Virginia Electronics Assembly Agreement - Self-Employed Independent Contractor

Description

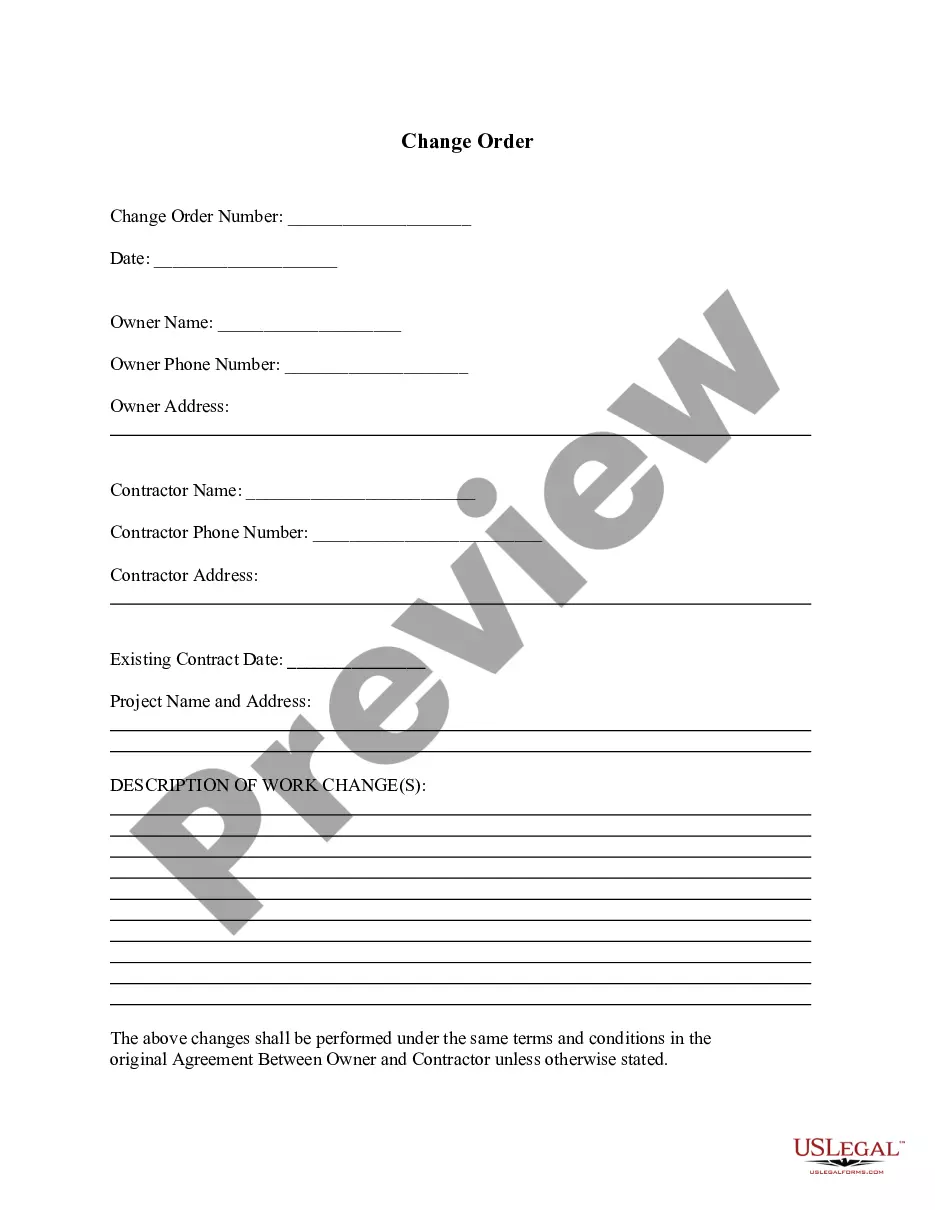

How to fill out Electronics Assembly Agreement - Self-Employed Independent Contractor?

If you require extensive, acquire, or generate legal document templates, utilize US Legal Forms, the largest repository of legal forms available online.

Take advantage of the site’s straightforward and user-friendly search to locate the documents you need. Various templates for business and personal purposes are categorized by types and states, or keywords.

Utilize US Legal Forms to procure the Virginia Electronics Assembly Agreement - Self-Employed Independent Contractor with just a few clicks.

Every legal document format you purchase is yours indefinitely. You will have access to all forms you downloaded in your account. Go to the My documents section and select a form to print or download again.

Compete and obtain, and print the Virginia Electronics Assembly Agreement - Self-Employed Independent Contractor with US Legal Forms. There are numerous professional and jurisdiction-specific forms available for your business or personal requirements.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to access the Virginia Electronics Assembly Agreement - Self-Employed Independent Contractor.

- You can also find forms that you have previously obtained in the My documents section of your account.

- If this is your first time using US Legal Forms, follow these steps.

- Step 1. Ensure you have selected the form for the correct region/state.

- Step 2. Use the Review option to examine the form's details. Don't forget to read the specifications.

- Step 3. If you are dissatisfied with the form, use the Search bar at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the desired form, click the Buy now button. Choose the payment plan you prefer and enter your details to register for the account.

- Step 5. Complete the transaction. You can utilize either your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Fill out, revise, and print or sign the Virginia Electronics Assembly Agreement - Self-Employed Independent Contractor.

Form popularity

FAQ

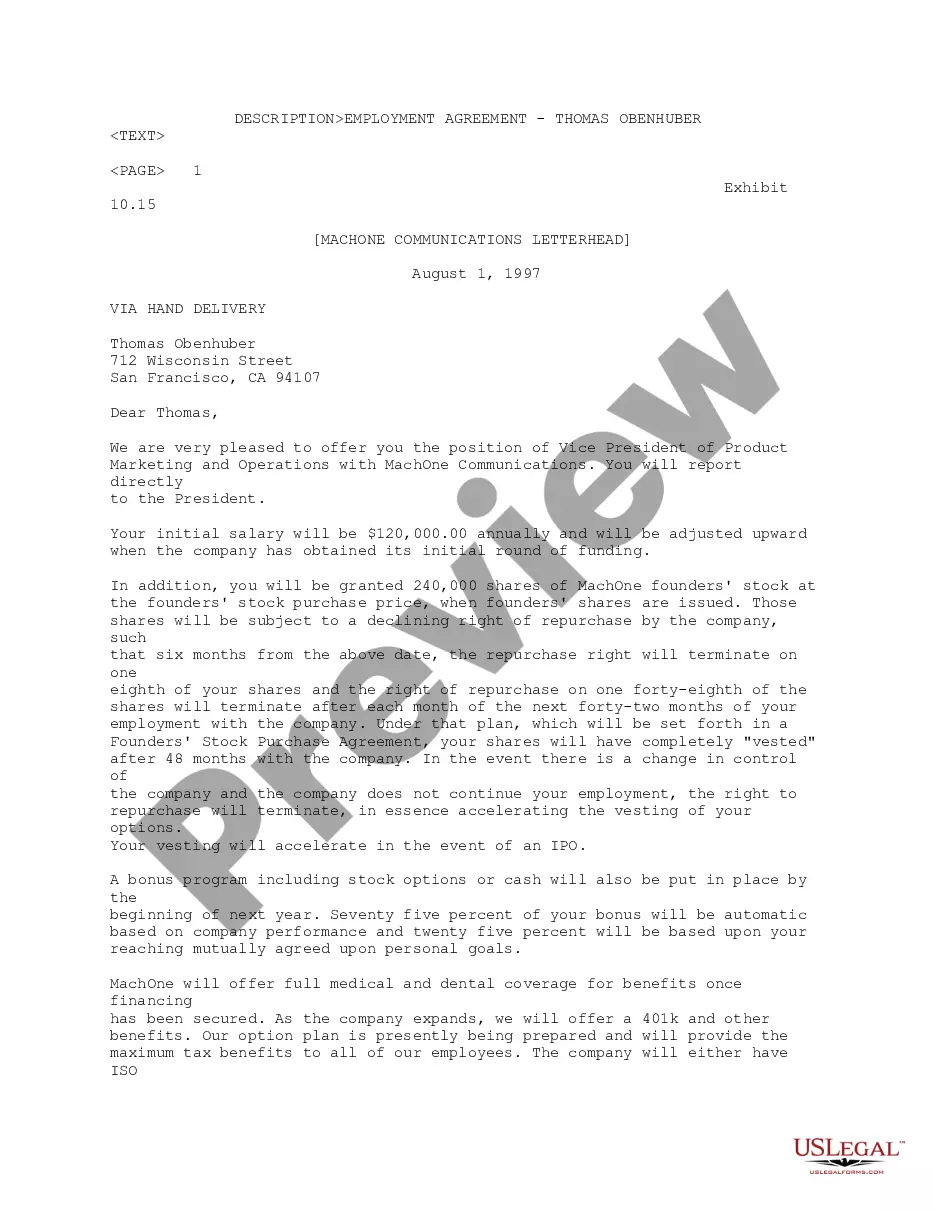

Yes, an independent contractor is typically considered self-employed. This classification allows individuals to operate their own businesses and have more control over their work arrangements. When you draft your Virginia Electronics Assembly Agreement - Self-Employed Independent Contractor, keep this classification in mind as it affects tax obligations and legal responsibilities.

The new independent contractor law in Virginia emphasizes the importance of worker classification and offers clearer guidelines. This law seeks to address common misconceptions and ensure that independent contractors are recognized for their contributions. Updating your Virginia Electronics Assembly Agreement - Self-Employed Independent Contractor can help you align with these new legal frameworks.

In Virginia, you can perform a limited amount of work as a self-employed independent contractor without a contractor's license. Specifically, you can undertake projects that do not exceed $1,000 in total costs. It's essential to understand the limitations and ensure your Virginia Electronics Assembly Agreement - Self-Employed Independent Contractor reflects your work scope appropriately.

Starting July 1st, 2025, Virginia will implement new laws affecting independent contractors. These laws will focus on providing better protections and rights for self-employed individuals. Make sure your Virginia Electronics Assembly Agreement - Self-Employed Independent Contractor complies with these new regulations for better security.

The new federal rule on independent contractors clarifies the criteria for classifying workers. This change aims to create consistency across different states and reduce misclassification. Under this rule, you should ensure that your Virginia Electronics Assembly Agreement - Self-Employed Independent Contractor aligns with these criteria to avoid legal issues.

Writing an independent contractor agreement starts with gathering essential details about the project and the parties involved. Detail the services provided, payment terms, and any relevant timelines. It’s also wise to include provisions for disputes or changes in work scope. For a comprehensive approach, consider using the Virginia Electronics Assembly Agreement - Self-Employed Independent Contractor to ensure all necessary elements are addressed.

Filling out the AW-9 form as an independent contractor requires you to provide your name, business name, address, and taxpayer identification number. Ensure that your information matches the records with the IRS to avoid discrepancies. This form informs clients about your tax status, which is critical in establishing a professional relationship. Utilizing the Virginia Electronics Assembly Agreement - Self-Employed Independent Contractor can help clarify tax-related arrangements.

To fill out an independent contractor agreement, first, gather all essential information such as your name, address, and the client’s details. Clearly define the scope of work, including tasks, deadlines, and payment terms. Remember to include clauses around confidentiality and termination for clarity. Using a well-structured template like the Virginia Electronics Assembly Agreement - Self-Employed Independent Contractor can streamline this process.

Creating an independent contractor agreement is a straightforward process. Start by defining the scope of work that the contractor will perform and outline the payment terms clearly. Next, include important details, such as confidentiality clauses and the duration of the agreement. For a comprehensive solution, consider using a Virginia Electronics Assembly Agreement - Self-Employed Independent Contractor template from uslegalforms, which provides a reliable framework tailored to your needs.

Qualifications for being an independent contractor include having your own business, the ability to set your work hours, and working for multiple clients simultaneously. You must also have a formal agreement, like a Virginia Electronics Assembly Agreement - Self-Employed Independent Contractor, which outlines the terms of your services. Overall, independence and control over work tasks are key indicators.