Virginia Simple Promissory Note for Car Loan

Description

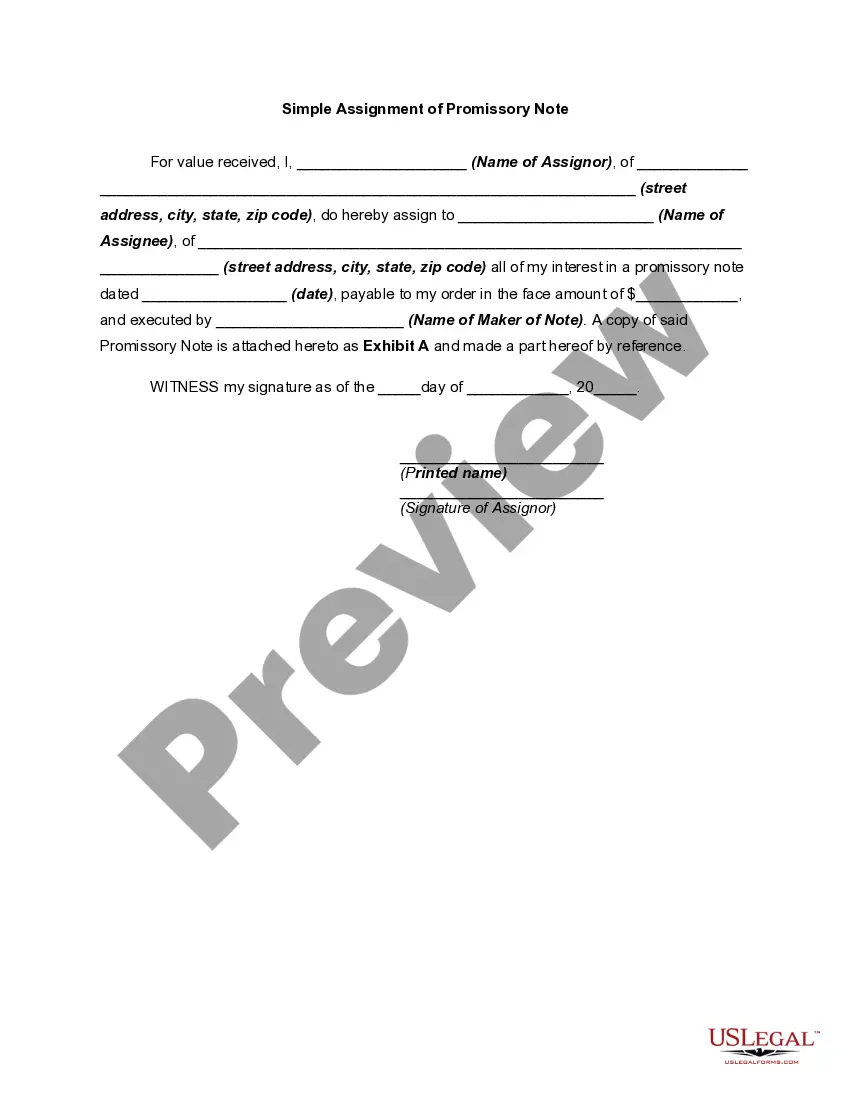

How to fill out Simple Promissory Note For Car Loan?

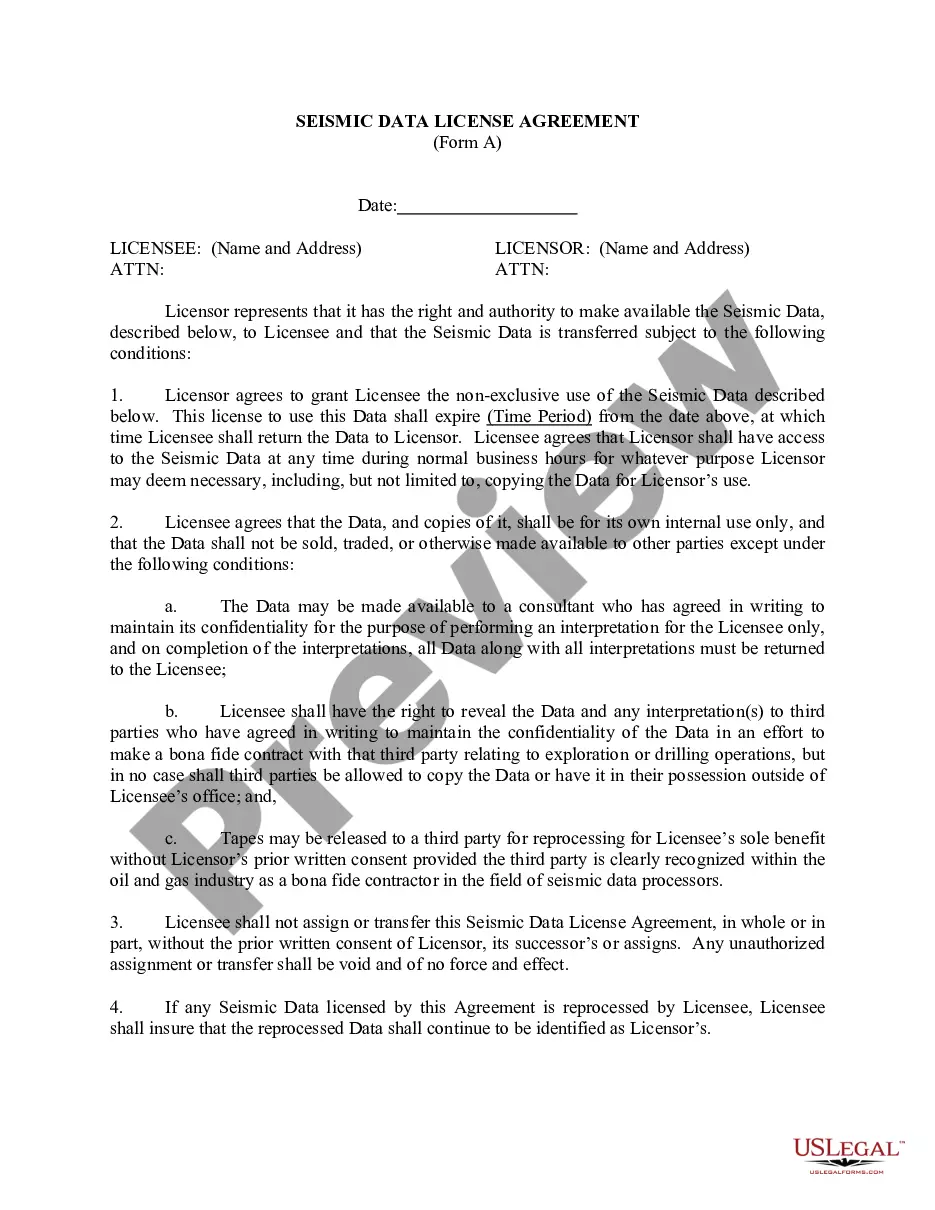

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal form templates that can be downloaded or printed.

While using the site, you'll find numerous forms for business and personal purposes, organized by categories, states, or keywords.

You can access the latest versions of forms such as the Virginia Simple Promissory Note for Car Loan in just minutes.

If the form does not fulfill your requirements, utilize the Search field at the top of the page to find one that does.

Once you are satisfied with the form, validate your selection by clicking the Get Now button. Then, choose the pricing plan you prefer and provide your details to register for an account.

- If you have an active subscription, Log In to download the Virginia Simple Promissory Note for Car Loan from the US Legal Forms library.

- The Download button will appear on each form you view.

- You can access all previously downloaded forms from the My documents tab in your account.

- If you’re using US Legal Forms for the first time, here are some simple steps to help you get started.

- Ensure you have selected the correct form for your city/state.

- Click the Review button to examine the form's content.

Form popularity

FAQ

Writing a promissory note for a car is straightforward. You should start with the date of the agreement, followed by the names of both parties involved. Include the amount being financed, the interest rate if applicable, and the payment schedule. Utilizing a template from uslegalforms can help ensure that you cover all necessary details effectively.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

A banknote is frequently referred to as a promissory note, as it is made by a bank and payable to bearer on demand. Mortgage notes are another prominent example. If the promissory note is unconditional and readily saleable, it is called a negotiable instrument.

In order for the promissory note to be valid, the borrower needs to sign it. The lender may require the borrower to sign this document in front of a notary to guarantee the signature.

There is no legal requirement for most promissory notes to be witnessed or notarized in Virginia (promissory notes related to real estate must be notarized). Still, the parties may decide to have the document certified by a notary public for protection in the event of a lawsuit.

Generally, as long as the promissory note contains legally acceptable interest rates, the signatures of the two contracted parties, and are within the applicable Statute of Limitations, they can be upheld in a court of law.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.19-Aug-2021

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

In any event, a promissory note does not have to be notarized to be binding. The private respondents have admitted signing the two notes and they have not succeeded in proving that they did so "under duress, fear and undue influence."