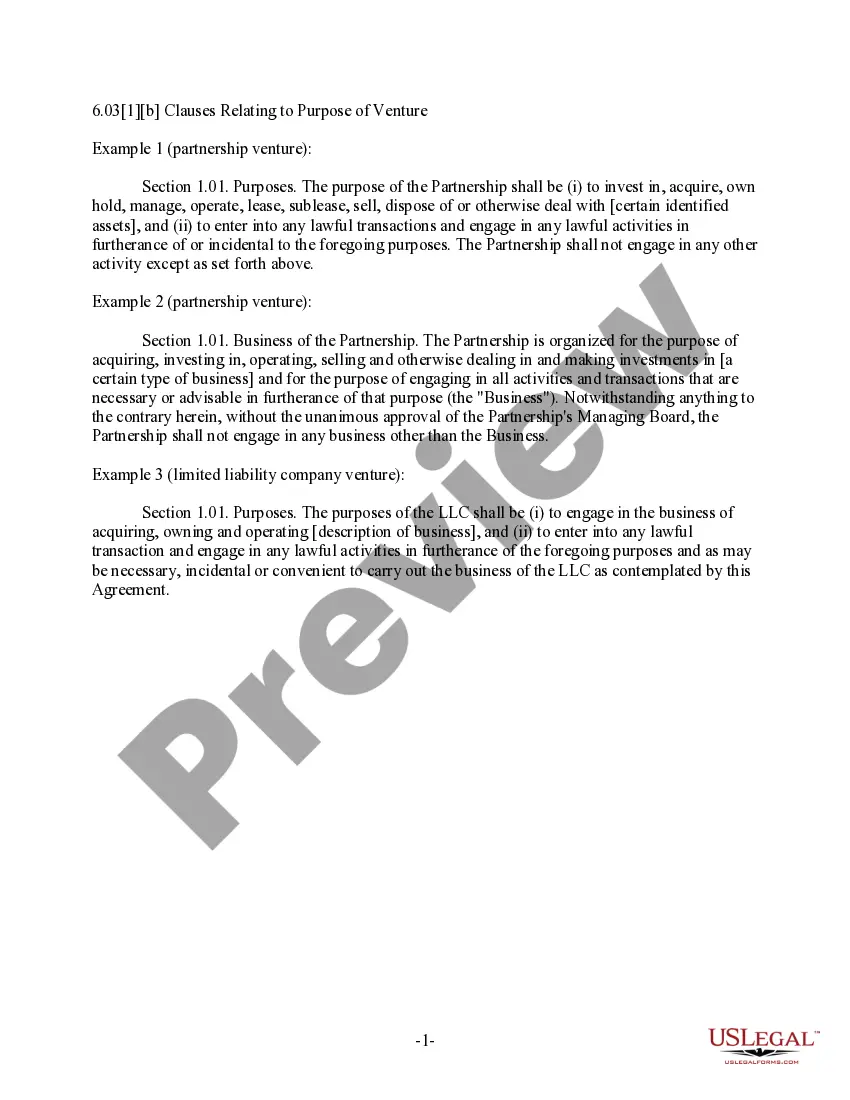

Utah Clauses Relating to Purpose of Venture

Description

How to fill out Clauses Relating To Purpose Of Venture?

Have you been in a placement the place you require papers for both enterprise or individual reasons nearly every working day? There are a lot of legitimate papers web templates available online, but finding versions you can rely is not straightforward. US Legal Forms provides a huge number of kind web templates, much like the Utah Clauses Relating to Purpose of Venture, which can be published to fulfill federal and state specifications.

Should you be previously acquainted with US Legal Forms internet site and possess a free account, merely log in. After that, you can obtain the Utah Clauses Relating to Purpose of Venture design.

Unless you come with an accounts and would like to begin to use US Legal Forms, abide by these steps:

- Obtain the kind you will need and make sure it is for the right metropolis/region.

- Use the Review option to review the form.

- Read the explanation to actually have selected the proper kind.

- When the kind is not what you`re seeking, use the Research industry to get the kind that suits you and specifications.

- Whenever you find the right kind, simply click Purchase now.

- Pick the pricing strategy you would like, fill in the required info to create your money, and buy an order utilizing your PayPal or Visa or Mastercard.

- Pick a convenient paper structure and obtain your copy.

Find every one of the papers web templates you have purchased in the My Forms menus. You can obtain a further copy of Utah Clauses Relating to Purpose of Venture at any time, if required. Just click on the needed kind to obtain or produce the papers design.

Use US Legal Forms, by far the most considerable selection of legitimate kinds, to save some time and prevent faults. The assistance provides expertly produced legitimate papers web templates that can be used for a range of reasons. Make a free account on US Legal Forms and begin making your lifestyle a little easier.

Form popularity

FAQ

A venture capitalist's goal is to invest in a company while it's growing. Then, once it (hopefully) becomes successful, they aim to get a good return on their investment (ROI) through a company acquisition or when the company goes public.

The key difference between venture capital and venture debt is that venture capital is an equity investment made by a VC firm into a startup, whereas venture debt is a loan taken up by the startup to be repaid with interest during the loan tenure.

Private equity involves making controlling investments in distressed companies, with the hopes of making them more profitable. VC, often considered a subset of private equity, refers to making early investments in promising companies (or even ideas) with significant growth potential.

Venture capitalists spend their time on this process of raising funds, finding startups to invest in, negotiating deal terms, and helping the startups grow.

Venture capitalists are investors that form limited partnerships to pool investment funds. They use that money to fund startup companies in return for equity stakes in those companies. VCs usually make their investments after a startup has been bringing in revenue, rather than in its initial stage.

Key provisions of a VC term sheet include: investment structure, key economic terms, shareholder agreements, due diligence, exclusivity and closing.

It acts as a trigger in launching new business and as a catalyst in stimulating existing firms to achieve optimum performance. Venture capitalists role extends even as far as to see that the firm has proper and adequate commercial banking and receivable financing.

Corporate venturing ? also known as corporate venture capital ? is the practice of directly investing corporate funds into external startup companies. This is usually done by large companies who wish to invest small, but innovative, startup firms.