Virgin Islands Corporate Resolution Authorizing a Charitable Contribution

Description

The RMBCA even authorizes a corporation to make charitable contributions. The following form is a sample of a corporate resolution authorizing a charitable contribution.

How to fill out Corporate Resolution Authorizing A Charitable Contribution?

Selecting the optimal legal document template might be a challenge. Clearly, there are numerous templates accessible on the web, but how will you obtain the legal document you require.

Utilize the US Legal Forms website. This service provides thousands of templates, including the Virgin Islands Corporate Resolution Authorizing a Charitable Contribution, suitable for both business and personal purposes.

All documents are verified by professionals and comply with state and federal regulations.

If the document does not meet your requirements, use the Search box to find the suitable document. Once you are confident that the document is correct, click on the Purchase now button to acquire the document. Choose the pricing plan you desire and enter the needed information. Create your account and pay for the purchase using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, and print as well as sign the acquired Virgin Islands Corporate Resolution Authorizing a Charitable Contribution. US Legal Forms is the largest repository of legal documents where you can find a variety of record templates. Utilize the service to obtain professionally-created papers that adhere to state requirements.

- If you are already registered, Log In to your account and click the Download button to retrieve the Virgin Islands Corporate Resolution Authorizing a Charitable Contribution.

- Use your account to browse through the legal forms you have previously purchased.

- Navigate to the My documents section of your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple steps for you to follow.

- First, ensure you have selected the appropriate document for your area/state.

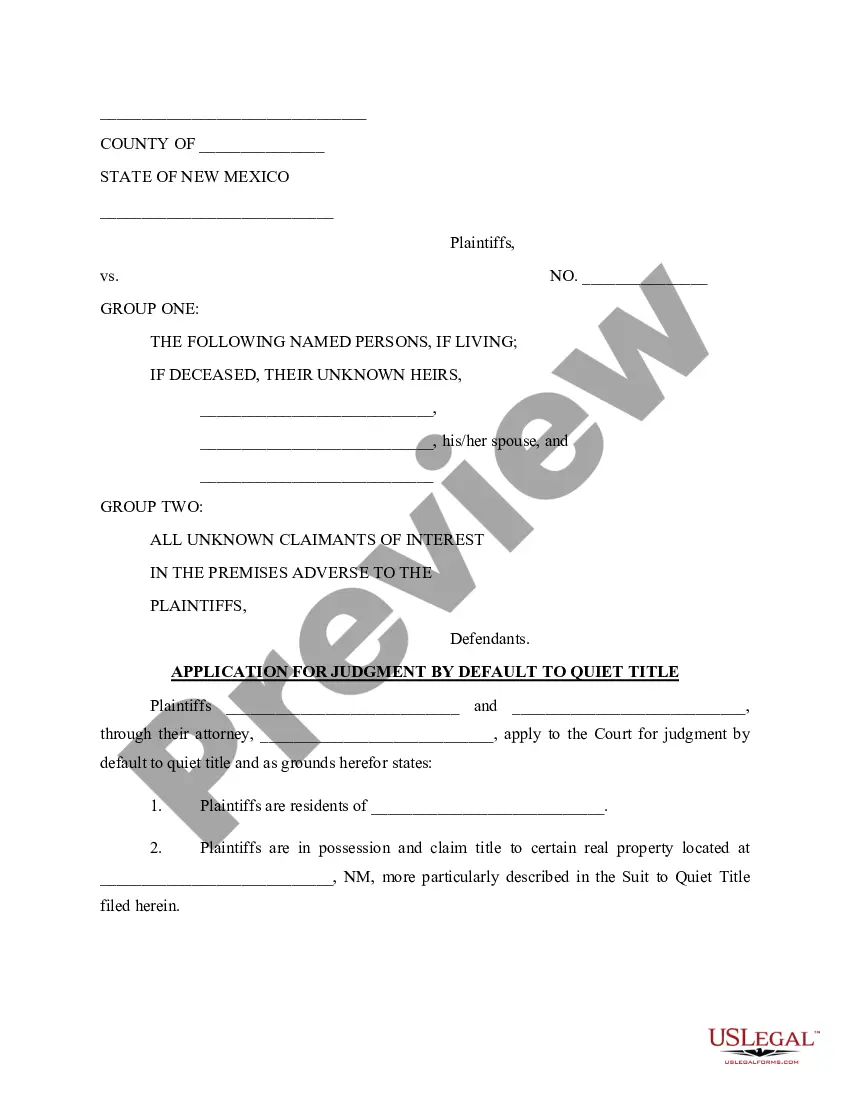

- You can preview the document by clicking the Review button and check the document description to confirm it is the right one for you.

Form popularity

FAQ

The British Virgin Islands operates under the sovereignty of the United Kingdom as a British Overseas Territory. This means that while it has its own legal systems and regulations, certain UK laws may still apply. If you are a business looking to contribute to a cause, drafting a Virgin Islands Corporate Resolution Authorizing a Charitable Contribution can streamline your efforts. It aligns your corporate philanthropy with the territory's legal framework, ensuring transparency and compliance.

The British Virgin Islands is a noted jurisdiction for company incorporation due to its flexible legal framework. Companies established here are incorporated under BVI law, making them distinct from companies in other countries. If your business is considering a charitable contribution, a Virgin Islands Corporate Resolution Authorizing a Charitable Contribution can be an effective tool. It ensures that your intentions are documented and compliant with local legislation.

A BVI company is not a UK company, although the British Virgin Islands is a British Overseas Territory. This distinction is important for understanding the legal framework and regulatory requirements of BVI entities. When considering charitable contributions, a BVI company can issue a Virgin Islands Corporate Resolution Authorizing a Charitable Contribution. This allows them to operate under their local laws while benefitting from their British affiliation.

The country code for the British Virgin Islands is BVI. This code is often used in internet domains and international transactions. Understanding this code can be essential when drafting legal documents, especially when creating a Virgin Islands Corporate Resolution Authorizing a Charitable Contribution. It helps in identifying the jurisdiction and ensuring compliance with local regulations.

BVI incorporation refers to the process of registering a business entity in the British Virgin Islands. This process is popular among entrepreneurs due to the jurisdiction's favorable tax regime and business-friendly laws. A key aspect of running a BVI company is the ability to authorize actions, such as a Virgin Islands Corporate Resolution Authorizing a Charitable Contribution. This resolution is crucial for companies looking to engage in charitable activities while maintaining legal compliance.

Incorporating a company in the British Virgin Islands involves several steps, including choosing a unique company name and filing specific documents with the BVI Financial Services Commission. After incorporation, companies can draft a Virgin Islands Corporate Resolution Authorizing a Charitable Contribution to facilitate donations. Engaging with a local legal expert or using services like uslegalforms can simplify this process. They can guide you through the necessary documentation and compliance.

Section 179 of the BVI Companies Act outlines the rules governing corporate resolutions related to charitable contributions. This section is particularly relevant when considering a Virgin Islands Corporate Resolution Authorizing a Charitable Contribution. By understanding this section, businesses can ensure compliance while making philanthropic decisions. It provides a clear framework for companies in the British Virgin Islands to document and authorize their contributions.

The U.S. Virgin Islands is often regarded as a tax-friendly environment due to its unique tax incentives. However, it is important to understand the implications of these incentives, especially if you engage in a Virgin Islands Corporate Resolution Authorizing a Charitable Contribution. Consulting with a tax professional can provide clarity on how to navigate the system effectively.

To locate your USVI tax refund, you can check the status on the Virgin Islands Bureau of Internal Revenue website. If you submitted a Virgin Islands Corporate Resolution Authorizing a Charitable Contribution, include any relevant documentation in your inquiry. Patience is essential, as processing times may vary based on the volume of returns filed.

Filing an Island tax return involves collecting your income information and providing the required forms to the Virgin Islands Bureau of Internal Revenue. If your business includes charitable contributions, a Virgin Islands Corporate Resolution Authorizing a Charitable Contribution can be crucial in detailing your donations. Additionally, ensure you file before the state deadlines to avoid penalties.