Utah Collections Agreement - Self-Employed Independent Contractor

Description

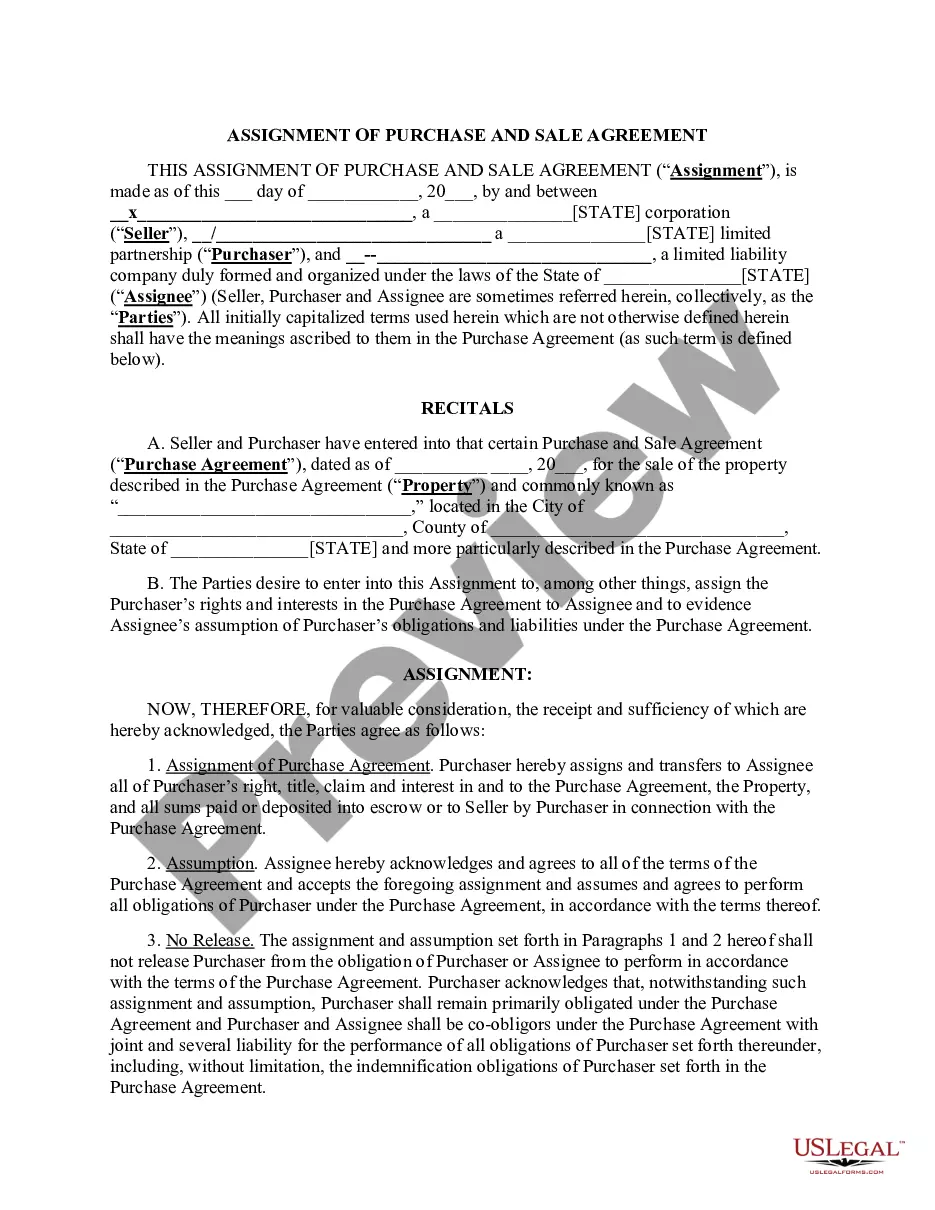

How to fill out Collections Agreement - Self-Employed Independent Contractor?

It is feasible to invest time online searching for the valid document template that satisfies the federal and state stipulations you desire. US Legal Forms offers a vast array of legal forms that are reviewed by experts.

You can download or print the Utah Collections Agreement - Self-Employed Independent Contractor from your account.

If you already have a US Legal Forms account, you can Log In and then click the Download button. After that, you can complete, modify, print, or sign the Utah Collections Agreement - Self-Employed Independent Contractor. Each legal document template you obtain is yours permanently. To get an additional copy of a purchased form, go to the My documents section and click the corresponding option.

Complete the transaction. You can use your credit card or PayPal account to pay for the legal document. Choose the format of the file and download it to your device. Make modifications to the document if needed. You can complete, modify, sign, and print the Utah Collections Agreement - Self-Employed Independent Contractor. Download and print a wide variety of document templates using the US Legal Forms website, which provides the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have chosen the correct document template for the county/town of your choice.

- Review the form description to confirm you have selected the correct template.

- If available, utilize the Preview option to view the document template as well.

- If you wish to find another version of the form, use the Search field to locate the template that meets your needs and requirements.

- Once you have identified the template you want, click on Acquire now to proceed.

- Select the pricing plan you prefer, enter your information, and create a free account on US Legal Forms.

Form popularity

FAQ

Receiving payments as an independent contractor can be straightforward with proper planning. Establish your payment terms in your agreement, like due dates and accepted payment methods. You can use online payment platforms, checks, or bank transfers to streamline transactions. By clearly defining these terms in your Utah Collections Agreement - Self-Employed Independent Contractor, you ensure timely payments and avoid disputes.

Creating an independent contractor agreement involves a clear understanding of the terms and conditions between the parties. Begin by outlining the scope of work, payment terms, and deadlines. It's also essential to include clauses that protect both parties, such as confidentiality and ownership rights. For a comprehensive solution, consider using the Utah Collections Agreement - Self-Employed Independent Contractor available on the US Legal Forms platform.

Independent contractors usually need to complete a W-9 form for tax purposes and may require a specific contract form for their services. Depending on your work and location, project-specific documents may also be necessary. Utilizing templates from uslegalforms can simplify this process, helping you create a thorough Utah Collections Agreement - Self-Employed Independent Contractor that meets your needs.

Accepting payment as an independent contractor typically involves setting clear payment methods, such as bank transfers, checks, or online payment platforms. Ensure you include payment details in your agreement to avoid misunderstandings later on. By establishing these terms in your Utah Collections Agreement - Self-Employed Independent Contractor, you facilitate smooth transactions and professional relationships.

When writing an independent contractor agreement, start with an introduction that identifies the parties and the project. Follow with sections outlining the payment terms, project timeline, and any necessary legal disclaimers. This structured approach is crucial to creating a solid Utah Collections Agreement - Self-Employed Independent Contractor that protects both you and your client.

Filling out an independent contractor agreement involves listing all parties involved, defining the project, and specifying payment conditions. Make sure to clarify deadlines, the nature of the relationship, and confidentiality clauses if applicable. With a properly structured Utah Collections Agreement - Self-Employed Independent Contractor, you ensure all parties understand their rights and responsibilities.

To fill out an independent contractor form, you first need to gather all relevant information such as your name, address, and tax identification number. Next, ensure you include the specific details of the work you will perform, including the project scope and payment terms. Using a reliable template, like those provided by uslegalforms, can help you complete the Utah Collections Agreement - Self-Employed Independent Contractor accurately.

Indeed, an independent contractor operates as a business entity. This status allows you to manage your work independently, invoicing clients for services rendered. Utilizing a Utah Collections Agreement - Self-Employed Independent Contractor establishes a formal business relationship, making it easier to handle payments and project terms with your clients.

Yes, you typically need to register your business as an independent contractor, particularly if you operate under a business name rather than your own. Registration helps legitimize your services and establishes credibility with clients. Coupling this registration with a Utah Collections Agreement - Self-Employed Independent Contractor can streamline your operations and ensure smoother transactions.

As an independent contractor in Utah, you may need a business license, especially if your activities require one based on local laws. It is essential to verify your licensing requirements with your city or county. When drafting a Utah Collections Agreement - Self-Employed Independent Contractor, keeping compliance regulations in mind will help you avoid potential pitfalls.