Virgin Islands Exchange Addendum to Contract - Tax Free Exchange Section 1031

Description

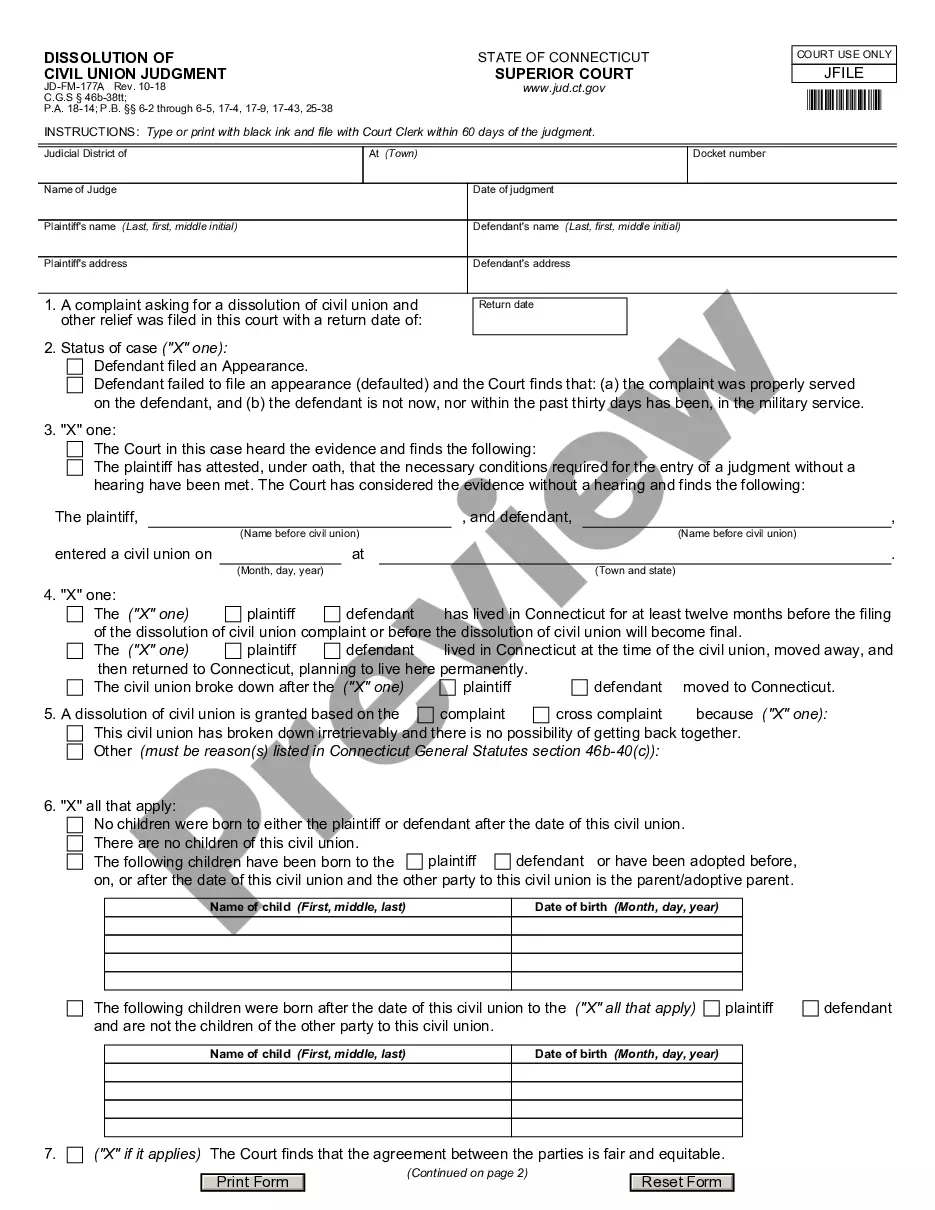

How to fill out Exchange Addendum To Contract - Tax Free Exchange Section 1031?

It is feasible to allocate time on the Internet looking for the valid document format that meets the federal and state requirements you will require.

US Legal Forms offers thousands of valid templates that are examined by professionals.

It is straightforward to download or print the Virgin Islands Exchange Addendum to Contract - Tax Free Exchange Section 1031 from our platform.

If available, use the Review button to browse through the template as well.

- If you already possess a US Legal Forms account, you may Log In and click on the Acquire button.

- Then, you can complete, modify, print, or sign the Virgin Islands Exchange Addendum to Contract - Tax Free Exchange Section 1031.

- Every valid document you obtain is yours indefinitely.

- To obtain an additional copy of any acquired form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have selected the correct template for the region/city of your choice.

- Review the form description to ensure you have picked the correct form.

Form popularity

FAQ

Potential Drawbacks of a 1031 DST Exchange1031 DST investors give up control.The 1031 DST properties are illiquid.Costs, fees and charges.You must be an accredited investor.You cannot raise new capital in a 1031 DST.Small offering size.DSTs must adhere to strict prohibitions.

Gain deferred in a like-kind exchange under IRC Section 1031 is tax-deferred, but it is not tax-free. The exchange can include like-kind property exclusively or it can include like-kind property along with cash, liabilities and property that are not like-kind.

Areas that are not on the list of coordinated territories do not contain property eligible for a 1031 exchange. However, with islands such as American Samoa and Puerto Rico now considered a Qualified Opportunity Zone, there is more than one way to defer capital gains taxes.

Any rental property sold by those who qualify in accordance with IRS rules as real estate professionals is not considered passive and thus will not be counted as net investment income. The gain deferred in a 1031 exchange is not included in your Adjusted Gross income (AGI) or Net Investment Income (NII).

ARE THE US VIRGIN ISLANDS 1031 ELIGIBLE? Yes Section 1031 does apply to businesses and investment properties in the US Virgin Islands. Section 932(a)(3) generally provides that the U.S. shall be treated as including the Virgin Islands.

However, Puerto Rico is not included on this list of coordinated territories. Meaning that while Puerto Rico is most certainly a United States Territory, you cannot carry out a 1031 exchange selling within the 50 United States and purchasing there.

HOW TO REPORT THE EXCHANGE. Your 1031 exchange must be reported by completing Form 8824 and filing it along with your federal income tax return. If you completed more than one exchange, a different form must be completed for each exchange.

Nontaxable Exchanges - A nontaxable exchange is an exchange in which any gain is not taxed and any loss can not be deducted. If you receive property in a nontaxable exchange, its basis is usually the same as the basis of the property you exchanged.

Internal Revenue Code (IRC) Section 1031 applies to all citizens or residents of the United States (US) or non-resident aliens subject to US federal income taxes.

A 1031 exchange that starts with a property in the U.S. can't be exchanged for an asset in another country; the replacement property or properties must also be within the United States.