Virginia Notice of Violation of Fair Debt Act - Letter To Attorney Generals Office

Description

How to fill out Notice Of Violation Of Fair Debt Act - Letter To Attorney Generals Office?

US Legal Forms - one of the most significant libraries of lawful forms in the USA - offers a variety of lawful record web templates you can download or produce. Using the site, you may get a huge number of forms for enterprise and individual purposes, categorized by types, states, or search phrases.You will find the most up-to-date versions of forms like the Virginia Notice of Violation of Fair Debt Act - Letter To Attorney Generals Office in seconds.

If you already have a monthly subscription, log in and download Virginia Notice of Violation of Fair Debt Act - Letter To Attorney Generals Office in the US Legal Forms collection. The Download switch can look on every single form you perspective. You gain access to all previously delivered electronically forms in the My Forms tab of the profile.

If you would like use US Legal Forms the first time, here are straightforward guidelines to obtain began:

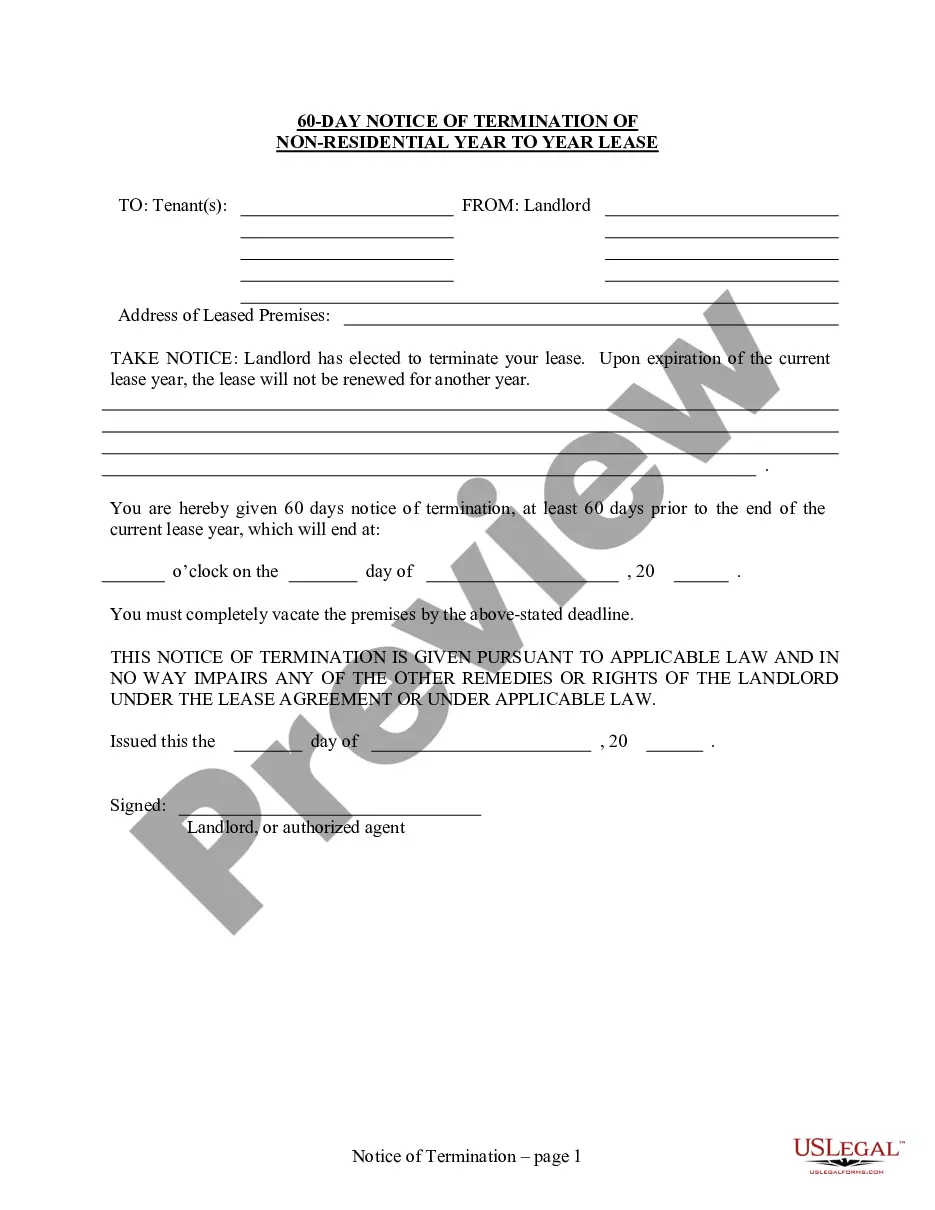

- Make sure you have selected the right form for the metropolis/region. Select the Preview switch to review the form`s information. Browse the form description to actually have chosen the right form.

- In the event the form does not match your specifications, utilize the Look for industry towards the top of the screen to find the one which does.

- Should you be content with the shape, affirm your option by clicking on the Buy now switch. Then, pick the prices plan you like and provide your qualifications to sign up for an profile.

- Approach the transaction. Make use of credit card or PayPal profile to perform the transaction.

- Select the structure and download the shape on the device.

- Make modifications. Complete, change and produce and indicator the delivered electronically Virginia Notice of Violation of Fair Debt Act - Letter To Attorney Generals Office.

Each and every format you added to your bank account lacks an expiry particular date which is your own permanently. So, if you would like download or produce an additional backup, just go to the My Forms segment and then click about the form you will need.

Obtain access to the Virginia Notice of Violation of Fair Debt Act - Letter To Attorney Generals Office with US Legal Forms, probably the most substantial collection of lawful record web templates. Use a huge number of skilled and status-particular web templates that meet your organization or individual requirements and specifications.

Form popularity

FAQ

The Fair Debt Collection Practices Act (FDCPA) (15 USC 1692 et seq.), which became effective in March 1978, was designed to eliminate abusive, deceptive, and unfair debt collection practices.

While debt validation requests can be a useful tool, they are not effective at resolving the issue. In most cases, creditors and collection agencies are able to provide the necessary documentation to prove the validity of the debt.

If you receive a notice from a debt collector, it's important to respond as soon as possible?even if you do not owe the debt?because otherwise the collector may continue trying to collect the debt, report negative information to credit reporting companies, and even sue you.

If the collection agency failed to validate the debt, it is not allowed to continue collecting the debt. It can't sue you or list the debt on your credit report. Why request validation, even if you're ready to pay and you know it's your debt? Simple.

The Fair Debt Collection Practices Act (FDCPA) prohibits debt collectors from using abusive, unfair, or deceptive practices to collect debts from you, including: Misrepresenting the nature of the debt, including the amount owed. Falsely claiming that the person contacting you is an attorney.

If you are struggling with debt and debt collectors, Farmer & Morris Law, PLLC can help. As soon as you use the 11-word phrase ?please cease and desist all calls and contact with me immediately? to stop the harassment, call us for a free consultation about what you can do to resolve your debt problems for good.

Debt collectors are legally obligated to send you a debt validation letter. If you don't receive a debt validation letter, or it lacks detail, you can make a debt verification request. You can file a complaint with the Consumer Federal Protection Bureau or the Federal Trade Commission.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

However, they're required to send a debt validation letter within five days of first contacting you. If you don't receive a debt validation letter within 10 days of initial contact, you can submit a complaint to the Consumer Financial Protection Bureau.