Virginia No-Fault Attendance Plan - Action Checklist

Description

How to fill out No-Fault Attendance Plan - Action Checklist?

You can spend hours online attempting to locate the legal document template that fulfills the federal and state standards you require.

US Legal Forms offers thousands of legal templates that are reviewed by professionals.

You can actually download or print the Virginia No-Fault Attendance Plan - Action Checklist from our service.

If available, use the Review button to go through the document template as well.

- If you already have a US Legal Forms account, you may Log In and click the Acquire button.

- Then, you can fill out, modify, print, or sign the Virginia No-Fault Attendance Plan - Action Checklist.

- Each legal document template you purchase is yours to keep indefinitely.

- To obtain another copy of the purchased form, visit the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple steps below.

- First, ensure you have selected the correct document template for your state/town.

- Read the form description to confirm you have chosen the right template.

Form popularity

FAQ

How can I get information on the status of my claim? You can obtain this information through the Voice Response System (1-800-897-5630). Listen to the menu, and select "Claims and Benefits" (option 1), and enter your Social Security number and PIN.

Once your application has been approved, the Department of Labor will send a Monetary Determination with information on your weekly benefit amount. After making your claim, it will take between two to three weeks to receive it. Delays may be caused if the state needs additional information before sending payment.

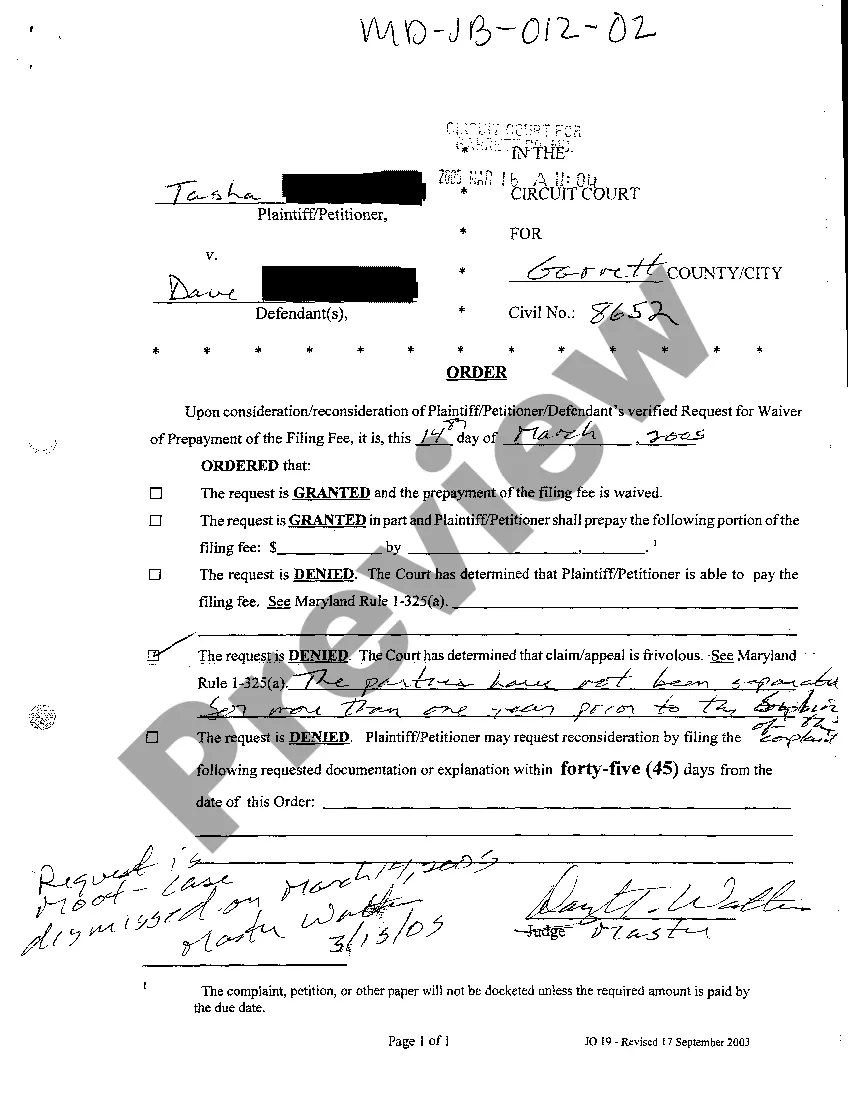

Many employers have implemented so-called no-fault attendance policies that count all absencesregardless of the reasonagainst employees, with some specific number of absences leading to discipline or even termination. These policies are sometimes called reasonable attendance policies.

A: You should receive your payment within 14 calendar days after you file your weekly request for payment of benefits. You may not receive your payment on the same day of the week each time you file your request for payment.

In order to be eligible to receive unemployment benefits, you must have sufficient earnings in your base period from a covered employer. The base period is defined as the first four of the last five completed calendar quarters. Without sufficient earnings, you will not be eligible to receive benefits.

In Virginia, an employee is guilty of misconduct connected with her work sufficient to disqualify her from receiving unemployment benefits when she deliberately violates a company rule reasonably designed to protect the legitimate business interests of her employer, or when his acts or omissions are of such a nature

An employee that was fired, terminated, or released from an employer is not automatically entitled to unemployment benefits. The Virginia Unemployment Compensation Act 2026 intended unemployment benefits to be paid only to those who find themselves unemployed without fault on their part. Va.

When applying for unemployment benefits, you must:Have earned enough wages during the base period.Be totally or partially unemployed.Be unemployed through no fault of your own.Be physically able to work.Be available for work.Be ready and willing to accept work immediately.

You will be disqualified if the deputy determines that you quit your job without good cause, or you were fired from your job for misconduct in connection with your work. You and your employer have the right to appeal the deputy's determination if either of you disagrees with the results.

The Virginia Employment Commission (VEC) oversees unemployment benefits in Virginia. An employee that was fired, terminated, or released from an employer is not automatically entitled to unemployment benefits.