Utah Assignment of Overriding Royalty Interest (No Proportionate Reduction)

Description

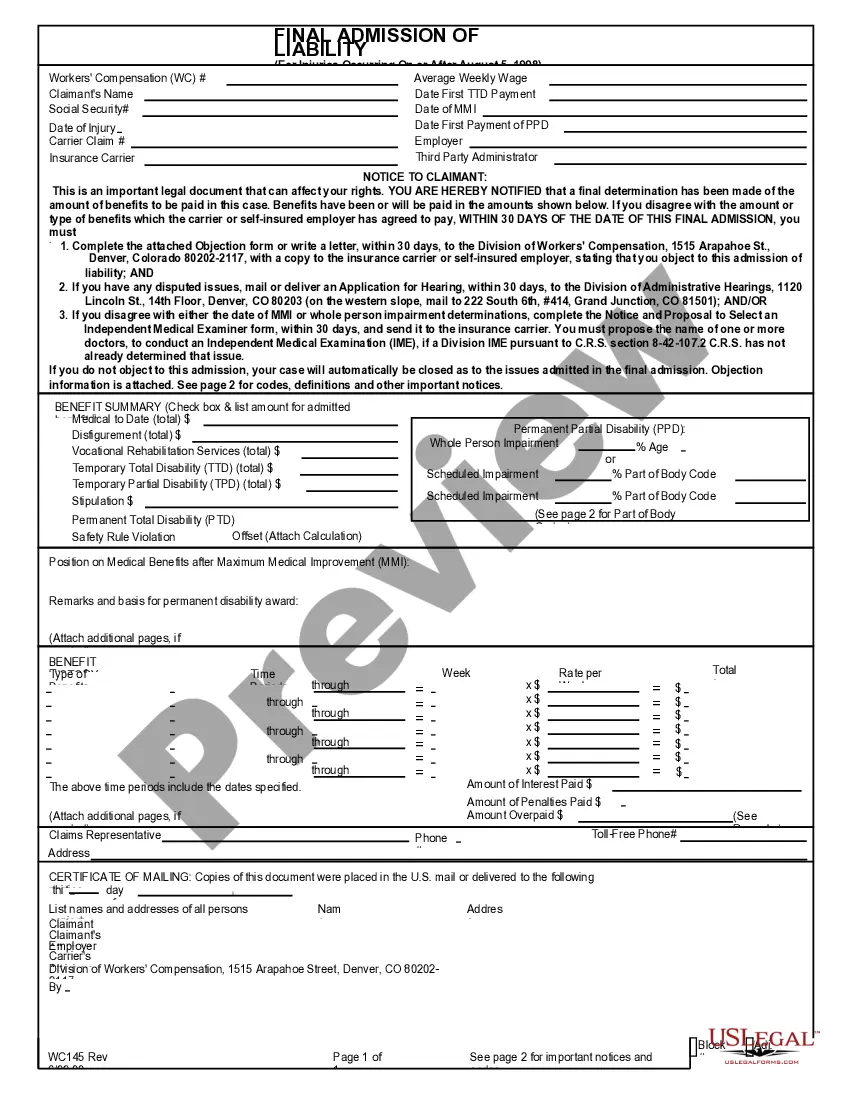

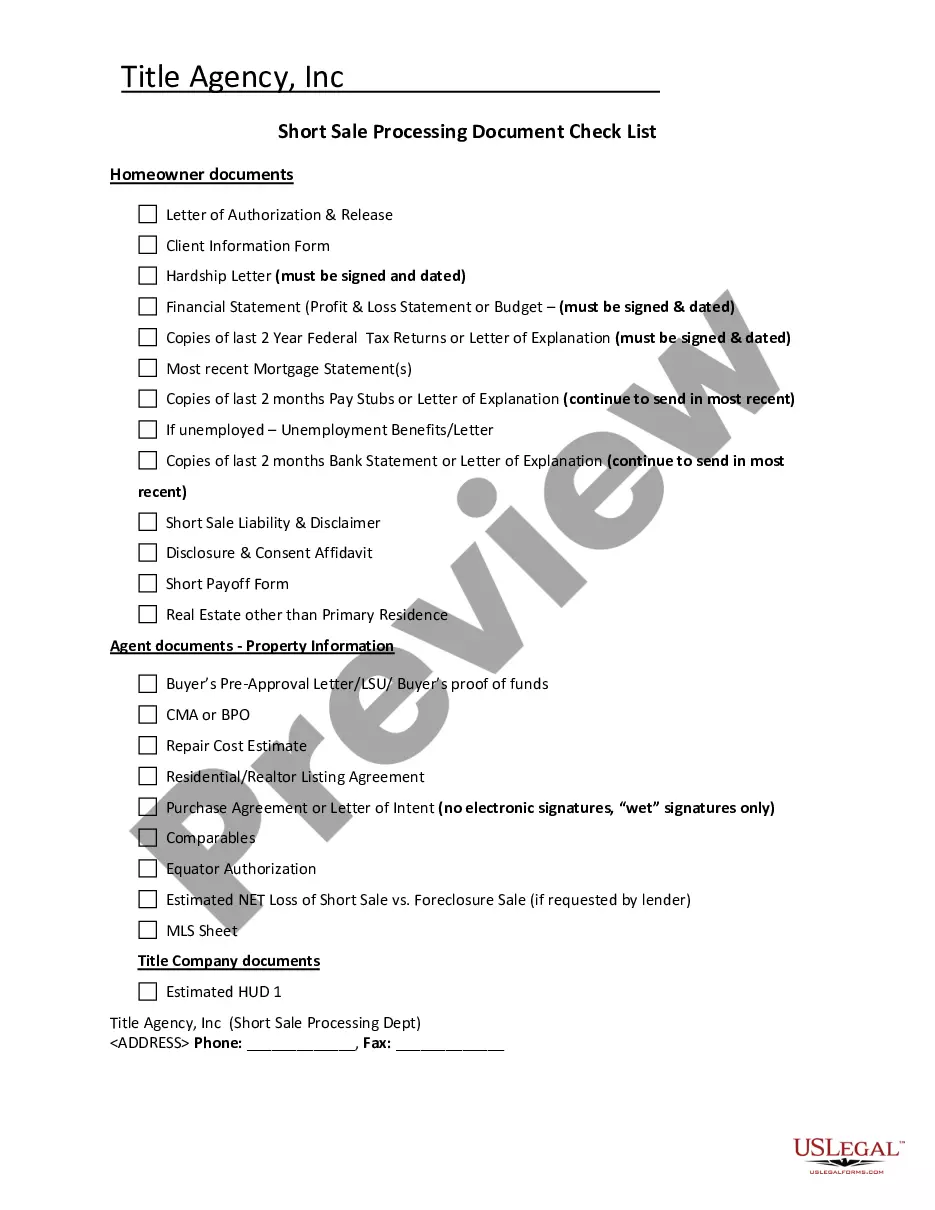

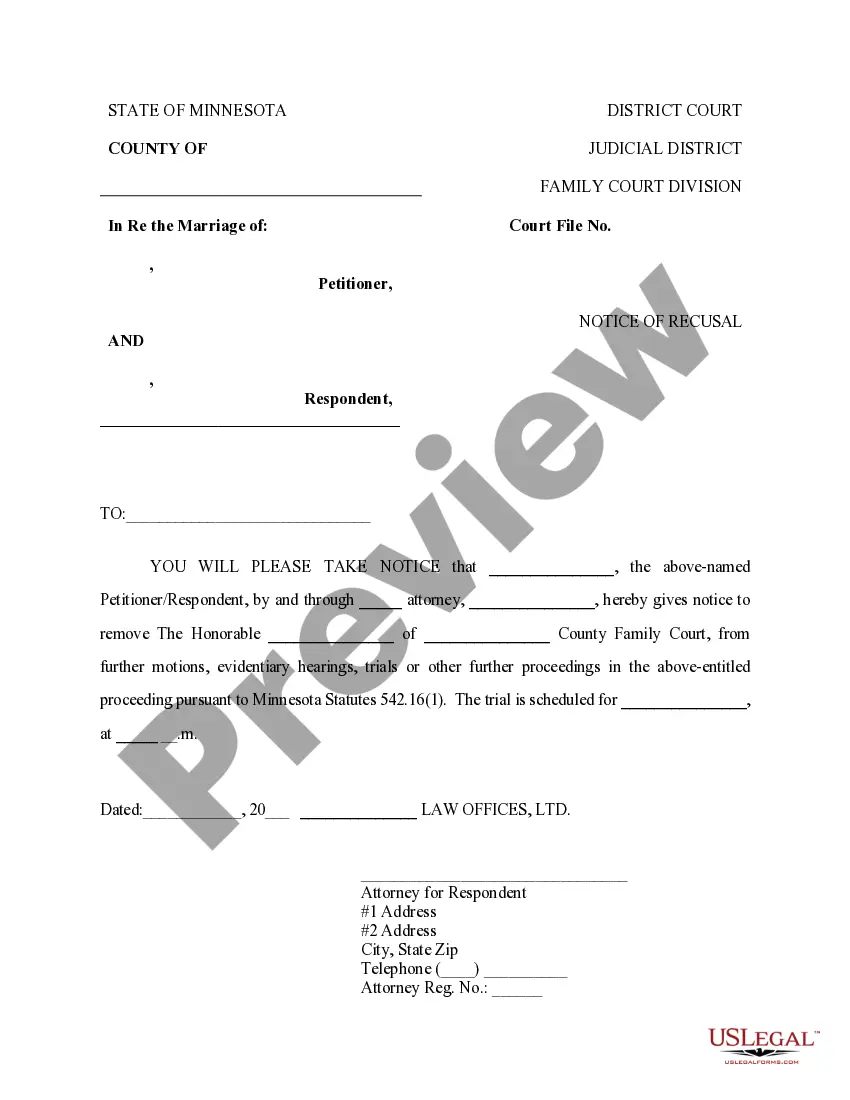

How to fill out Assignment Of Overriding Royalty Interest (No Proportionate Reduction)?

Are you currently in a situation in which you will need paperwork for sometimes business or individual purposes virtually every working day? There are tons of lawful record layouts available on the net, but finding types you can rely on isn`t simple. US Legal Forms delivers a huge number of develop layouts, such as the Utah Assignment of Overriding Royalty Interest (No Proportionate Reduction), which are published to satisfy state and federal demands.

If you are already informed about US Legal Forms web site and possess a merchant account, basically log in. After that, you are able to acquire the Utah Assignment of Overriding Royalty Interest (No Proportionate Reduction) web template.

Unless you provide an account and need to begin to use US Legal Forms, follow these steps:

- Obtain the develop you want and ensure it is to the right town/state.

- Make use of the Preview key to review the shape.

- Read the information to actually have selected the appropriate develop.

- In the event the develop isn`t what you are searching for, take advantage of the Research area to discover the develop that meets your needs and demands.

- Once you discover the right develop, click Purchase now.

- Pick the pricing plan you would like, fill in the specified information and facts to generate your account, and pay for the order making use of your PayPal or charge card.

- Choose a handy document file format and acquire your backup.

Find each of the record layouts you might have purchased in the My Forms menu. You may get a additional backup of Utah Assignment of Overriding Royalty Interest (No Proportionate Reduction) anytime, if possible. Just click the needed develop to acquire or print the record web template.

Use US Legal Forms, the most substantial collection of lawful varieties, to save time as well as prevent mistakes. The service delivers expertly produced lawful record layouts that you can use for a range of purposes. Make a merchant account on US Legal Forms and commence generating your way of life a little easier.

Form popularity

FAQ

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

However, unlike royalty and working interests, an overriding royalty interest cannot be fractionalized unlike royalty and working interests. The ORRI is a non-possessory, undivided right to a share of the oil and gas production, but it excludes the production costs of the mineral lease.

Essentially, NPRI is the royalty severed from minerals just as minerals are severed from the surface interest. Unlike mineral owners, non-participating royalties do not have executive rights in lease negotiations, leasing incentives, or rental payments. They just receive the actual production proceeds.

An override provision allows for ongoing royalty payment on future albums, sometimes including those not produced by the original producer.

A quick definition of proportionate-reduction clause: This means that if the lessor does not have full ownership of the minerals being leased, the lessee can adjust their payments ingly.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

However, unlike royalty and working interests, an overriding royalty interest cannot be fractionalized unlike royalty and working interests. The ORRI is a non-possessory, undivided right to a share of the oil and gas production, but it excludes the production costs of the mineral lease.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.