Virginia Accounts Receivable Write-Off Approval Form

Description

How to fill out Accounts Receivable Write-Off Approval Form?

If you need to acquire, secure, or print sanctioned document templates, utilize US Legal Forms, the largest collection of legal documents available online.

Employ the site's user-friendly search option to find the documents you require.

Various templates for business and personal purposes are categorized by type and jurisdiction, or keywords.

- Use US Legal Forms to obtain the Virginia Accounts Receivable Write-Off Approval Form with just a few clicks.

- If you are a current US Legal Forms user, Log In to your account and click the Get button to find the Virginia Accounts Receivable Write-Off Approval Form.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the guidelines outlined below.

- Step 1. Ensure you have selected the form for the appropriate locality/state.

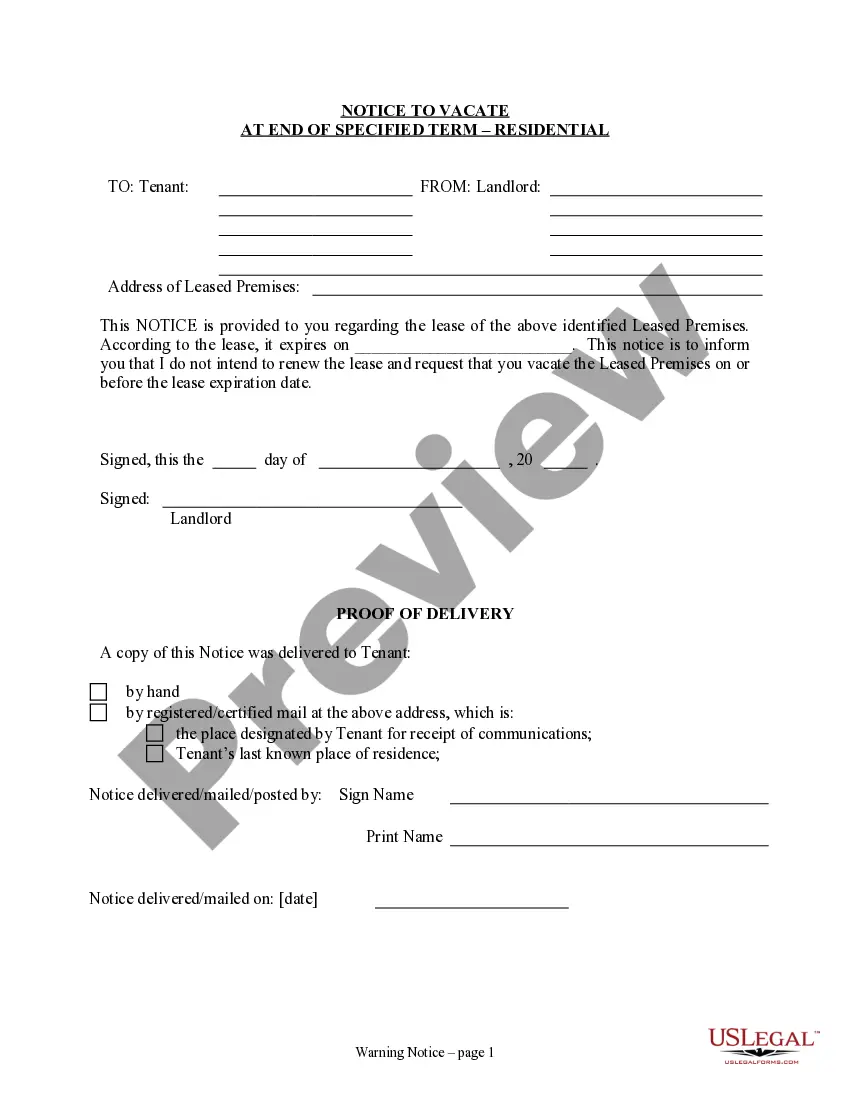

- Step 2. Use the Preview feature to review the content of the form. Do not forget to read the description.

- Step 3. If you are dissatisfied with the form, utilize the Search bar at the top of the screen to find alternative versions of the legal document template.

- Step 4. After locating the necessary form, click the Get Now button. Choose your preferred payment plan and enter your details to create an account.

- Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Virginia Accounts Receivable Write-Off Approval Form.

- Every legal document template you purchase is yours indefinitely. You have access to every form you downloaded in your account. Go to the My documents section and select a form to print or download again.

- Stay competitive and obtain, and print the Virginia Accounts Receivable Write-Off Approval Form with US Legal Forms. There are countless professional and state-specific forms you can use for your business or individual needs.

Form popularity

FAQ

The journal entry for uncollectible accounts typically involves debiting the bad debt expense account and crediting accounts receivable. This entry reduces your assets while acknowledging the loss, ensuring your financial statements remain accurate. It is advisable to utilize the Virginia Accounts Receivable Write-Off Approval Form during this process to maintain proper records and oversight.

Writing off uncollectible accounts receivable involves identifying debts that are unlikely to be collected and properly documenting them. After a thorough review of outstanding accounts, you would then initiate a formal write-off using the Virginia Accounts Receivable Write-Off Approval Form. This process ensures that the accounts are accurately reflected in your financials and that you remain compliant with accounting standards.

To record the write-off of a receivable, you typically debit the bad debt expense account and credit the accounts receivable account. This action reflects the loss on the financial statements and maintains accurate accounting records. Utilizing the Virginia Accounts Receivable Write-Off Approval Form simplifies this process and ensures all necessary documentation is in place.

If accounts receivable becomes uncollectible, it can negatively impact a company's financial statements. The uncollectible amount must be written off, reducing the total revenue reported. It is crucial for businesses to address these uncollectible debts promptly. Utilizing the Virginia Accounts Receivable Write-Off Approval Form can help manage this process effectively.

Yes, the IRS can withhold your tax refund and apply it toward certain federal debts, but credit card debt is generally not one of them. However, if you owe federal taxes or other specified debts, your refund may be at risk. Understanding how the Virginia Accounts Receivable Write-Off Approval Form operates can help you assess your financial situation and assist with debt management strategies.

To write off an accounts receivable balance, you typically need to document the outstanding debt and the steps taken to collect it. This process involves formally recognizing that the account is uncollectible and removing it from your active balance. Using the Virginia Accounts Receivable Write-Off Approval Form simplifies this process by providing a structured approach to documenting your write-off.

Commonwealth debts include any financial obligations owed to the state, such as unpaid taxes, fees, and other dues. These debts may originate from various sources and can impact your financial standing if not addressed. Knowing about the Virginia Accounts Receivable Write-Off Approval Form can guide you through the steps needed to manage these debts effectively.

The Commonwealth debt setoff program allows the state to recover debts owed to it by intercepting certain payments, such as tax refunds. This program aids in the collection of outstanding debts by designating these funds towards the debts you owe. If you have debts that qualify, understanding how to utilize Virginia Accounts Receivable Write-Off Approval Form can help streamline your process.