Virginia Medical Representative Agreement - Self-Employed Independent Contractor

Description

How to fill out Medical Representative Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, categorized by type, state, or keywords. You can find the newest versions of forms like the Virginia Medical Representative Agreement - Self-Employed Independent Contractor in just a few minutes.

If you already have an account, Log In to download the Virginia Medical Representative Agreement - Self-Employed Independent Contractor from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously saved forms from the My documents tab in your account.

Complete the transaction. Use a credit card or PayPal account to finalize the purchase. Choose the format and download the form to your device.

Make modifications. Fill out, edit, print, and sign the saved Virginia Medical Representative Agreement - Self-Employed Independent Contractor. Each template added to your account does not have an expiration date and is yours indefinitely. If you wish to obtain or print another copy, simply navigate to the My documents section and click on the form you need. Access the Virginia Medical Representative Agreement - Self-Employed Independent Contractor with US Legal Forms, one of the most extensive libraries of legal document templates. Utilize a wide range of professional and state-specific templates that fulfill your business or personal requirements.

- Ensure you have selected the correct form for your city/state.

- Click the Review button to examine the details of the form.

- Check the form description to confirm you have chosen the right one.

- If the form does not meet your needs, use the Search bar at the top of the screen to find the appropriate one.

- Once satisfied with the form, confirm your choice by clicking the Acquire now button.

- Then, select your preferred pricing plan and provide your details to register for an account.

Form popularity

FAQ

Yes, a sales rep can indeed be an independent contractor. Engaging them through a Virginia Medical Representative Agreement - Self-Employed Independent Contractor allows companies to leverage their expertise while keeping operational costs flexible. Such arrangements benefit both parties by encouraging a performance-driven approach without the full employment commitment.

Sales representatives can be classified as 1099 contractors if they meet specific criteria. A Virginia Medical Representative Agreement - Self-Employed Independent Contractor often leads to this classification, highlighting their independent status. It's important for businesses to correctly classify these workers for compliance with tax regulations and to ensure fair compensation.

Yes, an independent contractor is considered self-employed. When individuals work under a Virginia Medical Representative Agreement - Self-Employed Independent Contractor, they manage their own business operations and control their schedules. This self-employed status comes with various implications, including tax responsibilities and eligibility for certain benefits.

A sales representative can be an independent contractor, especially if they operate under a Virginia Medical Representative Agreement - Self-Employed Independent Contractor. This arrangement allows them to work independently while promoting products or services. By establishing clear parameters, this classification benefits both the representative and the hiring company in terms of flexibility and clarity.

Yes, an independent contractor can also serve as an agent, depending on the agreement between the parties involved. In the context of the Virginia Medical Representative Agreement - Self-Employed Independent Contractor, this means that sales representatives may act on behalf of companies while maintaining their independent status. Understanding these roles is crucial for defining responsibilities and expectations in such agreements.

The new independent contractor law in Virginia clarifies the classifications of workers. It ensures that independent contractors, including those involved in the Virginia Medical Representative Agreement - Self-Employed Independent Contractor, have specific protections and rights. This law aims to differentiate independent contractors from employees, making it essential for businesses to understand these classifications.

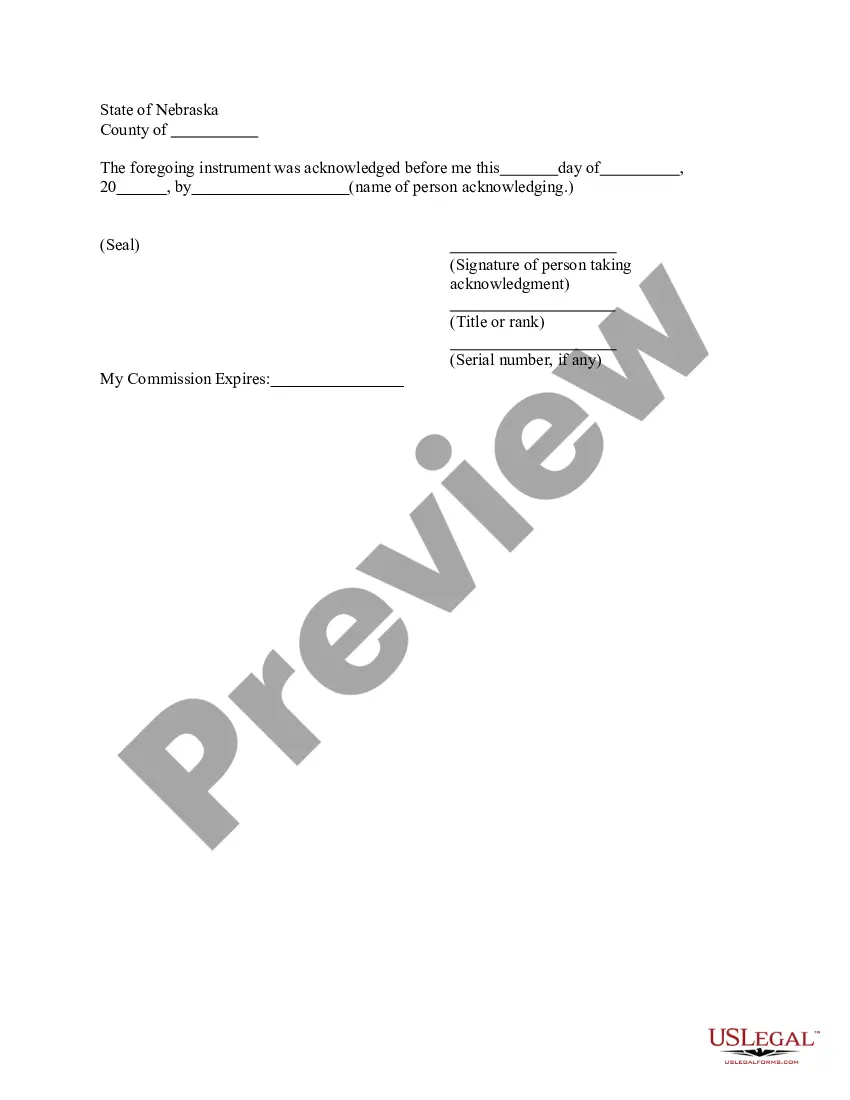

Filling out an independent contractor agreement involves providing key details such as your name, contact information, and the scope of services. Clearly define the payment methods and deadlines, while emphasizing your status under the Virginia Medical Representative Agreement - Self-Employed Independent Contractor. Always review the agreement for accuracy and ensure both parties sign it to make it legally binding.

An independent contractor typically needs to fill out a W-9 form, which provides your taxpayer identification information to clients. Additionally, when operating under a Virginia Medical Representative Agreement - Self-Employed Independent Contractor, you may need to submit a declaration of independent contractor status to confirm your employment classification. This helps protect both you and the client during business engagements.

When writing an independent contractor agreement, begin with a clear title and the names of both parties. Next, outline the services you will perform under the Virginia Medical Representative Agreement - Self-Employed Independent Contractor, specify the payment terms, and include termination clauses. Make sure to state how and when payments will be made for full clarity.

To fill out a declaration of independent contractor status form, you must provide your personal information, including your name, address, and Social Security number. Clearly state that you are a self-employed independent contractor under a Virginia Medical Representative Agreement. Include details about the service you plan to provide and sign the form to confirm your understanding of the agreement terms.