Utah Distribution Agreement between First American Insurance Portfolios, Inc. and SEI Financial Services Company

Description

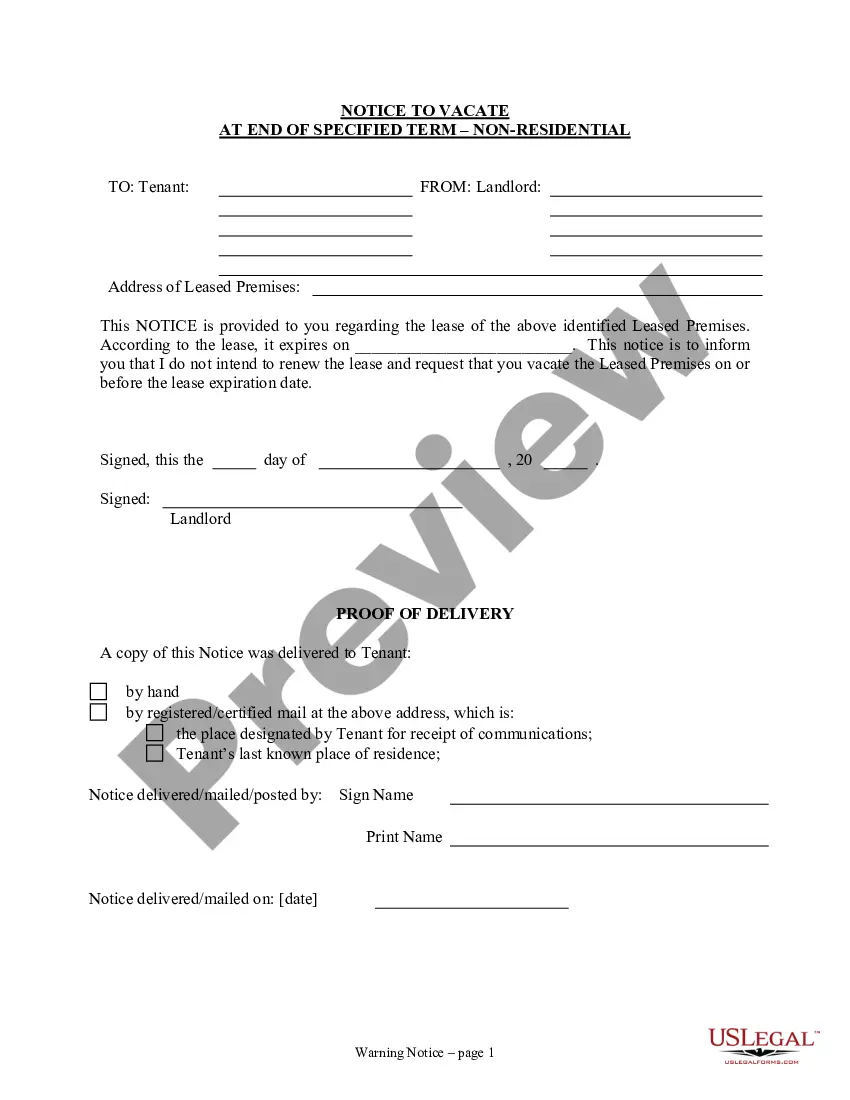

How to fill out Distribution Agreement Between First American Insurance Portfolios, Inc. And SEI Financial Services Company?

If you have to comprehensive, acquire, or print lawful file templates, use US Legal Forms, the biggest assortment of lawful kinds, which can be found on the web. Make use of the site`s basic and hassle-free lookup to get the documents you want. Numerous templates for business and specific functions are categorized by classes and says, or keywords and phrases. Use US Legal Forms to get the Utah Distribution Agreement between First American Insurance Portfolios, Inc. and SEI Financial Services Company within a handful of click throughs.

In case you are presently a US Legal Forms client, log in in your profile and click the Obtain key to obtain the Utah Distribution Agreement between First American Insurance Portfolios, Inc. and SEI Financial Services Company. You may also entry kinds you previously acquired inside the My Forms tab of your own profile.

If you are using US Legal Forms the first time, follow the instructions listed below:

- Step 1. Be sure you have selected the shape for your correct town/land.

- Step 2. Take advantage of the Preview option to look over the form`s content material. Never forget to see the explanation.

- Step 3. In case you are not happy with the type, use the Lookup area at the top of the display screen to find other variations in the lawful type template.

- Step 4. Upon having found the shape you want, select the Acquire now key. Choose the costs prepare you like and include your qualifications to register to have an profile.

- Step 5. Method the deal. You should use your Мisa or Ьastercard or PayPal profile to complete the deal.

- Step 6. Find the file format in the lawful type and acquire it on your own gadget.

- Step 7. Full, revise and print or sign the Utah Distribution Agreement between First American Insurance Portfolios, Inc. and SEI Financial Services Company.

Every lawful file template you acquire is your own forever. You possess acces to every single type you acquired within your acccount. Click the My Forms area and pick a type to print or acquire once more.

Be competitive and acquire, and print the Utah Distribution Agreement between First American Insurance Portfolios, Inc. and SEI Financial Services Company with US Legal Forms. There are millions of professional and condition-distinct kinds you can utilize for your personal business or specific needs.