US Legal Forms - one of several most significant libraries of lawful varieties in America - provides a variety of lawful file themes you are able to download or produce. Making use of the website, you can find thousands of varieties for organization and specific reasons, categorized by types, claims, or search phrases.You will discover the latest types of varieties much like the Virginia Renunciation and Disclaimer of Interest in Life Insurance Proceeds in seconds.

If you already have a membership, log in and download Virginia Renunciation and Disclaimer of Interest in Life Insurance Proceeds through the US Legal Forms collection. The Obtain option will show up on each kind you see. You have access to all in the past saved varieties in the My Forms tab of your accounts.

If you would like use US Legal Forms the very first time, listed below are basic guidelines to help you get started off:

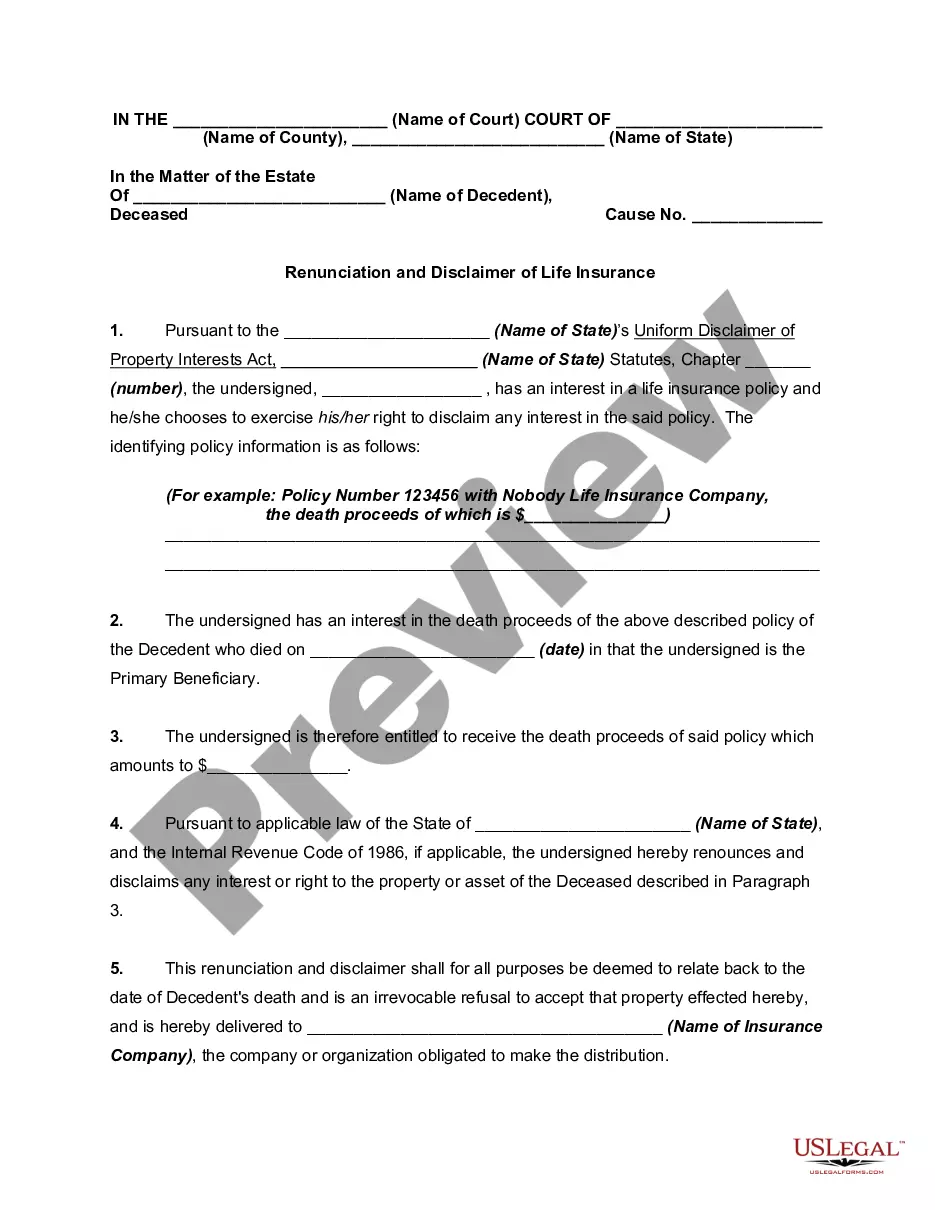

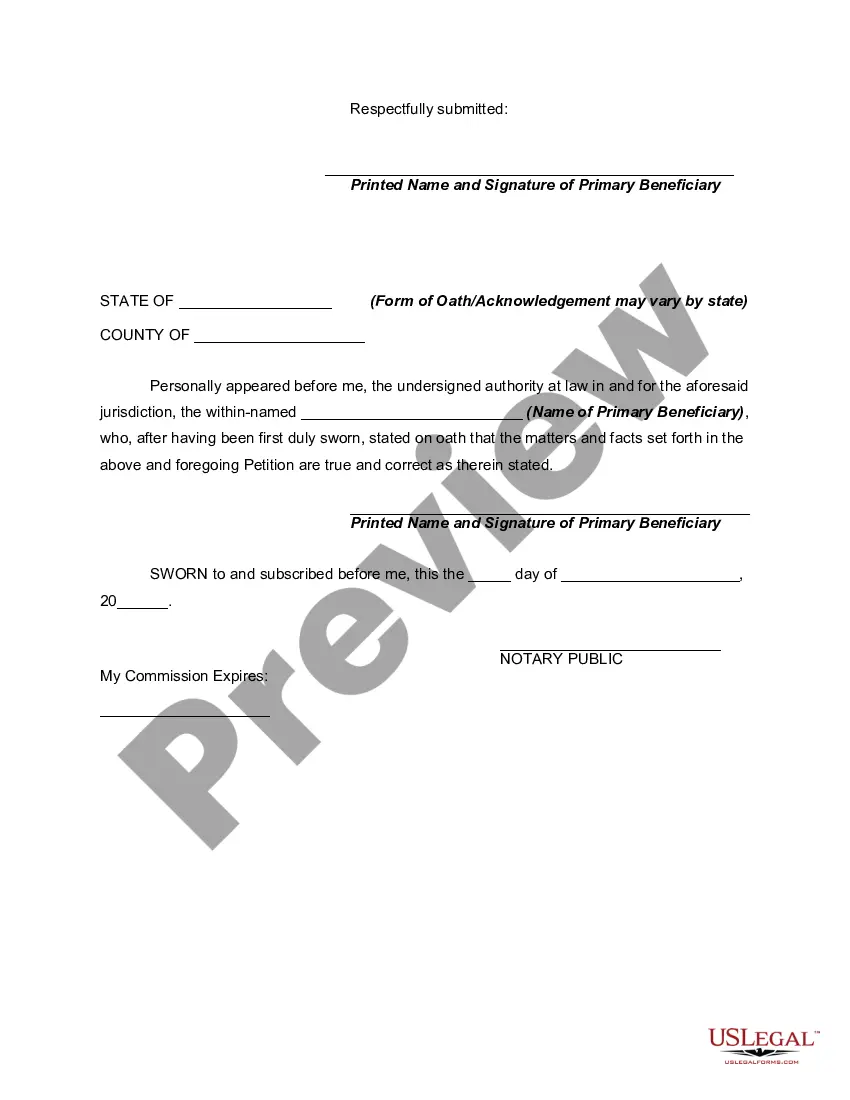

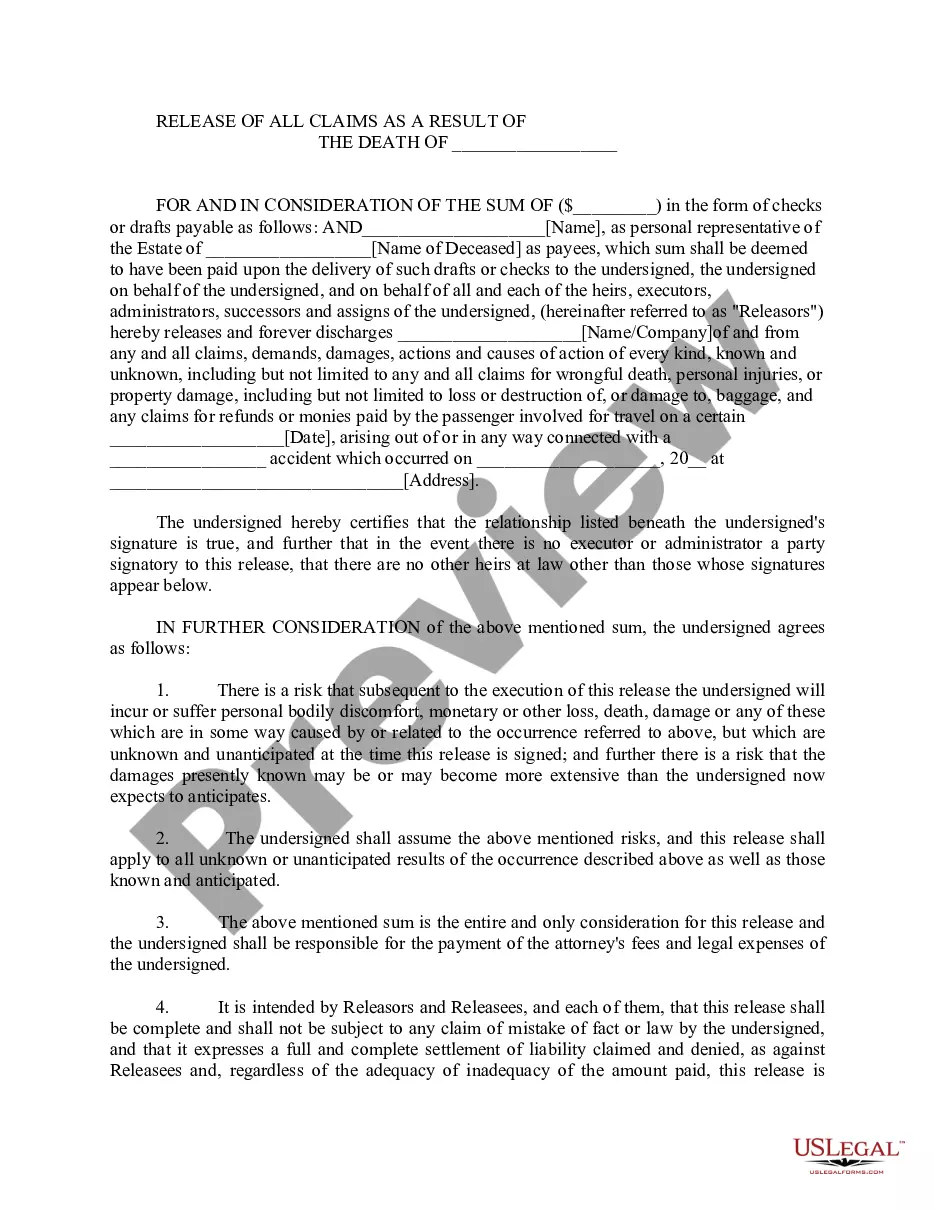

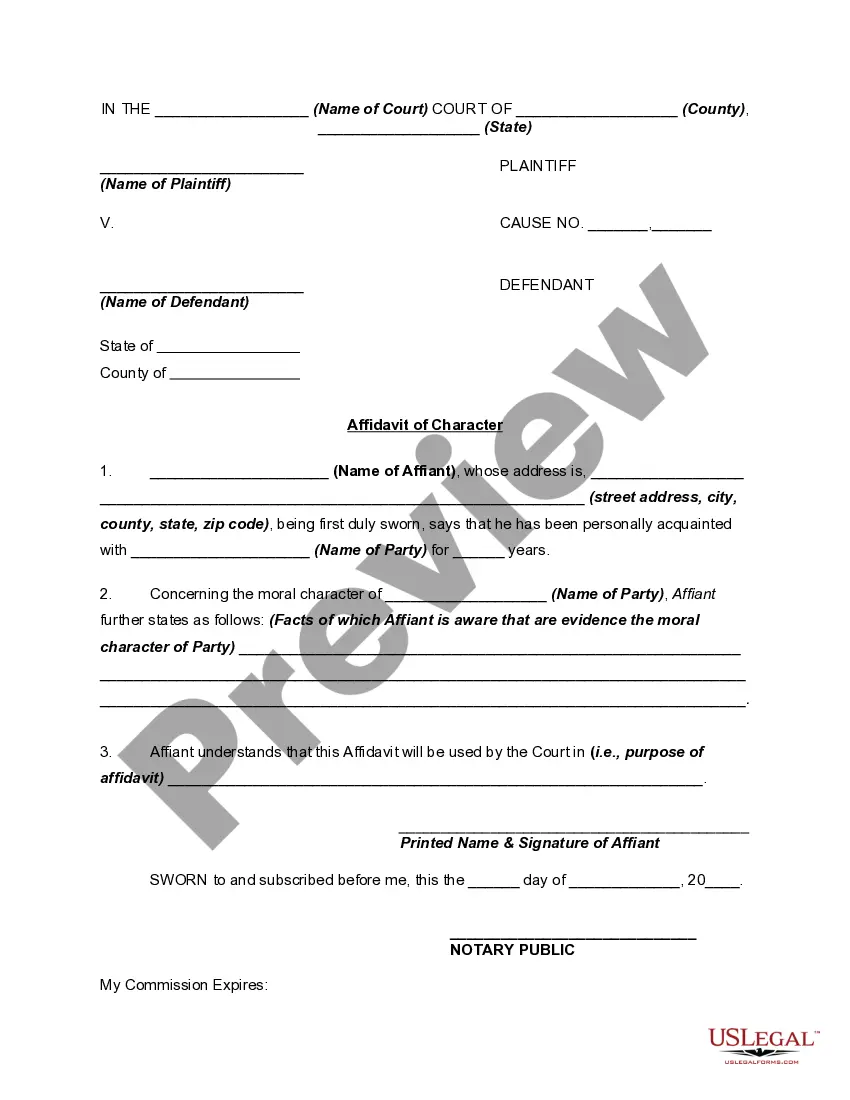

- Be sure you have picked the best kind for your city/state. Select the Preview option to analyze the form`s information. Browse the kind information to ensure that you have selected the appropriate kind.

- When the kind does not satisfy your demands, use the Research industry towards the top of the display to obtain the one that does.

- When you are satisfied with the form, affirm your selection by visiting the Purchase now option. Then, choose the pricing plan you prefer and supply your references to register for the accounts.

- Approach the financial transaction. Utilize your credit card or PayPal accounts to perform the financial transaction.

- Find the formatting and download the form on the system.

- Make modifications. Load, modify and produce and indicator the saved Virginia Renunciation and Disclaimer of Interest in Life Insurance Proceeds.

Each and every format you added to your bank account lacks an expiration particular date and it is the one you have forever. So, if you wish to download or produce yet another backup, just go to the My Forms area and then click on the kind you require.

Obtain access to the Virginia Renunciation and Disclaimer of Interest in Life Insurance Proceeds with US Legal Forms, the most extensive collection of lawful file themes. Use thousands of skilled and state-specific themes that meet your organization or specific requires and demands.