Utah Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock

Description

How to fill out Share Exchange Agreement Regarding Shareholders Issued Exchangeable Nonvoting Shares Of Capital Stock?

You are able to devote time on the web searching for the authorized document design that suits the federal and state requirements you will need. US Legal Forms offers 1000s of authorized forms that happen to be evaluated by experts. It is possible to download or print the Utah Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock from my service.

If you already have a US Legal Forms account, you may log in and click the Download switch. Next, you may total, modify, print, or sign the Utah Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock. Each authorized document design you acquire is your own property permanently. To obtain another version for any acquired form, visit the My Forms tab and click the corresponding switch.

If you work with the US Legal Forms website the first time, adhere to the easy instructions under:

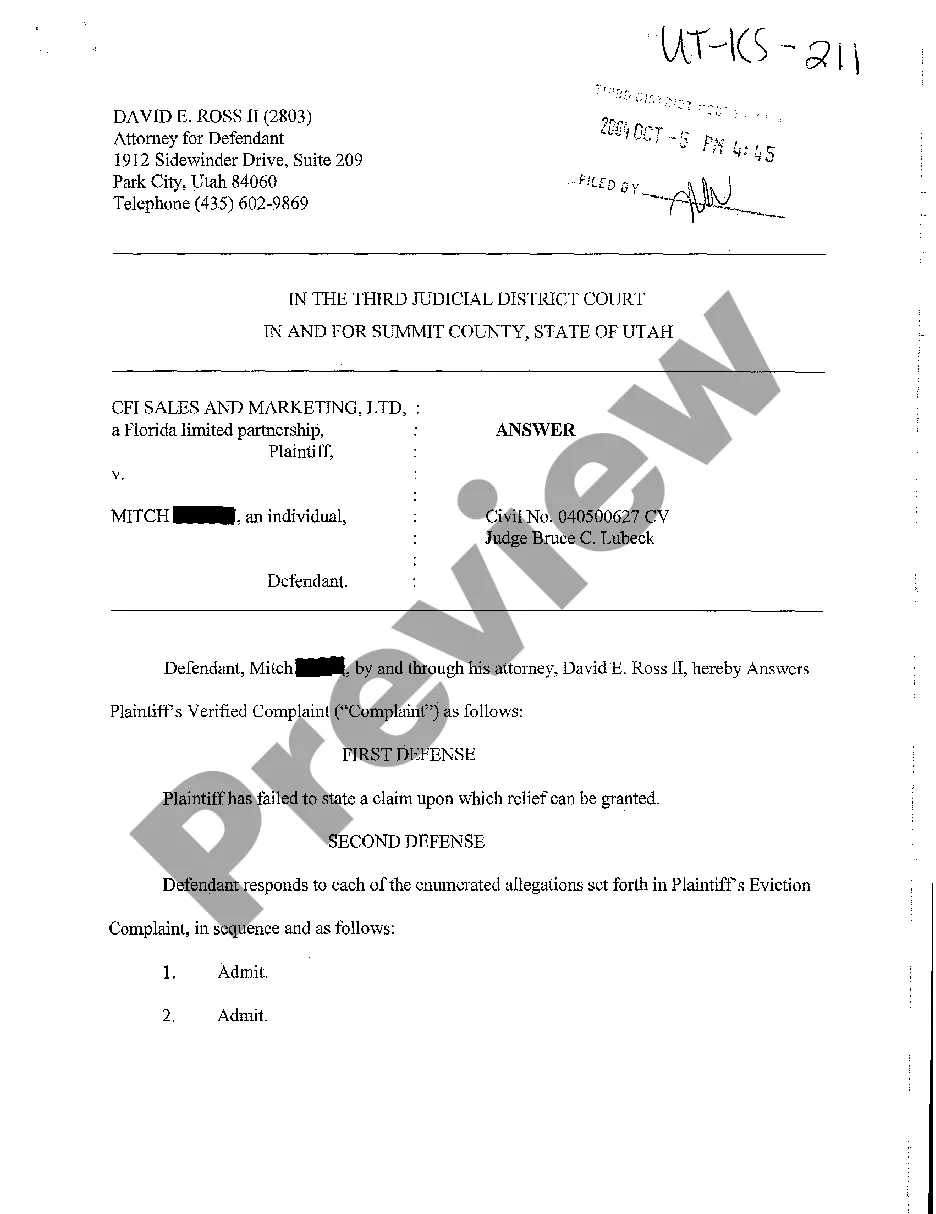

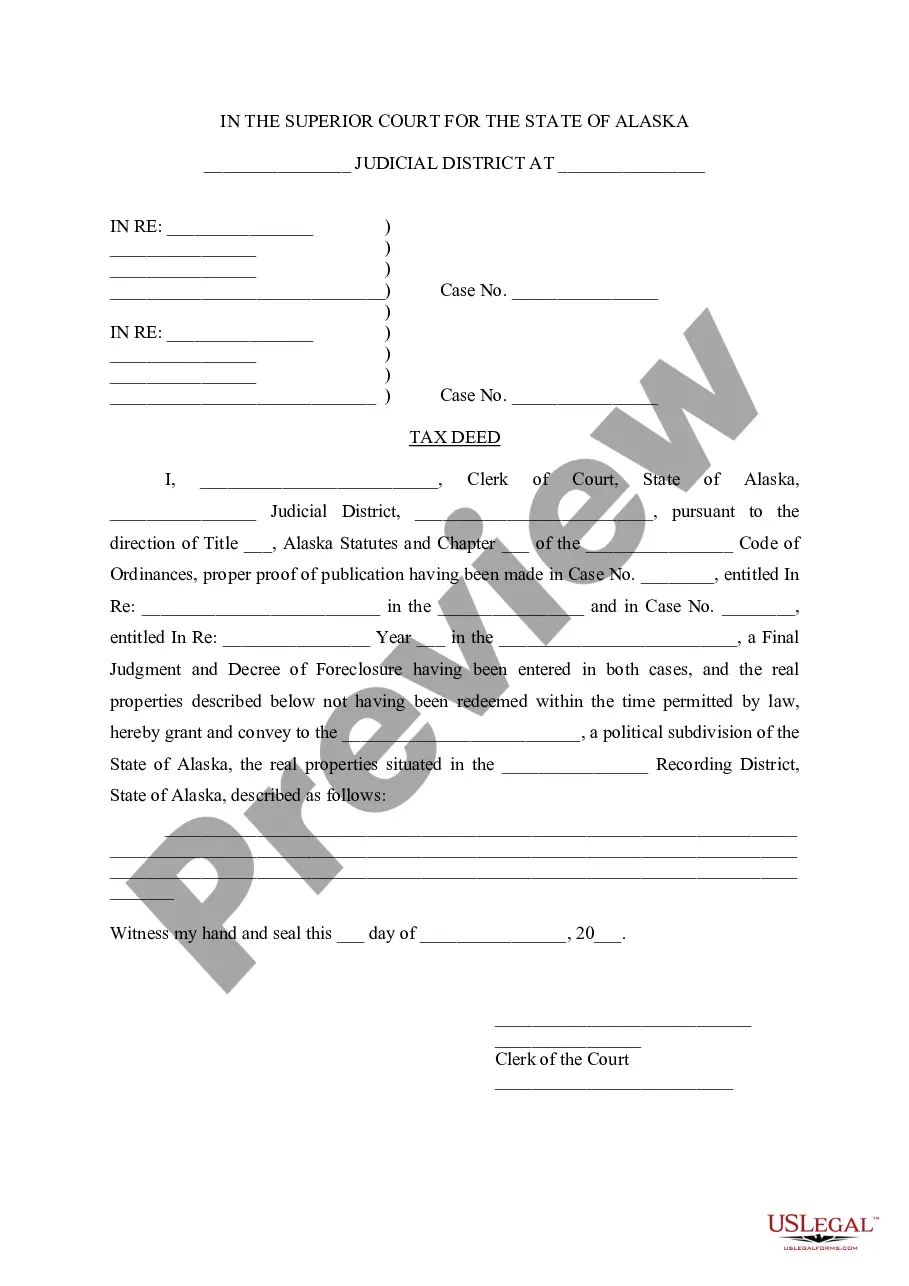

- First, make certain you have chosen the correct document design to the region/city of your choice. Browse the form explanation to make sure you have picked the right form. If available, use the Review switch to search through the document design at the same time.

- In order to get another version of the form, use the Research discipline to get the design that meets your needs and requirements.

- Once you have found the design you would like, simply click Get now to proceed.

- Select the prices strategy you would like, type in your credentials, and sign up for an account on US Legal Forms.

- Total the transaction. You may use your charge card or PayPal account to pay for the authorized form.

- Select the formatting of the document and download it to the gadget.

- Make modifications to the document if required. You are able to total, modify and sign and print Utah Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock.

Download and print 1000s of document web templates while using US Legal Forms website, that provides the largest collection of authorized forms. Use professional and state-distinct web templates to tackle your organization or individual needs.

Form popularity

FAQ

Purpose of shareholder agreement 1.2 The Shareholders are entering into this Shareholder Agreement to provide for the management and control of the affairs of the Corporation, including management of the business, division of profits, disposition of shares, and distribution of assets on liquidation.

A shareholders' agreement includes a date; often the number of shares issued; a capitalization table that outlines shareholders and their percentage ownership; any restrictions on transferring shares; pre-emptive rights for current shareholders to purchase shares to maintain ownership percentages (for example, in the ...

The Shareholder's Agreement is generally used to resolve disputes between the corporation and the Shareholder. The Share Purchase Agreement, on the other hand, is a document that justifies the exchange of shares held by the Buyer and Seller.

A good shareholders agreement should set out the decisions a shareholder-director may and may not make without agreement from others. These are known as reserved matters. Disclosure of decision making is also important. A shareholder-director may be able to make decisions that aren't reported to other shareholders.

We have 5 steps. Step 1: Decide on the issues the agreement should cover. ... Step 2: Identify the interests of shareholders. ... Step 3: Identify shareholder value. ... Step 4: Identify who will make decisions - shareholders or directors. ... Step 5: Decide how voting power of shareholders should add up.

However, drafting a shareholder agreement requires careful consideration of a range of critical issues, such as ownership structure, transferability of shares, voting rights, management structure, decision-making procedures, dividend distribution, dispute resolution mechanisms, confidentiality, termination provisions, ...

A shareholders' agreement includes a date; often the number of shares issued; a capitalization table that outlines shareholders and their percentage ownership; any restrictions on transferring shares; pre-emptive rights for current shareholders to purchase shares to maintain ownership percentages (for example, in the ...

A share for share exchange is where one or more shareholders exchange shares they hold in one company for shares in another company. A common example of this is where a new holding company B is put on top of existing company A.