Virginia Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts

Description

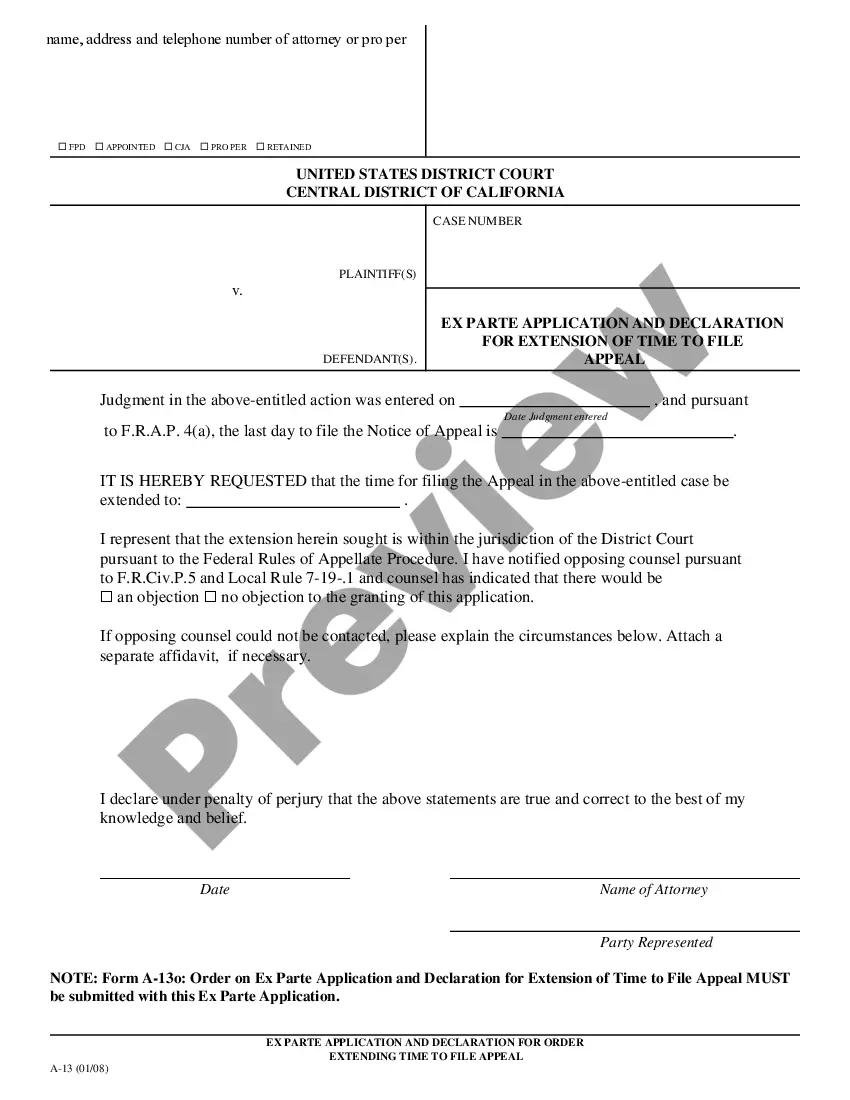

How to fill out Letter To Creditors Notifying Them Of Identity Theft Of Minor For New Accounts?

If you wish to aggregate, retrieve, or produce authentic document templates, utilize US Legal Forms, the most extensive variety of authentic forms available online.

Utilize the site’s straightforward and convenient search feature to obtain the documents you require.

Various templates for business and personal purposes are sorted by categories and regions, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Select the pricing plan you prefer and enter your details to create an account.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Use US Legal Forms to obtain the Virginia Letter to Creditors Informing Them of Identity Theft of Minor for New Accounts with just a few clicks.

- If you are currently a US Legal Forms user, sign in to your account and click on the Obtain button to find the Virginia Letter to Creditors Informing Them of Identity Theft of Minor for New Accounts.

- You can also retrieve forms you previously purchased from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Preview option to review the form’s content. Always remember to read the details.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

What does identity theft insurance not cover? It's important to note that these insurance policies typically don't cover stolen money or direct financial losses from fraudulent purchases and other unauthorized use of credit accounts. They typically reimburse you only for the costs of the reporting and recovery process.

The four types of identity theft include medical, criminal, financial and child identity theft. Medical identity theft occurs when individuals identify themselves as another to procure free medical care.

Identity theft happens when someone takes your name and personal information (like your social security number) and uses it without your permission to do things like open new accounts, use your existing accounts, or obtain medical services.

The three most common types of identity theft are financial, medical and online.

Some of the best steps to take to avoid becoming a victim of identity theft include: Get a free credit report each year. ... Never give personal information over email. ... Stay on top of your bank account. ... Set up a password for your mobile devices. ... Be wary of scam phone calls. ... Take advantage of services you can trust.

Dear Sir or Madam: I am a victim of identity theft. I recently learned that my personal information was used to open an account at your company. I did not open or authorize this account, and I therefore request that it be closed immediately.

How Does Identity Theft Occur? All that is needed is a little information, such as your social security number, birth date, address, phone number, or any other information which can be discovered.