Utah Sample Restricted Stock Purchase Agreement between Intermark, Inc. and Purchasers

Description

How to fill out Sample Restricted Stock Purchase Agreement Between Intermark, Inc. And Purchasers?

You can commit hours on the Internet searching for the legitimate papers format which fits the federal and state requirements you want. US Legal Forms provides thousands of legitimate varieties which can be evaluated by specialists. It is simple to down load or produce the Utah Sample Restricted Stock Purchase Agreement between Intermark, Inc. and Purchasers from my assistance.

If you already possess a US Legal Forms account, it is possible to log in and then click the Down load key. Next, it is possible to full, edit, produce, or sign the Utah Sample Restricted Stock Purchase Agreement between Intermark, Inc. and Purchasers. Every legitimate papers format you purchase is yours permanently. To get an additional backup associated with a obtained type, proceed to the My Forms tab and then click the related key.

If you use the US Legal Forms website the first time, keep to the simple directions listed below:

- Initial, make sure that you have selected the best papers format to the region/area of your choice. Browse the type explanation to make sure you have selected the right type. If offered, utilize the Preview key to appear with the papers format also.

- If you want to locate an additional model in the type, utilize the Search discipline to obtain the format that suits you and requirements.

- When you have found the format you need, click Get now to continue.

- Choose the pricing strategy you need, type in your credentials, and sign up for a merchant account on US Legal Forms.

- Complete the financial transaction. You can utilize your charge card or PayPal account to fund the legitimate type.

- Choose the file format in the papers and down load it to your device.

- Make modifications to your papers if necessary. You can full, edit and sign and produce Utah Sample Restricted Stock Purchase Agreement between Intermark, Inc. and Purchasers.

Down load and produce thousands of papers layouts while using US Legal Forms site, which offers the most important selection of legitimate varieties. Use specialist and condition-particular layouts to handle your small business or personal needs.

Form popularity

FAQ

A ?Restricted Stock Agreement? places a limit on a stockholder's ability to sell stock on the open market. 0Imagine a company is worth $20 million and the company wants to issue new employee a 1% stock interest in the company.

Unlike restricted stock, an owner of a stock option does not have an actual ownership interest in the company at the time of issuance. A stock option is an agreement between the company and the employee that grants them the option to purchase company stock for an agreed-upon price.

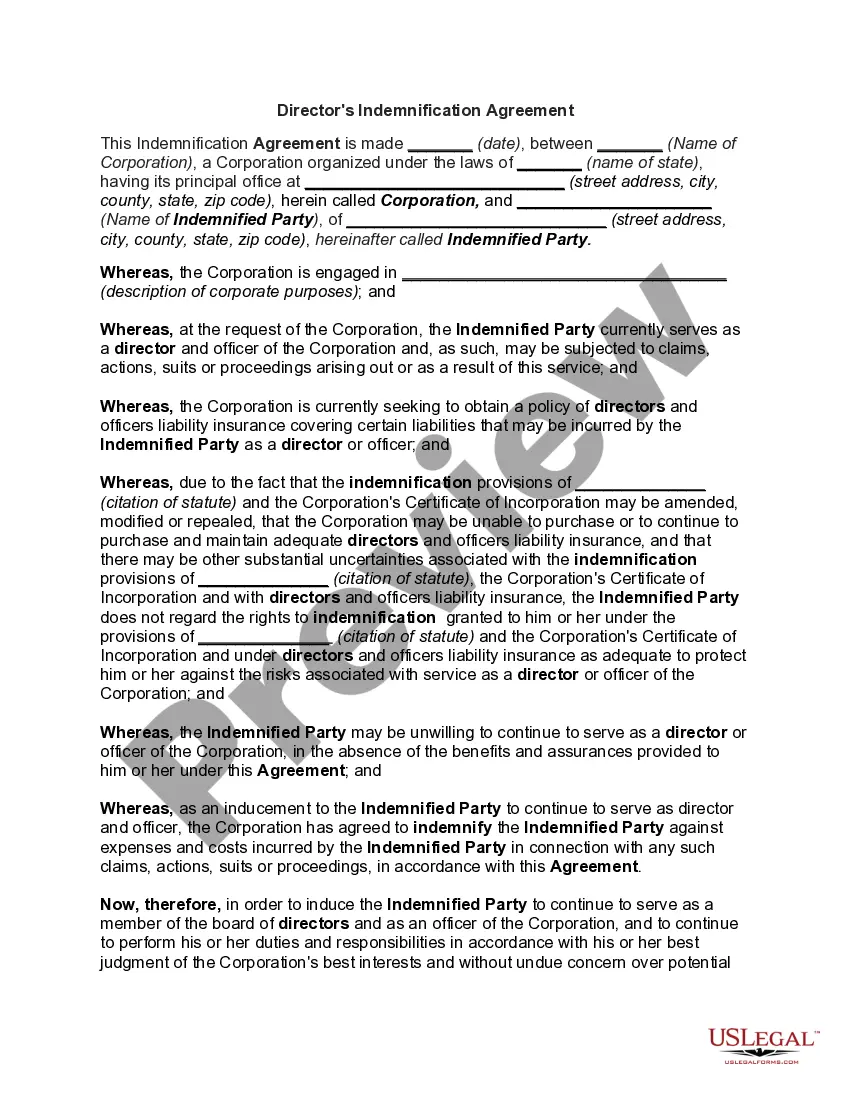

A: The most common provisions included in restricted stock purchase agreements are restrictions on when and how stock can be sold or transferred; non-compete agreements; rights of first refusal; and termination clauses which allow either party to terminate the agreement under specified conditions.

Resigning before your RSUs have vested is a tough pill to swallow. Usually, you'll lose all the RSUs that have not yet vested at the time of your resignation. They'll be forfeited back to the company, and you'll walk away with nothing for those unvested units.

A restricted stock purchase agreement is a type of written agreement that places restrictions on the stockholder's rights with respect to the shares being issued. The restrictions generally restrict selling, transferring, etc.

Restricted stock units are a form of stock-based employee compensation. RSUs are restricted during a vesting period that may last several years, during which time they cannot be sold. Once they are vested, RSUs can be sold or kept like any other shares of company stock.

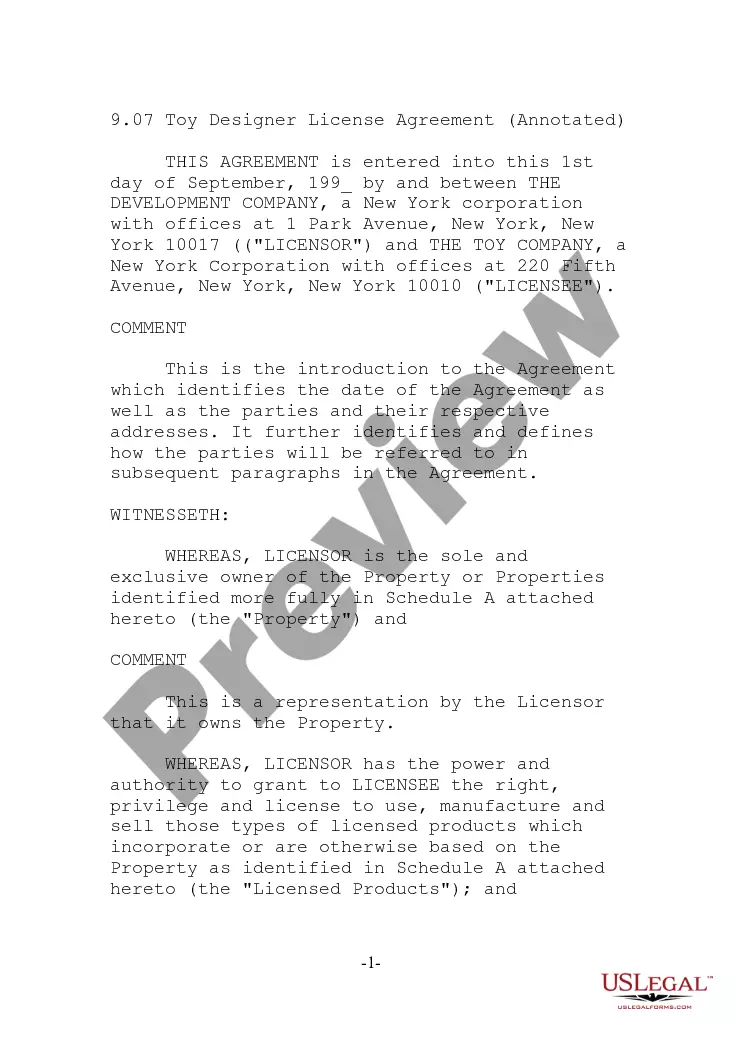

A Stock Purchase Agreement is used for the purchase and sale of outstanding stock of a business. The agreement typically includes purchase and sale terms, representations and warranties, covenants, conditions precedent, termination, and indemnification provisions.

Long-term capital gains rates are likely the lowest tax on your company shares. In order to minimize your RSU taxes as much as possible, it's typically advisable to hold your shares for at least one year after the exercise date to qualify for long-term capital gains taxes.