.

In Victoria, advance rent usually requires one month’s rent upfront, though it may vary depending on the lease agreement. Confirm with your landlord regarding any specific requirements. Tenants should remember that including a Virgin Islands Receipt for Payment of Rent can create clarity and assure that both parties are aware of the agreed amount and terms.

To fill out a rent receipt, start with the date of payment, followed by the landlord's name and tenant's details. Clearly state the rental property address and the payment amount. It's also helpful to include the rental period that the payment covers and a note confirming that the payment was received. Ensure that you provide a Virgin Islands Receipt for Payment of Rent to formalize this record.

Writing a letter to confirm payment is straightforward; begin with the recipient's address. Clearly mention the payment details, including the amount and the date it was made. Express gratitude and state that you expect any further correspondence regarding the transaction. Having a Virgin Islands Receipt for Payment of Rent can simplify this process and validate the confirmation.