This office lease form is a provision from a negotiated perspective. The landlord shall provide to the tenant in substantial detail each year the calculations, accounts and averages performed to determine the building operating costs.

Utah Tenant Audit Provision Fairer Negotiated Provision

Description

How to fill out Tenant Audit Provision Fairer Negotiated Provision?

If you have to comprehensive, acquire, or printing lawful file layouts, use US Legal Forms, the largest variety of lawful types, that can be found on the web. Use the site`s basic and practical look for to obtain the papers you will need. Various layouts for organization and person reasons are sorted by types and says, or key phrases. Use US Legal Forms to obtain the Utah Tenant Audit Provision Fairer Negotiated Provision in just a number of click throughs.

In case you are presently a US Legal Forms client, log in to your profile and click the Acquire switch to obtain the Utah Tenant Audit Provision Fairer Negotiated Provision. You may also access types you in the past acquired inside the My Forms tab of your own profile.

If you use US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Make sure you have selected the form to the proper town/region.

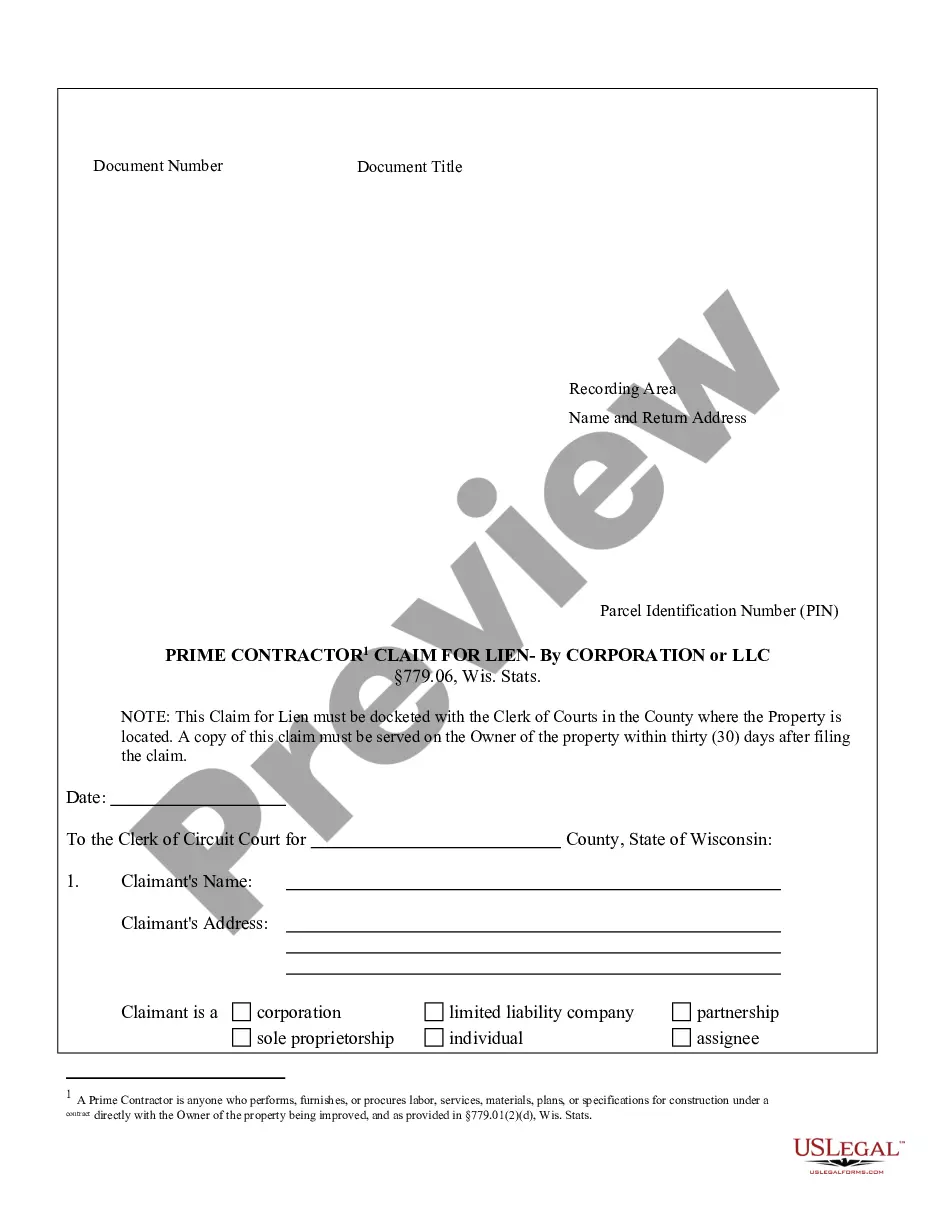

- Step 2. Make use of the Review choice to examine the form`s articles. Do not forget about to learn the outline.

- Step 3. In case you are unhappy with all the develop, use the Search field on top of the display screen to discover other versions of the lawful develop design.

- Step 4. Once you have identified the form you will need, select the Buy now switch. Opt for the rates strategy you choose and add your accreditations to register for an profile.

- Step 5. Process the financial transaction. You should use your bank card or PayPal profile to complete the financial transaction.

- Step 6. Select the structure of the lawful develop and acquire it on the product.

- Step 7. Complete, revise and printing or signal the Utah Tenant Audit Provision Fairer Negotiated Provision.

Each lawful file design you buy is your own eternally. You possess acces to each develop you acquired within your acccount. Click on the My Forms section and pick a develop to printing or acquire yet again.

Remain competitive and acquire, and printing the Utah Tenant Audit Provision Fairer Negotiated Provision with US Legal Forms. There are millions of skilled and state-particular types you can utilize for your personal organization or person requires.

Form popularity

FAQ

A lease audit is an examination of a landlord's expenses and contract terms, which ensures that expenses billed to the tenant are accurate and follow the structure negotiated in the lease.

Example: ?The Purchaser shall have the right to audit Vendor's records and facilities related to the performance of this Agreement. Such audits may be conducted by the Purchaser or its authorized representatives at reasonable times during normal business hours upon providing [X] days' written notice to Vendor.

Verifying rent payments: Review the lease agreements to determine the amount of rent due, payment due dates, and any late payment penalties. In addition, the auditor must go through the rent payment records and tenant receipts to ensure that the rent has been paid on time and accurately.

6 Lease Audit Assertions Existence/Occurrence: The assets and liabilities related to leases actually exist and have occurred. Valuation/Allocation: The assets and liabilities related to leases have been valued and allocated correctly. Cut-off: All lease transactions have been recorded in the correct accounting period.

Identifying a complete population of leases can be a large undertaking, depending on how centralized a business' operations are. Typically, this process involves inquiries with department heads along with a detailed review of accounts payable.

Lease audits go over any information needed to verify the accuracy of your charges, locate discrepancies, and determine whether you're owed any compensation. They can include the terms of the lease itself, additional relevant documents, and the physical property space.