The Truth-in-Lending Act (TILA) is part of the Federal Consumer Credit Protection Act. The purpose of the TILA is to make full disclosure to debtors of what they are being charged for the credit they are receiving. TILA applies only to consumer credit transactions. Consumer credit is credit for personal or household use and not commercial use. This form was designed to cover an situation where the Seller is not a creditor as defined by the TILA.

Virginia Installment Sale not covered by Federal Consumer Credit Protection Act with Security Agreement

Description

How to fill out Installment Sale Not Covered By Federal Consumer Credit Protection Act With Security Agreement?

Selecting the appropriate legal document format can pose challenges. Clearly, there are numerous templates accessible online, but how do you acquire the legal form you require.

Utilize the US Legal Forms site. This service offers thousands of templates, including the Virginia Installment Sale not governed by the Federal Consumer Credit Protection Act alongside a Security Agreement, suitable for both business and personal needs.

All documents are verified by professionals and meet state and federal requirements.

If the form does not meet your needs, use the Search field to find the right form. Once you are certain the form is correct, click on the Purchase Now button to acquire the form. Choose the pricing plan you need and enter the required information. Create your account and process the transaction using your PayPal account or credit card. Select the file format and download the legal document format to your device. Complete, edit, print, and sign the received Virginia Installment Sale not governed by the Federal Consumer Credit Protection Act alongside a Security Agreement. US Legal Forms stands as the largest repository of legal forms, where you can find a variety of document templates. Use this service to download professionally crafted documents that comply with state regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Virginia Installment Sale not governed by the Federal Consumer Credit Protection Act alongside a Security Agreement.

- Use your account to review the legal templates you have purchased previously.

- Navigate to the My documents tab in your account and download another copy of the document you require.

- If you are a new user of US Legal Forms, here are some basic instructions to follow.

- First, ensure you have selected the correct form for your locality/region.

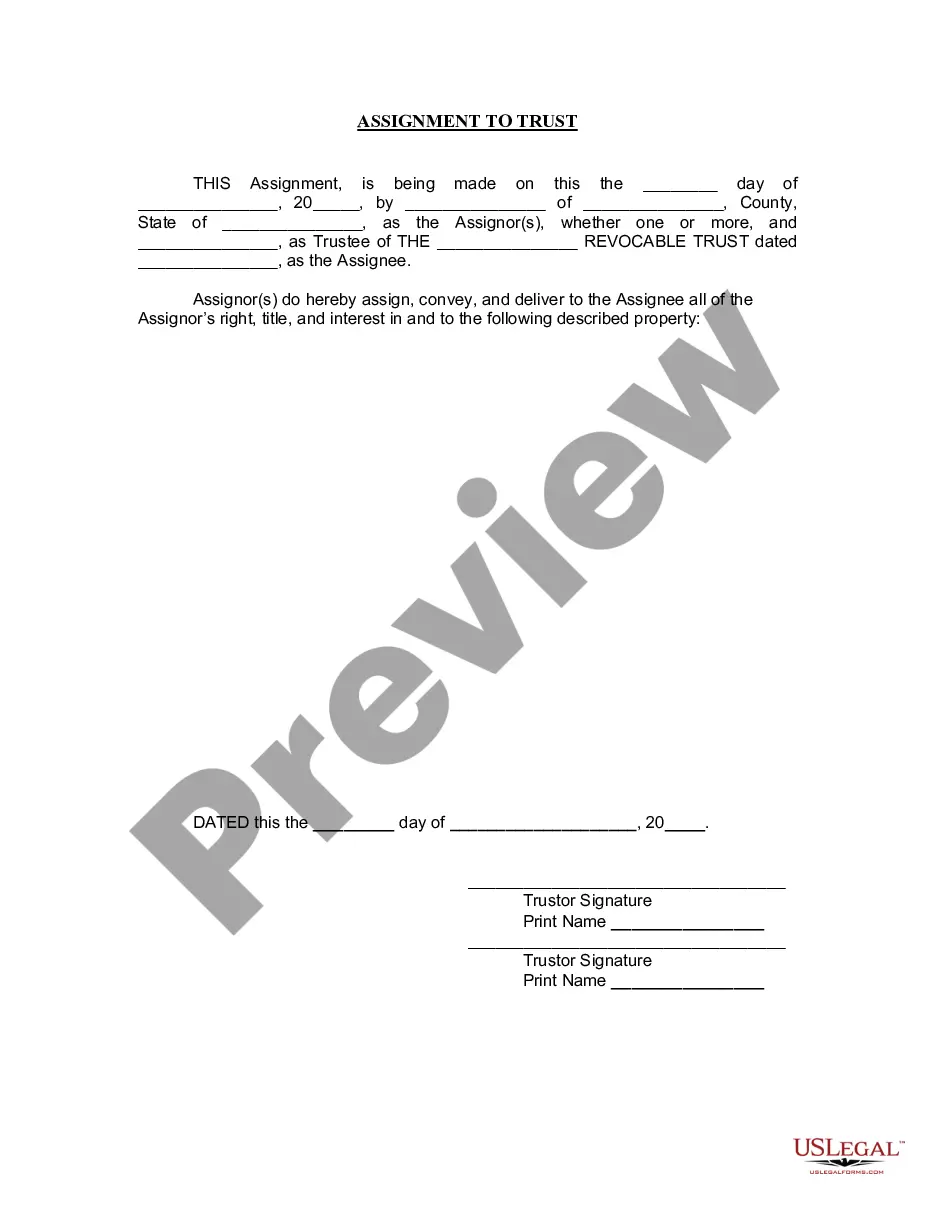

- You can browse the form using the Review button and examine the form description to confirm this is the right one for you.

Form popularity

FAQ

Types of property that generally do not qualify for installment sales tax treatment include inventory and certain financial securities. These exclusions are important when structuring a sale, as they can impact the overall tax ramifications. Make sure you are aware of these aspects when considering the Virginia Installment Sale not covered by Federal Consumer Credit Protection Act with Security Agreement.

Items that do not qualify for installment sale treatment include stocks, bonds, and other intangible assets. Sales involving the primary residence may also have special rules and exemptions. It's crucial to identify these exclusions when working with the Virginia Installment Sale not covered by Federal Consumer Credit Protection Act with Security Agreement.

An installment sale may be disqualified if it involves the sale of personal property used in a trade or business, or if payments are received over a period extending beyond the required time limits. Additionally, the sale of certain financial assets may not qualify. Understanding these restrictions is essential for anyone considering the Virginia Installment Sale not covered by Federal Consumer Credit Protection Act with Security Agreement.

To report an installment sale on your tax return, you will need to complete IRS Form 6252 for each year that you receive payments. This will detail the amount of gain recognized and the payments received. Make sure to include relevant sections associated with the Virginia Installment Sale not covered by Federal Consumer Credit Protection Act with Security Agreement for accuracy.

Typically, a seller agrees to an installment sale to facilitate a sale while maximizing their financial benefits. It allows for a steady income stream over time, rather than a lump sum payment. Moreover, understanding the Virginia Installment Sale not covered by Federal Consumer Credit Protection Act with Security Agreement can help sellers navigate this process more effectively.

The IRS installment sale rule allows sellers to report the sale of property and spread gain reporting over the years the payments are received. This approach can offer tax benefits for many sellers. However, it's essential to understand the specific stipulations laid out in the Virginia Installment Sale not covered by Federal Consumer Credit Protection Act with Security Agreement.

To elect out of installment sale treatment, you must report the sale in full on your tax return for the year of sale. This means you will not defer tax on the gain over several years. Consult your tax professional to ensure that you handle this correctly, especially within the framework of Virginia Installment Sale not covered by Federal Consumer Credit Protection Act with Security Agreement.

Certain transactions, such as sales of inventory or stocks, are not eligible for reporting through the installment sale method. The Virginia Installment Sale not covered by Federal Consumer Credit Protection Act with Security Agreement primarily applies to real property and certain types of personal property. It's crucial to assess the nature of your transaction to determine eligibility.

VA Code 6.2 303 touches on the rights and responsibilities of creditors in Virginia. This code is significant for anyone involved in a Virginia Installment Sale not covered by Federal Consumer Credit Protection Act with Security Agreement. It ensures transparent practices in lending, protecting both the buyer and seller. Educating yourself about this code can help you navigate your rights effectively.

VA Code 6.2 1003 outlines the rules regarding the licensing of mortgage lenders and brokers in Virginia. This code is important because it establishes the standards for lending practices, especially concerning consumer rights. A Virginia Installment Sale not covered by Federal Consumer Credit Protection Act with Security Agreement may also have implications under this code. Familiarizing yourself with these requirements can enhance your understanding of financial agreements.