Utah Clauses Relating to Initial Capital contributions

Description

How to fill out Clauses Relating To Initial Capital Contributions?

Are you currently in a placement in which you need files for either organization or specific functions virtually every working day? There are plenty of lawful file templates accessible on the Internet, but getting types you can depend on isn`t easy. US Legal Forms gives a huge number of type templates, such as the Utah Clauses Relating to Initial Capital contributions, which are composed to meet state and federal requirements.

Should you be already knowledgeable about US Legal Forms internet site and possess an account, just log in. Following that, you may acquire the Utah Clauses Relating to Initial Capital contributions web template.

Should you not provide an bank account and need to start using US Legal Forms, adopt these measures:

- Discover the type you require and make sure it is for the correct metropolis/state.

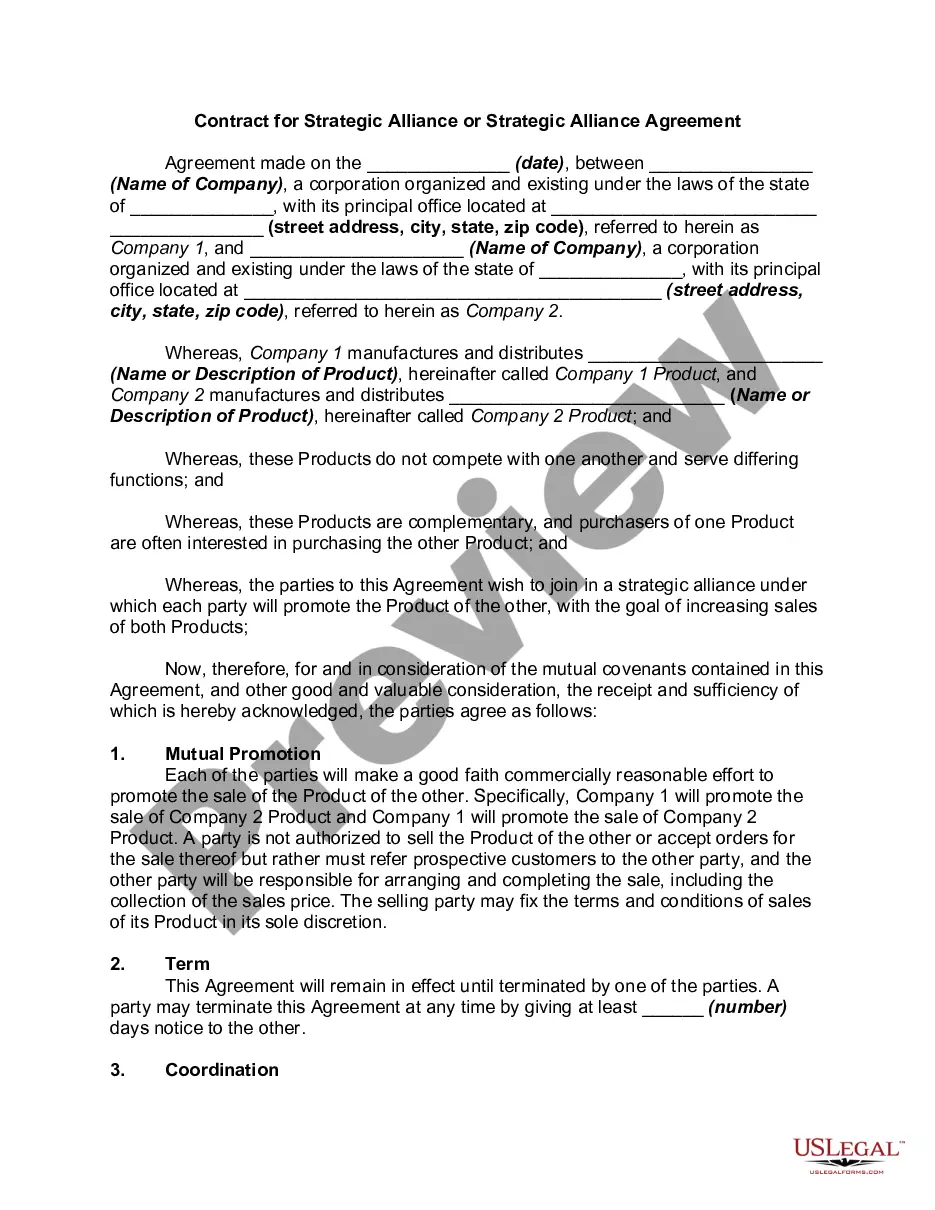

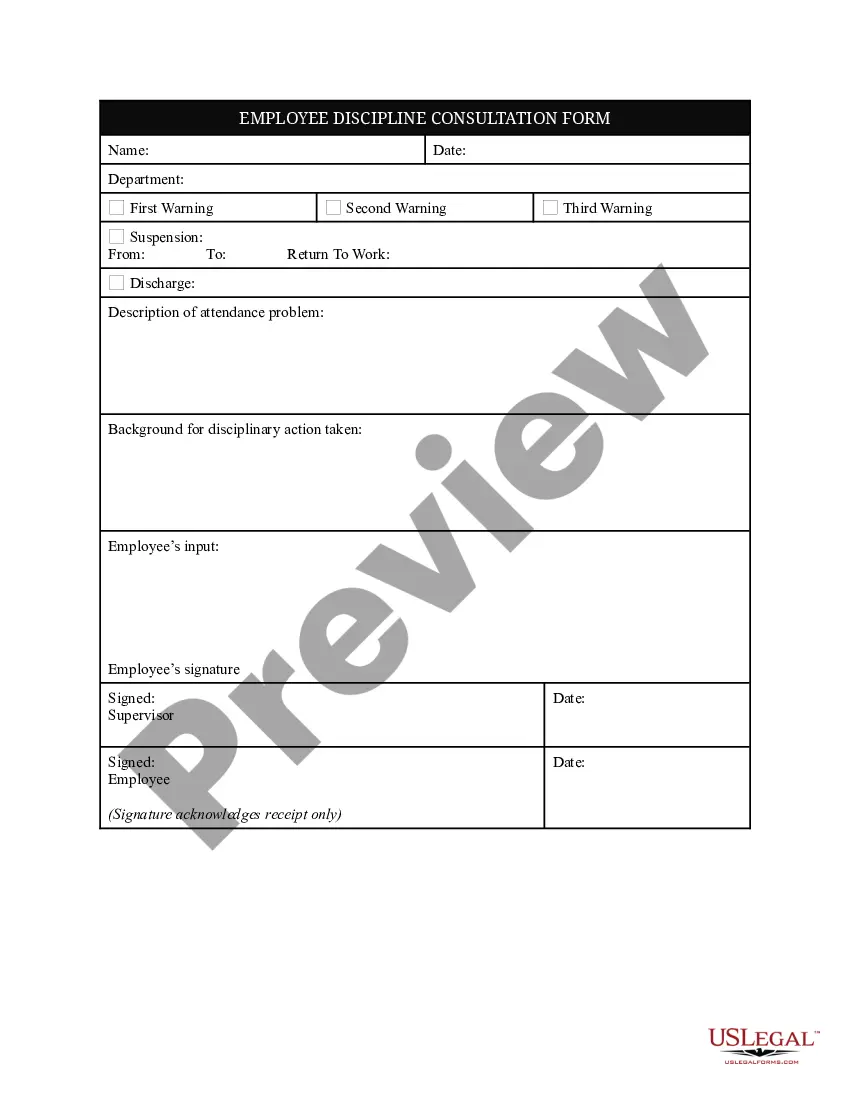

- Take advantage of the Review option to analyze the form.

- Browse the description to actually have selected the proper type.

- If the type isn`t what you are seeking, use the Research area to find the type that meets your needs and requirements.

- If you find the correct type, click on Purchase now.

- Pick the prices program you would like, fill out the necessary info to make your bank account, and purchase an order with your PayPal or credit card.

- Choose a hassle-free file formatting and acquire your copy.

Locate every one of the file templates you have purchased in the My Forms menu. You can obtain a extra copy of Utah Clauses Relating to Initial Capital contributions anytime, if needed. Just go through the essential type to acquire or printing the file web template.

Use US Legal Forms, the most considerable selection of lawful kinds, in order to save time as well as prevent faults. The services gives skillfully produced lawful file templates which can be used for a selection of functions. Make an account on US Legal Forms and initiate generating your lifestyle easier.

Form popularity

FAQ

Capital contributions are the money or other assets members give to the LLC in exchange for ownership interest. Members fund the LLC with initial capital contributions?these are usually recorded in the operating agreement. Additional capital contributions can be made at any time later on.

This can either be from a secondary issuance of stock or from an initial public offering. The accounting entry for the contributed capital are to debit cash or asset and credit Shareholders' Equity, reflecting the increase in assets and balance owed to shareholders.

An Initial Capital Stock Contribution is a specific amount of money you noted on your Operating Agreement that you as a shareholder in your LLC with S Corp tax formation would 'contribute' to get the business up and running.

How do I add capital to my LLC? You should make capital contributions in ance with your operating agreement. The agreement might require regular contributions or ?as-needed? contributions. Either way, a capital contribution often entails making a check out to the LLC.

After you have made your capital contributions to the business, each member's contribution should be recorded on the balance sheet as an equity account. You should have a capital contribution account for each member's contributions and record their initial contribution as well as additional contributions there.

After you have made your capital contributions to the business, each member's contribution should be recorded on the balance sheet as an equity account. You should have a capital contribution account for each member's contributions and record their initial contribution as well as additional contributions there.

Is Capital Contribution Taxable? Our tax laws say that most capital contributions are not taxable for the LLC owner or the LLC.

Unfortunately, capital contributions are not tax deductible when it comes to contributions toward an LLC.