Virgin Islands Deferred Compensation Agreement - Long Form

Description

How to fill out Deferred Compensation Agreement - Long Form?

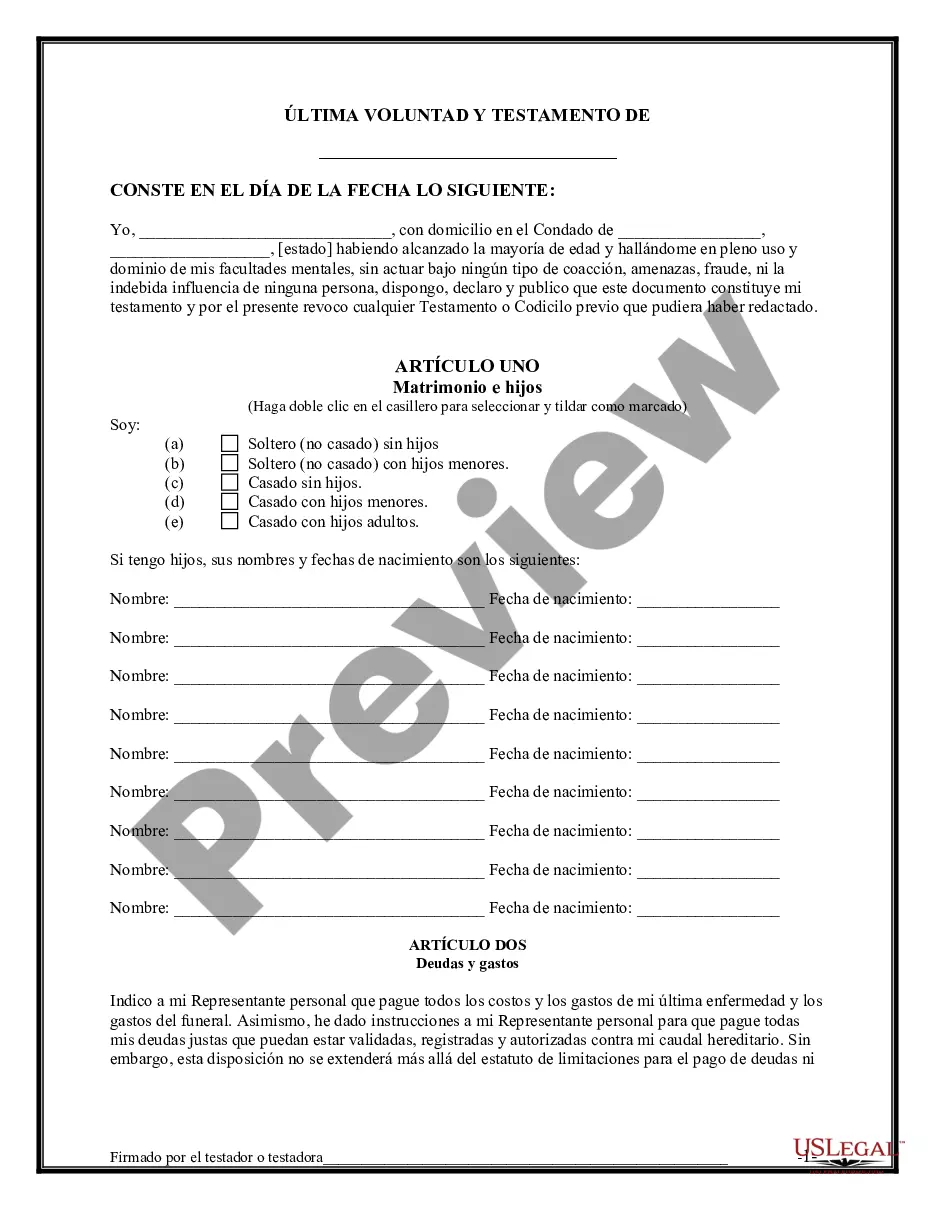

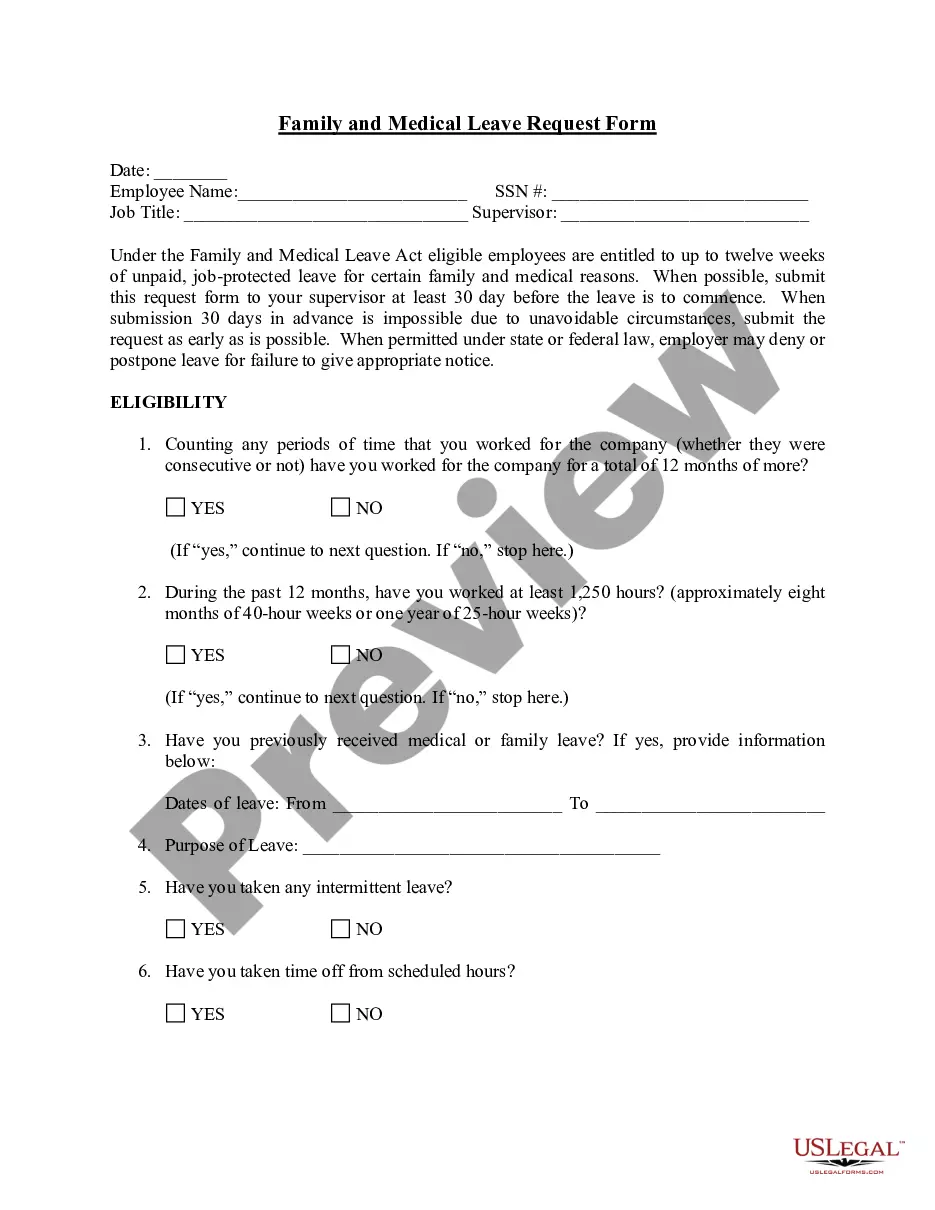

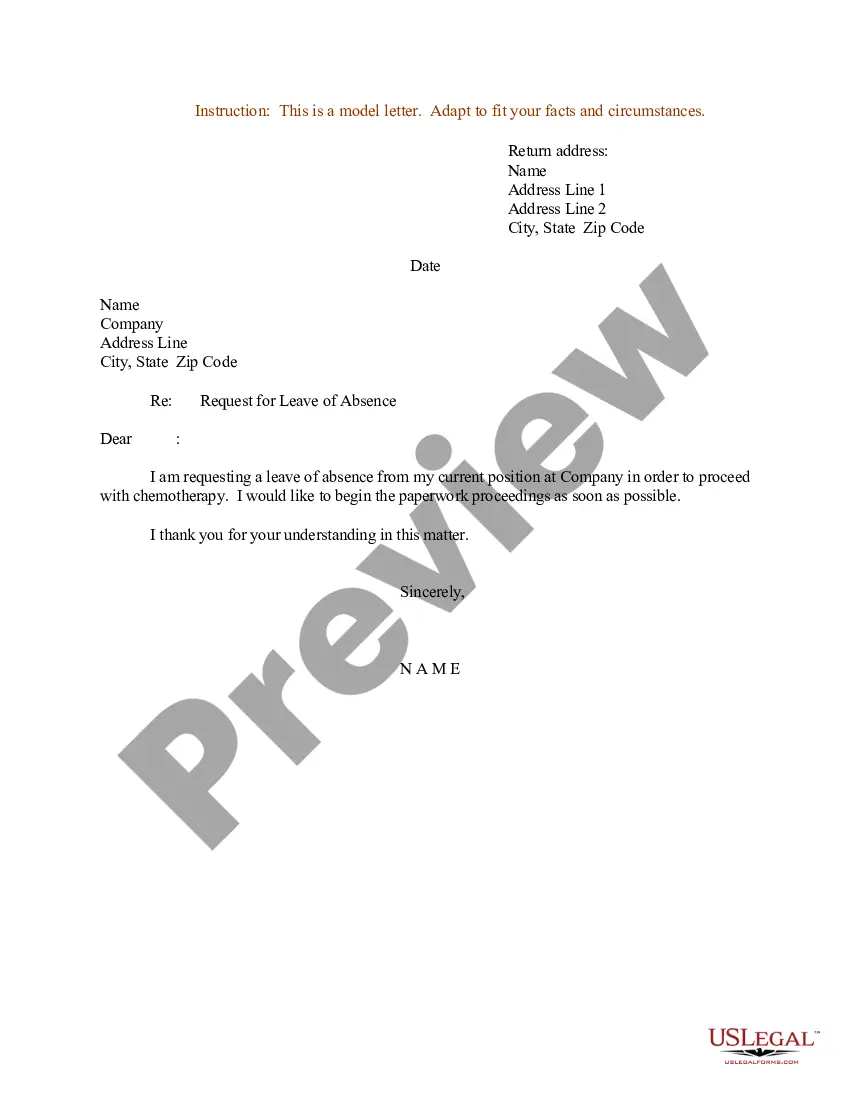

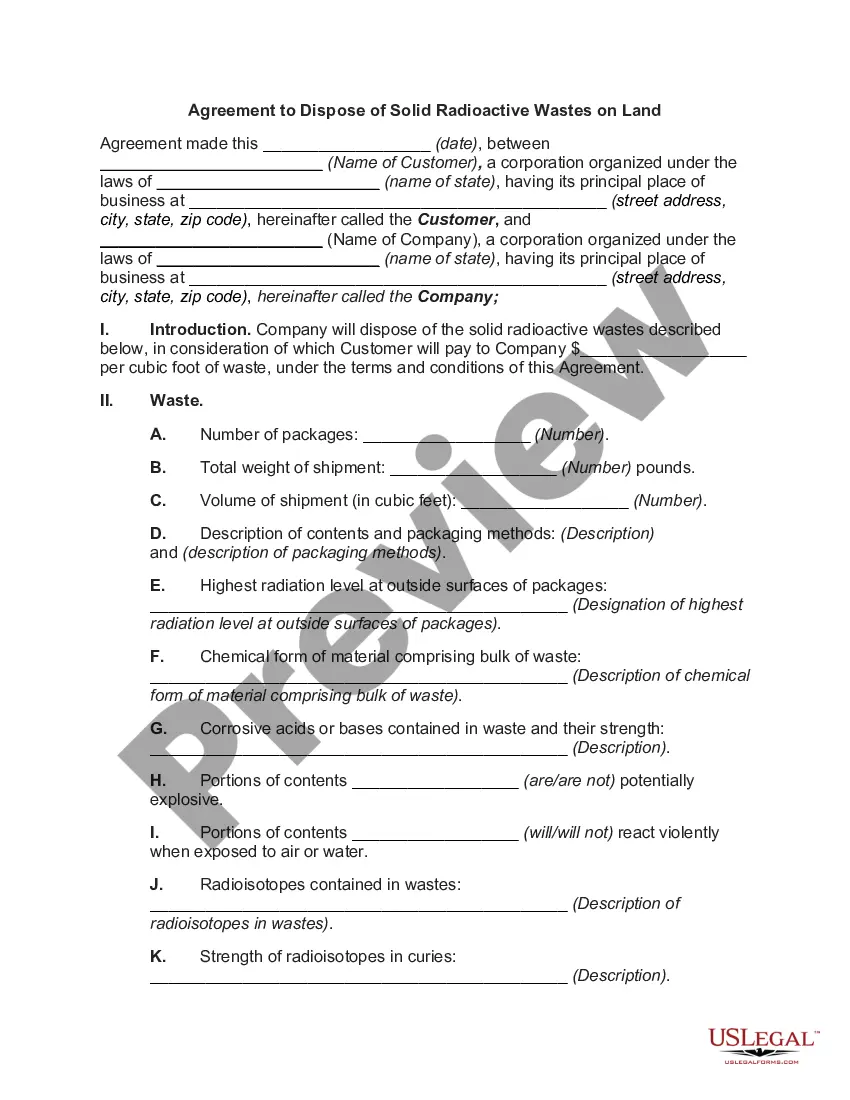

Finding the appropriate legal document format can be quite challenging. Clearly, there are numerous templates accessible online, but how do you locate the specific legal document you're looking for? Utilize the US Legal Forms website.

The service provides a wide array of templates, such as the Virgin Islands Deferred Compensation Agreement - Long Form, which you can utilize for both business and personal purposes. All the forms are reviewed by experts and comply with state and federal regulations.

If you are currently registered, Log In to your account and click on the Download button to access the Virgin Islands Deferred Compensation Agreement - Long Form. Use your account to retrieve the legal forms you have previously ordered. Visit the My documents section of your account to obtain another copy of the document you need.

Choose the file format and download the legal document to your device. Fill out, modify, print, and sign the downloaded Virgin Islands Deferred Compensation Agreement - Long Form. US Legal Forms is the largest repository of legal forms where you can find various document formats. Utilize the service to download professionally created documents that adhere to state requirements.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have selected the correct document for your city/region. You can review the form by clicking the Review button and reading the form description to confirm it suits your needs.

- If the form does not meet your requirements, use the Search field to locate the appropriate document.

- Once you're certain the form is appropriate, click the Purchase now button to obtain the document.

- Select the pricing plan you prefer and input the necessary details.

- Create your account and make the payment using your PayPal account or Visa/MasterCard.

Form popularity

FAQ

Form W-2, also known as the Wage and Tax Statement, is the document an employer is required to send to each employee and the Internal Revenue Service (IRS) at the end of the year. A W-2 reports employees' annual wages and the amount of taxes withheld from their paychecks.

How to fill out Form W-2Box A: Employee's Social Security number.Box B: Employer Identification Number (EIN)Box C: Employer's name, address, and ZIP code.Box D:Boxes E and F: Employee's name, address, and ZIP code.Box 1: Wages, tips, other compensation.Box 2: Federal income tax withheld.Box 3: Social Security wages.More items...?

In most cases, the information that your employer lists in Box 14 of your W-2 does not affect your income tax return. In fact, for many Box 14 entries, the IRS does not even provide a place for it to get reported on your return forms.

9 Form InstructionsLine 1 Name.Line 2 Business name.Line 3 Federal tax classification.Line 4 Exemptions.Lines 5 & 6 Address, city, state, and ZIP code.Line 7 Account number(s)Part I Taxpayer Identification Number (TIN)Part II Certification.

How to fill out Form W-2Box A: Employee's Social Security number.Box B: Employer Identification Number (EIN)Box C: Employer's name, address, and ZIP code.Box D:Boxes E and F: Employee's name, address, and ZIP code.Box 1: Wages, tips, other compensation.Box 2: Federal income tax withheld.Box 3: Social Security wages.More items...?

Box 14: Your employer may report additional tax information here. If any amounts are reported in Box 14, they should include a brief description of what they're for. For example, union dues, employer-paid tuition assistance or after-tax contributions to a retirement plan may be reported here.

Enter in box 14 the total employment income before deductions. Include the following: Salary and wages (including pay in lieu of termination notice). Bonuses.

In each box 12 line, select the capital letter code from the drop-down list and enter the corresponding amount....In this fictitious (and somewhat unrealistic) example, the W-2 shows these box 12 amounts:$5,000 in box 12a with code D.$5,000 in box 12b with code DD.$5,000 in box 12c with code W.Box 12d is blank.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.