This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Virginia Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete

Description

How to fill out Contract With Consultant As Self-Employed Independent Contractor With Confidentiality Agreement And Covenant Not To Compete?

You can dedicate hours online looking for the legal document template that meets the state and federal requirements you need.

US Legal Forms offers thousands of legal forms that have been reviewed by professionals.

You can obtain or create the Virginia Contract with Consultant as a Self-Employed Independent Contractor, including a Confidentiality Agreement and Covenant not to Compete, through our service.

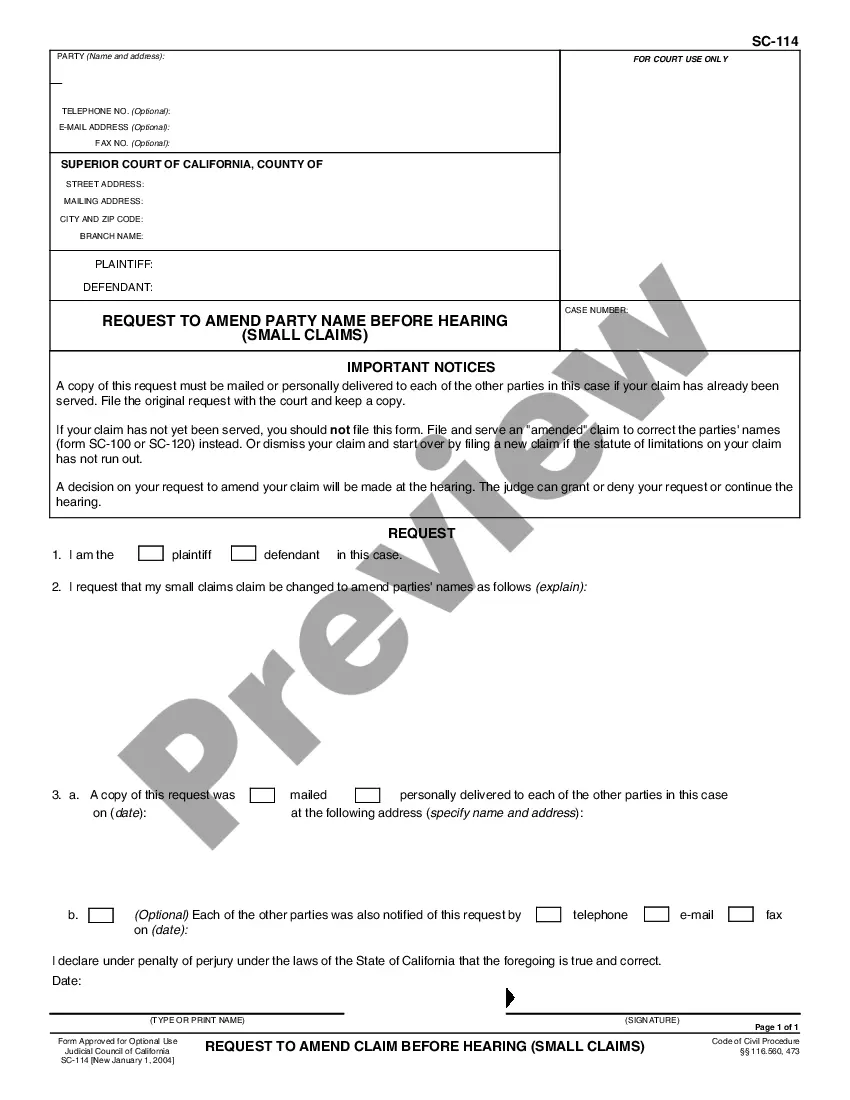

If available, use the Preview button to browse the document template as well.

- If you already possess a US Legal Forms account, you may Log In and click the Download button.

- Then, you can complete, modify, print, or sign the Virginia Contract with Consultant as a Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of the purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow these simple instructions below.

- First, ensure you have selected the appropriate document template for your location/area of interest.

- Review the form description to confirm you have chosen the correct form.

Form popularity

FAQ

A noncompete agreement can be voided for several reasons, including if it is overly broad or not protecting a legitimate business interest. Additionally, if the agreement is not supported by consideration or if the terms are unclear, it may not hold up in court. To avoid these pitfalls, craft your Virginia Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete with clear definitions and reasonable limits. Consulting legal expertise can help you navigate these complexities.

Yes, an independent contractor can have a non-compete clause in their contract in Virginia. This clause can help ensure that sensitive business information remains confidential and that the contractor does not engage in competing activities for a specified time period after their contract ends. It's important to frame the clause properly to abide by Virginia's legal standards. Utilizing US Legal Forms can streamline the drafting of a Virginia Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete.

Non-compete agreements can be enforceable for independent contractors in Virginia, but their enforceability depends on how they are structured. For them to hold up in court, these agreements must not impose undue hardship on the contractor and must protect legitimate business interests. Clearly outline the scope and limitations in your Virginia Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete to increase enforceability.

Yes, Non-Disclosure Agreements (NDAs) do apply to independent contractors in Virginia. These agreements protect sensitive information that contractors may access during their work. An NDA ensures that your confidential information remains secure and is not shared with unauthorized parties. In the context of a Virginia Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete, an NDA is a vital component.

In Virginia, noncompete bans can apply to independent contractors as well as employees. However, the enforceability of these agreements may vary based on specific terms and the nature of the contractor's work. It's crucial to draft these agreements carefully to ensure they uphold in court. Consulting a legal service can help refine your Virginia Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete.

Yes, Virginia does enforce non-compete agreements, but they must meet specific criteria. The agreements need to protect legitimate business interests, such as customer relationships or trade secrets. Additionally, the restrictions should be reasonable in duration and geographic scope. When creating a Virginia Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete, it's essential to ensure these terms are well-defined.

A typical confidentiality clause in a Virginia Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete may state that 'the contractor agrees not to disclose any confidential information obtained during the term of the contract to any third party without the prior written consent of the client.' This clear language ensures that both parties understand their rights and obligations regarding sensitive information, promoting a secure working relationship.

In Virginia, non-compete agreements are generally enforceable if they meet specific criteria. These agreements must be reasonable in duration, geographic scope, and intended purpose, aligning with the legitimate business interests of the client. Therefore, when drafting a Virginia Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete, ensure that your non-compete clause adheres to these requirements to enhance enforceability.

The confidentiality clause for independent contractors in a Virginia Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete ensures that the contractor does not disclose any confidential information obtained during the agreement. This clause defines what constitutes confidential information and the consequences of violating this agreement. Such measures protect both parties and foster a culture of trust.

The indemnification clause in a Virginia Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete outlines the contractor's responsibility to cover the costs associated with legal claims arising from their work. This clause helps safeguard clients against potential liabilities that may arise, thus providing peace of mind. It encourages accountability and a professional attitude in the contractor's work.