Virginia Proposal to decrease authorized common and preferred stock

Description

How to fill out Proposal To Decrease Authorized Common And Preferred Stock?

US Legal Forms - one of the largest libraries of authorized kinds in the States - offers a wide range of authorized papers web templates you can down load or produce. Utilizing the web site, you will get 1000s of kinds for business and person purposes, sorted by groups, suggests, or search phrases.You can find the most recent types of kinds just like the Virginia Proposal to decrease authorized common and preferred stock in seconds.

If you currently have a membership, log in and down load Virginia Proposal to decrease authorized common and preferred stock through the US Legal Forms catalogue. The Down load key will show up on each and every form you perspective. You get access to all formerly delivered electronically kinds from the My Forms tab of your own profile.

If you want to use US Legal Forms the first time, here are simple directions to obtain started out:

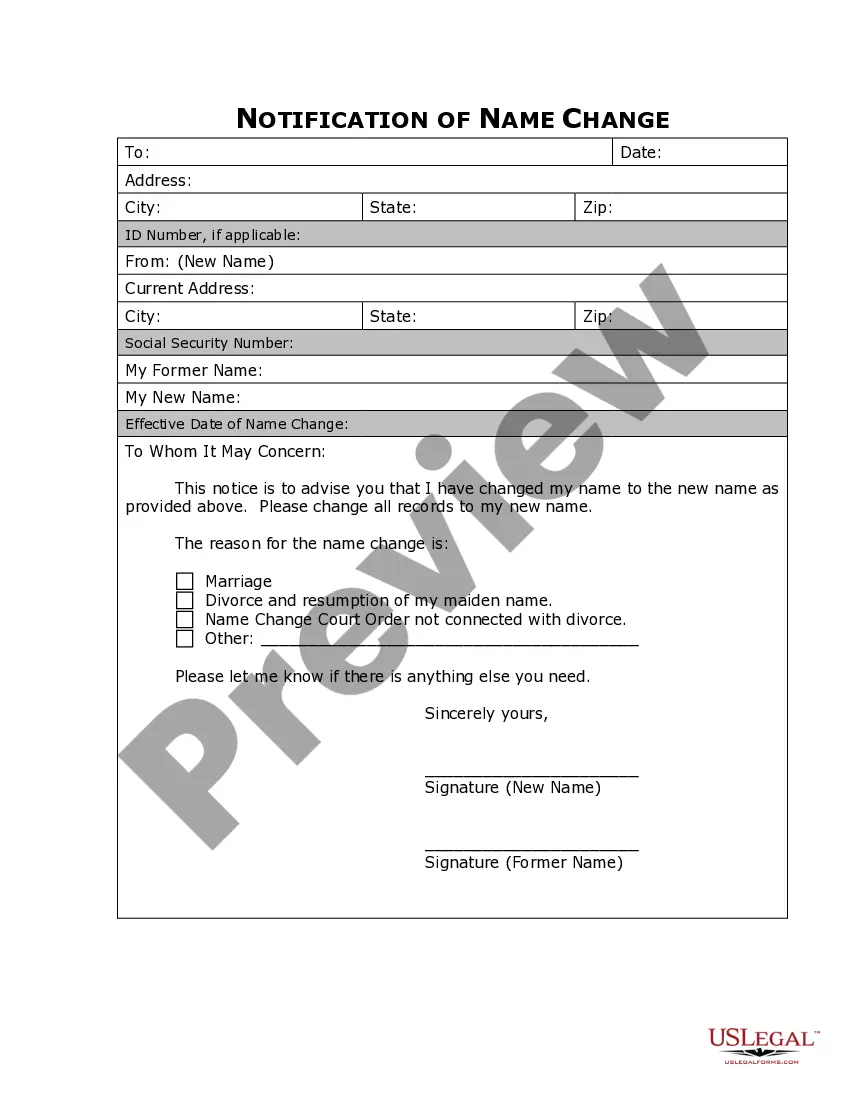

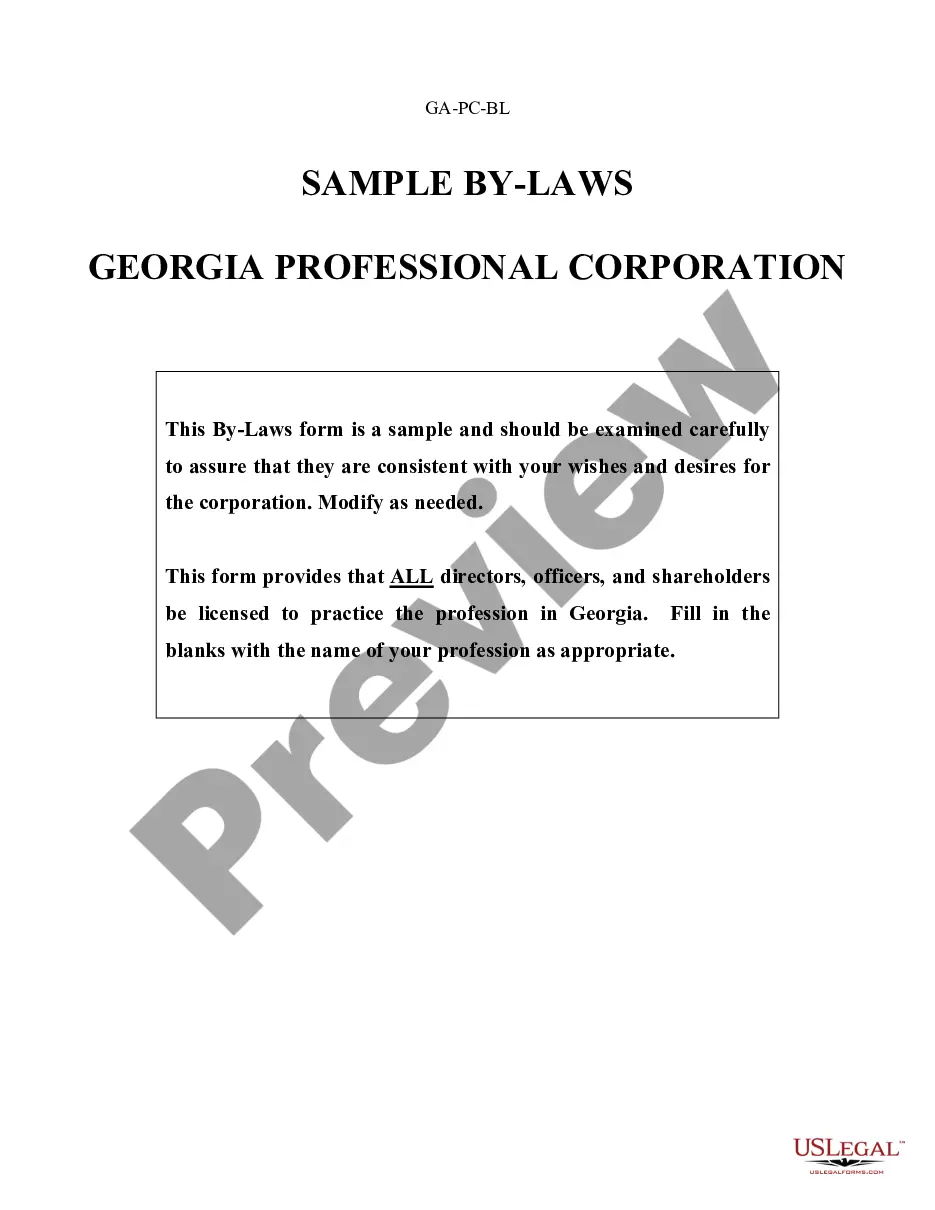

- Ensure you have picked out the proper form for your personal city/region. Select the Preview key to check the form`s content material. Read the form explanation to actually have selected the right form.

- If the form doesn`t fit your needs, utilize the Research area towards the top of the display screen to discover the one which does.

- In case you are satisfied with the shape, affirm your choice by simply clicking the Purchase now key. Then, pick the pricing plan you favor and supply your qualifications to sign up to have an profile.

- Approach the deal. Make use of credit card or PayPal profile to finish the deal.

- Choose the format and down load the shape on your gadget.

- Make changes. Fill up, change and produce and indication the delivered electronically Virginia Proposal to decrease authorized common and preferred stock.

Each and every web template you included in your account lacks an expiration particular date and is also your own forever. So, if you wish to down load or produce another duplicate, just check out the My Forms portion and click on the form you will need.

Gain access to the Virginia Proposal to decrease authorized common and preferred stock with US Legal Forms, by far the most extensive catalogue of authorized papers web templates. Use 1000s of skilled and condition-specific web templates that satisfy your company or person requires and needs.

Form popularity

FAQ

Issuing preferred stock provides a company with a means of obtaining capital without increasing the company's overall level of outstanding debt. This helps keep the company's debt to equity (D/E) ratio, an important leverage measure for investors and analysts, at a lower, more attractive level.

The journal entry for issuing preferred stock is very similar to the one for common stock. This time Preferred Stock and Paid-in Capital in Excess of Par - Preferred Stock are credited instead of the accounts for common stock.

The company can go for Change in Share Capital by transforming the fully paid-up shares into the Stock. The re-conversion of the stocks toward fully paid up shares can also be done additionally.

The number of authorized shares is typically higher than those actually issued, which allows the company to offer and sell more shares in the future if it needs to raise additional funds.

Preferred stock is listed first in the shareholders' equity section of the balance sheet, because its owners receive dividends before the owners of common stock, and have preference during liquidation.