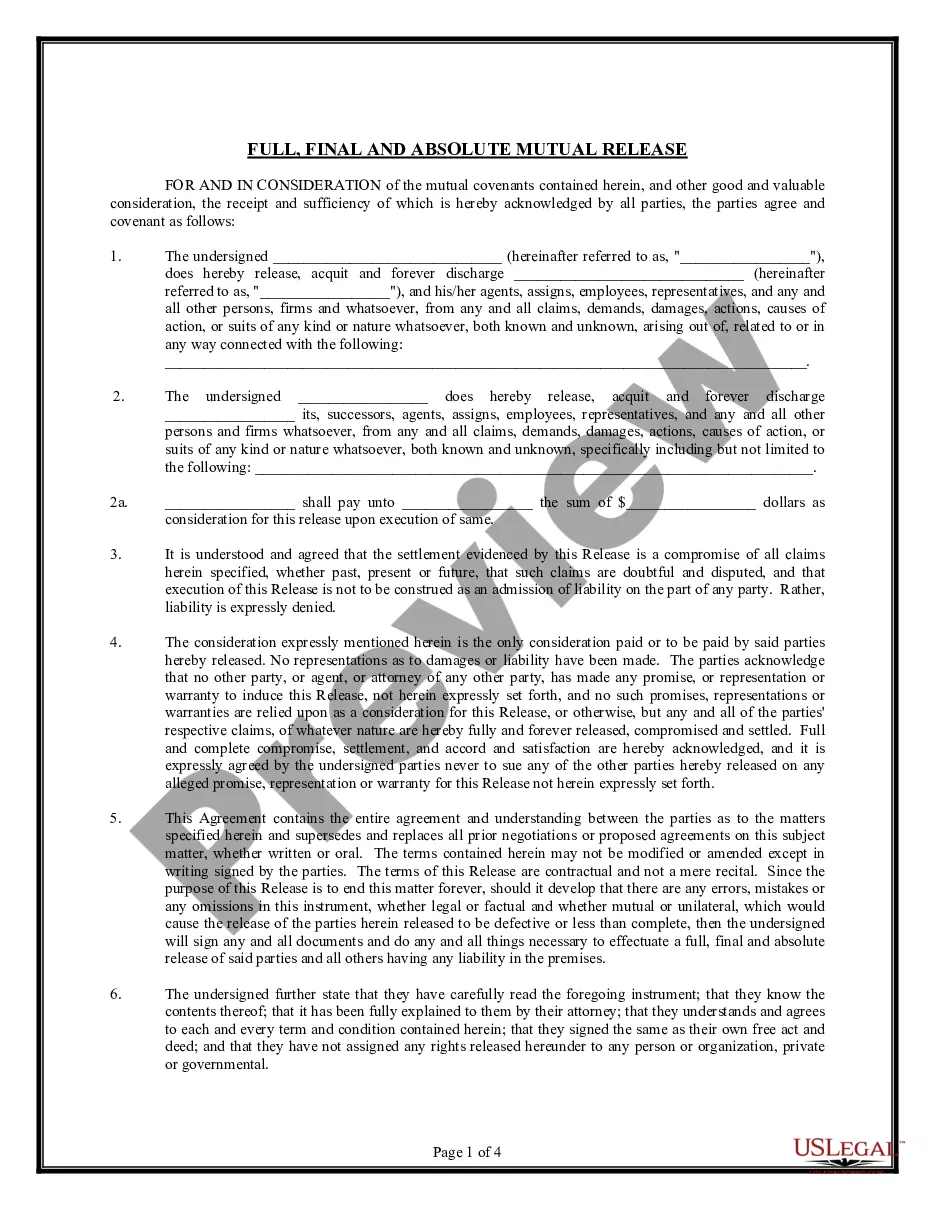

Virginia Mutual Release of Claims

Description

How to fill out Mutual Release Of Claims?

Are you in a position where you require documents for potential business or personal reasons almost consistently.

There are numerous legal document templates accessible online, but obtaining reliable versions can be challenging.

US Legal Forms provides a wide array of form templates, such as the Virginia Mutual Release of Claims, which are crafted to comply with federal and state regulations.

Once you find the correct form, click Get Now.

Select the payment plan you prefer, fill in the required information to create your account, and complete the transaction using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and possess a free account, simply Log In.

- From there, you can download the Virginia Mutual Release of Claims template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it's for your specific city/region.

- Utilize the Preview button to review the document.

- Examine the description to confirm you have selected the correct form.

- If the form isn’t what you’re searching for, use the Search field to find the form that suits your needs.

Form popularity

FAQ

A mutual release is a legal agreement where both parties agree to relinquish any future claims or disputes against each other. This document serves as a clear path toward closure, ensuring that both sides understand that the matter is settled. Utilizing a Virginia Mutual Release of Claims is beneficial when parties wish to resolve disputes amicably, providing legal clarity and peace of mind.

If a claim is taking longer than expected, it is essential to stay proactive and keep communication open with your insurance provider. You might consider seeking assistance from legal experts or using a Virginia Mutual Release of Claims as a strategy to push for a resolution. This type of release can clarify expectations and protect your interests while encouraging timely action from the insurance company.

The time limit for claim settlement in Virginia often depends on the nature of the claim and the specifics of your policy. Insurance companies aim to settle claims within a reasonable period, typically ranging from 30 to 60 days for simpler claims. If you experience delays, engaging in a Virginia Mutual Release of Claims can help expedite the settlement process and ensure both parties reach an agreement more quickly.

In Virginia, the time frame to back out of a contract can vary depending on the type of contract. Generally, you may have three days for contracts related to door-to-door sales or timeshare purchases. For other contracts, you usually cannot simply back out unless the contract states otherwise. A Virginia Mutual Release of Claims can provide clarity and officially terminate agreements in various situations.

In Virginia, an insurance company typically has 15 days to acknowledge a claim after it is filed. This prompt response is crucial for your peace of mind during the claims process. If you do not receive a timely response, you may want to consider utilizing tools like a Virginia Mutual Release of Claims to facilitate effective communication. This mutual agreement ensures that both parties are on the same page regarding the resolution.

In Virginia, insurance companies typically have a statutory time period of 30 days to investigate claims after they are submitted. This timeframe can vary depending on the complexity of the claim, especially for cases that may involve a Virginia Mutual Release of Claims. If you find that your claim is taking longer than this standard period, it is reasonable to reach out for an update. Being proactive can often expedite the process and provide you with clearer expectations.

If an insurance company is taking too long to respond or investigate your claim, the first step is to contact them for an update. You can also review your policy and understand your rights regarding time frames outlined in the Virginia Mutual Release of Claims. If necessary, consider filing a complaint with the Virginia State Corporation Commission. They can guide you on your next steps, helping ensure your claim is processed promptly.

Insurance companies in Virginia are typically expected to complete their investigations within 30 days of receiving a claim. However, this period may extend in certain circumstances, such as needing additional information or evaluating claims involving a Virginia Mutual Release of Claims. If you notice a delay beyond the norm, it's beneficial to follow up with your insurer for clarity. Staying informed about these timelines can aid your peace of mind during the process.

The statute of limitations for insurance claims in Virginia generally runs for two years. This time frame starts from the date of the loss or damage and is essential to keep in mind when filing claims. If you don't file your claim within this period, you may lose your right to seek compensation. Knowing this helps you take timely action during your claims process, especially in cases involving a Virginia Mutual Release of Claims.

In Virginia, insurance companies typically have a set period to investigate claims, generally around 30 days. However, this time frame can be extended if the insurer needs more information, especially in complex cases involving a Virginia Mutual Release of Claims. Understanding the investigation timeline allows you to hold the insurer accountable. If the investigation takes longer, you have the right to inquire about its progress.