Virginia Clauses Relating to Capital Withdrawals, Interest on Capital

Description

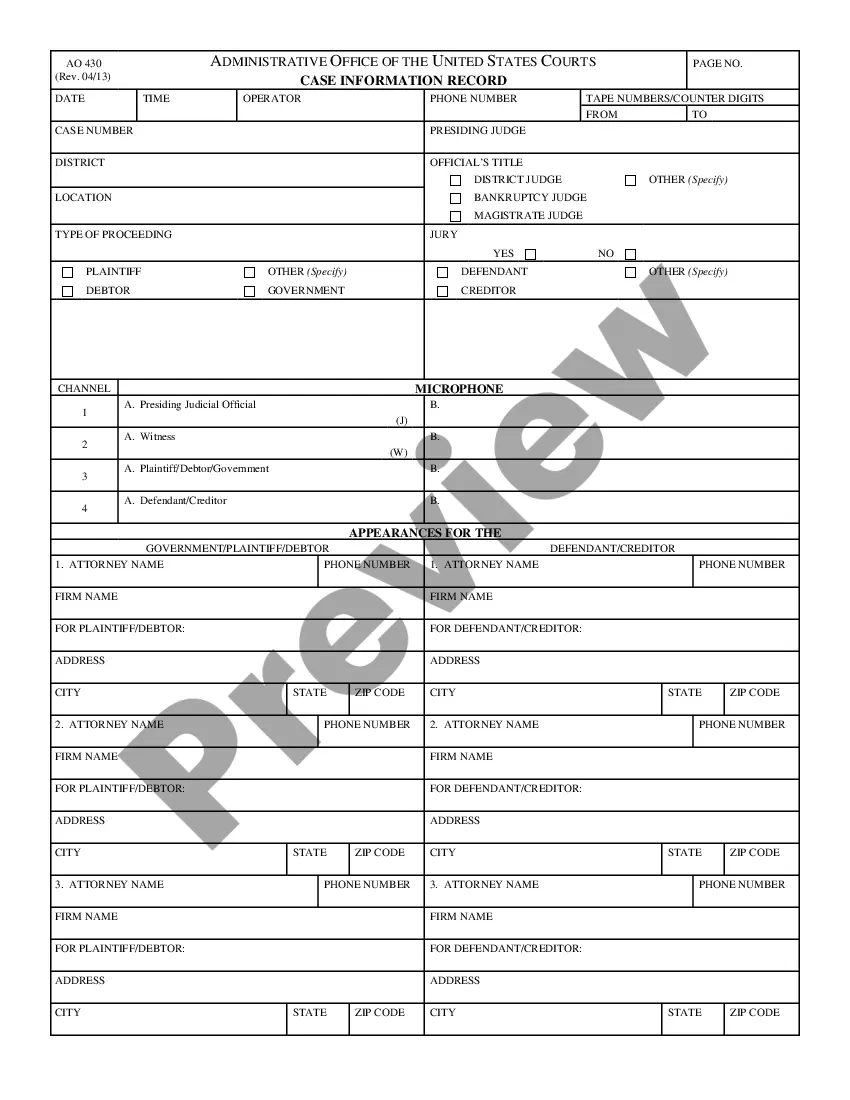

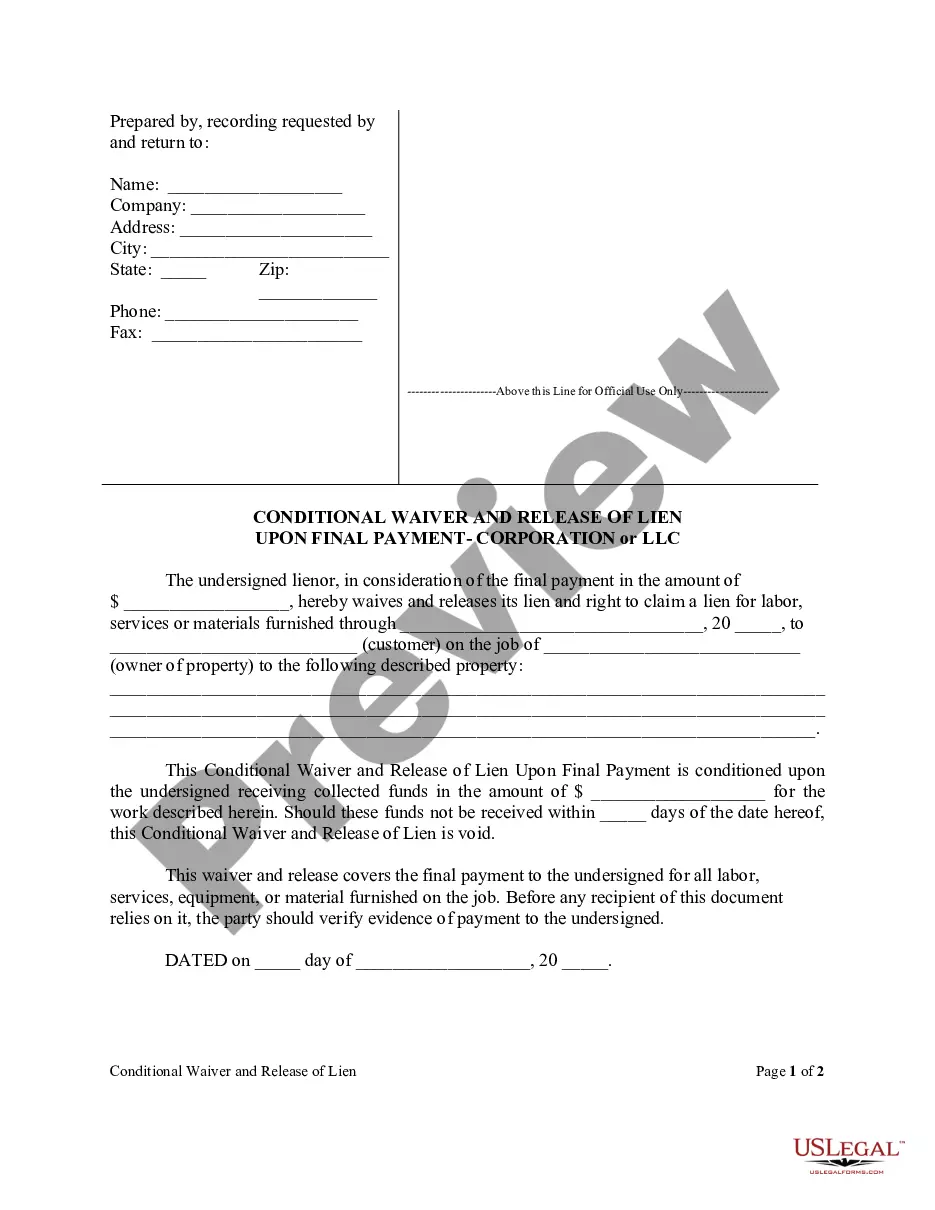

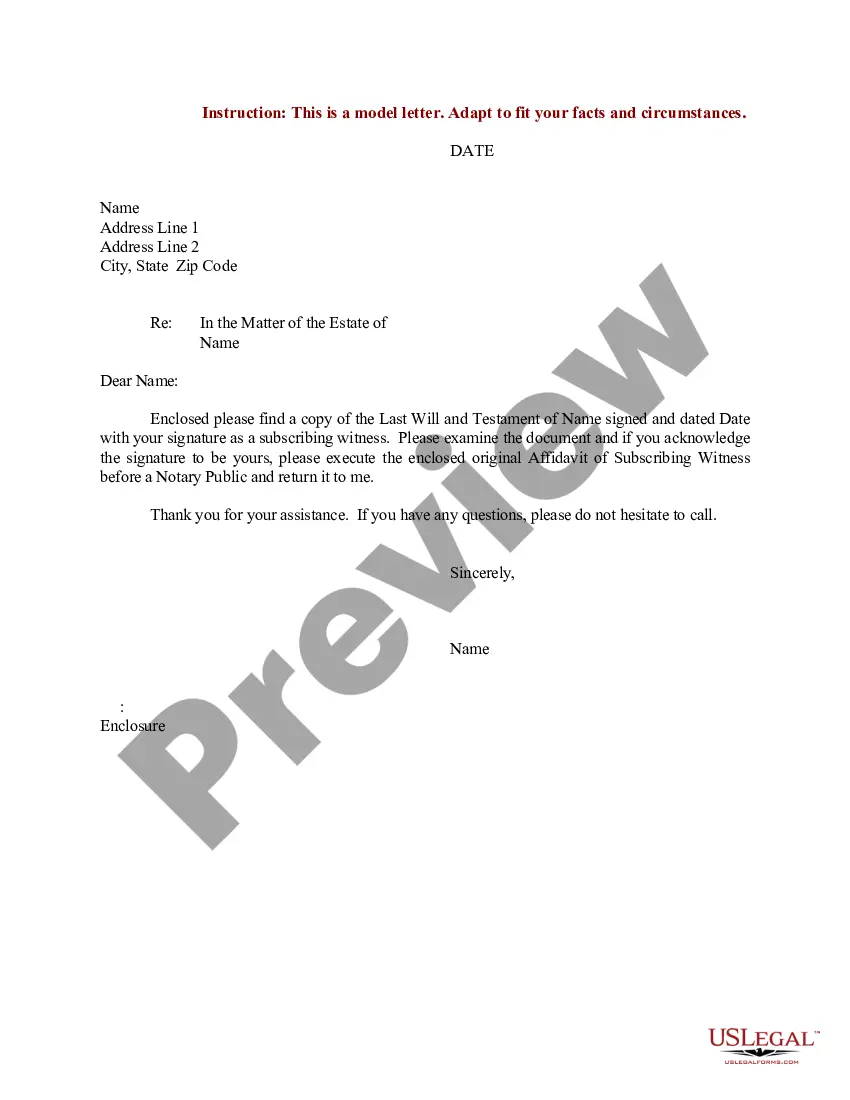

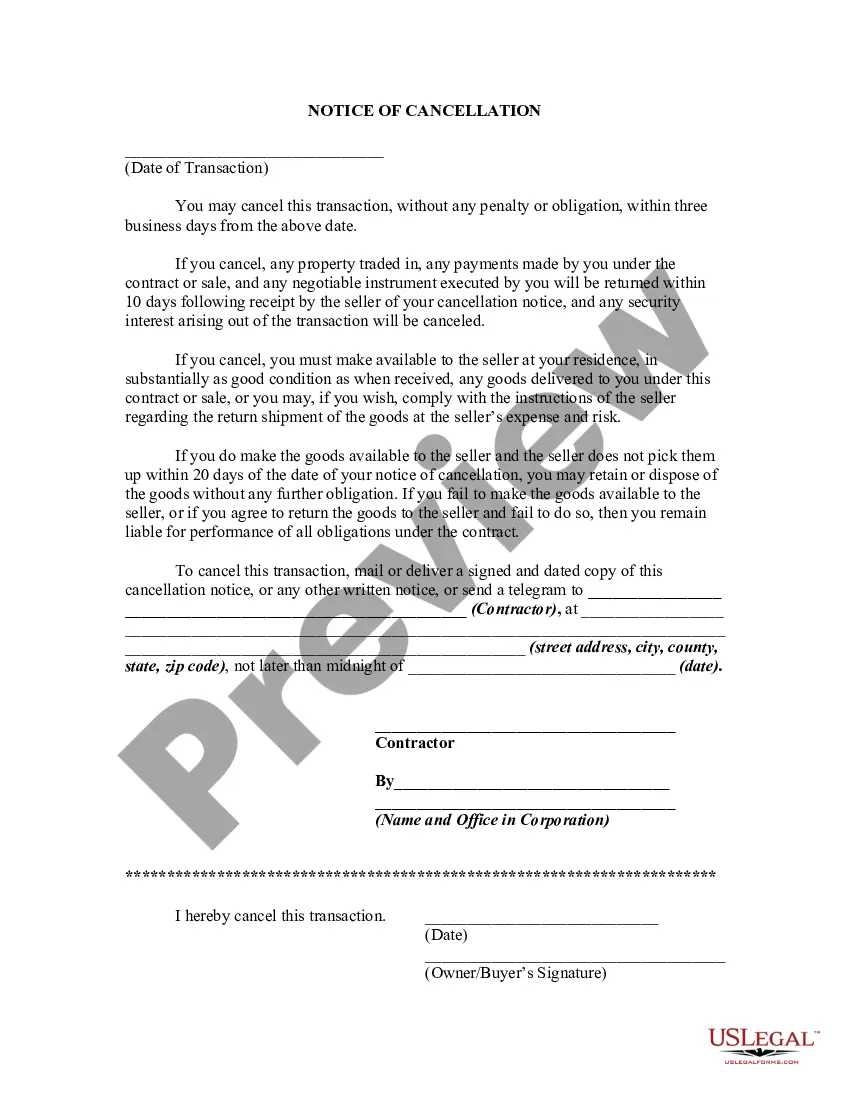

How to fill out Clauses Relating To Capital Withdrawals, Interest On Capital?

US Legal Forms - one of the largest libraries of legitimate forms in the States - delivers a variety of legitimate file web templates it is possible to down load or printing. Utilizing the website, you can find a large number of forms for business and specific purposes, sorted by classes, states, or keywords.You will discover the latest types of forms like the Virginia Clauses Relating to Capital Withdrawals, Interest on Capital in seconds.

If you currently have a monthly subscription, log in and down load Virginia Clauses Relating to Capital Withdrawals, Interest on Capital in the US Legal Forms local library. The Acquire option will show up on every single type you view. You have accessibility to all earlier saved forms within the My Forms tab of your respective profile.

In order to use US Legal Forms initially, allow me to share straightforward guidelines to help you began:

- Make sure you have picked out the right type for your personal city/state. Go through the Review option to examine the form`s information. See the type explanation to actually have chosen the correct type.

- If the type doesn`t satisfy your demands, take advantage of the Look for area on top of the monitor to obtain the one who does.

- When you are pleased with the shape, affirm your choice by clicking the Acquire now option. Then, select the rates strategy you favor and give your accreditations to register for the profile.

- Procedure the financial transaction. Utilize your bank card or PayPal profile to accomplish the financial transaction.

- Select the format and down load the shape on your gadget.

- Make alterations. Fill out, change and printing and signal the saved Virginia Clauses Relating to Capital Withdrawals, Interest on Capital.

Every single template you put into your money lacks an expiry particular date and is your own property forever. So, if you want to down load or printing yet another copy, just check out the My Forms segment and click on on the type you want.

Obtain access to the Virginia Clauses Relating to Capital Withdrawals, Interest on Capital with US Legal Forms, the most considerable local library of legitimate file web templates. Use a large number of expert and state-particular web templates that meet your small business or specific demands and demands.

Form popularity

FAQ

If related unemployment compensation was excluded from federal adjusted gross income, it should be added back as a Fixed Date Conformity Adjustment on your 2020 Virginia return. Use code 37 to subtract any applicable unemployment compensation benefits.

The effective tax rate derived from Federal Adjusted Gross Income (FAGI) is the tax rate (percentage) as applied to FAGI that generates the amount of net tax liability as current tax provisions.

The amount of the deduction is equal to the amount of child and dependent care expenses used to calculate the federal credit (not the federal credit amount). The maximum amount of deduction allowed is based on how many dependents you have: $3,000 for one dependent. $6,000 for two or more dependents.

Gross receipts for license tax purposes shall not include any amount not derived from the exercise of the licensed privilege to engage in a business or profession in the ordinary course of business.

If related unemployment compensation was excluded from federal adjusted gross income, it should be added back as a Fixed Date Conformity Adjustment on your 2020 Virginia return. Use code 37 to subtract any applicable unemployment compensation benefits.

Under HB 30, for tax year 2022 the standard deduction increases from $4,500 to $8,000 for single filers and from $9,000 to $16,000 for married filers filing jointly if the annual revenue growth is at least 5% for the six-month period of July 2022 through December 2022.

The subtraction is equal to the amount of income received for total or permanent disability, not to exceed $20,000. You may not claim this subtraction if you claim the Age Deduction for Taxpayers Age 65 and Over.

Taxpayers Age 65 & Older If you, or your spouse, were born on or before January 1, 1958, you may qualify to claim an age deduction of up to $12,000 each for 2022.