Utah Window Contractor Agreement - Self-Employed

Description

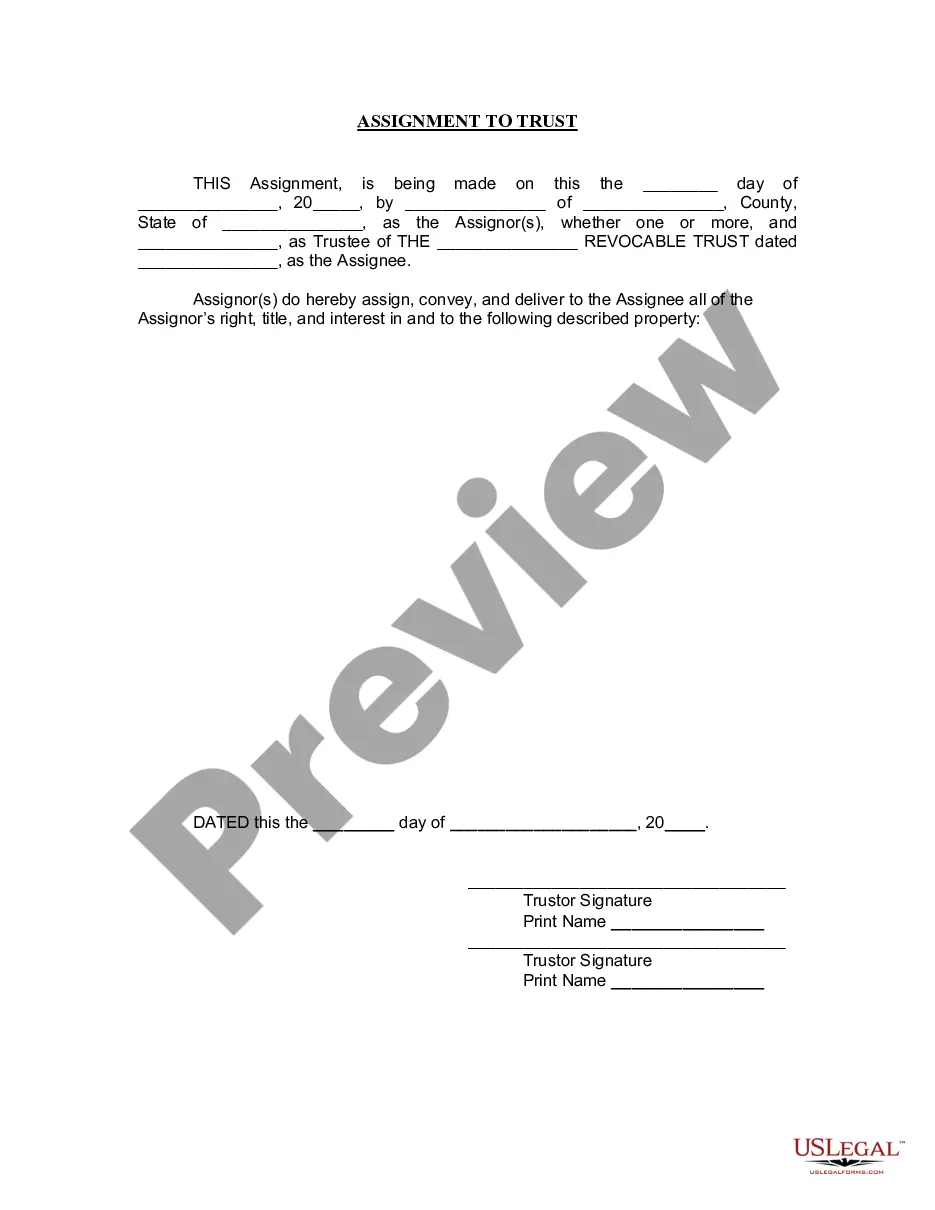

How to fill out Window Contractor Agreement - Self-Employed?

Locating the appropriate legal document template can be a challenge. Of course, there are numerous templates accessible online, but how do you find the legal form you require? Utilize the US Legal Forms website. The platform offers a wide range of templates, including the Utah Window Contractor Agreement - Self-Employed, which you can use for business and personal needs. All documents are reviewed by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click on the Download button to obtain the Utah Window Contractor Agreement - Self-Employed. Use your account to browse through the legal forms you have previously acquired. Visit the My documents section of your account to retrieve another copy of the document you need.

If you are a new user of US Legal Forms, here are simple steps for you to follow: First, ensure you have selected the correct form for your city/county. You can review the form using the Review option and read the form description to ensure it is suitable for you. If the form does not meet your requirements, use the Search feature to find the appropriate form. Once you are confident that the form is acceptable, click the Buy now button to obtain the form. Choose the pricing plan you desire and enter the necessary information. Create your account and complete your purchase using your PayPal account or credit card. Select the document format and download the legal document template to your device. Fill out, modify, print, and sign the obtained Utah Window Contractor Agreement - Self-Employed. US Legal Forms is the largest repository of legal forms where you can find a variety of document templates. Leverage the service to obtain professionally crafted documents that adhere to state regulations.

Form popularity

FAQ

An independent contractor may not need a business license depending on the services offered and the local regulations. It’s wise to review your particular situation with local authorities or a legal expert. A thorough Utah Window Contractor Agreement - Self-Employed can outline your rights and requirements, helping you remain compliant and secure.

You can handle projects worth up to $3,000 without a contractor's license in Utah. This limit allows some flexibility for small jobs and services. However, to expand your offerings, a Utah Window Contractor Agreement - Self-Employed can prepare you to take on larger projects that require official licensing.

As an independent contractor in Utah, a business license may not always be required, but it depends on your specific location and the type of work you are doing. It's essential to check with your local government for specific licensing requirements. A well-drafted Utah Window Contractor Agreement - Self-Employed might also specify any licenses needed for your particular services.

Yes, registering your business as an independent contractor can offer legal protection and easier compliance with tax regulations. In Utah, you might need to file as a sole proprietorship or another business structure, depending on your situation. Using a Utah Window Contractor Agreement - Self-Employed can help protect your interests during the registration process.

Yes, an independent contractor is considered a business entity, even if it's a one-person operation. You offer services under your name, managing your taxes and expenses. A proper Utah Window Contractor Agreement - Self-Employed can formalize this arrangement and clarify your status in business dealings.

In Utah, you can perform minor jobs valued at $3,000 or less without needing a contractor's license. This allows DIY enthusiasts or independent contractors to operate under certain limitations. However, for larger projects, a Utah Window Contractor Agreement - Self-Employed becomes essential. Always check local regulations to remain compliant.

To write an independent contractor agreement, start by outlining the scope of work and duties required. Include details such as payment terms, deadlines, and confidentiality clauses. You can also specify the nature of the relationship, highlighting that the agreement is for a Utah Window Contractor Agreement - Self-Employed. Utilizing online platforms like US Legal Forms can simplify this process.

Filling out an independent contractor agreement involves detailing the parties involved, the scope of work, and payment terms. Make sure to specify deadlines for deliverables and include sections for confidentiality and dispute resolution. It's important to consult a legal expert if you have any doubts about the terms. US Legal Forms offers a tailored Utah Window Contractor Agreement - Self-Employed that guides you through each section, ensuring thoroughness.

When writing a contract for a 1099 employee, start with a description of the work to be performed and any relevant deadlines. Clearly state the payment terms, including the amount and schedule, as well as any additional expenses that may be reimbursed. It is also advisable to outline the independent nature of the work, ensuring clarity on the employee's status. A well-crafted Utah Window Contractor Agreement - Self-Employed can serve as an effective template to follow.

Filling out an independent contractor form begins with entering your personal details and business information. Specify the services you will provide, the duration of the project, and payment terms. It is crucial to review all information for accuracy before submission. Utilizing a Utah Window Contractor Agreement - Self-Employed form from US Legal Forms can help streamline this process and ensure compliance with state regulations.