Virginia Approval of deferred compensation investment account plan

Description

How to fill out Approval Of Deferred Compensation Investment Account Plan?

If you wish to total, down load, or print out lawful file web templates, use US Legal Forms, the largest selection of lawful kinds, that can be found on the web. Make use of the site`s basic and hassle-free look for to get the paperwork you will need. A variety of web templates for organization and specific reasons are categorized by classes and suggests, or search phrases. Use US Legal Forms to get the Virginia Approval of deferred compensation investment account plan in just a couple of mouse clicks.

If you are presently a US Legal Forms customer, log in in your bank account and click on the Obtain key to have the Virginia Approval of deferred compensation investment account plan. You can also accessibility kinds you earlier saved inside the My Forms tab of your respective bank account.

If you work with US Legal Forms initially, follow the instructions under:

- Step 1. Be sure you have chosen the shape to the correct city/nation.

- Step 2. Use the Preview choice to check out the form`s content. Don`t neglect to read through the outline.

- Step 3. If you are unsatisfied with the kind, utilize the Research discipline at the top of the display to discover other variations from the lawful kind design.

- Step 4. Once you have identified the shape you will need, select the Get now key. Pick the costs plan you prefer and include your accreditations to register for the bank account.

- Step 5. Method the purchase. You may use your bank card or PayPal bank account to complete the purchase.

- Step 6. Select the formatting from the lawful kind and down load it on the system.

- Step 7. Total, change and print out or indication the Virginia Approval of deferred compensation investment account plan.

Every single lawful file design you buy is yours forever. You possess acces to each kind you saved within your acccount. Go through the My Forms section and decide on a kind to print out or down load again.

Be competitive and down load, and print out the Virginia Approval of deferred compensation investment account plan with US Legal Forms. There are thousands of professional and express-particular kinds you can use for the organization or specific demands.

Form popularity

FAQ

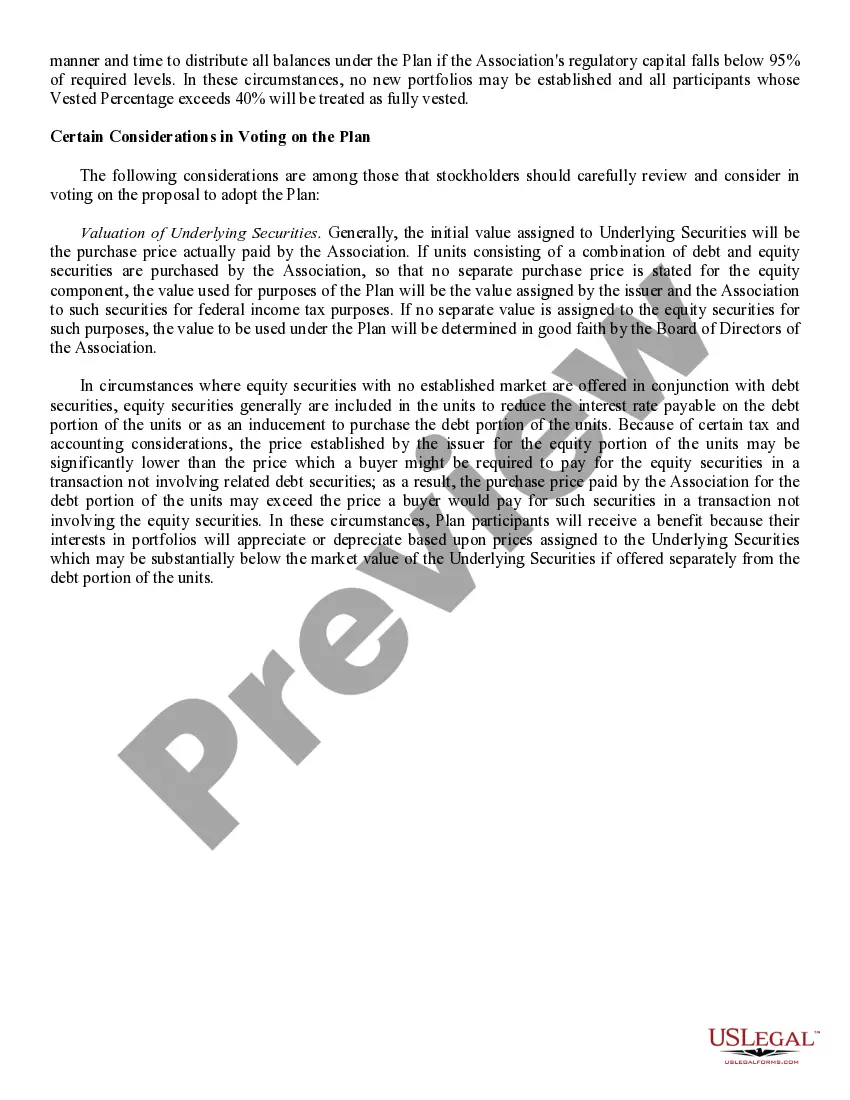

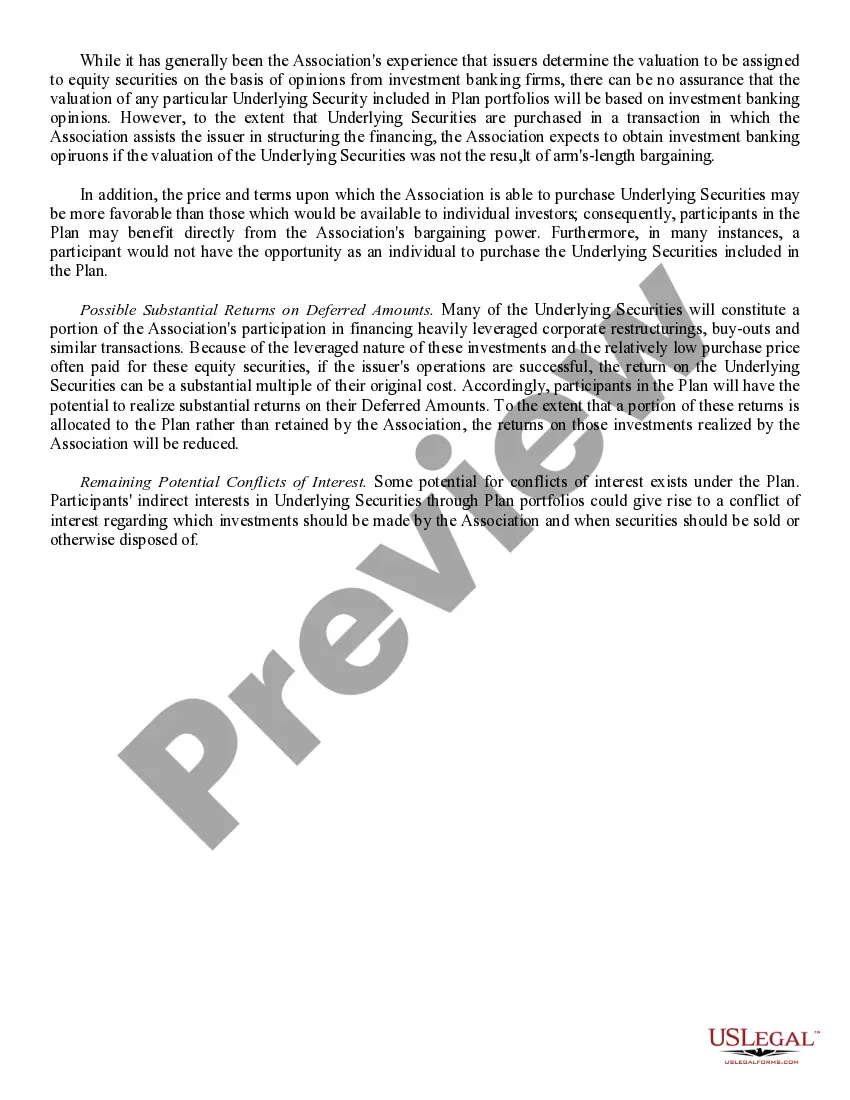

Qualified deferred compensation plans have a limit. For example, employees can only defer up to $22,500 to their traditional 401(k) plan in 2023. Nonqualified deferred compensation plans have no limit. Employees can defer as much of their compensation as they would like.

You may withdraw from your account only when you meet one of these conditions: Terminate employment from the employer that offers the plan. Use your plan account to purchase VRS service credit, if approved. Experience an unforeseeable emergency that is approved by the Plan Administrator.

A deferred compensation plan withholds a portion of an employee's pay until a specified date, usually retirement. The lump sum owed to an employee in this type of plan is paid out on that date. Examples of deferred compensation plans include pensions, 401(k) retirement plans, and employee stock options.

Understanding a Qualified vs. Non-Qualified Annuity. A qualified annuity is funded with pre-tax money and withdrawals are subject to ordinary income tax, while a non-qualified annuity is funded with after-tax money, with only earnings taxed upon withdrawal.

1. Is a 401(k) Plan Qualified or Nonqualified? A 401(k) plan is considered a qualified retirement plan. If your company offers employees a 401(k), you may get a tax break by contributing a percentage on your employees' behalf.

A deferred compensation plan withholds a portion of an employee's pay until a specified date, usually retirement. The lump sum owed to an employee in this type of plan is paid out on that date. Examples of deferred compensation plans include pensions, 401(k) retirement plans, and employee stock options.

With a nonqualified deferred compensation (NQDC) plan, your employees can defer some of their pay until a later date. This type of deferred compensation plan typically pays out income after an employee leaves their job, like in retirement, for instance.

Qualified plans have tax-deferred contributions from the employee, and employers may deduct amounts they contribute to the plan. Nonqualified plans use after-tax dollars to fund them, and in most cases employers cannot claim their contributions as a tax deduction.