Virginia Depreciation Schedule

Description

How to fill out Depreciation Schedule?

If you desire to complete, obtain, or generate valid document templates, utilize US Legal Forms, the largest collection of valid forms available online.

Take advantage of the site’s user-friendly search to locate the documents you require.

Various templates for business and personal purposes are organized by categories and states, or search terms. Use US Legal Forms to locate the Virginia Depreciation Schedule within a few clicks.

Each legal document template you acquire belongs to you indefinitely.

You will have access to every form you obtained in your account. Check the My documents section and select a form to print or download again. Stay competitive and obtain, and print the Virginia Depreciation Schedule using US Legal Forms. There are countless professional and state-specific templates available for your business or personal requirements.

- If you are already a US Legal Forms subscriber, Log In to your account and click the Obtain button to retrieve the Virginia Depreciation Schedule.

- You can also access forms you previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Make sure you have selected the form for the appropriate city/state.

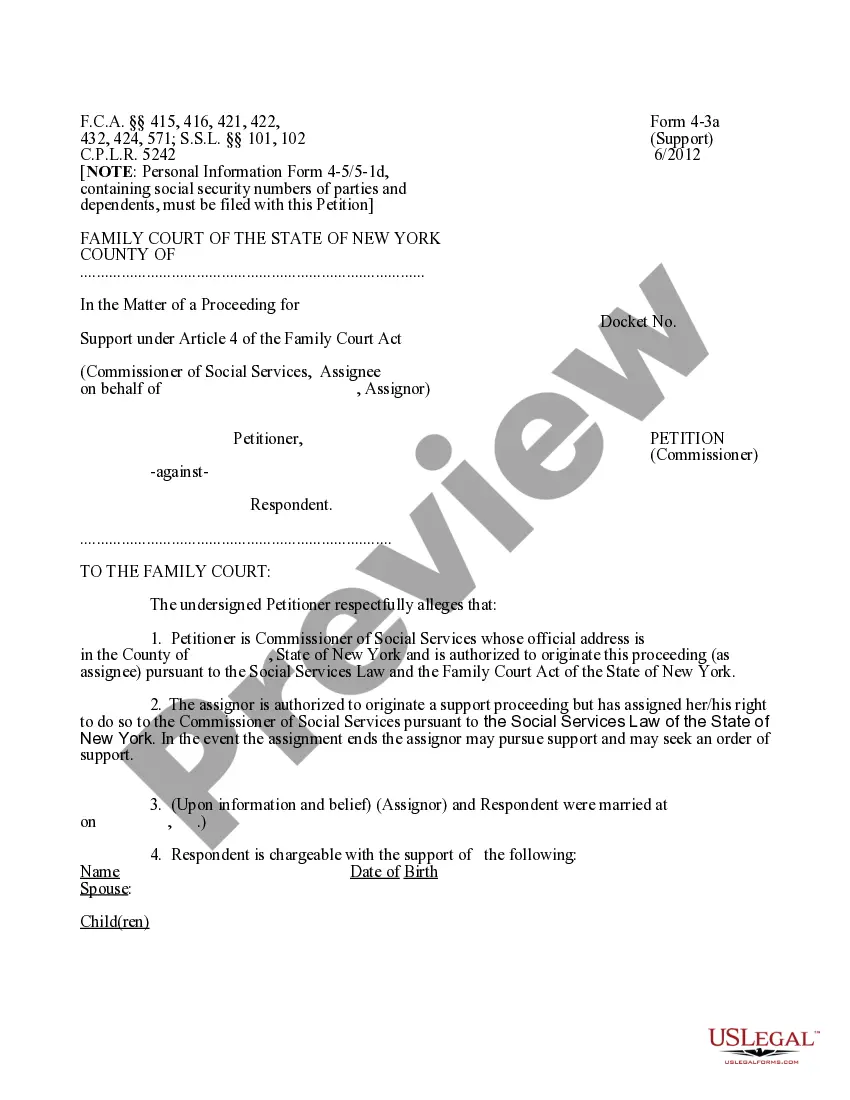

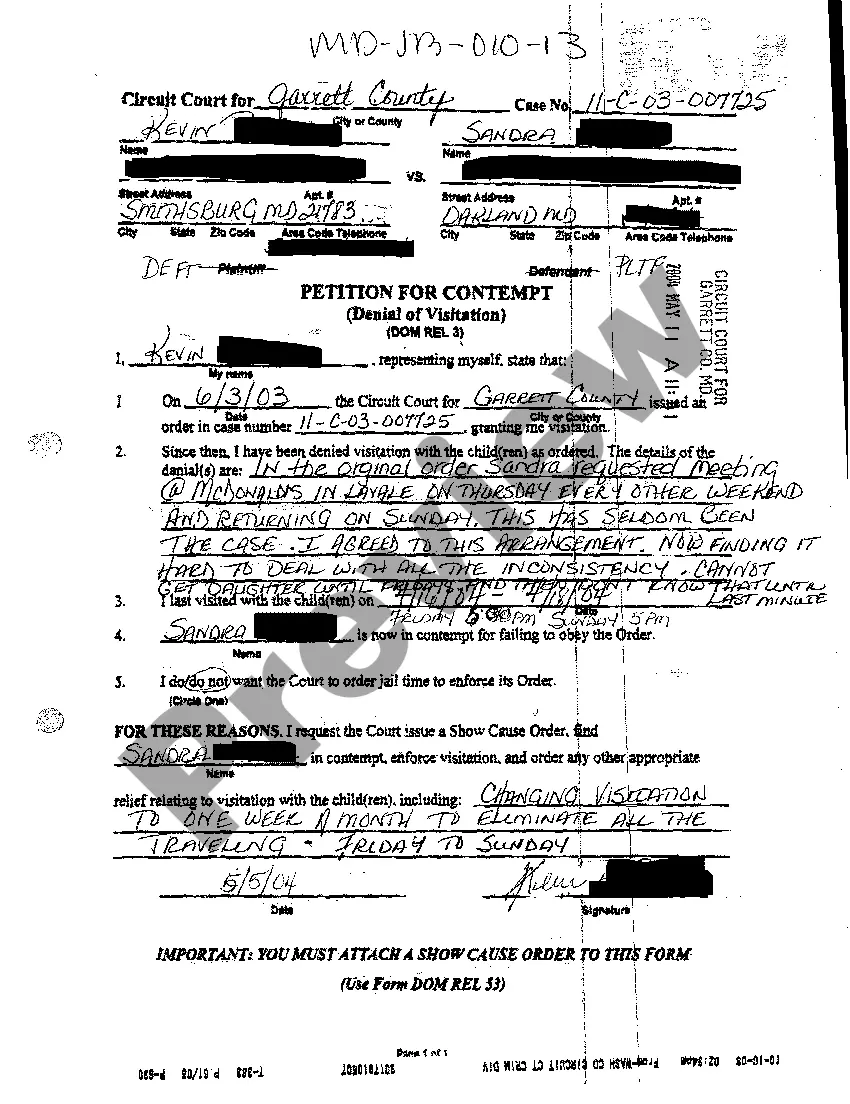

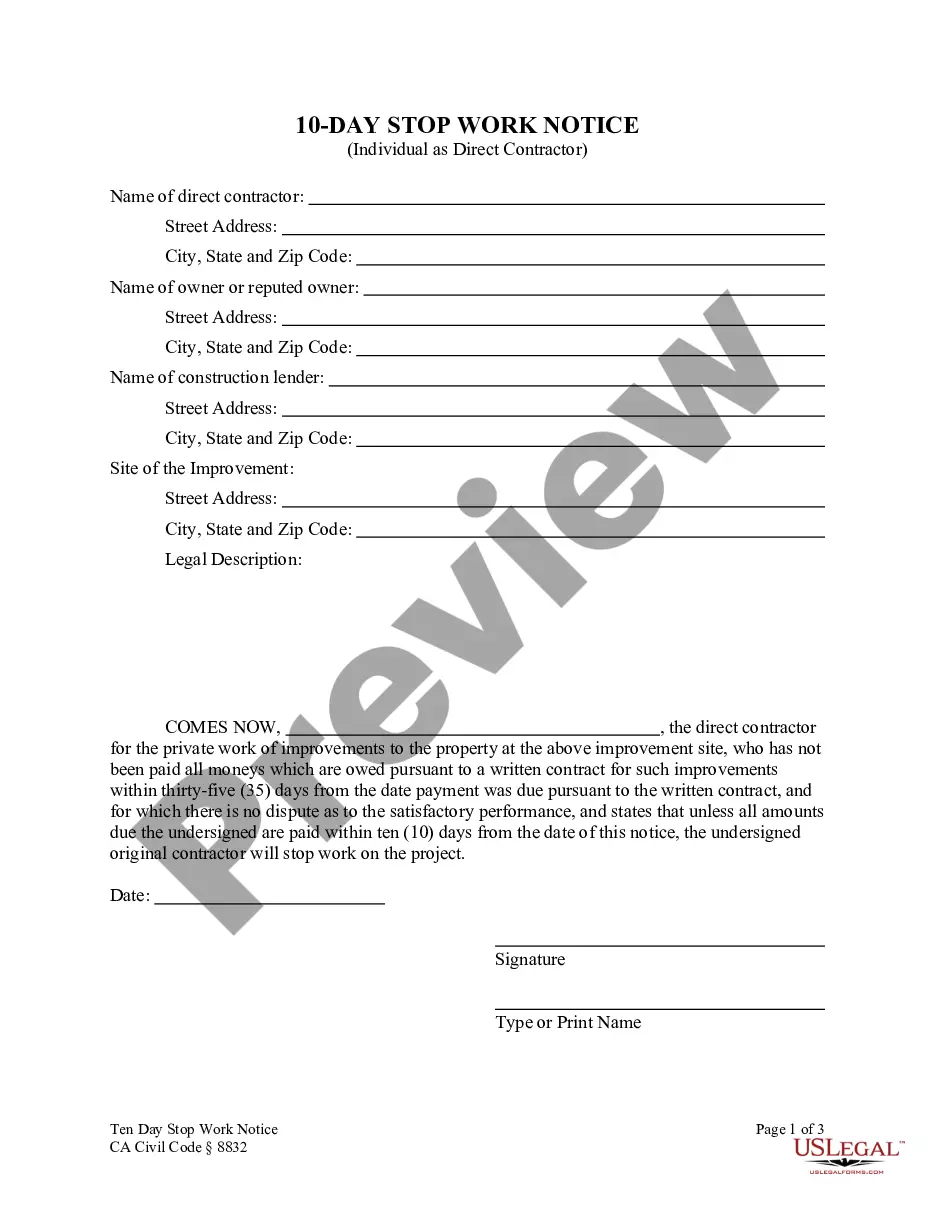

- Step 2. Use the Review option to peruse the form’s content. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have located the form you need, click the Acquire now button. Choose the pricing plan you prefer and provide your details to register for the account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the payment.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Complete, modify, and print or sign the Virginia Depreciation Schedule.

Form popularity

FAQ

Fixed Date Conformity Additions Bonus Depreciation: Federal tax law allows businesses to write off the cost of certain types of assets more quickly than normal. Visit information on the types of assets covered and how to depreciate them. Virginia tax law doesn't recognize this bonus depreciation.

The tax is based on the Federal Adjusted Gross Income. In most cases, your federal adjusted gross income (line 21 on form 1040A; and line 37 on form 1040) plus any Virginia additions and minus any Virginia subtractions computed on Schedule ADJ, is called Virginia Adjusted Gross Income.

States that have adopted the new bonus depreciation rules:Alabama.Alaska.Colorado.Delaware.Illinois.Kansas.Louisiana.Michigan.More items...

Taxable income from Virginia sources includes "income from the practice of a trade or business in Virginia" and includes, but is not limited to, wages and salaries earned while in Virginia, income from a business operating in Virginia, rental income from a property in Virginia, etc.

PART 1 - MAXIMUM SCHEDULE CR NONREFUNDABLE CREDITS A. Enter the total tax computed on your return less the total of Spouse Tax Adjustment, Credit for. Low-Income Individuals or Virginia Earned Income Credit, and Credit for Tax Paid to Another. State.

Schedule CR, Credit for Tax Paid to Other States, allows you to take a credit for income taxes you paid to other states on income you received while a resident of Illinois. You are allowed this credit only if you filed a required tax return with the other state.

If you file Form 1040-NR, use Schedule NEC (Form 1040-NR) to figure your tax on income that is not effectively connected with a U.S. trade or business and to figure your capital gains and losses from sales or exchanges of property that is not effectively connected with a U.S. business.

With the passage of H.B. 2529, Virginia generally now conforms to most, but not all, of the 2017 federal tax reform law known as the Tax Cuts and Job Act (TCJA) amendments, for tax years beginning on or after January 1, 2018, with certain exceptions.

Schedule 502A is used to show the amount of allocated income and to determine the apportionment percentage. If the PTE's income is all from Virginia, then the entity does not allocate and apportion income; the Virginia apportionment percentage is 100%, and Schedule 502A is not required.

Yes, Virginia requires taxpayers that have included federal bonus depreciation in the calculation of their federal taxable income to add back the bonus depreciation to federal taxable income to determine Virginia taxable income.