This form is an outline of issues that the due diligence team should consider when determining the feasibility of the proposed transaction.

Virginia Outline of Considerations for Transactions Involving Foreign Investors

Description

How to fill out Outline Of Considerations For Transactions Involving Foreign Investors?

If you want to gather, retrieve, or produce authentic document templates, utilize US Legal Forms, the largest repository of legal forms available online. Take advantage of the site’s straightforward and convenient search to find the documents you need.

Various templates for commercial and personal use are sorted by categories and states, or keywords. Use US Legal Forms to obtain the Virginia Outline of Considerations for Transactions Involving Foreign Investors in just a few clicks.

If you are already a US Legal Forms user, sign in to your account and click the Download button to access the Virginia Outline of Considerations for Transactions Involving Foreign Investors. You can also view documents you previously stored in the My documents section of your account.

Every legal document template you acquire is yours indefinitely. You will have access to every form you saved in your account. Navigate to the My documents section and select a form to print or download again.

Be proactive and download, and print the Virginia Outline of Considerations for Transactions Involving Foreign Investors with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- Step 1. Ensure you have chosen the form for the appropriate city/state.

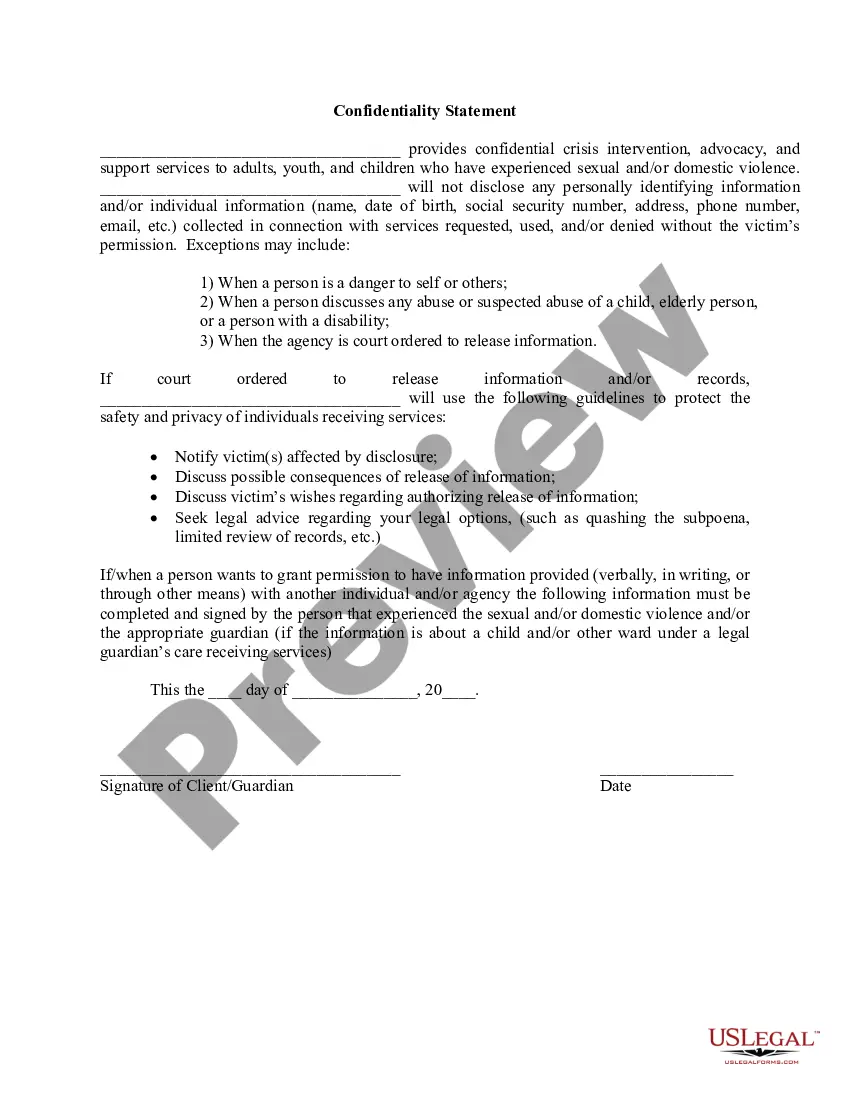

- Step 2. Use the Preview option to review the content of the form. Don’t forget to read the details.

- Step 3. If you are not satisfied with the form, use the Search section at the top of the screen to look for other versions of the legal form template.

- Step 4. Once you find the form you need, click the Get Now button. Choose your preferred pricing plan and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Step 6. Choose the format of your legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Virginia Outline of Considerations for Transactions Involving Foreign Investors.

Form popularity

FAQ

The industry code 0 general in Virginia refers to a broad classification that encompasses companies that may not fit neatly into specific categories or sectors. This classification can be significant when considering the Virginia Outline of Considerations for Transactions Involving Foreign Investors, as it determines regulatory obligations and reporting requirements. Understanding your industry classification can help tailor your approach to ensure compliance. Utilize our services to clarify further how this may impact your business operations.

A Virginia foreign limited liability company is an LLC that is formed in another state but wishes to conduct business in Virginia. This concept is pivotal within the Virginia Outline of Considerations for Transactions Involving Foreign Investors as it involves compliance with local laws while leveraging benefits from your home state. Registering as a foreign LLC allows businesses to navigate legal and tax frameworks efficiently in both states. Navigating this process can be complex, so consider using resources like uslegalforms for guidance.

To register a foreign business in Virginia, you need to file an Application for a Certificate of Authority with the Virginia State Corporation Commission. As part of the Virginia Outline of Considerations for Transactions Involving Foreign Investors, you'll also need to provide documentation that confirms your business's existence in its home state. Make sure you adhere to the requirements set forth by the state and consult professionals if needed to ensure a smooth registration process.

Virginia does tax income generated from foreign sources. As part of the Virginia Outline of Considerations for Transactions Involving Foreign Investors, it’s essential for foreign entities to understand how state tax laws apply to their earnings. This includes understanding whether certain deductions or credits apply. Consulting with a tax professional can provide clarity on your specific situation.

The VA Code 13.1 757, similar to its counterpart in Virginia Code, discusses shareholder rights and the mechanics of corporate governance. This code highlights the necessity for transparency and fairness in corporate practices. Foreign investors should understand these rights to navigate their involvement in Virginia businesses effectively. The Virginia Outline of Considerations for Transactions Involving Foreign Investors can assist you in understanding the implications of this code.

Virginia Code 13.1 757 outlines the criteria for shareholder meetings and voting rights in corporate governance. These provisions impact how decisions are made within corporate entities, including those with foreign investment. It is important for foreign investors to recognize these regulations to protect their interests. To clarify your position and obligations, refer to the Virginia Outline of Considerations for Transactions Involving Foreign Investors.

Virginia Code 13.1 752 details statutory provisions related to business entities and their formation within Virginia. This includes foreign corporations that may seek to do business in the state. Understanding this code is vital for foreign investors to ensure they meet all legal formation requirements. The Virginia Outline of Considerations for Transactions Involving Foreign Investors offers comprehensive guidance on this topic.

Virginia Code 13.1 706 addresses the corporate governance and operational requirements for businesses, including those with foreign investors. This code ensures that companies maintain standards that promote ethical practices and transparent operations. Knowing this code’s implications can guide foreign investors in maintaining compliance while operating in Virginia. The Virginia Outline of Considerations for Transactions Involving Foreign Investors can be a reliable resource for you.

Foreign investment restrictions are legal limitations on how foreign entities can participate in the local economy. These restrictions exist to protect national security and economic integrity. Understanding these limitations is critical for foreign investors looking to engage in Virginia markets. The Virginia Outline of Considerations for Transactions Involving Foreign Investors offers valuable insights into navigating these restrictions effectively.

Virginia Code 13.1 774 outlines the standards and requirements for certain transactions involving foreign investments. This statute plays an essential role in ensuring compliance and transparency in financial dealings. It provides guidelines that foreign investors must follow to operate legally in Virginia. Familiarity with the Virginia Outline of Considerations for Transactions Involving Foreign Investors can help you navigate these regulations.