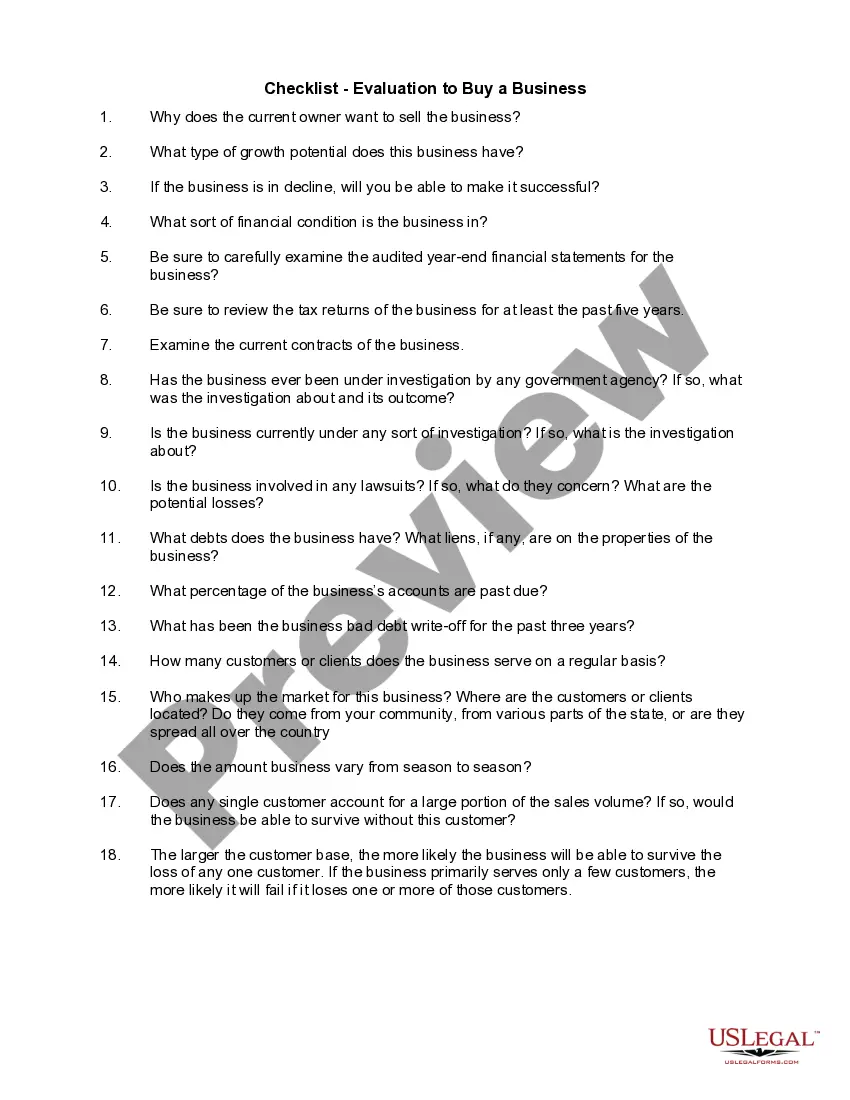

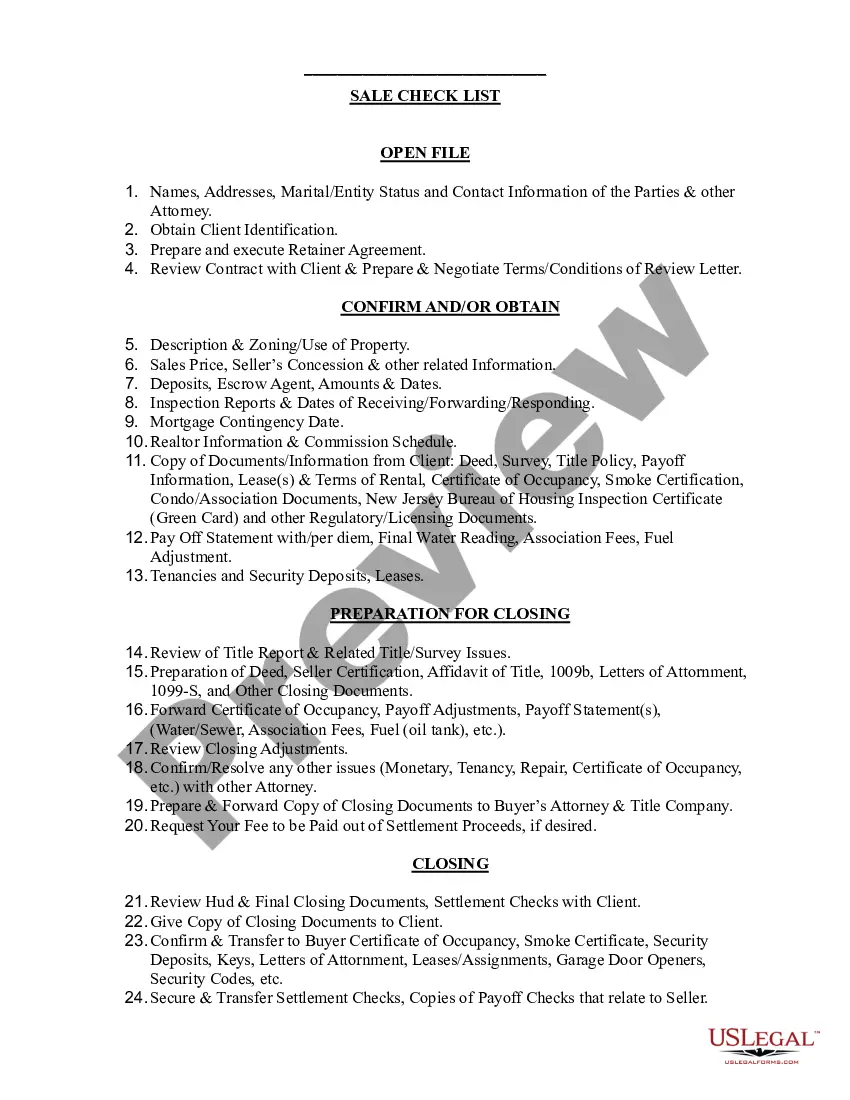

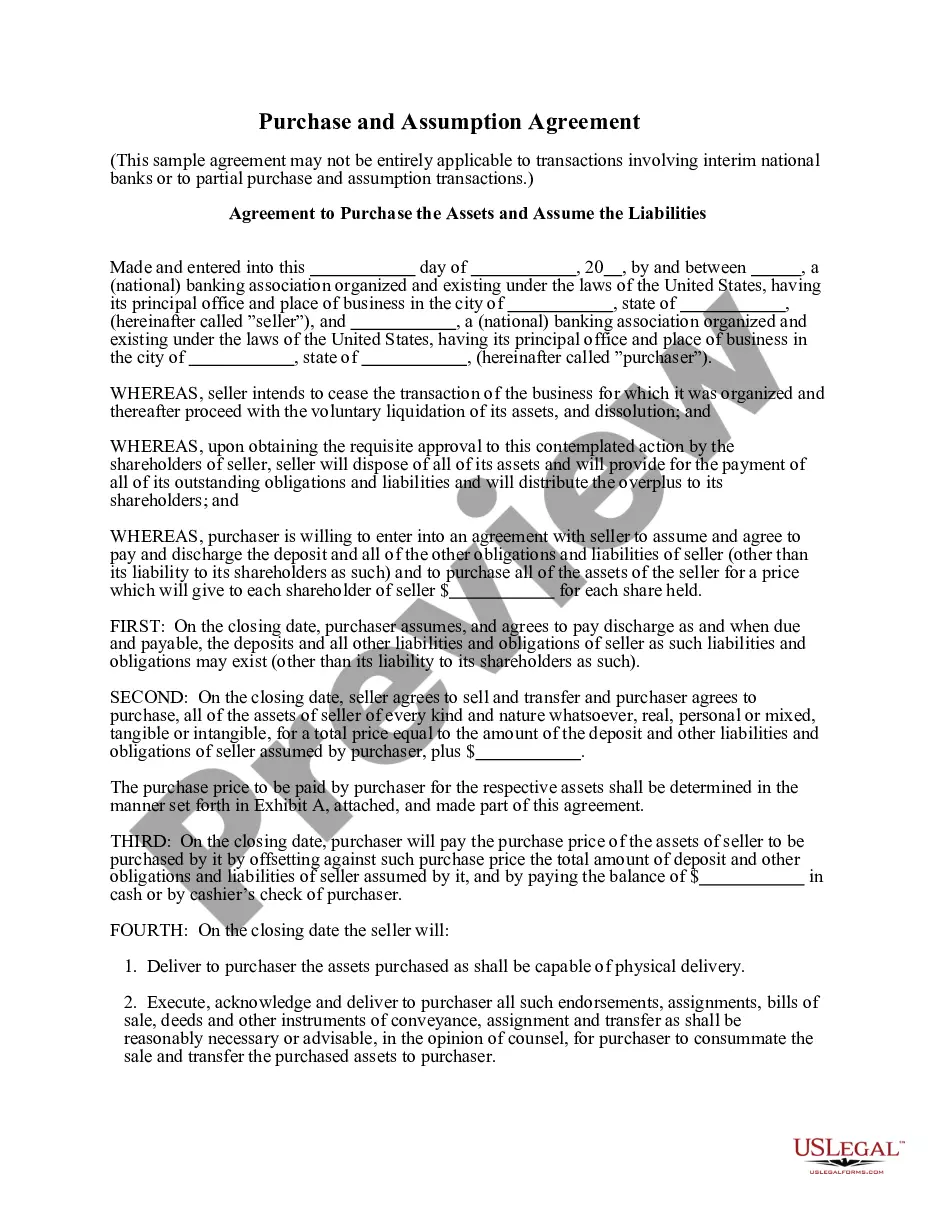

Virginia Checklist - Sale of a Business

Description

How to fill out Checklist - Sale Of A Business?

Finding the appropriate genuine document template can be quite a challenge.

Clearly, there are numerous templates accessible online, but how do you obtain the legitimate form you need.

Utilize the US Legal Forms website.

Initially, ensure you have selected the right form for your specific city/state. You can review the form using the Preview button and read the form description to confirm it is suitable for you.

- The service offers thousands of templates, including the Virginia Checklist - Sale of a Business, which can be used for both business and personal purposes.

- All of the forms are reviewed by experts and comply with federal and state standards.

- If you are already registered, Log In to your account and click the Download button to get the Virginia Checklist - Sale of a Business.

- Use your account to browse the legal forms you have previously purchased.

- Visit the My documents tab in your account and obtain an additional copy of the document you require.

- If you are a new user of US Legal Forms, here are simple instructions you should follow.

Form popularity

FAQ

You cannot cancel your EIN, however, you can close your account with the IRS. You'll need to send a letter to the IRS office and explain the reason you want to close your tax account. You'll need to include important details about your business, such as the corporation name, structure, address and EIN.

To dissolve an LLC in Virginia, you'll need to file Articles of Cancellation with the state. These can be filed in either online or by mail. To file Articles of Cancellation, you must pay the Virginia State Corporation Commission a fee of $25.

HOW TO GET A RESALE CERTIFICATE IN VIRGINIA2714 STEP 1 : Complete the Virginia Sales and Use Tax Registration.2714 STEP 2 : Fill out the Virginia ST-10 tax exempt form.2714 STEP 3 : Present a copy of this certificate to suppliers when you wish to purchase items for resale.

If you have paid any contractors at least $600 for services (including parts and materials) during the calendar year in which you close your business, you must report those payments.

Steps to Take to Close Your BusinessFile a Final Return and Related Forms.Take Care of Your Employees.Pay the Tax You Owe.Report Payments to Contract Workers.Cancel Your EIN and Close Your IRS Business Account.Keep Your Records.

To dissolve an LLC in Virginia, simply follow these three steps: Follow the Operating Agreement. Close Your Business Tax Accounts....Step 1: Follow Your Virginia LLC Operating Agreement.Step 2: Close Your Business Tax Accounts.Step 3: File Articles of Dissolution.

Follow these steps to closing your business:Decide to close.File dissolution documents.Cancel registrations, permits, licenses, and business names.Comply with employment and labor laws.Resolve financial obligations.Maintain records.

To dissolve an LLC in Virginia, simply follow these three steps: Follow the Operating Agreement. Close Your Business Tax Accounts....Step 1: Follow Your Virginia LLC Operating Agreement.Step 2: Close Your Business Tax Accounts.Step 3: File Articles of Dissolution.

HOW TO GET A RESALE CERTIFICATE IN VIRGINIA2714 STEP 1 : Complete the Virginia Sales and Use Tax Registration.2714 STEP 2 : Fill out the Virginia ST-10 tax exempt form.2714 STEP 3 : Present a copy of this certificate to suppliers when you wish to purchase items for resale.

Virginia does not charge for a sales tax permit. Other business registration fees may apply. Contact each state's individual department of revenue for more about registering your business. 5.