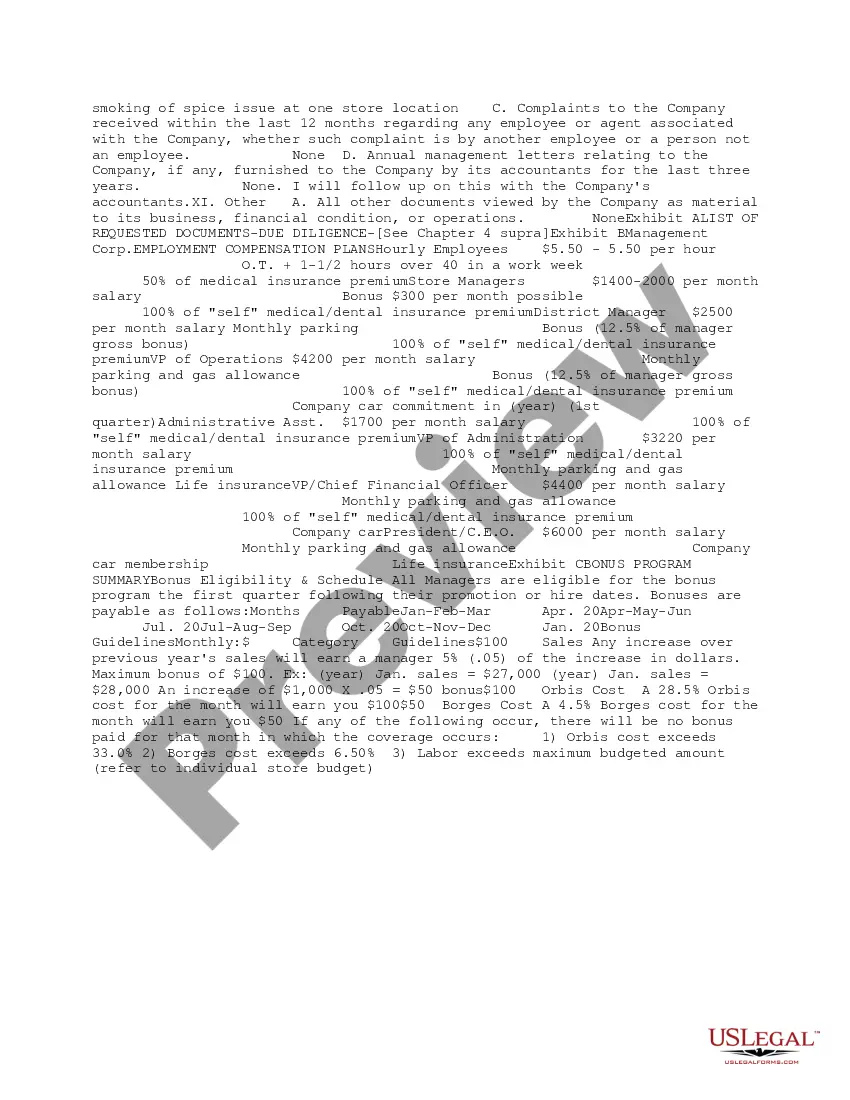

This due diligence form is a memorandum that summarizes the review of documents and the formation produced by a company in response to a list of requested materials.

Utah Summary Initial Review of Response to Due Diligence Request

Description

How to fill out Summary Initial Review Of Response To Due Diligence Request?

If you wish to finish, obtain, or reproduce sanctioned document templates, utilize US Legal Forms, the most extensive collection of legal documents available online.

Take advantage of the site’s straightforward and user-friendly search feature to find the documents you require.

An assortment of templates for corporate and personal purposes is organized by categories and subjects, or key phrases.

Step 4. Once you have located the required form, click the Purchase now button. Choose the payment plan you prefer and input your details to register for an account.

Step 5. Complete the transaction. You can use your Visa, Mastercard, or PayPal account to finalize the payment. Step 6. Select the format of the legal document and download it onto your device. Step 7. Complete, modify, and print or sign the Utah Summary Initial Review of Response to Due Diligence Request. Each legal document template you obtain belongs to you for years. You will have access to every form you downloaded within your account. Click the My documents section and select a document to print or download again. Compete and acquire, and print the Utah Summary Initial Review of Response to Due Diligence Request with US Legal Forms. There are countless professional and state-specific documents you can use for your business or personal requirements.

- Utilize US Legal Forms to obtain the Utah Summary Initial Review of Response to Due Diligence Request with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click on the Download button to acquire the Utah Summary Initial Review of Response to Due Diligence Request.

- You can also access forms you previously submitted electronically in the My documents section of your account.

- If you are using US Legal Forms for the first time, consult the guidelines below.

- Step 1. Confirm that you have selected the form for the appropriate city/state.

- Step 2. Use the Preview option to review the content of the form. Be sure to read the details.

- Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

A red flag during due diligence usually indicates potential issues that may undermine confidence in the transaction. Common red flags include discrepancies in financial statements, unclear ownership structures, or pending legal matters. Being vigilant during the Utah Summary Initial Review of Response to Due Diligence Request will help you identify these issues early and make more informed decisions.

Responding to due diligence requires careful consideration of the requests made by the other party. Provide thorough and accurate information, addressing each question or document request. This thoughtful approach supports a favorable Utah Summary Initial Review of Response to Due Diligence Request, showcasing your transparency and reliability.

To handle due diligence effectively, start by consulting with professionals who specialize in this area. Their expertise will guide you through various aspects, from document collection to analysis. Utilizing tools such as our uslegalforms platform can streamline the process, making your Utah Summary Initial Review of Response to Due Diligence Request much more manageable.

If you decide to back out during the due diligence phase, it is crucial to review the terms of your agreement. You may need to provide a valid reason for your withdrawal, which could involve issues identified during the Utah Summary Initial Review of Response to Due Diligence Request. Keep in mind that understanding your rights and obligations can help you navigate this process smoothly, ensuring minimal legal repercussions.

The due diligence process includes organization, research, analysis, and reporting. Initially, you prepare by gathering documents, followed by researching relevant information to assess the subject thoroughly. Conducting a Utah Summary Initial Review of Response to Due Diligence Request can streamline your analysis and help gather crucial insights.

The 4 P's of due diligence stand for People, Product, Process, and Partnership. Each element requires careful examination to ensure a well-rounded assessment. Incorporating a Utah Summary Initial Review of Response to Due Diligence Request can help clarify each category, providing insights that lead to informed decisions.

The steps of due diligence involve several phases, beginning with preparation and planning. Next, you collect and analyze relevant documents, followed by assessing the data to identify potential risks. Utilizing a Utah Summary Initial Review of Response to Due Diligence Request can enhance your understanding of each phase, making the entire process more efficient.

A due diligence checklist is a tool that helps you systematically gather and analyze essential information before making a significant business decision. It typically includes items like financial records, legal documents, and operational data. Specifically, using a Utah Summary Initial Review of Response to Due Diligence Request can guide you in creating a thorough checklist, ensuring nothing critical is overlooked.